Is It Time Yet?

VIX extended its Master Cycle low to futures and options expiration. This makes sense since there is a huge Dealer/Institutional presence in the short-vol trade in futures, options, and other volatility sensitive products.

ZeroHedge discusses “The Market's Toxic "Liquidity-Volatility-Flows" Feedback Loop”

-- The NYSE Hi-Lo Index has been creeping beneath the 10-month trendline instead of a breakout. This means that less than 1% of the more than 3200 issues in the NYSE are hitting new 52-week highs in this rally. In fact, not a single S&P 500 issue has hit a new 52-week high in the past three weeks.

(DailyReckoning) Fed Chair Jay Powell did not deliver any early Christmas presents to the markets last month, but he did pop the cork on a bottle of Champagne as a belated New Year’s gift on Friday, Jan. 4.

With just a few words, Powell sent the most powerful signal from the Fed since March 2015. Investors who understand and properly interpret that signal stand to avoid losses and reap huge gains in the weeks ahead.

First, let’s focus on Powell’s comments. Then we’ll explain what they actually meant.

The Fed has taken a March rate hike off the table until further notice. At a forum in Atlanta two Fridays ago, Powell joined former Fed chairs Yellen and Bernanke to discuss monetary policy.

In the course of his remarks, Powell used the word “patient” to describe the Fed’s approach to the next interest rate hike. When Powell did this, he was reading from a script of prepared remarks in what was otherwise billed as a “roundtable discussion.” This is a sign that Powell was being extremely careful to get his words exactly right.

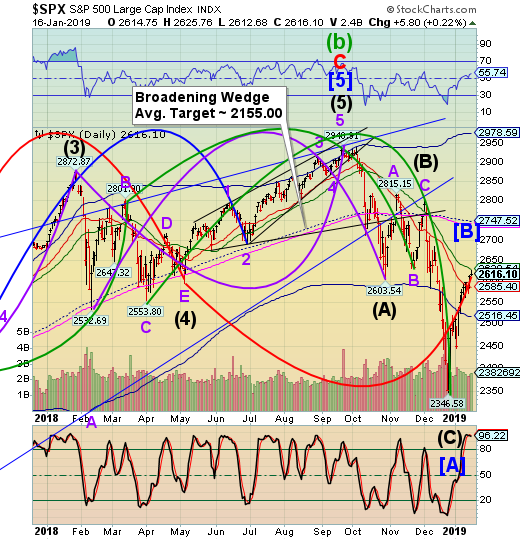

-- The SPX extended its rally to the 50-day Moving Average at 2628.54 and closed beneath it. In the process of doing so, it made a Master Cycle inversion. The decline is due to resume in a matter of days, according to the Cycles Model.

(Bloomberg) The global rebound in equities from December’s gut-wrenching sell-off has many calling it a “melt-up,” defined as a sharp and unexpected gain driven by a stampede of investors who don’t want to miss out rather than any fundamental improvements. Including Wednesday’s gains, the MSCI All-Country World Index has rallied 9.13 percent since Christmas. That’s better than the gauge’s 7.28 percent surge in the first four weeks of 2018, a performance many compared to a bubble that was ready to pop — which it did, tumbling 9 percent over the following two weeks.

Although the latest moves come with most economists downgrading their outlook for global economic growth and corporate earnings, it’s not as if the move has been built on smoke and mirrors. Medley Global Macro-Managing Director Ben Emons has zeroed in on three plausible reasons for sentiment quickly shifting for the better. First is the rally in China’s yuan, which has reduced the risk of a capital flight from the country that would throw global markets into turmoil. The yuan has appreciated on speculation authorities will continue ramping up their stimulus efforts to keep the local economy from slowing much further — as it did this week.

-- NDX also had a Cycle inversion (high). The rally managed to close over the 50-day Moving Average at 6640.42. There is a new Head & Shoulders formation with the right shoulder being completed. There is a potential of a probe to 6750.00 to complete the rally.

