In Defense Of Economic Sanity: An Essay On Investment Logic

Introduction:

I had a college professor once tell me that people are irrational, thus we need the government to intervene in the markets to fix distortions. I quickly stood up and said that is contradictory. He narrowed his eyes and waited for me to continue. I said, "If people are irrational, then governments must also be irrational, as they are people themselves."

Investing and economics have always shared a unique attribute: They are wholly subjective. Up until the 1950s, economics was considered a social science along with politics and philosophy. After WWII, educators became obsessed with teaching economics alongside positivism and quantitative models instead of subjectivism between consumer tastes and constantly changing values. Economics quickly went from a social science into a crude attempt at being an actual science. Carelessly add misleading models combined with artificially low interest rates, and one has a recipe for a speculative boom. The Austrian economic school of thought has done irreplaceable work regarding the sphere of booms and busts and subjectivism within the markets.

Thesis:

In a world of new economic monetary frontiers i.e. quantitative easing (open currency printing), there are bound to be unintended consequences. Either investors have completely gone insane, or they are clinging to a group of Federal Reserve officials to take care of the next crisis. Something should be said about the Fed's completely mediocre projections of where the economy will go, but that is for a different article. Sticking to the classical subjective investment and economic theory, this article will clearly and concisely give investors a commonsense approach to the markets and global economies to stimulate investor minds on important topics. Continuing on, this article will give investors arguments for challenging commonly held investment precepts that are irrational, illogical, potentially devastating and deserve serious explanations.

I. 0% Rates: A Poor Replacement for Due Diligence

Since 2008, the Federal Reserve has embarked on pushing ZIRP (zero interest rate policy) to allegedly stimulate growth. In fact, the Euro zone has recently began NIRP (negative interest rate policy). Adding insult to injury, not only do banks speculate with depositor money/tax payer bailouts, but they receive all the profits as the rest of us actually lose money by depositing it in these banks (inflation rate - nominal deposit rate = real return). For simplicity, if inflation is at 3% and the interest rate on savings account is 0.10%, the depositor is actually losing 2.90% annually. With rates held at and below zero, the institutions get rich while everyone else loses.

0% rates are a double-edged sword that the Fed ignorantly ignores. The governments are subsidizing the young and reckless and indebted to go out and get loans and more debts at lower financing, while simultaneously punishing the retired and prudent and savers. The Fed, famous for ignoring the law of unintended consequences (I have written another article about the governments contradicting flaws on housing, banking, and monetary stimulation), is creating another problem with low rates: How on earth can the baby boomers retire with no yield for their life savings? Not only were many just recently burned in the housing bubble debacle, but the Fed is actually encouraging individuals with low rates to do the same thing again. Corporate America has also taken advantage of these low rates to borrow cheap money and buy back their own shares in record amounts, artificially boosting their own earnings and share price.

The most important dilemma from the ZIRP is by far the mis-allocation of wealth and the disruption of due diligence. Interest rates are key to distinguishing risk. Example: If John is more likely to pay back the bank loan than Zach is, John will receive a lower rate due to his security while Zach will be offered a loan at a higher rate due to the lender's risk of giving him money. Rates uniformly held at zero mix the good with the bad. At next to nothing interest rates, one loan looks identical to another loan. And for a return of merely nothing, what demands any diligence? Add inflation into the analysis and the creditor is risking capital for a mere couple percentage points by either a borrower defaulting or a loss of purchasing power. Do investors honestly believe that after the over $3.5 trillion printed dollars since 2008, the CPI (consumer price index) won't go above 4% within the next three decades? Any creditor financing debtors a 30/yr fixed mortgage at 3.5% is committing suicide once the United States, Japan, and the Euro finally get their inflation. It has sadly become a rush to the bottom that will leave no one better off.

II. Inflation: The Disturbing Feds' Objective

The nations of the global economy have one thing in common: They will go to any measure to fight deflation. Clinging to their Keynesian economic theory, the central banks from all over have been printing amounts that a decade ago were unheard of. In-fact, our former Fed Chairman Ben Bernanke recently gave a speech in Japan where he actually liked that Japan was forcing more inflation than the Euro Zone. Bernanke's comments should come as no surprise to anyone as he has dedicated his life work to preventing any amount of deflation. Economists fear deflation for the dreaded excuse of a "deflationary death spiral". But prices can only fall too low before production is cut due to costs exceeding profits. Economists shun the fact that in a world population of over 6 billion, people constantly need to buy food and energy and clothing and so forth, keeping demand and consumption very alive. Another excuse is that economists claim deflation leads to a stronger currency which in turn leads to lower prices, but rational intellects would challenge that with a counter argument: Wouldn't a stronger currency allow for more goods to be purchased, thus growing demand? But the reality is that the central banks are resisting deflation today and most likely will forever, and they themselves are causing future consequences that not even their PhDs will foresee.

