Investing In One Sucker Yield REIT Can Sink The Fleet

In an article last week I suggested the Hospitality Property Trust (NYSE:HPT) appeared to operating a self-serving sale/leaseback platform as a means to tap into high-yielding off-balance assets owned by TravelCenters of America (NYSE:TA). HPT's "truckstop piggybank" - consisting of over 184 travel centers - provides the Lodging REIT with substantial exposure (33%) in which the cozy relationship (between the two) appears ripe for conflicts of interest.

As I explained, TravelCenters does not own most of the locations it operates. Instead it leases the majority of them from HPT. The "coziness" comes into play when you see that HPT is managed by REIT Management & Research, which is majority-owned by Barry Portnoy.

In 2007 TA spun off from HPT, so now Barry Portnoy has his hands in two pies which might mean that he can favor HPT when setting the leases and other contractual affairs.

But having multiple hands in the pie is nothing new for Portnoy since he also owns interests in other REITs, all managed by RMR/ Government Properties Trust (NYSE:GOV), Select Income REIT (NYSE:SIR), and Senior Housing Properties Trust (NYSE:SNH) are all externally-managed by the Portnoy clan.

In a recent Benzinga article, Bill Stoller explained several differences between internal and external (fee-based) REIT management teams, as it relates to RMR:

- RMR gets paid large fees for growing assets under management, (even to the detriment of shareholder returns).

- Therefore, RMR and shareholder interests are clearly not aligned.

- These RMR managed REITs have underperformed compared to the broader REIT sector.

- This situation does not appear likely to change any time soon.

RMR has demonstrated a willingness to do whatever it takes to retain voting control of the REIT trustee boards which approve these lucrative management agreements.

Is Government Properties Trust On Solid Ground?

Recently I was writing an article on STAG Industrial (NYSE:STAG) and when I was researching the dividend yields for the broader peer group, I noticed that Government Properties Trust was offering an outsized yield of 8.9%.

I'm sure you know what I was thinking, "GOV looks like a sucker yield".

You read my mind. How can a Net Lease REIT that is generating an outsized yield of almost 9% be sustainable? By definition (mine on Investopedia), a "sucker yield" means that it is "too good to be true" and I offered the following explanation:

If a stock seems to pay a dividend yield that is exceptionally high, investors should look harder at the sources of payment behind the dividend. That is, how profitable is the company? Can the sources of income cover the dividend payment? How sustainable is the dividend? Are there threats to the underlying business model?

It has been a while since I wrote on GOV and many followers have asked me to weigh in on the high-flying alternative. Last week, while writing on HPT, I decided that now would be a good time to peel back the onion, especially since shares in GOV are trading at all-time lows.

GOV listed shares on June 2, 2009 (almost 6 years ago) and since that time the shares prices has dropped by 3.25% (GOV opened at $20.00 per share):

As you can see, on April 29th GOV shares got clobbered. It appears that's the same day that earnings were released. What could have caused the slide?

RMR Is At It Again

As mentioned above, RMR has its hands in many REIT pies and one previous shareholder in SIR (Lakewood Capital Management) was highly vocal as it relates to RMR's self-dealing attributes. According to Benzinga, "back in June 2014, Lakewood published a scathing letter with multiple exhibits detailing the convoluted efforts engaged in by RMR to keep control of the SIR board, including a dilutive May 2014 issuance of 8,000,000 new common shares".

It appeared that the Lakewood dispute (with SIR) was ending "after the Portnoy/RMR group lost control of the former CommonWealth REIT (CWH) - the then largest stakeholder in SIR - which effectively controlled who appointed the board".

However, RMR pulled another hand out of the pie (GOV REIT), this time to buy the shares of CommonWealth (now called Equity Commonwealth Trust) at a premium. GOV established a 24% investment in Select REIT in July 2014, and recently increased it to 28.2% in March 2015.

I know that's confusing…So let me write it in the King's English:

GOV is a Triple Net REIT that invests in government-leased buildings. SIR is an office REIT that also focuses on free-standing buildings. Both REITs are managed by RMR. GOV now owns 28.2% of SIR.

To facilitate the new trade, in Q1-15 GOV took a non-cash charge of approximately $40.8 million to purchase shares in SIR. This was triggered by SIR's issuance of more than 28 million new common shares in connection with its acquisition of Cole Corporate Income Trust in January 2015. I wrote an article on SIR last year and here's how I summed up the Cole deal:

It seems to me that by adding another $3 billion of dilutive deals, this REIT is "throwing good money after bad." In my opinion, Select Income could be more "selective with income" and attempt to "cherry pick" accretive deals versus trying to bulk-up for the sake of bulking up on yield.

The new stock issuance was made at a price below the per share carrying value of SIR, which prompted the charge and results in GOV reporting a GAAP net loss for the 2015 first quarter. I will address the income statement in more detail below.

Personally, I view the investment by GOV in SIR as foolish and I see no rational to support the argument that the shares were bought at a bargain price. As I alluded in a previous article, SIR was already deemed a risky REIT in light of the fact that the cap rate (5.8%) for the Cole acquisition was a premium price to pay. Now, GOV investors get to participate in the "folly" that screams "fool's gold".