(ZeroHedge) While many traders saw the mid-December market meltdown as a "catharsis" of sorts, a long overdue and much-needed "mean reversion" process, one which hit hard stocks that were the biggest winners of 2018 and slammed "momentum" names, those which had enjoyed the biggest pile-up of "smart money", while names that had seen little institutional interest (and were heavily shorted) outperformed, arguably bringing some semblance of normalcy to a gaping valuation dispersion, one month later something unexpected has emerged.

According to Sanford Bernstein, momentum stocks have not only regained their mojo in the past three weeks but according to Bloomberg, now display a valuation gap relative to losers that widened to levels not seen since the dot-com era.

"This is worrying - the spreads are (much) higher than they were in February 2009 – a catastrophic career-costing period for momentum," Bernstein wrote in the note to clients. "This shocked us and caused us to double check our numbers."

The numbers were correct.

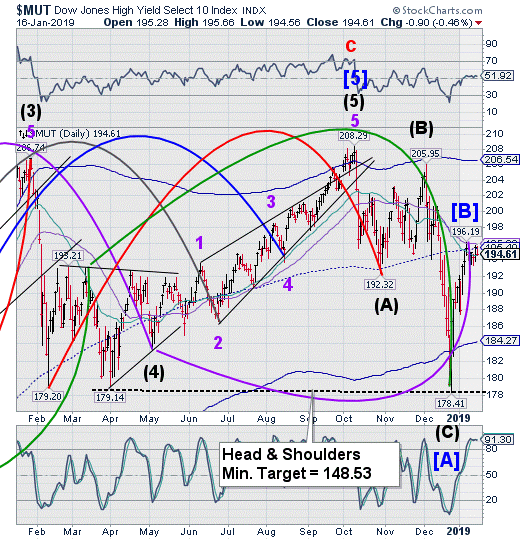

The High Yield Bond Index may have made its own Master Cycle inversion on January 8 with a 50% retracement of the decline from October 3. The right shoulder of a Head & Shoulders formation appears complete. The Cycles Model suggests that the decline may resume at any time.

(Bloomberg) Junk bonds limped into 2019 nursing wounds from a December rout that was the worst month for the market since 2011. After a robust rally to start the year, strategists are significantly upgrading their annual forecasts.

Most bullish on the asset class is Wells Fargo, which boosted its high-yield total return forecast to 9.9 percent, from a 6-7 percent call made last year. An attractive starting yield, fundamental backdrop and slight uptick in issuance are all positive drivers, the bank said in a Jan. 4 report.

The turnaround is stunning given that December was the first month with no issuance for the asset class in at least a decade. High-yield debt fell 2.14 percent that month during the year-end market turmoil. After a 3 percent jump since the start of the year, other strategists swiftly joined in on the junk-bond optimism.

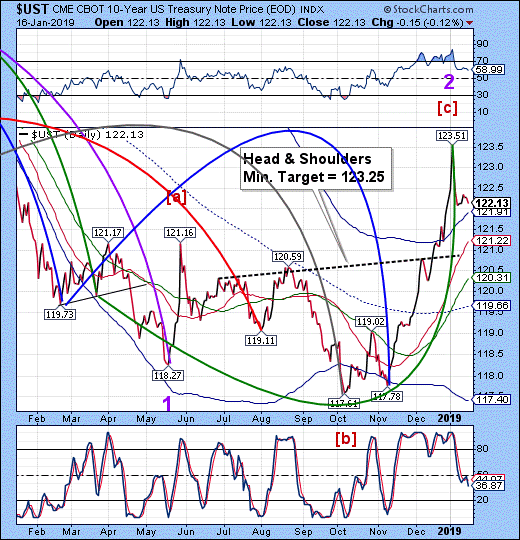

10-Year Treasury Notes reversed from the Master Cycle high on January 3 but closed above Cycle Top support at 121.91. The Cycles Model calls for a decline over the next 3 weeks which, in all probability, may reach the Cycle Bottom at 117.40.

(ChannelNewsAsia) With equities slumping, exchange-rate volatility increasing, and political risks intensifying, financial markets around the world have hit a rough patch.

