If Congress Can't Pass More Stimulus, Here Is What Else The Fed Can Do

Now that nothing short of a miracle is needed to pass a new fiscal stimulus deal before the election - with Democrats and Republicans unable to reach a compromise deal even as Trump appears to have broken away from Senate Democrats and is siding with Nancy Pelosi in demanding a "big number" - attention is turning to life after the election, where bulls point to a Blue Sweep as unleashing as much as $7 trillion in fiscal spending over the next few years, an amount which Goldman believes will be more than enough to offset the adverse impact on stocks from higher corporate and capital gains taxes.

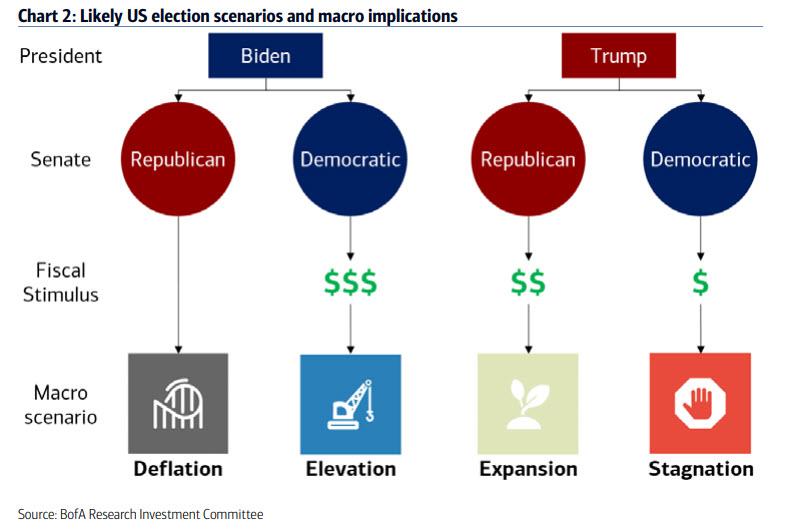

But what if there is no "blue wave", and we get four years of gridlock instead which can happen with either with another four years of president Trump and a Democratic Congress, or with a Biden presidency where GOP keeps the Senate, the two adverse cases recently modeled by Bank of America, which termed these the "Stagnation" and "Deflation" scenarios, respectively?

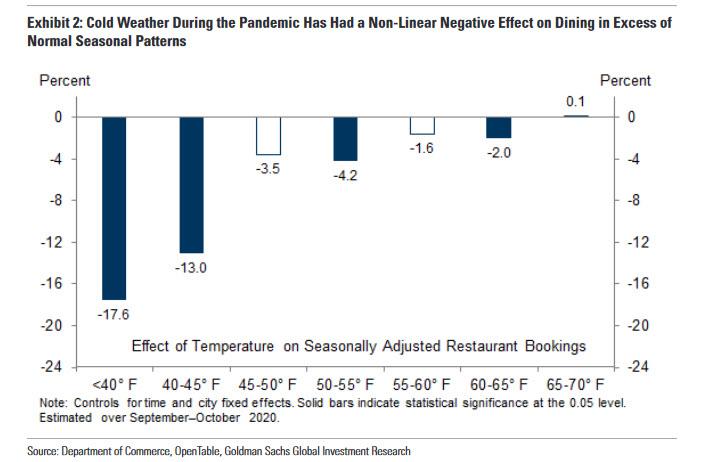

That said, even a Blue Wave scenario means that a new fiscal deal won't be signed until at least early 2021, which is a major risk for the US economy, where the recent rise in covid cases could translate to a double-dip in the economy as we enter the winter - especially once temperatures drop below 40 and outdoor dining shutters, hitting GDP,which would then raise the old fallback question: what else the Fed can do to stimulate the economy?

That's also the question that Goldman's chief economist Jan Hatzius posed overnight in a research report in which he explains that Fed officials have recently discussed three possible options.

