I Love The Irreplaceable Assets, But I Need A 5% Dividend Yield To Excite Me

Summary

- "For companies with meaningful yields, I take dividend increases as the loudest and clearest message that management can send." - Josh Peters.

- Urstadt Biddle's capital structure is uncommon, with two classes of common stock.

- I had a few chances (last year) to pick UBA last year at a 5% dividend yield.

- Urstadt Biddle is definitely a buy-and-hold candidate, and I need to plant a 5% seed before I begin to start harvesting the crops.

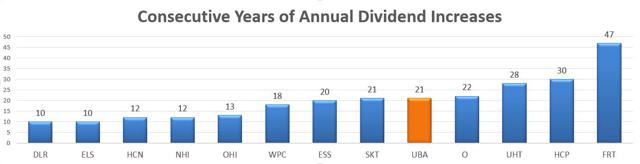

There weren't many REITs that were able to increase annual dividend payouts during the Great Recession. In fact, there are just a handful that can claim that durable record, revealing a very reliable earnings stream can often outmaneuver adversity. I have provided a chart below of all of the REITs that have proved their successful risk management skills and consistent corporate performance:

I have written about many of these stalwart REITs, and collectively they are all similar in that these companies, and specifically the management teams, have all been strongly committed to not only maintaining the dividend, but also increasing it. As Josh Peters, author of The Ultimate Dividend Playbook, explains:

For companies with meaningful yields, I take dividend increases as the loudest and clearest message that management can send.

One REIT on the list is Urstadt Biddle Properties (NYSE:UBA), and while I have analyzed this REIT from a distance, I have never researched the company in great detail... up until now.

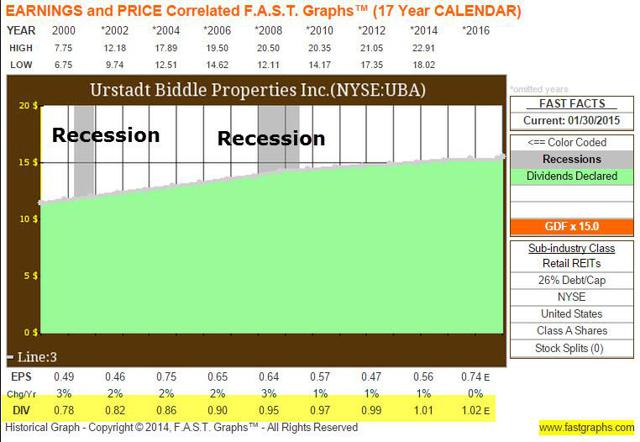

Urstadt Biddle: A History of Reliable Dividends

Urstadt Biddle Properties Inc. was founded in 1969 and listed on the NYSE on July 6, 1969. As noted above, UBA has an impressive track record of increasing annual dividends for 21 years in a row; in addition, the company has maintained 45 consecutive years of uninterrupted dividends. Tanger Factory Outlets (NYSE:SKT) has a similar 21-year record, and the only other REITs with better dividend records include Realty Income (NYSE:O), HCP, Inc. (NYSE:HCP), Universal Realty (NYSE:UHT), and Federal Realty (NYSE:FRT).

UBA is based in Greenwich, CT, and this shopping center REIT focuses on the NYC tri-state geographic area. The company owns 70 properties, primarily grocery-anchored retail centers.

Continue reading the article on Seeking Alpha.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor ...

more