During times like these, international investors generally grow cautious and prioritize safety over returns, so money flees to “safe havens” that can provide secure, liquid investment-grade assets on a sufficiently large scale.

But there are no obvious safe havens today. For the first time in living memory, investors lack a quiet port where they can find shelter from the storm.

Historically, the safe haven par excellence was the United States, in the form of Treasury bonds backed by the “full faith and credit” of the US government. As one investment strategist put it back in 2012:

When people are worried, all road lead to Treasuries.

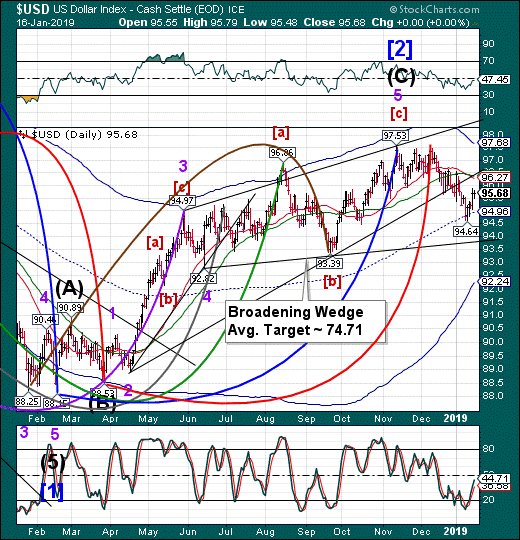

The U.S. Dollar bounced off its mid-Cycle support at 94.96 in a partial retracement that may be complete, or nearly so. It remains on a sell signal. The Cycles Model suggests the decline may continue through mid-February. The Ending Diagonal formation is triggered, allowing the USD to decline to its 2018 lows.

(Morningstar) The US dollar is turning in a mixed performance against other major currencies on Wednesday. Traders are largely making cautious moves as they look for fresh signals.

The political uncertainty in the US due to the ongoing government shutdown and the Brexit turmoil appear to be forcing traders to refrain from making big moves.

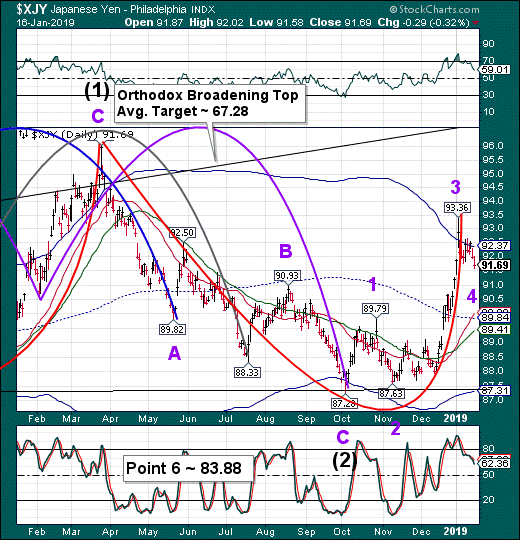

--The Yen appears to be digesting the sharp two-week rally ending on January 3. The decline may be complete by the end of the week. The Cycles Model implies a potential reversal that could take the Yen much higher by mid-February.

(Bloomberg) The yen is likely to reach its strongest level in more than six years if Japan enters a recession, which could come as early as the fall of this year, according to a former central bank official.

“I don’t think it will hit the 70s but the 80s is quite likely,” Hideo Hayakawa, a former chief economist at the Bank of Japan, said in an interview with Bloomberg on Tuesday. He was referring to the yen’s exchange rate against the dollar.

The BOJ would be powerless to stop such a move, though it could slow it down by introducing a negative lending rate, one of the few policy options it has left, said Hayakawa, a consistent critic of the BOJ’s current stimulus policies.

Analysts’ median yen forecast for end-2019 is 108. They see it at 105 at end-2020. The currency hasn’t been in the 80s since before Governor Haruhiko Kuroda took over the BOJ in early 2013.

