Interesting Times...

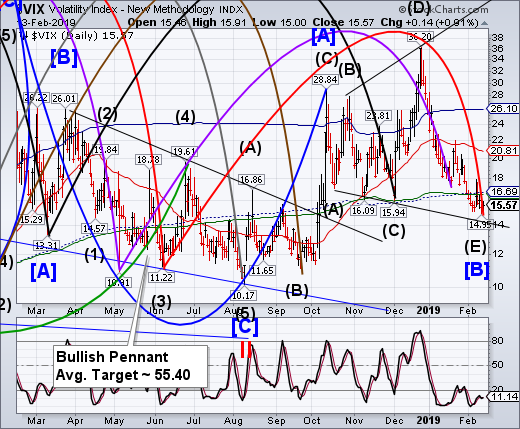

VIX may have reached a second Master Cycle low in less than a month, patterned after the May-June lows last year. Volatility shorts have been having a field day until now. Today is options and futures expiration for the VIX. The conditions are ripe for a reversal.

-- The NYSE Hi-Lo Index made a lower high today, adding evidence that the Master Cycle is complete as of February 1. The Cycles Model tells us to expect a significant low by mid-March.

(ZeroHedge) While stocks continue their scorching post-Christmas rally, the big story so far of 2019 is not so much the move in the market which was to be expected once the Fed capitulated to petulant traders, but the fact that investors have so far shown no faith in the sustainability of the rally and instead have been withdrawing capital from equity funds for the duration of the rally.

Confirming this, the latest BofA Fund Managers Survey showed that professional investors' allocation to global equities tumbled 12% to just net 6% overweight, the lowest level since September 2016, and the biggest MoM drop relative to the performance of global equities (+7% from Jan 4th start of Jan'19 survey) to Feb 7th (end of Feb'19 survey) on record.

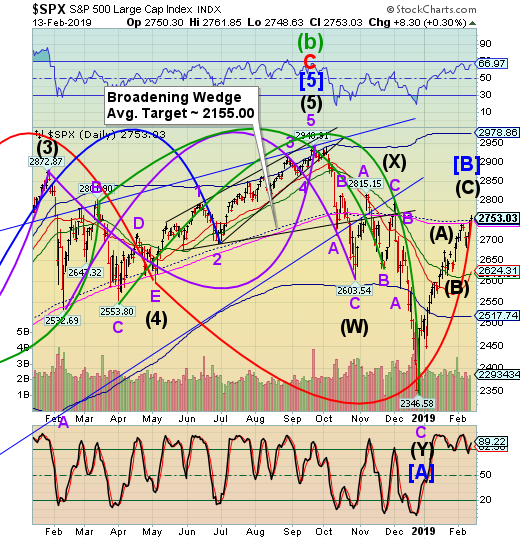

-- The SPX rally extended into its (inverted) Master Cycle high today, closing above its 200-day Moving Average at 2743.78. Cycles require meeting both time and price targets. In this case, the time was extended to accommodate the price target. The next agenda item is a retest of the December low.

(Bloomberg) U.S. equities put in their fourth straight session of gains as optimism over trade negotiations countered some of the jitters that Senator Marco Rubio triggered when he announced a bill to tax buybacks on equal footing with dividends.

Rubio’s tweet Wednesday about his buyback proposal slowed an advance in the S&P 500 Index, but the benchmark still finished higher, even after Netflix dragged on the communication-services sector late in the day. The dollar gained and Treasuries edged lower as data showed U.S. inflation remained contained.

Equities have been climbing this week in part on news that President Donald Trump is open to extending a March 1 deadline to raise tariffs on Chinese products if the two sides are near an agreement. High-level talks between the U.S. and China are set for later this week. Also buoying stocks was news that Trump is closer to accepting a border spending deal, averting another government shutdown.

-- NDX may have completed its rally this morning by challenging the 200-day Moving Average at 7049.52 but closing beneath it. Should it reverse, it will have completed the right shoulder of a new Head & Shoulders formation. If valid, new downside lows may be made. I will publish the target at the break of the neckline.

(ZeroHedge) One of the bigger "mysteries" of the market in 2019 has been how, with virtually everyone selling US equities, something confirmed not only by fund flow data...

