Is COVID's Impact Semi-Permanent?

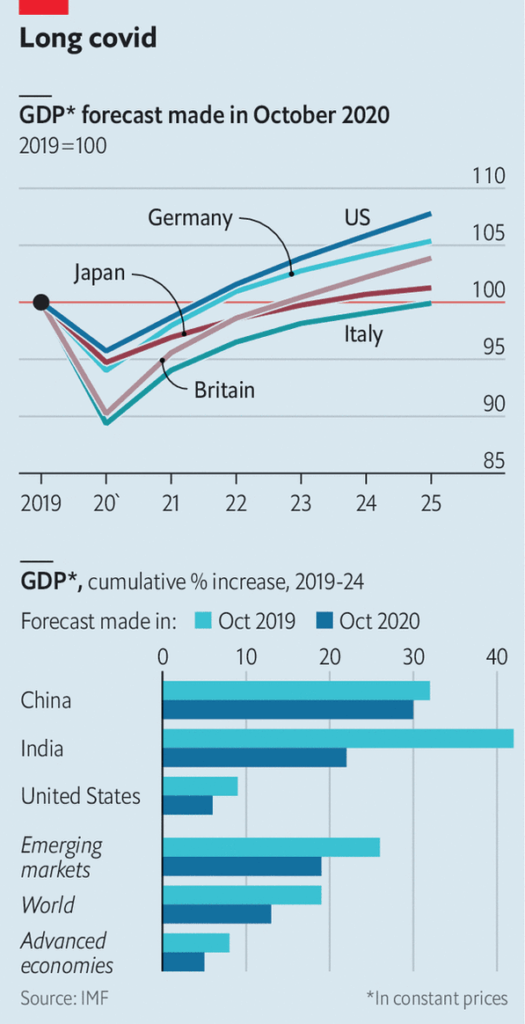

This graph in The Economist caught my eye:

Thoughts:

1. What’s up with India? And another lost decade for Italy?

2. Less immigration might slow growth in the US, but the slowdown is a global phenomenon. Immigration is a zero sum game for the world, and yet world growth is expected to slow.

[Update: I meant zero sum for the global labor force. Several commenters pointed out that it’s not zero sum for global GDP, because labor moves to where it’s more productive. I should have said, “and yet growth is slowing in each region.”]

3. It seems likely that COVID-19 will be over long before 2025, so there seem to be some semi-permanent effects. Why? It looks like a loss of roughly 3 percentage points in the US (or 0.6% per year for 5 years).

4. Perhaps the Fed won’t allow enough NGDP growth, and some of the lost growth will be employment related.

5. Or maybe productivity growth will slow. That could be due to less capital accumulation resulting from less investment during COVID, or slower technological progress.

6. The IMF forecasts may be wrong; maybe growth will not slow. Or maybe it will slow for reasons unrelated to the IMF model, such as Biden policies. (I doubt Biden would have a big impact, but who knows?)

7. But growth is expected to also slow outside the US, and the Great Recession also led to sharp reductions in long run RGDP forecasts for many countries, including the US. Why aren’t we expected to bounce back to trend?

I’d like to end up with a slightly different hypothesis, which I’ve been discussing on and off for almost a decade. Maybe trend growth is slower than we assume. Growth during 2009-2019 was in the 2% to 2.5% range, but that was entirely during the expansion phase of the business cycle. During that period, unemployment fell from 10% to 3.5%. That’s unsustainable.

The correct way to measure trend growth is to compare two widely separated years with similar unemployment rates. That approach often yields trend growth estimates that are lower than the consensus. If the IMF is correct, then total growth between 2019 and 2025 will be roughly 7.8%, or 1.3% per year. Maybe that’s the new normal. After all, population growth is gradually slowing, and productivity growth is also slow, although poorly measured.

I’ve recently been saying the new normal is 1.5% measured trend growth, and I’m sticking with that. FWIW, if the IMF is correct about the 7.8% growth from 2019-25, then RGDP growth from 2007:Q4 to 2025:Q4 will average 1.54%. If unemployment is around 4.5% in 2025 (as in 2007), then that will likely be the new long run trend. That’s relatively bad, and may help to explain why we see such low real interest rates.

PS. I say “relatively” bad; it still means the richest big country the world has ever seen will keep getting richer and richer and richer. It beats living in a disease-ridden London slum in 1831. Or a rural French village in 1324. Those people did not have pet psychologists to address depression in dogs and cats. We are bursting with happiness; I see it on twitter every single day. 🙂