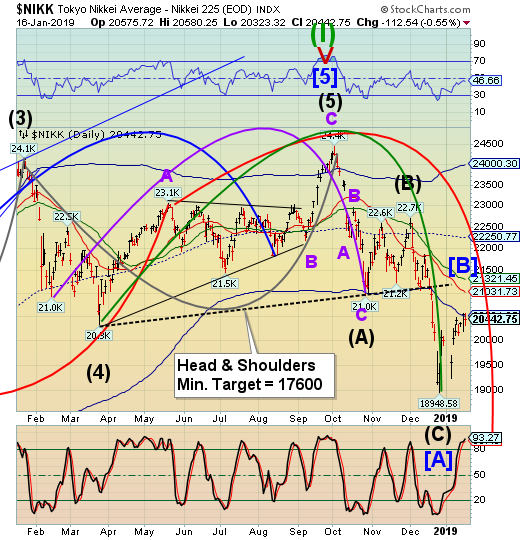

The Nikkei contended with Cycle Bottom resistance at 20501.25 yesterday and lost, closing beneath it. The Cycles Model suggests the decline may be imminent. The 2016 low may be a possible target for this decline.

(Reuters) - Japanese shares retreated from a four-week high on Wednesday as investors took profits on firms exposed to China’s economy a day after they enjoyed a boost from Chinese stimulus hopes.

Despite small gains on Wall Street the previous day, the Nikkei share average dropped 0.6 percent to 20,442.75, after briefly touching a four-week high of 20,580.25.

Bank Of America Merrill Lynch said in its fund manager survey that as the dollar-yen was sold off and global investors became more concerned about prospects for the global economy, their Japan equity allocation fell to net minus 1 percent in January, the first minus figure since 2016.

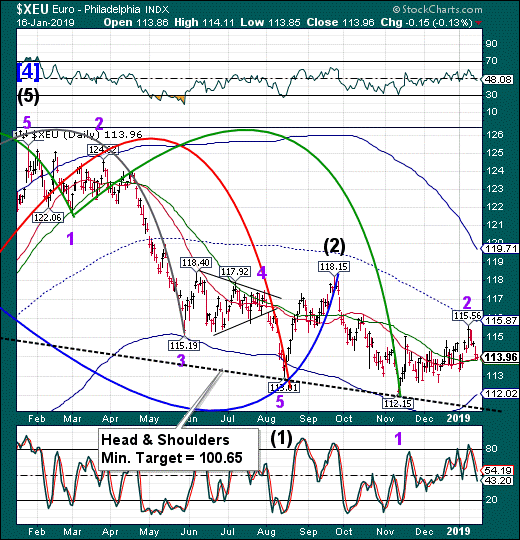

The Euro tested its 50-day Moving Average at 113.84 but closed above it. The reversal occurred on schedule. A sell signal is triggered beneath the 50-day. The Cycles Model suggests 4 weeks of decline ahead.

(Bloomberg) European Central Bank officials stepped up the urgency of their warnings that Britain’s messy divorce from the Europe Union could further damage the currency area’s slowing economy.

Speaking a day after the U.K. parliament rejected the government’s Brexit deal in a landslide, Austria’s Ewald Nowotny said uncertainty over the way forward could hurt sentiment in the eurozone. In a newspaper interview, Executive Board member Yves Mersch called the U.K.’s departure a potential source of “unnecessary shocks.”

“Brexit -- from the banking point of view -- is not so much a technical problem, because here we are pretty well prepared for whatever outcome there will be,” Nowotny told a conference in Vienna. “But it could be a psychological problem. And as you know, 50 percent of economic thinking is psychology.”

EuroStoxx 50 Index may have completed its bounce last Wednesday, followed by a sideways consolidation as it waits for the other markets to catch up. A reversal here is almost certain to take out the Head & Shoulders target and then some…

(CNBC) European stocks closed higher on Wednesday, as market participants awaited a no-confidence vote in the U.K. government led by Theresa May.

The pan-European Stoxx 600 was up almost half a percent at the closing bell, with most sectors and major bourses in positive territory.