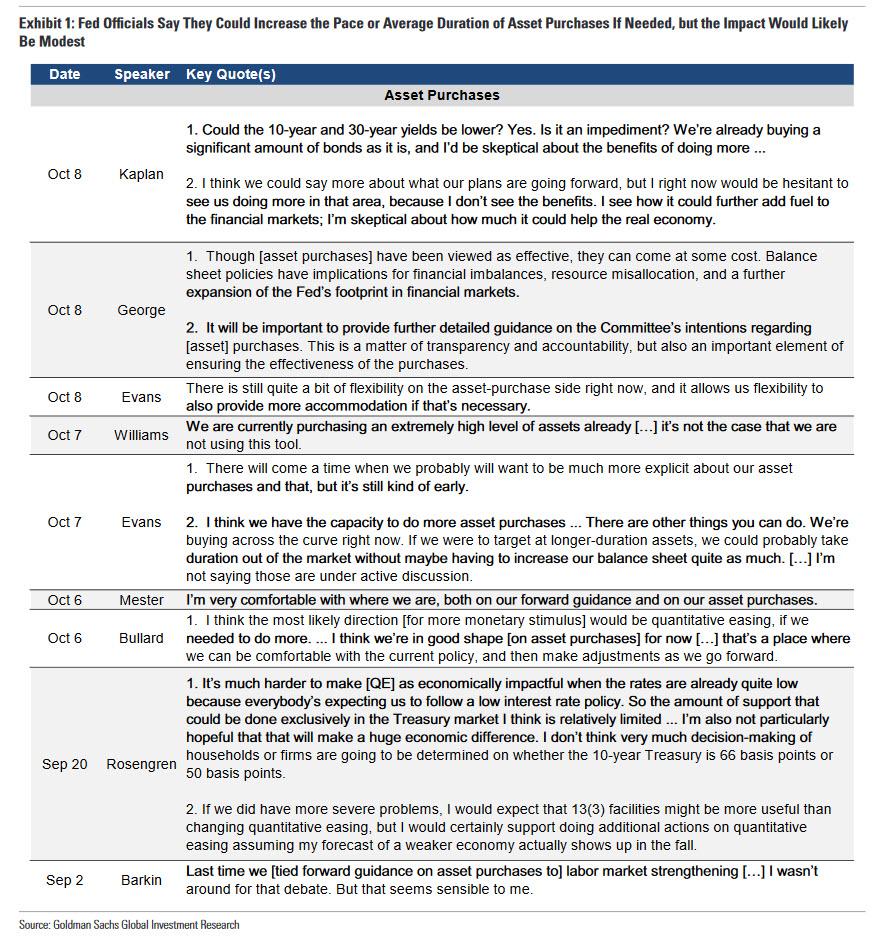

- First, the FOMC could adjust the composition or pace of asset purchases. Several Fed officials have expressed at least lukewarm support for this option, while a couple have been skeptical.

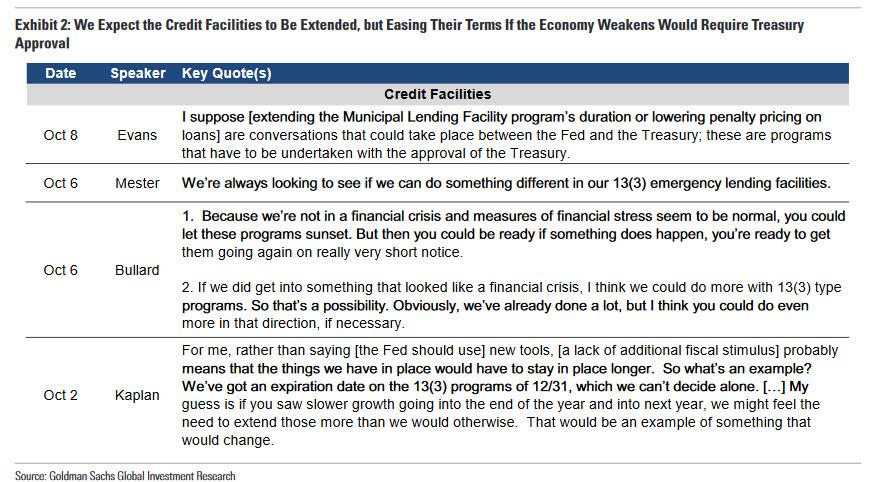

- Second, the FOMC could extend or adjust its new credit market facilities. Goldman expects Fed and Treasury officials to extend the facilities even if the economy performs well, but Hatzius sees little room for doing more with them.