The Fed claims there is no inflation, but anyone who grocery shops will disagree. The CPI has shown anemic inflation which gives the central banks their argument for continued printing. There is widespread agreement that inflation is among us (also worry for rising costs in Australia, England, Singapore, UAE) and yet the CPI says differently. Thus the conclusion must be that the formula for measuring inflation has changed. It's simple; if one does not like the results - change the way they are measured. The website led by John Williams, ShadowStats, compares the Fed's CPI currently and also the CPI from how it was measured in the 1980s. The difference is staggering. The Fed has turned a blind eye to the population's growing worries of rising costs for too long in the name of justifying QE to promote employment and debt consumption.

There is a commonly held precept of a nation debasing its currency to stimulate exports. Assume that a German BMW is priced at 25,000 EUROS. Now if 1 EURO = 1.25 USD the price of the car in USD will be $31,250. If the Euro zone inflates and debases its currency relative to the dollar, to say 1 EURO = 1.05 USD, that same car is in USD is now worth $26,250. This $5,000 price reduction makes the BMW far more attractive to Americans. Hence the crude macro policies to promote exports which increase a country's GDP and trade surplus. This precept is irrational due to the fact that the global economies are connected more than ever. The officials don't look at the other side of the situation. Yes, exports may increase and be relatively cheaper abroad, but imports will become more expensive due to the cheapened currency as well. For example, Japan may sell their vehicles cheaper abroad due to temporary currency debasement, but domestically their population will have to import more expensive oil to drive their own vehicles and the raw materials for building the vehicles they export. One must remember; a wind can extinguish a flame and also grow a fire.

Now, looking at the reasons why the Fed promotes inflation, an investor can clearly see that their reasoning is flawed as covered above. That leaves a significant reason untouched: inflate the debts away. With many Americans constrained with bad credit and high debts, cheapening the currency can ease the debt burdens. This is because debts are set in fixed amounts. The debtor must pay the creditor back the amount owed. But if the currency itself loses value the debtor can pay back his debts with declining purchasing power. Inflation also cons consumers into spending more today in fear that prices will rise tomorrow, discouraging savings and investment. Also, by inflating, the government can finance its debts more easily (why would a nation borrow more from foreigners when it can print the difference?). An investor must wonder how much longer creditors and foreigners will stand for this abuse.

III. Theory and History for Logical Future Assumptions

As I stated earlier, investing is an art rather than a science. There are countless investment philosophies and schools of economic thought. A personal tool of mine is forming a question by using economic theory for causal human actions and then look at history for verification of my question.

For example:

- Question - Does increasing the money supply lead to inflation and rising asset prices?

- Austrian economic theory explains that inflating the money supply will cause a loss of purchasing power i.e. inflation and a potential loss of currency confidence.

- Using historical data, times when economies had inflated their money supply caused rising asset prices and economic turmoil (France - 1790's, Germany - 1920's, Argentina - 1980's, Zimbabwe - 2000's, etc)

- Verified the facts that monetary expansion overtime had led to rising asset values and cost of living and eventually a collapse of the currency.

- Thus, one can logically assume that if the Federal Reserve continues its monetary expansion (ZIRP, QE) it will cause rising asset prices (bubbles) that will end in complete ruin.

There is a metaphor that describes our economy: One Christmas, Joseph's grandma sends him a check for $75,000. He made only $15,000 dollars in wages and income himself without the subsidized amount, so he now has $90,000 to do as he wishes. Joseph quickly goes out and purchases a brand new fully loaded Mercedes sports car. The year passes by and he has spent all his grandmother's money on the car itself and along with it the recurring higher insurance costs, foreign maintenance/repair parts, and gasoline. It becomes painfully obvious that he can not afford the new vehicle's expenses from his own annual income and will need his Grandmother to give him more money again so that he can continue enjoying the Mercedes, otherwise he will be forced to settle for a vehicle within his own income.

On a larger scale, it would be reasonable to claim that if families and economies are still struggling with debt servicing and financing even at 0% rates and artificially low 30/yr mortgage rates, how on earth will they be able to service those loans/debts once rates actually increase?

Here investors can use empirical data and common sense to make future assumptions.

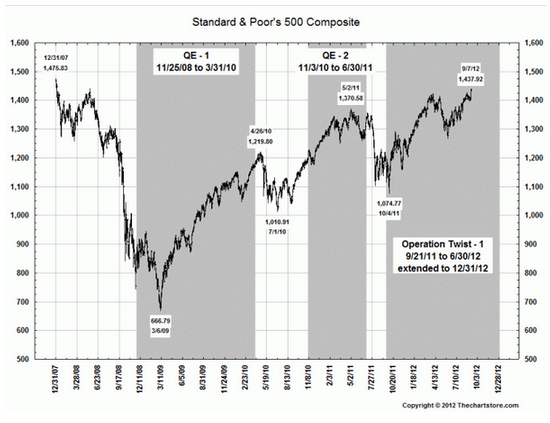

For example: If Quantitative Easing I and Quantitative Easing II tapers had caused markets to fall negative and trend sideways which in turn had been combated by further measures which boosted stock prices, it is safe to assume as an investor since nothing has fundamentally changed in our economy, except more total debts, that Quantitative Easing III tapering will also cause asset price declines which will prompt the Fed to step in with another round of liquidity.