Europe’s banking index led the gains, rising 2.4 percent as some of Italy’s notoriously fragile lenders pared some of their recent losses. It comes after a prominent Italian lawmaker reportedly said mergers among some of the country’s struggling lenders could help make Rome’s banking system more solid. Italy’s Unicredit and FinecoBank both gained almost 6 percent on the news.

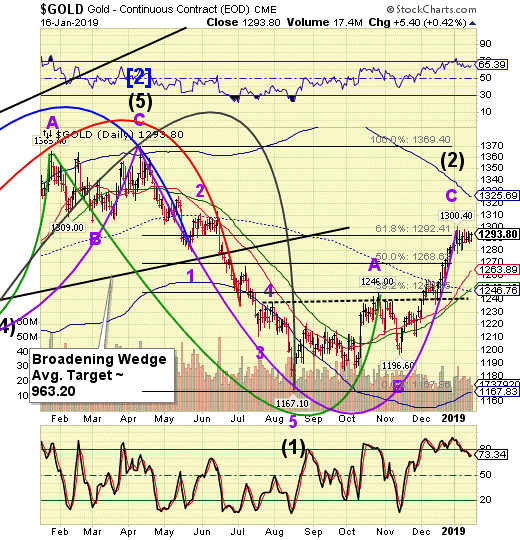

-- Gold has been consolidating in place near its 61.8% retracement level for almost two weeks. It is now overdue for a reversal. The Cycles Model suggests a decline into the first week of February is possible.

(CNBC) Newmont Mining’s $10 billion purchase of Goldcorp does not mean the metals miner is making a bullish call on gold, according to CEO Gary Goldberg.

Instead, the global gold and copper miner is seeking to optimize Goldcorp’s assets during a period when the cost of the yellow metal has flatlined and the industry is undergoing significant consolidation.

“We’re designing our business to survive through the cycles in prices. We’re not predicting an up or down,” Goldberg told CNBC.

“As we go through our longer-term plans, we use a $1,200 gold price and we’re really focused on returns and making sure that any project, any business going forward, is delivering at least a 15 percent rate of return.”

West Texas Intermediate Crude has consolidated above its Broadening Wedge trendline and critical support/resistance at 50.00. The retracement pattern may be near completion as it challenges the 50-day Moving Average at 52.15. That critical resistance may force crude oil back beneath 50.00, reigniting a sell signal.

(Reuters) - Oil prices dipped on Thursday as U.S. crude production quickly approached an unprecedented 12 million barrels per day (bpd) just as worries about weakening demand emerge.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $52 per barrel at 0140 GMT, down 31 cents, or 0.6 percent, from their last settlement.

International Brent crude oil futures LCOc1 were down 34 cents, or 0.6 percent, at $60.98 per barrel.

American crude oil production C-OUT-T-EIA reached a record 11.9 million bpd in the week ending Jan. 11, the Energy Information Administration (EIA) said on Wednesday, up from 11.7 million bpd last week, which was already the highest national output in the world.

The Shanghai Index appears to have made a Master Cycle low on January 4. Since then it has bounced toward the 50-day Moving Average at 2597.65, but closing short of its target. The probe higher discussed last week may be over. This raises the possibility of a larger decline after the bounce.

(SouthChinaMorningPost) Hong Kong and China stocks shot up Tuesday after the Chinese government pledged tax cuts to boost manufacturing and small enterprises amid a slowing economy and the US-China trade war.

The Hang Seng Index surged 2 per cent, or 531.96 points, to close at 26,830.29, the highest level since December 4. The Shanghai Composite Index climbed 1.4 per cent, or 34.58 points, at 2,570.34.

Traders piled into stocks -- from banks and insurers to automobiles -- after China’s policymakers and government bureaus declared their resolution to help the slowing economy with supportive measures in several back-to-back press conferences.

The stimulus signals followed an unexpected slump in China’s December exports and imports on Monday, which amplified concerns over China’s economy and weighed down on markets from Hong Kong to New York.