... but also the latest BofA Fund Manager Survey, which showed that that professional investors' allocation to global equities tumbled 12% to just net 6% overweight, the lowest level since September 2016, and the biggest MoM drop relative to the performance of global equities (+7% from Jan 4th start of Jan'19 survey) to Feb 7th (end of Feb'19 survey) on record...

... have stocks managed to stage not only a dramatic rebound from the December lows, but also enjoyed the best January since 1987, with the rally continuing well into February. In fact, as shown in the chart below, the YTD performance in the S&P is tied for second best since 1990 (on par with 1997) and only trailing the return of the 1991 market.

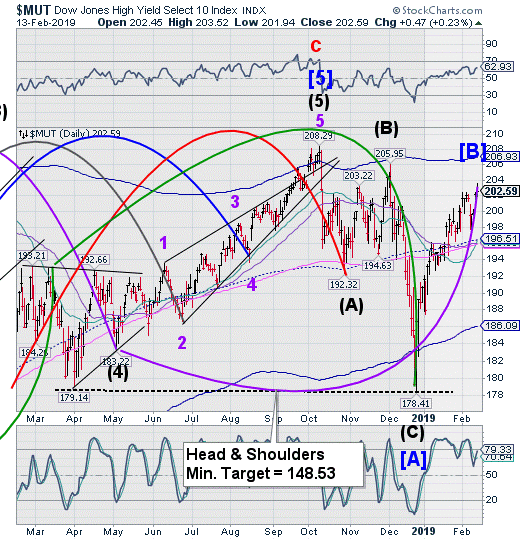

The High Yield Bond Index also made a new retracement high today. The High Yield Index is on the same or similar Cycle with Equities. A Major low appears to be due in mid-March.

(Bloomberg) Need more proof that investor appetite for risk-taking is returning in the U.S. junk-bond market? Take a look at the debt being offering by Ascend Learning, the educational software maker acquired two years ago by Blackstone Group and the Canada Pension Plan Investment Board in a leveraged buyout.

The $300 million high-yield offering is the first since July that will be used to fund a dividend to a company’s owners, a purpose that’s typically seen by investors as riskier than other types of deals. It was the first such deal to launch since Bruin E&P Partners sold $600 million of notes in July to, among other things, fund a payout to its equity sponsors, data compiled by Bloomberg show.

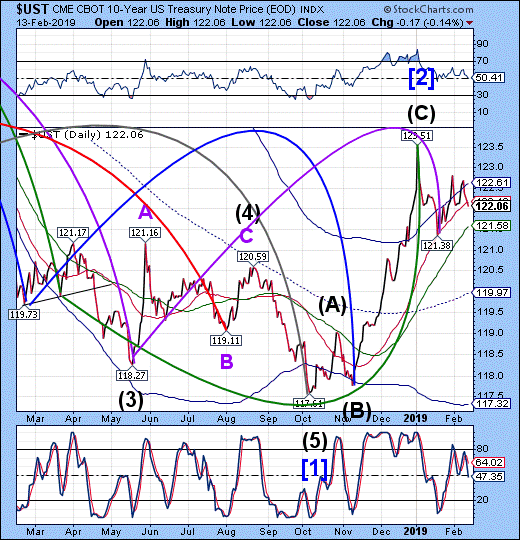

10-Year Treasury Notes retested its Cycle Top resistance at 122.61, but couldn’t hold on. It has since declined beneath Intermediate-term support at 122.16, putting it on a potential sell signal. The Cycles Model suggests the bounce may be over and a decline lasting through mid-April may have begun.

(Bloomberg) Investors are amassing an expensive insurance policy against market doomsday.

Confident that fragile economies will keep monetary policy makers in dovish straight-jackets, they poured another $490 million into the iShares 20+ Year Treasury Bond ETF last week -- bringing its year-to-date inflow to a record $2.3 billion.

That stocks will suffer as a result of this brittle growth outlook has also helped push three-month trailing inflows into fixed-income ETFs to the highest on record through end-January, according to State Street Global Advisors.

