Ignore The Media, Let’s See What The Market Says Is Really Going On

The market got hit yesterday in a big way, but the selling was well contained.

Traders have become way too conditioned to the market doing nothing but going up. As a result, we are in the ridiculous state in which even a single big down day has people talking about crashes.

Statistically speaking, stocks have two days like yesterday (down 3%) every year. Even after yesterday, stocks are only a mere 4%-5% off their ALL TIME HIGHS.

And traders are talking about crashes!

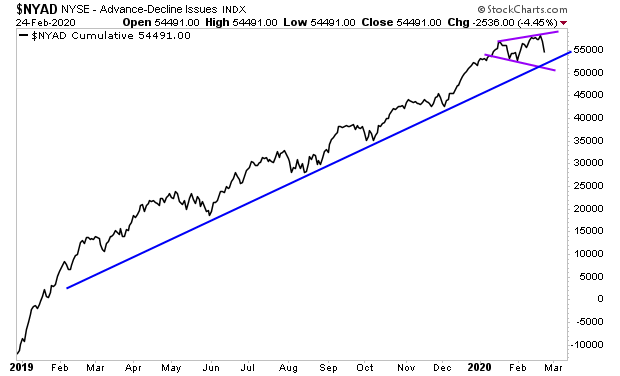

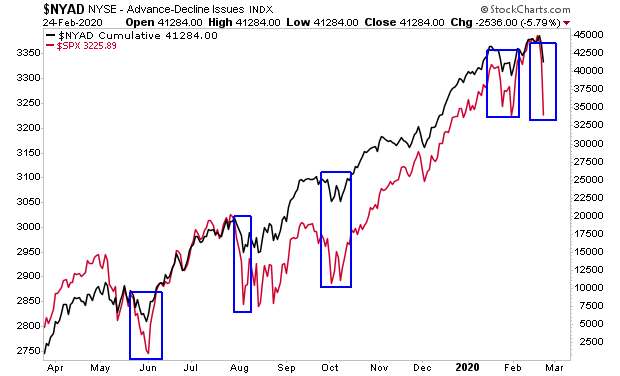

The fact is that we might have a bit more downside. Breadth still has a little ways to go before it finds support.

However, stocks have already overdone it falling far more than breadth. Over the last year, anytime stocks broke down this much relative to breadth, it triggered a “V” shaped recovery soon after.

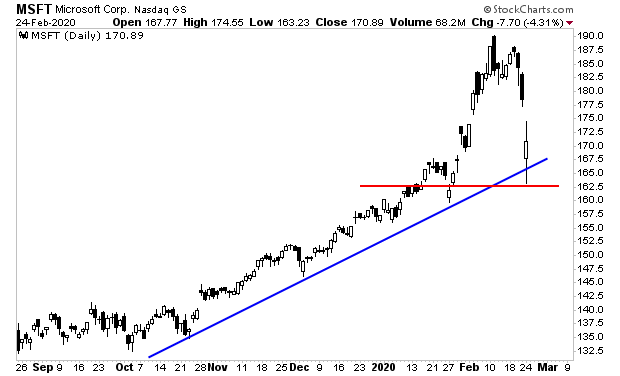

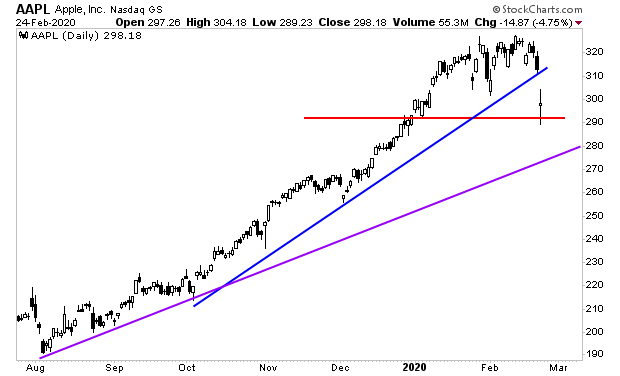

Moreover, the big four tech stocks, which comprise over 11% of the market, all held support yesterday.

Microsoft (MSFT)

Apple (AAPL)

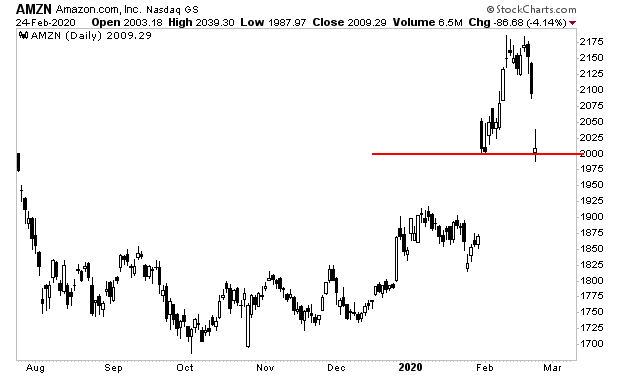

Amazon (AMZN)

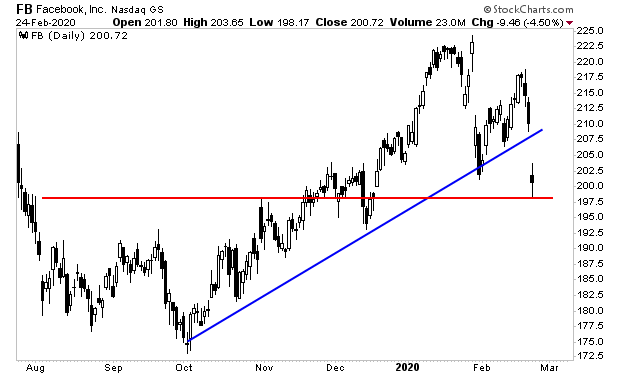

Facebook (FB)

As I said before, the selling was contained and orderly. There was no sign of a crash. And while stocks could fall a bit further from here, we’re getting close to the “buy zone” in terms of market internals.

At the end of the day, the odds are EXTREMELY low that President Trump is going to let his beloved stock market crash during an election year.

Which is why we can all but guarantee a MASSIVE Fed intervention is coming. And when it does the stock market will roar higher.

I want to be clear here.

I DO NOT care about politics. You can hate President Trump or you can love him. That’s 100% up to you.

But the reality is that under the Trump administration the stock market is giving us a once in a lifetime opportunity to GET RICH from our investments.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.