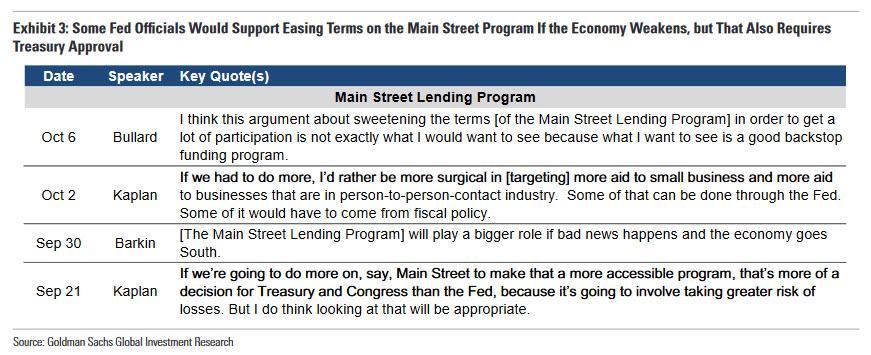

- Third, the Fed and Treasury could ease terms on the Main Street Lending Program to aid small businesses. While some Fed officials are sympathetic to this, but Treasury support appears doubtful.

To justify these scenarios, Goldman first lays out several recent quotes from Fed officials in which they explicitly discuss the option of increasing either the pace or duration of QE:

Next, here are several quotes showing that Fed officials are also amenable to extending credit facilities, although easing terms further would require Treasury approval:

Finally, on the third option - easing the terms on the Main Street Lending Program to specifically target support to small and medium-sized businesses - Goldman notes that Presidents Kaplan and Barkin have expressed sympathy for giving the Main Street program a larger role if the economy weakens, though President Bullard is more reluctant. But the key challenge here too is that this would require Treasury support, "and press reports noted some disagreement between Fed and Treasury officials on the parameters of the program at the time it was unveiled." This suggests that even if Fed officials wanted to ease terms on the Main Street program in the future, they might not be able to.

What about NIRP? As Goldman notes, "beyond these three possible steps, another option that has lingered in the minds of investors is negative interest rates", but Hatzius is quick to shoot down this idea too:

We previously argued that the unanimous opposition of FOMC participants to negative rates made this step very unlikely. At this point, we think any window of possibility that existed has likely closed because labor market conditions have improved surprisingly quickly and are probably no longer dire enough to persuade Fed officials to rethink an option that they clearly dislike.

So to summarize, Goldman - which has been quite cheerful in recent weeks and last week even wrote that the covid recession was not nearly as bad as many had expected - expects "the recovery to continue through the winter and do not think the FOMC will see a need to provide additional stimulus, despite the recent fiscal disappointment."

If, however, the economy weakens and Fed officials want to provide further accommodation, "increasing the average duration or pace of asset purchases is the most likely option, but not a particularly effective one." In contrast, Goldman echoes Powell in saying that "fiscal policy would likely be much more effective in the current environment", although as noted above, unless there is a Blue (or Red) Sweep, with the political climate in Washington hopelessly polarized, it is far more likely that Senate Republicans will revert to a regime of fiscal austerity in hopes of crippling the Biden admin. This is how Bank of America described a possible "gridlock" scenario:

If Republicans retains the Senate they are very likely to block further stimulus under a Democratic President, which would be bearish for economic growth, corporate profits and financial markets (but it would be bullish for more stimulus from the Fed). In any case, as BofA sarcastically puts it, "after $21tn of monetary & fiscal stimulus in 2020, $0 of follow-on support would be deflationary."

Indeed, political parties historically have used obstructionist tactics when out of power to thwart key legislation, most often through the “rediscovery” of commitments to “fiscal discipline”. An example is the budget austerity during 2012-2015 as a major reason for the slow economic recovery.

Of course, at this point we have to admit that all of this is completely meaningless: if Congress is indeed gridlocked indefinitely, and if the banks decide they need to convince the Fed another multi-trillion monetary stimulus - whether in the form of QE, or NIRP, or both - is critical, they will have no problem in doing so by sparking another crisis. After all, recall that last year's NOT QE was a bank-created crisis, the result of JPMorgan purposefully reducing its liquidity so much it proceeded to spark a liquidity crisis which paralyzed the repo market and forced the Fed to intervene (read "How JP Morgan broke the repo market" for the full details). Furthermore, while the coronavirus pandemic was a disaster for most Americans, it was a true gift from God for the global banking system, which has been flooded with trillion in new liquidity via the Fed's unlimited QE.

The only question we have at this point is just what crisis will the banks come up with to top a global virus pandemic and free the Fed's hands from unleashing another massive salvo of monetary generosity that sends stocks even higher and leads to even greater wealth inequality in US society. That said, one come to mind.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more