Individual Investors Reach Resistance

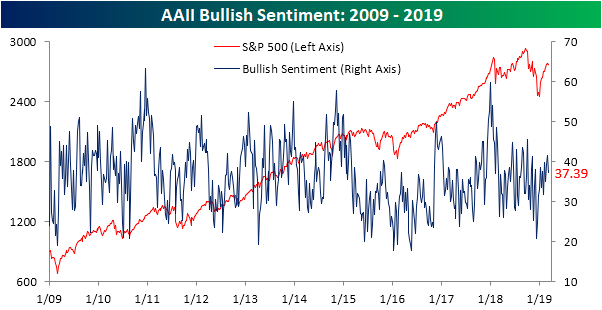

As the S&P 500 has stalled out near late 2018 highs, sentiment readings have moved pretty much in line with what could be expected. Bullish sentiment has fallen off of its multi-month high of 41.63% reached last week. This week, bullish sentiment as seen through the AAII individual investor survey came in at 37.39%. This drop is nothing too dramatic as it brings the percentage of optimistic investors just below the historical average of the survey of 38.5%. It is also still near the upper end of the range it has been in for the past year.

(Click on image to enlarge)

Bears have taken all of the gains from declines in neutral and bullish sentiment. Bearish sentiment rose this week to 26.75% off of 52-week lows of 20% from last week. Like bullish sentiment, while this is a solid increase it does not necessarily leave the sentiment level at any sort of extreme. At its current levels, it is under 4% away from its historical average. With that said, it remains low relative to where it had been for the latter half of 2018.

(Click on image to enlarge)

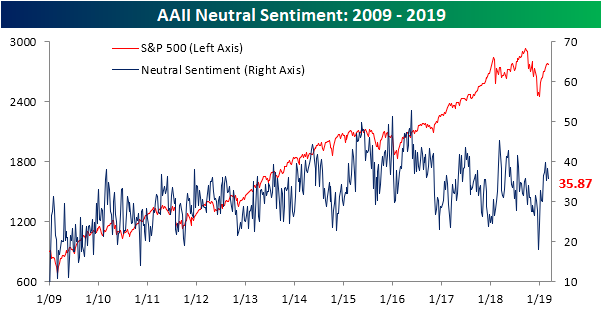

As previously mentioned, neutral sentiment fell this week by 2.5% down to 35.87%. Neutral sentiment has worked its way up since the market put in its bottom. Despite this week’s decline, it is still at fairly elevated levels. Given these readings, individual investors seem to be showing some signs of hesitation as the market reaches resistance, but at the same time, are not expressing outright bearishness at these levels.

(Click on image to enlarge)

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more