RISK: External Management with Conflicts of Interest

The Overview

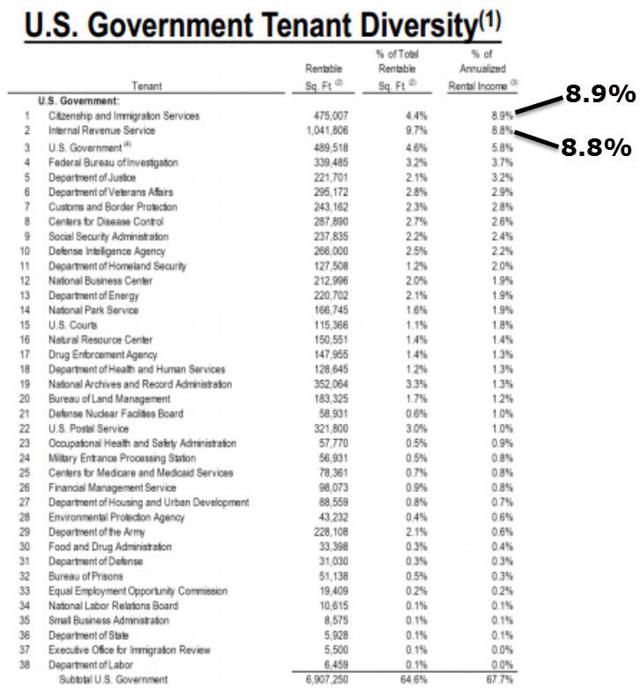

GOV owns 71 properties containing 10.7 million square feet in 31 states and Washington, DC. GOV's tenants include U.S. Government (38 agencies), 12 state governments (32 agencies) and the United Nations.

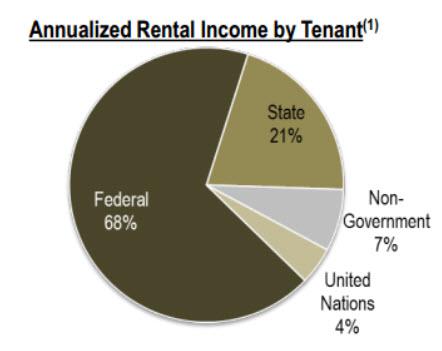

Around 93% of GOV's annualized rent is paid by the U.S. Government, state governments, and the United Nations and over 90% of revenue is paid by investment grade tenants. Here is a snapshot of several of GOV's tenants:

On the latest earnings call, GOV's president and COO, David Blackman, explained:

The U.S. government has created many challenges for our business over the past two years from freezing the footprint, increasing employee utilization rates at lease buildings and consolidating into government-owned space. Overall, we believe we have risen to these challenges and have performed well.

GOV's U.S. Government leases are overseen by the General Services Administration and most lease are GROSS LEASES with FLAT RENTS andANNUAL EXPENSE REIMBURSEMENTS. This is an important distinction because the leases are NOT NNN (triple-net). The Landlord is responsible for many expenses making the revenue less predictable (than a NNN Lease).

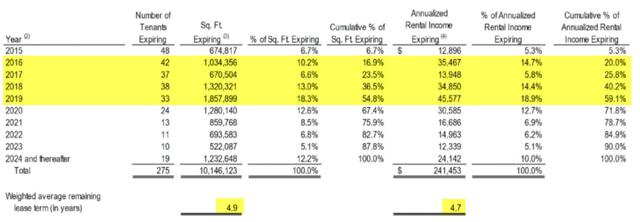

Most government lease are 10-20 years with renewal for 5 years (although 3-5 year renewal terms have been favored recently). GOV's weighted average lease term based upon revenue was 4.7 years.

The U.S. government continues to be GOV's largest tenant and combined with 12 state governments in the United Nations contributed nearly 93% of annualized rent as of March 31st.

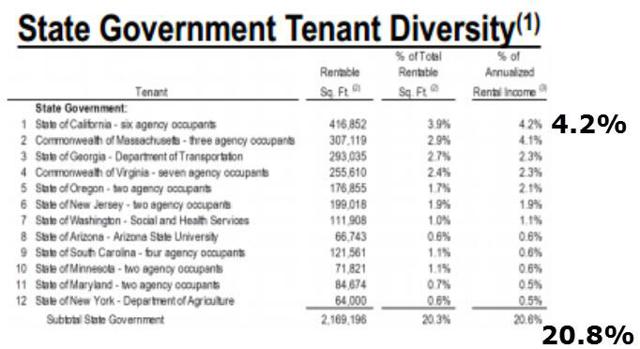

Around 21% of GOV's rental income is from state government leases. Most of these leases are full service GROSS with periodic rent increases and NO REIMBURSEMNET of OPERATING EXPENSES. Also, some state leases are subject to annual budget appropriations. The State of California is GOV's largest state government tenant:

Also, GOV has the highest state-wide exposure in California.

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more