Investing In The Time Of COVID-19

Summary:

- The emergence of the Omicron variant has significantly increased volatility in the market

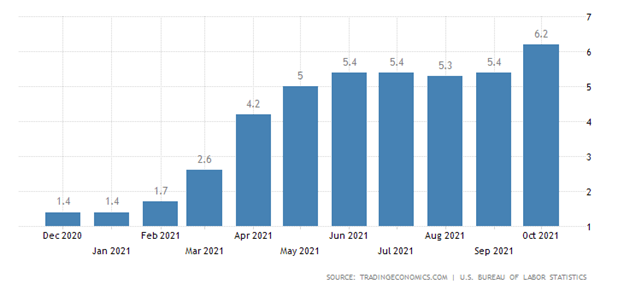

- The reaction of the Fed to Omicron is unclear now, taking into account the inflation threat

- The annual inflation rate in the US surged to 6.2% in October 2021

For more than one year we have been living in a time of global pandemic threat and unprecedented economic support from governments. Each time when we think that we have an effective vaccine again the virus, and we form expectations about living in the post-pandemic time, Corona strikes again jeopardizing our achievements in fighting it and creating chaos in the global economic system. Omicron, which introduced itself last week, is the new variant of COVID-19 (which has a high number of mutations in the virus spike protein). It is still unclear how dangerous the new variant is, but governments have begun to implement security measures to prevent the spread of Omicron to their territories.

Today there is a high level of uncertainty in financial markets and we do not have enough information about the new variant to adjust our expectations for the future. But Omicron is not a “Black Swan” event like the one that occurred during the initial COVID-19 breakout, and what is more important is that the world economy has already adapted to the realities of the pandemic and can react quickly to a current situation. While the beginning of COVID-19 in the February of 2020 was something new for us, which we had not seen before in modern history, the Delta variant also, did not as dramatic an impact on the global economy and our everyday life as COVID-19 did when it emerged.

Between the Coronavirus and Inflation Walls

Although the emergence of COVID-19 crashed financial markets in March 2020 and put much of the world economy under lockdown, it also introduced the mega uptrend growth which is continuing today.

(Figure 1 – Stock Prices in the Pandemic)

How is it possible that in pandemic times we have higher expectations about companies’ abilities to generate profit, which determines stock price, when companies do not operate at full capacity? The answer to this question is government support. So, to support the market, the Fed significantly increased the amount of money in the economy and cut interest rates close to zero. Despite the fact that such monetary policy has had a positive effect on stock prices, it has also created a threat of sustained inflation in the future if the amount of production does not grow significantly to absorb the money supply.

Today we have entered a phase in which we are face to face with inflation. According to Trading Economics, the annual inflation rate in the US surged to 6.2% in October 2021, which creates a threat of higher inflation expectations in the future with higher interest rates to meet these expectations, which will increase funding costs for corporate business. The Fed wanted to start decreasing the market support in April. However, the opposite position of the US Government forced the Fed to delay realizing its plan for the future, and the emergence of Omicron can delay it even further.

From the example of Delta, we see that the global economy has already adapted to the pandemic, and the emergence of a new variant can increase the volatility rate in the short term. However, the biggest difference in the Omicron case is that earlier the market could take into account government support to overcome some of the negative impacts of the pandemic such as lockdowns or new variants. But today, we are facing inflation and it is not clear if the Fed can continue postponing tackling inflation. Now we need to see that the Fed and the US Government have the same macroeconomic position to create an effective plan to confront Omicron while under the threat of continued inflation. Otherwise, policy actions will create additional levels of uncertainty that will increase volatility and undermine faith in the ability of the Fed to effectively manage the pandemic macroeconomic situation.

(Figure 4 – The VIX Dynamic)

How to React in the Period of Uncertainty

A period of high volatility and sell-off creates great opportunities in the market. However, at the same time, an investor has to stay calm to correctly analyze a current market situation in an environment of ambiguous information, and make correct investment decisions.

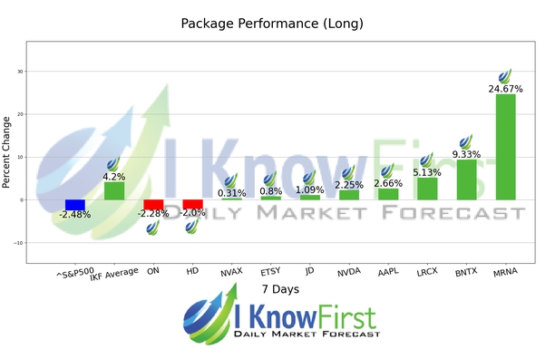

This week, we saw our Coronavirus Stock Market Forecast package delivering returns up to 4.2% to our clients in just seven days. Despite the price fluctuation, our AI algorithm has successfully predicted 8 out of 10 movements. The package average stood at 4.2% while the S&P 500 had a -2.48% return in the same period.

During periods of macroeconomic uncertainty, the actuality of safe-haven assets increases. In our article, we discuss the opportunities and risks of the Cryptocurrency market and switching the role of the safe-haven asset from Gold to Cryptocurrency during the pandemic.

Conclusion

The emergence of the Omicron variant shows that the current macroeconomic situation remains fragile. Countries prefer to close borders and implement security measures to prevent the spreading of Omicron to their territories. While we do not have enough information about the new variant to adjust expectations, we will see a high level of volatility in the financial market. Moreover, Omicron significantly increased the complexity of the inflation task for Fed, which could have a dramatic macroeconomic effect in the long-term period. Despite the uncertainty creating a high level of risk, it also creates great investment opportunities in the long term.

Disclosure: A period of high volatility and sell-off creates great opportunities in the market. However, at the same time, an investor has to stay calm to correctly analyze a current market ...

more