Huge Long Term Upside Available In Aetna

A) Introduction

With the fears of decreased profitability arising from the Affordable Care Act now firmly gone, the market has begun to realize the great opportunity available in managed health care providers and insurers. Within this industry, Aetna Inc. (AET) has been by far the best performer. Aetna provides health insurance plans and coordinates the various health services of its customers through its broad network of physicians and hospitals. The company offers preferred provider organizations (PPOs), point-of-service plans (POSs), employer funded plans, and accountable care organizations (ACOs). Even though the company has enjoyed a strong run, we believe there is huge long term upside in holding Aetna right now. The company combines an attractive valuation with strong momentum in price and earnings.

B) Valuation Breakdown

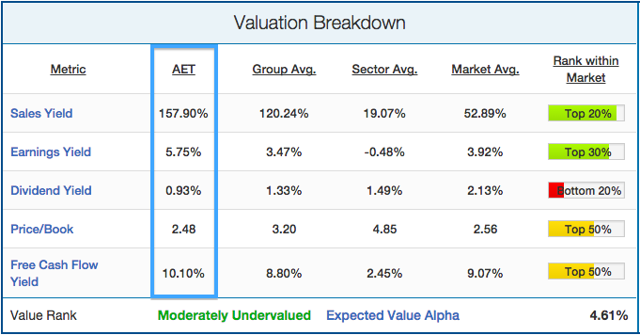

We take a quantitative approach to investing, preferring to focus our analysis on a certain set of metrics that have a strong predictive ability. This means that we only look at metrics that have an academically tested track record of predicting returns in the past. We'll start by analyzing Aetna's value profile. This is important to look at as "Value stocks (with low ratios of price to book value) have higher average returns than growth stocks (high price-to-book ratios)". Aetna's valuation profile is shown below:

(click to enlarge)

Besides its mediocre dividend yield (0.93%), Aetna's valuation looks undervalued by every measure shown above. The company generated more revenue over the last twelve months ($59.1 billion) than its market cap ($37.4), resulting in a sales yield of 157.9%. This is firmly in the top 20% percentile of the market, and higher than the industry group (120.2%), sector (19.1%), and overall market (52.9%) averages. These are by no means empty sales either; Aetna generated $2.15 billion in earnings over the last twelve months. This resulted in a 5.75% earnings yield, which is again higher than the industry group, sector, and overall market averages.

Aetna looks less attractive from a book value and free cash flow basis, though its price to book multiple (2.48x) and FCF yield (10.1%) are still in the top 50% of the entire market. Using a blend of all these ratios, our valuation model rates Aetna as "Moderately Undervalued." Holding everything else equal, we expect Aetna to outperform the S&P 500 by about 4.6% over the next twelve months.

C) Growth & Momentum Breakdown

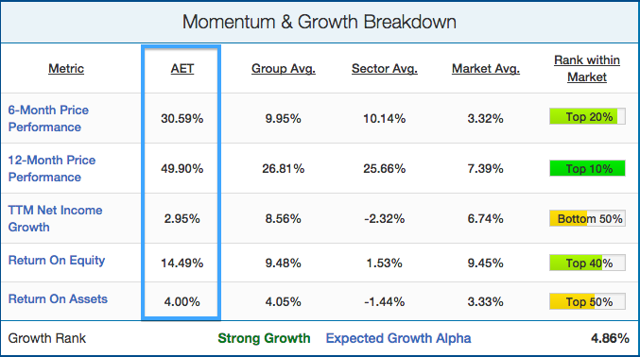

Next we'll look at Aetna's growth breakdown, specifically focusing on price momentum, EPS growth, and profitability efficiency. Price momentum is particularly important, as the momentum anomaly is almost as strong as the value anomaly (see here). EPS growth & profitability also have predictive power to a lesser degree, as initially outlined in James O'Shaughnessy's seminal book "What Works On Wall Street." Companies with expensive valuations can still be good investments if growth is strong enough. Aetna's growth breakdown is shown below:

(click to enlarge)

Reflecting the overall strength in the health care sector, Aetna has been performing very well recently. Aetna's stock price has gained 34.5% over the last six months, and 46.9% over the last twelve. This is compared to a gain of 10.1% and 25.7% for the average stock in the health care sector during the same time periods. While Aetna only grew net income by 3% over the last twelve months, earnings per share grew over 12% due to steady share buybacks.