“Fears of worsening economic momentum coupled with geopolitical uncertainties and corporate earnings revisions that appear to have limited upside has triggered a rush for safety,” said Antoine Lesne, head of SPDR ETF Strategy & Research for Europe at State Street Global Advisors. “Fixed income is thus a good place to be relative to higher potential drawdowns in equity portfolio.”

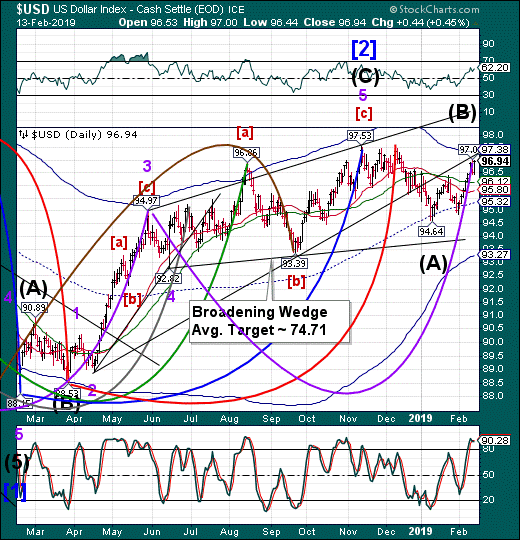

The U.S. Dollar may have put in its Master Cycle inversion (high) yesterday. While it may still challenge that high, all of the requirements for a reversal have been made. The Cycles Model suggests a significant low may be made around mid-March.

(CNN) So much for the Federal Reserve killing the US dollar.

When Fed chair Jerome Powell signaled last month that rate hikes probably won't happen anytime soon, many experts thought that would hurt the dollar. Powell said the central bank needed to be "patient" and see what happens next for the US economy.

Low-interest rates usually go hand in hand with a weaker currency. Think of Japan and the yen during its lost decades of negative rates, deflation and a sluggish economy.

But the US Dollar Index has rallied 1.5% against other currencies after the Fed's January 30 meeting. That has taken many by surprise.

An increase of 1.5% may not sound like a lot, but it's actually a fairly dramatic move in the usually sleepy world of currencies. The dollar is now up slightly year-to-date.

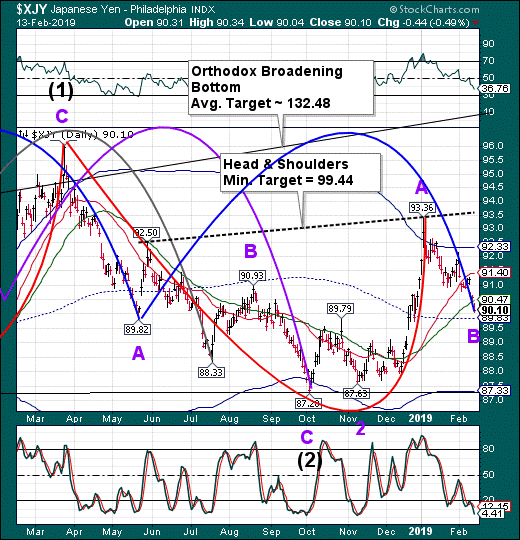

--The Yen extended its Master Cycle low through today. After having broken through the 50-day Moving Average, it may continue to mid-Cycle support at 89.83 for a reversal. If the Cycles are correct, there may be an extended rally that could last up to 4 weeks or longer.

(MarketPulse) USD/JPY has gained ground in the Wednesday session. In the North American session, the pair is trading at 110.76, up 0.25% on the day. On the release front, Japanese PPI disappointed with a gain of 0.6% in January, shy of the estimate of 1.0%. This was the lowest level since January 2017. Later in the day, Japan releases GDP for the fourth quarter, with an estimate of 0.4%. In the U.S., consumer inflation data for January was soft. CPI ticked up to 0.0%, shy of the estimate of 0.1%. Core CPI posted a gain of 0.2%, matching the estimate. On Thursday, the U.S. publishes retail sales and PPI.

Inflation levels in the U.S. remain low, despite a strong U.S. economy and strong labor market. CPI showed no change in January, and has failed to post a gain since November. Core CPI has recorded weak gains of 0.2% for four successive months. On an annualized basis, CPI gained 1.6% in January, the weakest year-over-year gain since mid-2017. The soft inflation numbers were a result of low energy prices, which fell 3.1% in January as oil prices remain under pressure.

