Intel Takes Lead On Dow Top-Stock List

We can use our data to track individual stocks, industries, sectors, and indices. For today's bulletin, we present key metrics for the top picks in the Dow Jones Industrials. The companies listed below represent the top stocks within the index. They are presented below according to their one-month forecast gain.

We have very little turnover this time for our Dow top-ten list. Our only newcomer is IBM, which has replaced GE. Since the last time we presented the top Dow picks, Intel has moved up to become the overall top pick while Verizon maintains the second spot and Traveler's has declined to third. Johnson and Johnson and United Health Group have also improved while Cisco, McDonald's, Home Depot, and Pfizer have declined a few positions. Be advised that none of these stocks are currently rated higher than BUY--there are no STRONG BUY picks in this edition of our DOW top-ten.

|

Ticker |

Company Name |

Market Price |

Valuation |

Last 12-M Retrn |

1-M Forecast Retn |

1-Yr Forecast Retn |

P/E Ratio |

Sector Name |

July 7, 2016 |

|

INTEL CORP |

34.83 |

3.99% |

22.86% |

0.94% |

11.23% |

13.88 |

Computer and Technology |

TRV |

|

|

VERIZON COMM |

55.32 |

-0.27% |

20.71% |

0.93% |

11.20% |

14.08 |

Utilities |

VZ |

|

|

TRAVELERS COS |

116.43 |

3.73% |

10.27% |

0.78% |

9.41% |

11.24 |

Finance |

INTC |

|

|

JOHNSON & JOHNS |

124.77 |

9.64% |

26.95% |

0.57% |

6.84% |

19.65 |

Medical |

CSCO |

|

|

CISCO SYSTEMS |

30.76 |

2.28% |

9.04% |

0.55% |

6.54% |

14.58 |

Computer and Technology |

JNJ |

|

|

INTL BUS MACH |

161.83 |

-5.87% |

1.74% |

0.47% |

5.63% |

12.01 |

Computer and Technology |

PFE |

|

|

UNITEDHEALTH GP |

141.68 |

6.62% |

20.19% |

0.43% |

5.12% |

20.77 |

Medical |

MCD |

|

|

MCDONALDS CORP |

119.48 |

9.20% |

24.41% |

0.41% |

4.92% |

22.29 |

Retail-Wholesale |

HD |

|

|

HOME DEPOT |

136.31 |

1.97% |

20.55% |

0.37% |

4.47% |

23.38 |

Retail-Wholesale |

UNH |

|

|

PFIZER INC |

36.85 |

14.80% |

7.31% |

0.35% |

4.14% |

15.23 |

Medical |

GE |

NOTE: New stocks are in BOLD.

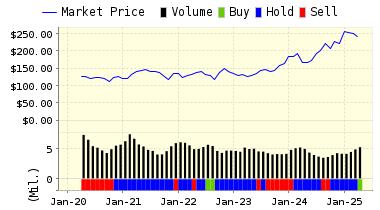

Below is today's data on IBM (IBM):

IBM is an information technology (IT) company. The company operates in five segments: Global Technology Services, Global Business Services, Software, Systems and Technology, and Global Financing. The Global Technology Services segment provides IT infrastructure services and business process services. The Global Business Services segment offers professional services and application management services. The Software segment consists primarily of middleware and operating systems software. The Systems and Technology segment provides computing power and storage solutions; and semiconductor technology products and packaging solutions. The Global Financing segment invests in financing assets, leverages with debt and manages the associated risks. IBM is headquartered in Armonk, New York.

VALUENGINE RECOMMENDATION: ValuEngine continues its BUY recommendation on INTL BUS MACH for 2016-07-27. Based on the information we have gathered and our resulting research, we feel that INTL BUS MACH has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and P/E Ratio.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

162.59 | 0.47% |

|

3-Month |

164.46 | 1.63% |

|

6-Month |

165.53 | 2.29% |

|

1-Year |

170.94 | 5.63% |

|

2-Year |

172.91 | 6.85% |

|

3-Year |

163.55 | 1.06% |

|

Valuation & Rankings |

|||

|

Valuation |

5.87% undervalued |

Valuation Rank(?) |

|

|

1-M Forecast Return |

0.47% |

1-M Forecast Return Rank |

|

|

12-M Return |

1.74% |

Momentum Rank(?) |

|

|

Sharpe Ratio |

-0.14 |

Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return |

-2.45% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

17.53% |

Volatility Rank(?) |

|

|

Expected EPS Growth |

0.82% |

EPS Growth Rank(?) |

|

|

Market Cap (billions) |

160.37 |

Size Rank |

|

|

Trailing P/E Ratio |

12.01 |

Trailing P/E Rank(?) |

|

|

Forward P/E Ratio |

11.91 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

14.71 |

PEG Ratio Rank |

|

|

Price/Sales |

2.00 |

Price/Sales Rank(?) |

|

|

Market/Book |

10.09 |

Market/Book Rank(?) |

|

|

Beta |

0.73 |

Beta Rank |

|

|

Alpha |

-0.08 |

Alpha Rank |

|

ValuEngine Market Overview

|

Summary of VE Stock Universe |

|

|

Stocks Undervalued |

54.39% |

|

Stocks Overvalued |

45.61% |

|

Stocks Undervalued by 20% |

23.26% |

|

Stocks Overvalued by 20% |

15.23% |

ValuEngine Sector Overview

|

Sector |

Change |

MTD |

YTD |

Valuation |

Last 12-MReturn |

P/E Ratio |

|

0.64% |

8.17% |

50.58% |

16.68% overvalued |

60.39% |

30.76 |

|

|

-0.57% |

1.92% |

9.37% |

5.97% overvalued |

8.98% |

24.21 |

|

|

-0.35% |

2.29% |

13.25% |

5.63% overvalued |

11.50% |

23.44 |

|

|

0.67% |

2.87% |

7.01% |

4.13% overvalued |

-5.69% |

18.77 |

|

|

0.00% |

5.96% |

11.62% |

1.71% overvalued |

5.50% |

22.69 |

|

|

0.20% |

3.86% |

-2.37% |

1.63% overvalued |

-1.06% |

19.69 |

|

|

-0.31% |

3.98% |

14.73% |

0.04% undervalued |

-2.16% |

23.93 |

|

|

0.02% |

7.05% |

27.66% |

0.05% undervalued |

9.72% |

22.36 |

|

|

0.12% |

5.33% |

11.43% |

0.64% undervalued |

2.36% |

30.21 |

|

|

0.09% |

3.76% |

5.05% |

2.09% undervalued |

0.36% |

16.45 |

|

|

0.04% |

4.42% |

6.66% |

3.10% undervalued |

-3.08% |

22.36 |

|

|

-0.75% |

-1.15% |

14.91% |

5.68% undervalued |

-14.09% |

24.34 |

|

|

0.47% |

6.09% |

0.83% |

8.49% undervalued |

-19.30% |

28.31 |

|

|

-0.47% |

3.37% |

0.03% |

8.67% undervalued |

-7.03% |

22.35 |

|

|

-0.24% |

6.22% |

7.13% |

9.10% undervalued |

-21.30% |

14.13 |

|

|

0.34% |

7.55% |

1.81% |

13.80% undervalued |

-3.84% |

12.81 |

VALUATION WATCH: Overvalued stocks now make up 45.61% of our stocks assigned a valuation and 15.23% of those equities are calculated to be overvalued by 20% or more. Six sectors are calculated to be overvalued.

Disclosure: None.

Disclaimer: ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, ...

more