Is It Time To Invest In Credit Stocks?

The stock market has recovered from one of the most devastating crashes in recent times. After plunging nearly 34% in March, the S&P 500 Index (SPX) has now recouped those losses to post a YTD gain of about 4.6%.

A similar recovery can be mapped across several sectors of the market. Consumer goods stocks are among the most to benefit from the coronavirus pandemic, amid increased stockpiling.

However, there are some interesting opportunities that may not be attracting similar attention. The credit market is one of the sectors that could rally significantly post-COVID-19 crisis. This is mainly because lending rates in most parts of the world are at the lowest levels. In the US, the base interest rate currently stands at 0.25% down from a 12-year high of 2.25% reached last year.

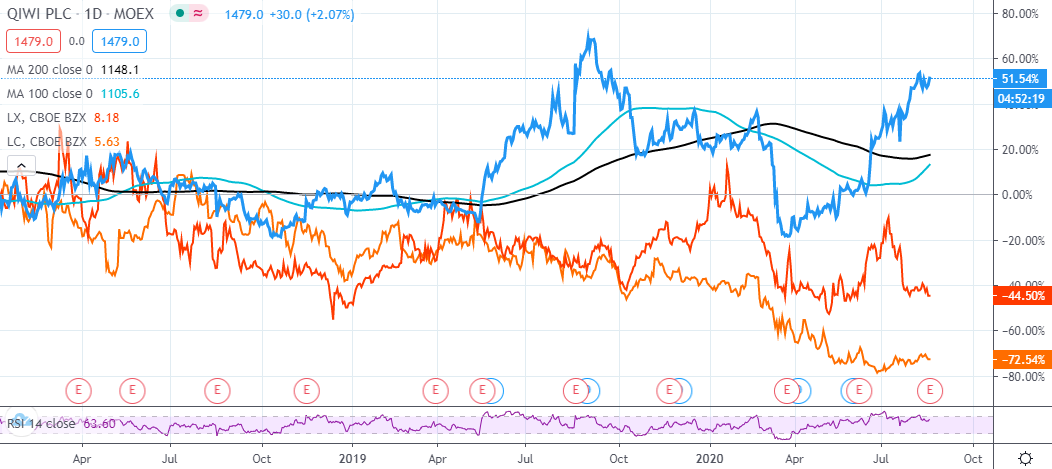

This creates some compelling investment opportunities in credit stocks like Qiwi Plc (QIWI) and LexinFinetch Holdings Ltd (LX), but of which reported their most recent quarterly earnings over the last five days.

Alternative lending platforms like the peer-to-peer lending platform, LendingClub Corporation (LC) could also benefit from increased borrowing activity amid low lending rates at a time of economic crisis. Even privately held platforms like Advance Point Cap are experiencing one of the most active periods since inception. This credit market has opened a compelling opportunity for investors to take positions ahead of what could be huge bull-run in the coming quarters.

As pointed some of the stocks that stand out include Qiwi, which currently trades an impressive forward P/E ratio of 8.32. In comparison, its trailing P/E ratio is 17.77. This indicates that the company expects significant earnings growth over the next 12 months. Shares of the company are up 40% over the last three months and just 3.25% YTD. This suggests that despite the 3-month bull-run, Qiwi could still add more gains through the rest of the year.

Another stock mentioned here, LexinFintech, has a forward P/E ratio of 3.62 and a trailing 12-month P/E of 9.19. Again, this suggests that the company expects a huge growth in earnings per share within the next few quarters. On the other hand, LendingClub, which trades at a current price of $5.63 has an average analyst target price of about $8.83 per share. So, it is all looking positive for credit stocks as we move closer to the final quarter of the year.

Therefore, as the stock market continues to recover from the COVID-19-driven crash, many investment opportunities will continue to pop up. It looks like the credit market could be a good place to start looking. Companies that have recently reported earnings like Qiwi and LexinFintech are already predicted to experience a rise in earnings and this shows that their prices could rise.

In summary, COVID-19 could yet stick around for longer than expected. This poses a risk in the global financial markets. Nonetheless, even in the midst of this crisis, government stimulus packages will boost credit uptake which could drive growth in the credit market.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more