Inverted Triangle Strategy

We have one day left in this second week of August, and with most of our markets turning sideways into ranges, the key is going to be buying low, selling high, and avoiding the middle…

And my favorite way to trade these types of range-bound markets is to use the inverted triangle pattern, in combination with my failure set-up – are you ready?

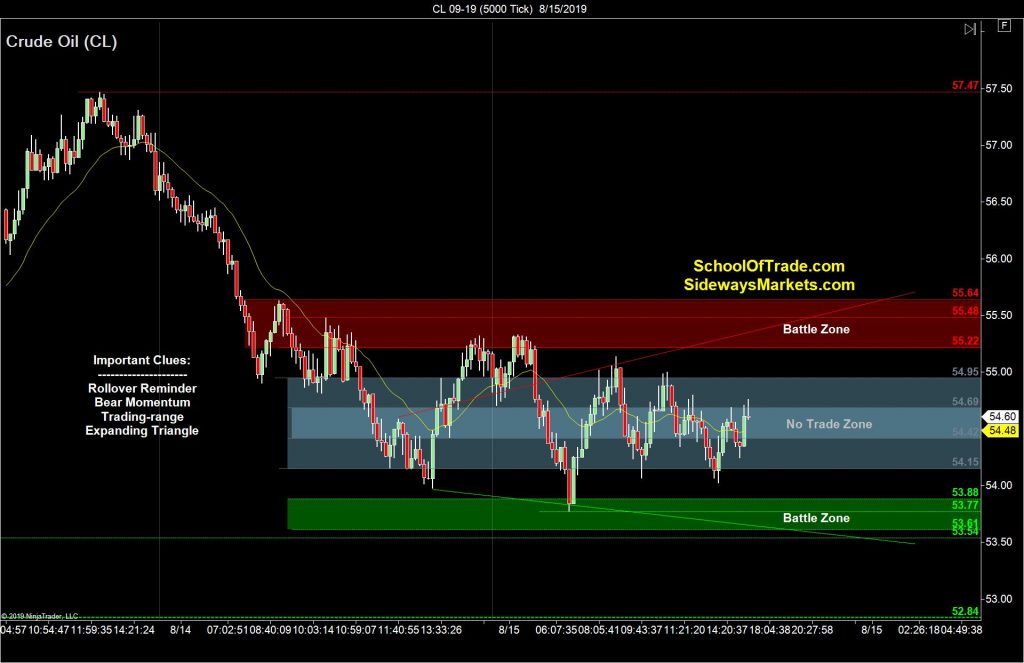

Crude Oil is range-bound with a bear-bias this evening, which tells me to look for sell set-ups at key resistance levels above the high of the range…

And I have my eyes on the highs and lows of an inverted triangle, in combination with a failure set-up, with a target going back into the range again.

E-Mini S&P Wants to Snap Higher – Time for a Reversal?

E-Mini S&P is bearish into a narrow trading range, which tells me to buy the low, sell the high, and avoid the middle…

But one big clue that stands out on this chart, is the short-term momentum for the bulls – telling me to look for a “nested” variation of my failure set-up to sell off the high of the inverted triangle.

Nasdaq Grinds Down the Low of an Inverted Triangle…

Nasdaq is range-bound with bearish momentum, which tells me to look for sell set-ups using resistance levels above the high of the range…

And I have my eyes on the range-expansion levels, combined with the high of an inverted triangle for sell set-up tomorrow morning.

Gold is Bullish, But I’m Trading It Like a Range

Gold is bullish into a flat bull channel, and a trading-range, which tells me to look for buy set-ups below the range using a seller-failure pattern.

But if the price keeps pushing higher, the next objective is the measured-move, and without a lot of open space overhead, I’m focused on “traps” for the most reliable way to buy it.

Euro is Three Legs Down, Look for a Range…

Euro is bearish with three large legs going lower, which is a big clue that this market is likely going to turn sideways into Friday morning…

Knowing this, my plan is to wait for the range to be confirmed, then look for sell set-ups above the high using a 2-Try Buyer-failure set-up.

Disclaimer: Join our Free Trading Course. Joseph James, SchoolOfTrade.com and United Business Servicing, Inc. are not registered investment or ...

more