The Nikkei extended its (inverted) Master Cycle high today as it tested the Head & Shoulders neckline. A breakdown beneath the 50-day Moving Average at 20934.02 puts the Nikkei on a sell signal. The Cycles Model calls for a potential decline lasting up to two months.

(JapanTimes) Stocks gained further ground on the Tokyo Stock Exchange on Wednesday thanks to an overnight advance in U.S. equities, with the key Nikkei average closing above 21,000 for the first time in almost two months.

The 225-issue Nikkei average gained 280.27 points, or 1.34 percent, to end at 21,144.48, the first finish above 21,000 since Dec. 18. On Tuesday, the key market gauge surged 531.04 points.

The Topix index of all first-section issues closed up 16.73 points, or 1.06 percent, at 1,589.33, after climbing 33.20 points the previous day.

The Nikkei recovered the psychologically important line of 21,000 as soon as the Tokyo market opened.

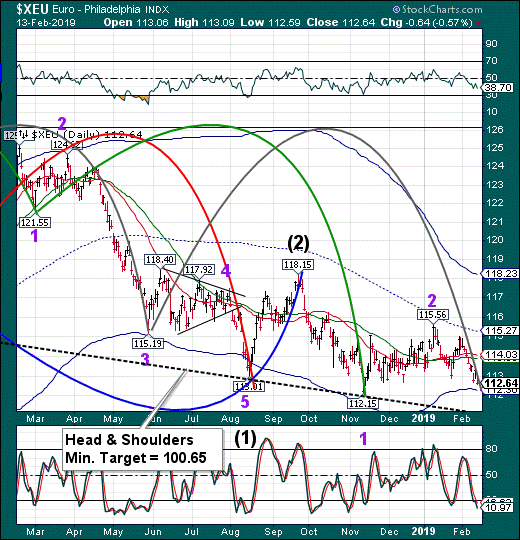

The Euro approaches its Cycle Bottom support at 112.30, but may not stop there. The Cycles Model indicates up to a two week window in which to put in a low, so the chart is preliminary. A more likely target for the decline may be the Head & Shoulders neckline.

(Bloomberg) Euro-area industrial production fell more than twice as much as forecast in December, raising further questions over the state of the bloc’s economy.

The 0.9 percent drop -- more than twice the 0.4 percent forecast -- was driven by declines in capital and non-durable consumer goods production. From a year earlier, output plunged the most since 2009, when the economy was dealing with the fallout from the financial crisis.

Disappointing news has piled up since the European Central Bank decided to halt asset purchases last year. Policy makers have kept a brave face, arguing that the 19-nation region is merely going through a phase of weaker growth -- amplified by a spate of temporary factors and external threats -- and there’s no risk of falling into a recession.

The EuroStoxx 50 Index rally fell 2 points short of the February 6 high. While it may go higher by the end of the week, the Cycle and Wave structure appear complete. The Cycles Model may turn bearish with a Master Cycle low due in March.

(CNBC) European stocks closed higher Wednesday, amid renewed optimism the world's two largest economies might be able to resolve their long-running trade dispute.

The pan-European Stoxx-600 closed provisionally up around 0.6 percent, with most sectors and major bourses in positive territory.

Europe's basic resources stocks — with their heavy exposure to China — were the top performers, up almost 2 percent as investors grew increasingly hopeful of a resolution to the U.S.-Sino trade spat.

Travel and leisure was another top-gaining sector, amid earnings news. Sweden's Kindred Group reported an all-time high in active customers in the fourth quarter of 2018. Shares of the Stockholm-listed stock rose by 7.5 percent.