Aetna continues to be at the top of the class in terms of shareholder return. Aetna returned 14.5% on equity over the last twelve months, and 4% on assets. While its return on assets fell within the industry average (4.05%), its return on equity was more than 50% above both the industry (9.48%) and overall market (9.45%) averages.

Overall, our model rates Aetna in the 93rd percentile of the +3,000 US equities that we cover in terms of growth, momentum, and profitability. Based on how companies with similar growth rankings in the past performed, we expect Aetna to outperform the returns of the S&P 500 by 4.86% over the next twelve months, holding everything else equal.

D) Earnings Momentum Breakdown

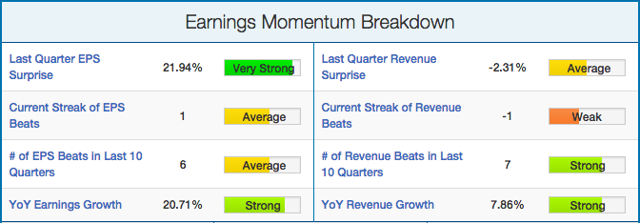

Earnings momentum is a critically important, yet under followed metric. We've noticed that almost no one pays attention to it, yet stocks release earnings every three months and see their stock price swing wildly based on the results. Essentially, we've found through historical back testing (and common sense) that stocks that have a track record of beating analyst expectations are much more likely to beat again in the future. The following breakdown shows Aetna's earnings momentum breakdown:

(click to enlarge)

Aetna beat EPS consensus estimates by 22% last quarter, marking its sixth beat in the last ten quarters. On the revenue side, Aetna missed consensus by 2.31% last quarter, though it has beaten the revenue consensus 7 times in the last 10 quarters. We also like to look at growth rates, as stocks with strong growth rates tend to beat estimates more often. Aetna's EPS grew 20.71% last quarter on a YoY basis, while revenue increased 7.86%.

(click to enlarge)

Analysts polled by Zacks expect $1.82 in EPS and $15.5 billion in quarterly revenue. Based on what we talked about above, our earnings model puts the probability of an EPS beat on the consensus estimates at 55-65%, and expect them to beat by 5-10%. We put the probability of a beat on the revenue consensus at 55-65%, and expect a small beat (0-5%) on the consensus. Aetna doesn't release earnings for another two and half months.

E) Conclusions

Overall, we feel that Aetna is a great long term opportunity due to its combination of value, profitability, and price momentum. The stock just hit a new 52-week high, but its rise reflects an extremely sound underlying business rather than euphoric investors. The stock is one our favorite picks to outperform, and comes in an otherwise unattractive sector (health care is very expensive at the moment).

We are currently long Aetna through long-duration call options. We hold the $95 strike price, January 15th 2016 calls. While one could play this opportunity with straight equity, we prefer in the money options as it takes up much less of your capital.

The company focuses on share buybacks rather than dividends, thus mitigating the main drawback with holding options over equity. In our opinion, these options are very undervalued at the moment as the $95 options can be purchased at about $18.5. This means one would need the stock to move to $113.5 by next January to break even on the position, which is about a 3% move from current prices as of writing (about $110). The options are relatively cheap because Aetna is not a very volatile stock, which results in lower option prices. We are betting on the direction though, rather than the volatility. If history is any indication of the past, we expect to see Aetna at a much higher price by expiry. Investors looking to learn more about how our models are built can do so here.

Disclosure: The author is long AET. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business ...

more