Inflation Dogma Dies Hard

It has been a busy week, if short. We found out this week that there is pressure on the doves at the Federal Reserve, the biggest of which is Chairman Yellen, to raise interest rates. To some extent we already knew this, based on the dissents in favor of immediate hiking at the latest FOMC meeting. But the minutes this week provided evidence that the support for such a move is broadening, and even normally-dovish Fed speakers have lately been conceding the argument that it “may” soon be time to raise rates again. Notably, and critically, the Chairman is not among those turncoats. I continue to believe that Dr. Yellen will look for any and all excuses to skip a rate hike at coming meetings. Most observers don’t expect an increase to happen immediately before the US election, but the market is putting a pretty heavy weight on December. According to Bloomberg, Fed funds futures are implying a 2/3 chance of a hike at one of the next two meetings.

But lots can change before December 14th, and it will not take much to constitute an excuse to remain sidelined. It is an absurdly high hurdle that Yellen has set. But it makes sense if you remember that Yellen believes that monetary policy is an important and useful tool for increasing employment, that inflation has been so low for so long that it can run “a bit hot” for a while and not be worrisome, and that it can be reined back in at will.

Some of her insouciance is shared by many at the Fed (and described in this Bloomberg article from August). The article is delicious, because some of the quotes suggest confusion about certain notions that have been long held at the Fed but don’t seem to be working any more. They’re not working because they never did, but there was correlation without causation that confused them, and an embraced dogma about inflation that was simply wrong and ignored everything we had learned about inflation in the 1970s and early 1980s. For example, the Fed has long believed that inflation expectations play an important role in anchoring inflation. They have believed this since the 1990s, when a role for expectations was inserted in economists’ models to explain the break to low inflation around 1993. Now, however, “movements in inflation expectations now appear inconsequential since they no longer have any predictive content for subsequent inflation realizations.”

It isn’t clear why anyone ever believed that the shopkeeper will set his prices based on what his customers expect to pay, rather than on what his input costs are, but there was a lot of math and some spurious correlations and poof! let there be dogma.

So here’s a thought: maybe inflation is caused by changes in money float and money velocity? And maybe…just maybe…changing the amount of the measurement stick (money) in circulation doesn’t change the amount of stuff (real GDP) being measured? Call me crazy, but these ideas have worked for decades, and they might be useful even if there isn’t as much math.

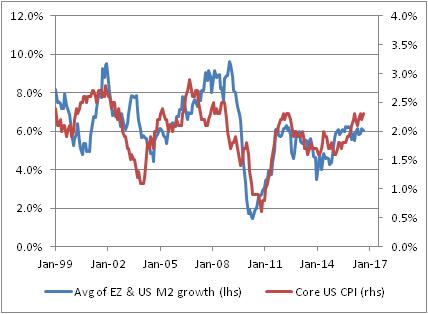

For fun, I did the chart above with both US and Eurozone money supply growth, versus US inflation. Even though I am ignoring the things the orthodoxy considers causal, like unemployment rates and inflation expectations, the fit is pretty good. MV=PQ still outperforms the output-gap based models easily. Of course, now that the unemployment rate is back to being low, the rising inflation that we are seeing will be attributed by the economic high priests to the closing of the output gap, despite the fact that inflation started accelerating in earnest long before that gap closed. Dogma dies hard.

Ironically, Yellen has the right stance but for the wrong reason: higher rates will cause higher money velocity, which will cause higher inflation; without any attempt to restrain reserves money supply growth will not roll over and squelch that inflation. So, if rates start to rise – Fed induced, or not – in earnest, the vicious cycle (higher rates cause higher velocity, which causes higher inflation, which causes higher rates, etc…) is going to kick into gear and it could be a long decade ahead. Go to our website and play with the MVPQ calculator. Starting velocity is 1.45. Remember that is an all-time low, and that the average velocity for 1960-1990 was 1.72 (and the average for 1980-2010 was 1.94). Current M2 growth is about 7.5%. It’s October. Go scare yourself.

On Tuesday, we will get another CPI and another chance to turn up the heat on the doves. In three of the last eight months, core CPI has been above 0.25%. If that happens again, then the year-over-year figure will rise to 2.4%. The Cleveland Fed’s Median CPI is already at 2.6%; the Atlanta Fed’s “Sticky” CPI is 2.72%. After the report, at 9am ET I will be doing a (free) live interactive virtual video event; you can sign up at this link. I will summarize what the inflation report said and what effect it should have on the Fed and markets, and I will take audience questions. You need to RSVP, so get in there while you can!

Disclaimer: Be sure to look at our Crowdfunder equity raise: https://www.crowdfunder.com/enduring-investments-llc … The ...

more