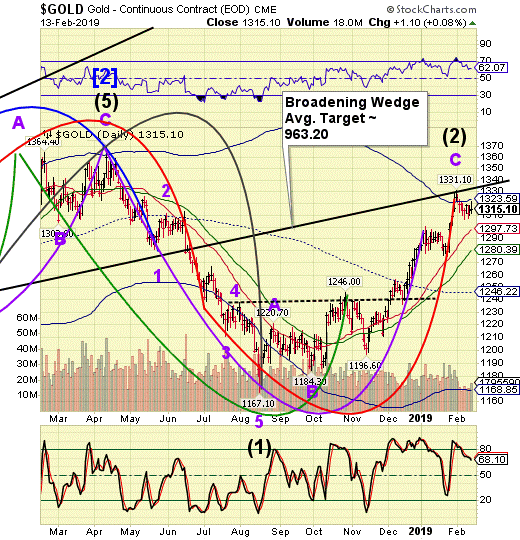

-- Gold continues to consolidate beneath the Cycle Top resistance at 1323.59. It is now on a sell signal which may be confirmed beneath Intermediate-term support at 1297.73. The resulting decline may last up to 5 weeks.

(CNBC) Gold prices rose on Wednesday on more signs the U.S. Federal Reserve will likely be patient on further interest rate rises, but rallying global equities kept the metal's gains in check.

Spot gold was up 0.04 percent at $1,310.99 per ounce as of 1:56 p.m. U.S. gold futures settled up $1.10 at $1,315.10 per ounce.

Federal Reserve officials have indicated that they will support a pause in interest rate hikes from the U.S. central bank to assess its impact in economy.

"It appears that the Fed is really going to be much more dovish going forward on their expectations on interest rates," said Phil Streible, senior commodities strategist at RJO Futures in Chicago.

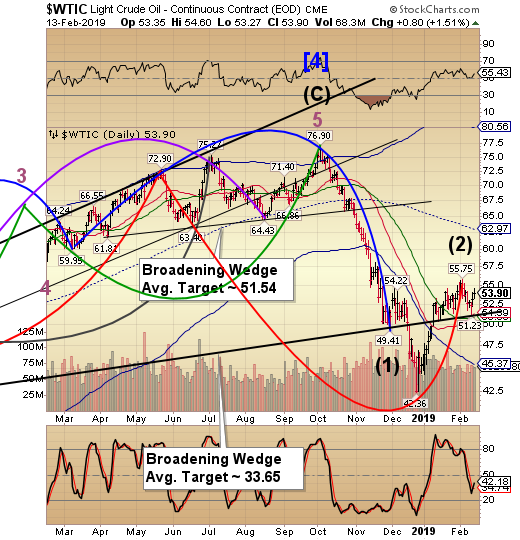

West Texas Intermediate Crude bounced from the Broadening Wedge trendline, but did not make a new high, making it likely that this is a partial retracement. A decline beneath the trendline at 51.39 activates the larger Broadening Wedge formation and a sell signal. This signal may be just as strong as the signal given on October 3.

(RigZone) Both major crude oil benchmarks finished higher during midweek trading.

The March WTI contract price gained 80 cents Wednesday, settling at $53.90 per barrel. During the midweek session it fluctuated within a range from $53.27 to $54.60.

Brent crude oil for April delivery ended the day at $63.61 per barrel, reflecting a $1.19 gain for the day.

“Both March WTI and April Brent crude oil have been trading with a sideways consolidation pattern for over a month,” Steve Murphy, vice president with Rockville Centre, N.Y.-based Rafferty Commodities Group, told Rigzone.

Murphy noted that the daily charts for the WTI and Brent show the market contained within horizontal lines of support and resistance.

The Shanghai Index came back from holiday with a mighty surge that may last through the weekend. The apparent target may be its mid-Cycle resistance at 2756.35. The Cycles Model indicates weakness may reappear as early as next week, lasting through mid-March.

(Reuters) - Chinese shares jumped on Wednesday, rising for a fourth straight session, after U.S. President Donald Trump suggested the deadline for Beijing and Washington to strike a trade deal could be pushed back.

The Shanghai Composite index closed 1.8 percent higher at 2,721.07 points, a level not seen since Oct. 10, 2018. The blue-chip CSI300 index rose 2 percent to its highest point since late September. Both indices marked their largest daily percentage gains since Jan. 4. The CSI300 financial sector sub-index added 1.9 percent, the consumer staples sector rose 1.6 percent, while healthcare shares gained 1.5 percent.

