I Pity The Fool That Chases Fool's Gold, Invest In REIT Preferreds

Yesterday fellow Seeking Alpha writer, Rubicon, wrote an excellent article and he specifically put the hammer down on the RMR family of REITs known as Select Income REIT (NYSE:SIR), Government Properties Income Trust (NYSE:GOV), Senior Housing Properties Trust (NYSE:SNH), and Hospitality Properties Trust (NYSE:HPT).

I'm grateful to Rubicon for calling out these REITs known for their "fool's gold" attributes and specifically providing documented research that suggests that "the glitter of high dividend yield" is not correlated to performance. As the author points out,

...an investor would be better off investing in strong management that can create positive returns over the long term.

I am currently working on a broader piece now that is aimed at not just the RMR REITs but the entire externally-managed REIT universe. Hopefully, I'll have this article finished soon.

At the end of Rubicon's article, the author suggested that "if the higher yield is necessary to hit certain bogeys, one might want to look within the preferred stock space".

This leads me to my topic for this article, Forget the Fool's Gold, Invest In The Preferred REIT Sector

A REIT Preferred Primer

As a subscriber to Forbes Real Estate Investor, I have created a preferred stock portfolio which has been designed to give readers/investors access to a "best ideas" portfolio of preferred stocks. As well, I showcase new REIT preferred stocks and portfolio trade ideas on a monthly basis, and with my new premium service new issues and trade ideas will be happening more frequently.

I have noticed that the attention to the preferred portfolio and questions regarding REIT preferred stocks generally has been increasing. In response, I have decided to revisit the thesis for REIT preferreds, how they fit in an investor's portfolio and the analytical methods used to determine value.

REIT preferred stock offers investors multiple benefits, chief among them are:

- Return,

- Income/Yield, and

- Diversification.

With this in mind, we need a general "lay of the land" for preferred stocks. To begin, preferred stocks fall between common equity and debt on the books of an issuer and have characteristics of both. The following describes the characteristics of preferred stocks within the capital structure and factors which differentiate them from either common equity or debt:

- Like most bonds, preferred stocks have a fixed dividend rate (the equivalent of a bond coupon). Like common equity, the dividend must be declared by the Board of Directors and the Board reserves the right to defer dividends (most are, however, cumulative). This is the crux of the hybrid nature of preferred stocks - dividends are fixed like a bond, but can be deferred without a default occurring.

- Unlike most REIT bonds and lines of credit, REIT preferred stock does not (typically) include financial covenants limiting the amount and type of debt.

- While preferred stock is considered stock, it does not afford owners voting rights as common equity would.

- In the event of bankruptcy, preferred stock gets paid ahead of common equity, but behind bonds, banks and mortgages.

Due to the above factors, preferred stocks (typically) yield more than common stocks (dividends don't grow and there is limited capital appreciation potential) and more than bonds (they are subordinate to bonds, and investors must therefore be compensated).

Next, here are a few general characteristics of preferred stocks:

- Preferreds are listed securities - primarily listed on the NYSE.

- Most REIT preferred stocks typically have a $25 par value (face value of the security).

- Most preferred stocks have no maturity date, they are perpetual fixed and floating rate securities.

- Dividends are declared and paid in cash on a quarterly or monthly basis.

- New issues typically carry 5-year call protection (or, technically, early redemption provision).

- Ratings for REIT preferred securities are usually lower than debt since preferred dividends do not carry the same covenant protection as interest payments from bonds.

- REIT preferred securities carry cumulative dividend covenants. A cumulative preferred stock requires that if a company fails to pay any dividend or any amount below the stated rate, it must make up for it at a later time.

- New issues incorporate typically change of control provisions (often premised on a ratings downgrade).

- REIT preferred dividends are generally taxed at ordinary income ratessimilar to REIT equity given the tax status of REITs.