Now the question is, if the Fed could not tolerate declines of asset prices before, when will they ever allow that? And if they will never allow falling asset prices i.e. deflation, what will happen to the dollar's future purchasing power?

V. Market Insanity or The "New" Normal?

Maybe as the investor reads over this list they will themselves realize the doubts that should have been raised:

- The US Government shutdown fiasco - In October 2013, markets and bonds rallied as the US government began shutting down and were not any closer to raising the US debt limit.

- Argentina market rally on eve of default - In late July 2014 Argentina suffered its second default in 13 years (as if investors wanted to be burned by the same flame twice) and instead of scaring investors off, the Argentina markets hit 20 year highs and bonds rallied.

- Greeks are fishing for more, investors bite - Only 4 years after defaulting and sending capital flight throughout the Euro zone, Greeks are back issuing bonds and investors are throwing money to them. With no improvement in the Greek nation's economy and another default approaching, they were able to raise 4 billion Euros at a mere 4.75% for 5 years. "International markets are now expressing in the most undoubted way possible their confidence in the Greek economy," said Greek Prime Minister Antonis Samaras.

- Italian and Spanish record debt demand amid crumbling economies - Italian and Spanish bond yields fell to a record low in 2014 as investors don't fear potential debt defaults from the anemic economies and increasing debt, but are eyeing a Euro Zone version of Quantitative Easing. Short term liquidity has surpassed importance instead of the actual solvency of all these European debts.

- Foreign nations bypassing the US dollar in trade - Currently there are at least 23 nations that are engaging in currency swaps and moving around the dollar. China has initiated currency swaps with countries such as the European Union, Switzerland, and Turkey. China and Russia together have also struck a massive 400 billion dollar gas deal that will now be paid by using each nation's local currencies. The dollar's stock as a reserve currency has been slowly diminishing over the past decade as the emerging markets have been calling for a "de-Americanized world". The BRICS (Brazil, Russia, India, China, South Africa) nations have recently formed the New Development Bank which will eventually rival Western nation banks in the future. Given the above paragraph and the massive $4.5 trillion balance sheet of the Fed, the supply of dollars has dramatically increased while demand is lessening. Yet the dollar has rallied and commonly held opinion is that the dollar will always be reserve currency, no matter what.

- The supply-stripped PGM (platinum group metals) market - In the beginning of 2014, South Africa (world's largest producer of platinum; second of palladium) had suffered massive mine strikes of the top 3 largest platinum/palladium producers. With global demand increasing and supplies decreasing the PGM market has been in a deficit for over 5 years and continues to grow larger. With the strikes lasting nearly 6 months and cut off 40% of global supply, adding substantial pressure to an already large deficit, the prices of the two metals have actually collapsed contrary to the law of supply and demand (article for further in-depth reading about the upside-down PGM market).

- And last but certainly not least, the gold and silver market - Gold has been in a bear market and gold mining shares have been slaughtered since 2012 even with the global central banks' war against deflation and the unbelievable Chinese demand and also recently the opening of the Shanghai Gold Exchange, an international physical gold trading platform similar to the Comex. Central banks are also increasing gold reserves (some officials, though, blatantly tout to the public that gold is a barbaric relic) while simultaneously increasing the money supply rapidly, a key precursor to gold's historical increase in price. There is also growing evidence and concern about gold market manipulation. Even with all logical and historical evidence that the price per ounce of gold should be higher, it has, in fact, declined. On the other hand silver demand has increased with record US mint sales while silver stock supply has decreased tremendously, all while the price of silver has collapsed. With the cost of gold much lower causing mines to shut down and higher grade deposits (most economical mines; lowest cash costs per ounce) becoming extinct, investors should conclude that future mine supply will suffer dramatically. Thus, with the increased foreign, specifically China, demand and central bank monetary debasement and massive public/private debts and increasing global financial instability and declining supply of economical gold deposits, one can logically assume the price of gold/silver is severely undervalued and will end up higher.

In all we can conclude this section with the following: We are in a world where bad data causes markets to rally, due to hopes of increased liquidity injections, while good news causes markets to fall, due to no liquidity injection. Markets aren't driven anymore by what corporations do, but by the vague words of the Federal Reserve. Thanks to the "Greenspan Put", any mediocre investment could be justified today.

VI. Subtle Conclusion

This essay covered many topics that should have spurred the curiosity of investors to the things taking place around them. This article was not intended for predicting the future, but for individuals to contemplate certain scenarios. Investors should not put too much faith in the crude numbers and public opinion and rather use their own diligence and rationale.

In euphoric times it is quite easy to find justification for irrational things - high prices demand higher prices. But it is when the panic arrives that what appeared justified suddenly no longer makes sense. History is littered with examples dating back to Tulipmania in the 17th century, South Sea Bubble in the 18th century, and the Roaring 1920's in the 20th century, each just as symmetrical as the last and ended in devastating investment losses and years of wealth re-allocation. I suppose only in hindsight is anything certain.

But even with history and Austrian economic theory on logic's side, It is as if investors have a gun in their mouths and they enjoy the taste of metal.

A great read! Thanks.