U.S. President Donald Trump said on Tuesday that he could let the March 1 deadline for a trade agreement with China “slide for a little while”, hinting at a possible delay for the first time. Trump’s advisers have previously described March 1 as a “hard deadline”, after which U.S. tariffs on $200 billion worth of imports from China will rise to 25 percent from 10 percent, if the two sides cannot reach a deal.

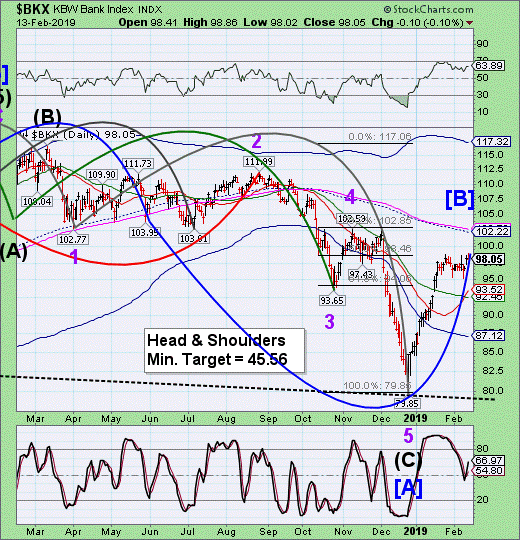

-- BKX barely made it above the 50% retracement level at 98.46 to extend its Master Cycle (inverted) high today. The Cycles Model suggests that Cyclical strength may remain until the weekend, but it is now overdue for a decline to retest the December low. The next Master Cycle low may not be due until late March.

(Fortune) Last month, Wall Street’s major banks celebrated robust quarterly earnings virtually across the board. Even before Morgan Stanley disclosed comparatively disappointing numbers, the likes of Goldman Sachs, JP Morgan Chase, Citigroup, Bank of America, and Wells Fargo combined to report more than $100 million in earnings for the fourth quarter of 2018. Buoyed by the Trump tax cuts and the crest of the current economic cycle, the big banks shrugged aside December’s topsy-turvy market volatility and other macroeconomic concerns to inform investors and analysts alike that business, for the time being, was booming.

Fast forward a few weeks and a more complicated picture is emerging. Goldman Sachs, fresh off its highest full-year revenues since 2010, is reportedly considering major cuts to its commodities trading operation as new CEO David Solomon seeks to reevaluate costs across the business. HSBC and Société Générale are said to be weighing investment banking job cuts, while beleaguered Deutsche Bank—which last year announced plans to cut more than 7,000 jobs—is reportedly considering slashing its bonus pool by 10%. BNP Paribas, meanwhile, has responded to underwhelming results by eyeing an additional 600 million euros in previously announced annual cost savings.

(TheStreet) Some folks just aren't cut out for running money. They're too candid.

Ask the five-decade Wall Street analyst Dick Bove why he lasted less than a year as a money manager for Hilton Capital Management, and the answer is pretty simple. He just couldn't, in good conscience, raise money for a bank-stock fund at a time when investors should instead be getting out.

"You can't tell people I think bank stocks are going down in price and then ask them for money to invest in bank stocks," Bove said this week in a phone interview.

Now approaching 80, Bove recently quit Hilton and last week joined the New York-based brokerage firm Odeon Capital, where he's already resumed doing what he's done for nearly his entire career: researching the prospects of big lenders like JPMorgan Chase & Co. (JPM - Get Report) , Bank of America Corp. (BAC - Get Report) and Goldman Sachs Group Inc. (GS - Get Report) , and then publishing reports on his views, often needling the CEOs for their misguided strategies and incompetent management.

(ZeroHedge) Banco Santander SA has earned its "special place in markets hell" - as Bloomberg columnist Marcus Ashworth termed it. Shares of Santander erased and earlier gain and closed lower on Tuesday after the bank confirmed anxious bondholders fears by affirming that it would refuse to exercise a call option on a €1.5 billion ($1.7 billion) issue of Additional Tier 1s - better known as contingent convertible, or CoCo - bonds.

Santander's decision makes it the first European bank in the still-young $340 billion market for bank AT1 notes to decline to call the bonds after the standard five-year term. A spokesman for the bank told BBG that it wouldn't redeem the bonds out of an “obligation to assess the economics and balance the interests of all investors."

Disclaimer: Nothing in this article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more