The pricing factors that are used in determining value are as follows:

Price: many investors don't want to purchase preferred stocks above par because of the potential loss if the REIT exercises their early redemption ((NASDAQ:CALL)). Personally, I am agnostic on the price as it is reflected in the:

Yield-to-Call: This is the yield an investor will realize if a company exercises its early redemption provision. If the yield-to-call is sufficient, the price becomes irrelevant.

Current yield: This is the most often-quoted yield on preferred stocks, but it can be misleading. The price of a preferred stock includes accrued interest, which means that the price has historical interest included in it and therefore, the current yield can be skewed.

Stripped yield: The stripped yield corrects for the current yield deficiency by stripping out the accrued dividend and then calculating the yield. This also allows for a comparison between preferred stocks with different rates and payment dates.

Having established the characteristics and pricing factors of REIT preferred stocks, let's return to the attraction of REIT preferreds:

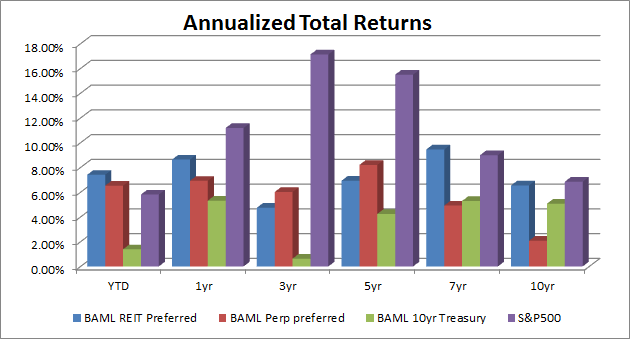

1. Returns. As the following chart shows, REIT preferred stocks have outperformed the broader preferred market and bonds over time, as well as keeping pace with the S&P 500 over longer periods of time.

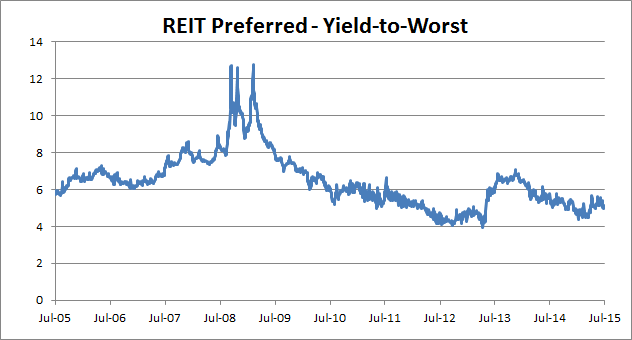

2. Income/Yield. REIT preferred stocks produce high yields and income for investors, one of the primary reasons investors have been attracted to them. As the chart below shows, while yields on equities and bonds have hovered near decade lows, REIT preferreds have consistently paid investors over 4% and currently yield approximately 5%.

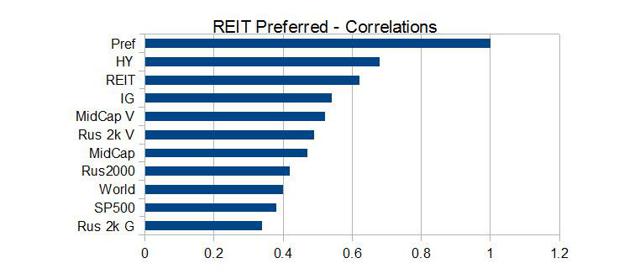

3. Diversification. REIT preferred stocks have low average correlation to both bonds and stocks generally, allowing investors the ability to dampen the volatility and risk of their portfolios. The chart below shows the correlation of REIT preferred stocks to other major asset classes/sectors:

In a September 2014 research paper, Cornell University researchers determined:

- REIT common stock helps low risk aversion investors attain portfolios with higher returns, while REIT preferred stock helps high risk aversion investors by providing a venue for risk reduction.

- While REIT preferred stock appears to behave somewhat like a hybrid debt/equity asset, its risk/return profile appears to not easily be replicated by those asset classes. When given the opportunity, investors will reduce allocations to REIT common stock and investment grade bonds and invest in REIT preferred stock.

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more