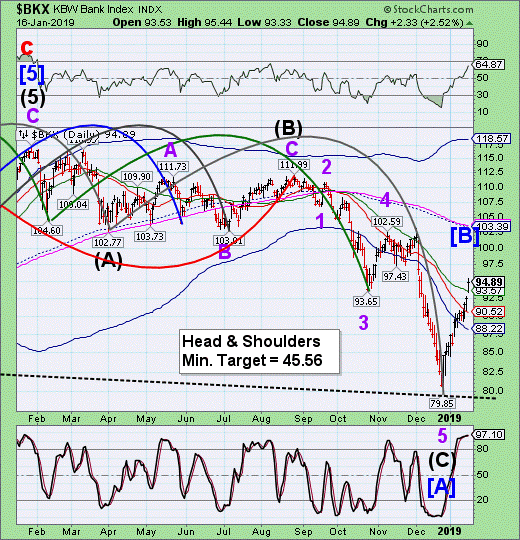

-- BKX rallied through its 50-day Moving Average in spite of poor earnings reports. While the bounce appears impressive, the Cycles Model warns that there is more to come on the downside. It also suggests peak strength runs out by the end of the week.

(ZeroHedge) Following what Bloomberg calculated was a record net reverse repo liquidity injection on Wednesday, when the PBOC injected a whopping 560 billion yuan of liquidity into the financial system via open market operations, the Chinese central bank has done it again and in Thursday's open market operation, it sold 250BN yuan in 7 Day repos (slightly below yesterday's record 350BN), and 150BN in 28 Day repos, which net of maturities resulted in a whopping net 380BN yuan ($56.2BN) liquidity injection.

This brings the net liquidity injection this week to a near record 1.14 Trillion yuan (Monday 20BN, Tuesday 180BN, Wednesday 560BN, and Thursday 380BN) and the week is not even over yet - should tomorrow's reverse repo be of similar magnitude, then this week will go down in history as China's biggest liquidity injection on record.

As on Tuesday, yesterday's massive liquidity injection was aimed at "keeping reasonable and sufficient liquidity in banking system as liquidity falls relatively fast during peak season for tax payments," according to a statement from the PBOC, although why this year should be such a significant outlier, even when factoring in the liquidity needs ahead of the Lunar new year, to prior periods was not exactly clear.

(ZeroHedge) One may not know it by looking at banker bonuses last year, but 2018 was a banner year if only for bank shareholders and upper management: this is the year when the 6 biggest banks generated (well) over $100 billion in profit. They can thank Trump's tax cuts, the Fed's payment of interest on reserves, rising interest rates, a jump in dealmaking and a retail-banking boom (if not so much the "bad volatility" that resulted in a plunge in fixed income, currency, and commodity trading fees).

As Bloomberg first noted, JPMorgan, Bank of America, Wells Fargo and their peers have already reported more than $111 billion of profit for 2018, and Morgan Stanley will complete the money-center picture tomorrow when it releases its fourth-quarter results Thursday and only makes this number bigger.

(ZeroHedge) Throwing a monkey wrench in rumored plans to merge Germany's two biggest banks, Bloomberg reports that Germany's financial regulators would prefer for Deutsche Bank to merge with a European rival rather than local, and just as troubled, competitor Commerzbank, setting them apart from forces in the government keen on an all-German deal.

According to Bloomberg, the ECB is favoring a cross-border combination to drive integration in the region’s financial markets, while analysis by German regulator BaFin suggests a preference for a European deal because the two domestic banks - surprise - are currently too weak to benefit sufficiently from a merger.

In other words, merging one Too Big To Fail bank with another would only result in a teetering behemoth that will need an even greater bailout when the next financial crisis hits. And by "sharing" the combined liabilities of the combined entity - which would likely inherit Deutsche Bank's tens of trillions in gross notional derivatives - with another sovereign, would at least ensure that German taxpayers would enjoy some dilution of the upcoming bailout pain with another European nation at some point in the coming years.

Disclaimer: Nothing in this article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more