How Traders Are Responding To Today's VIX Surge And Put/Call Spike

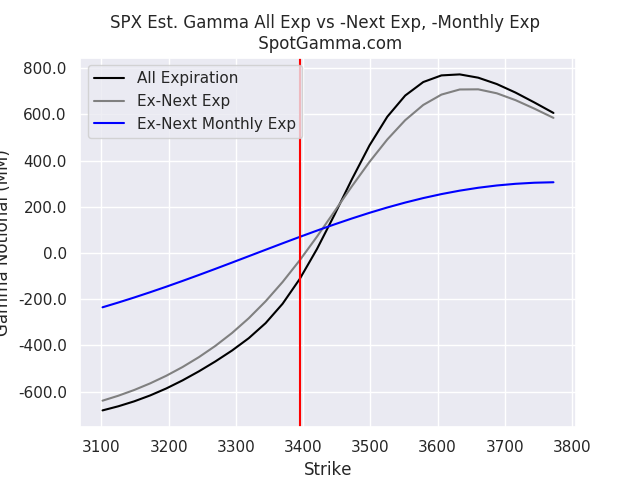

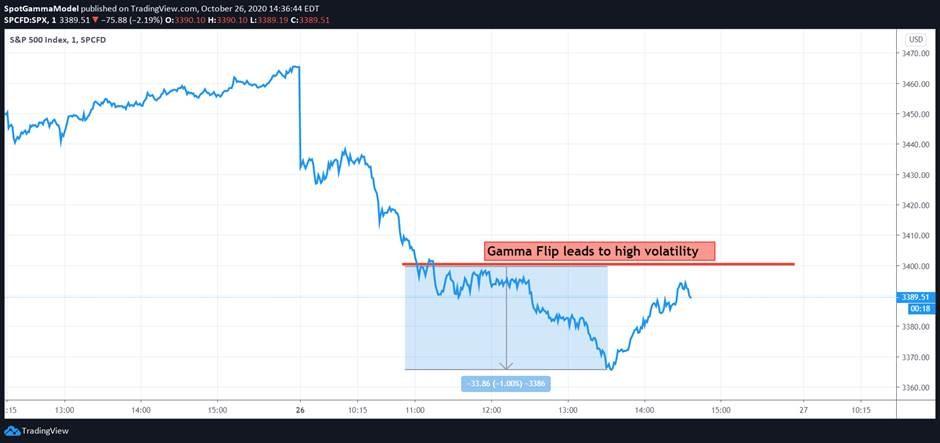

Earlier this morning, our "Greek geek" friends at SpotGamma pointed out that SPX 3,400 was a critical support for the market as it represented the so-called Zero Gamma or the level at which dealer gamma flipped from positive to negative (below which selling becomes self-reinforcing due to delta-hedging of puts by dealers), and as such a drop below 3,400 "could add some selling pressure."

It didn't take long for the S&P to do just that, and once the gamma flip level was breached less than an hour after the open, the selling accelerated, eventually dragging Eminis as low as 3356.

Then, in a following up note SpotGamma pointed out that there was an interesting response by the market today once the Zero Gamma line was broken: "as anticipated this break led to a large expansion of volatility in ES, with a sharp bounce off of the 3360 lows."

However, the action in the VIX was more interesting.

Having finally broken out of the post-Sept 10 trend channel, the VIX soared to the highest level since the early September rout.

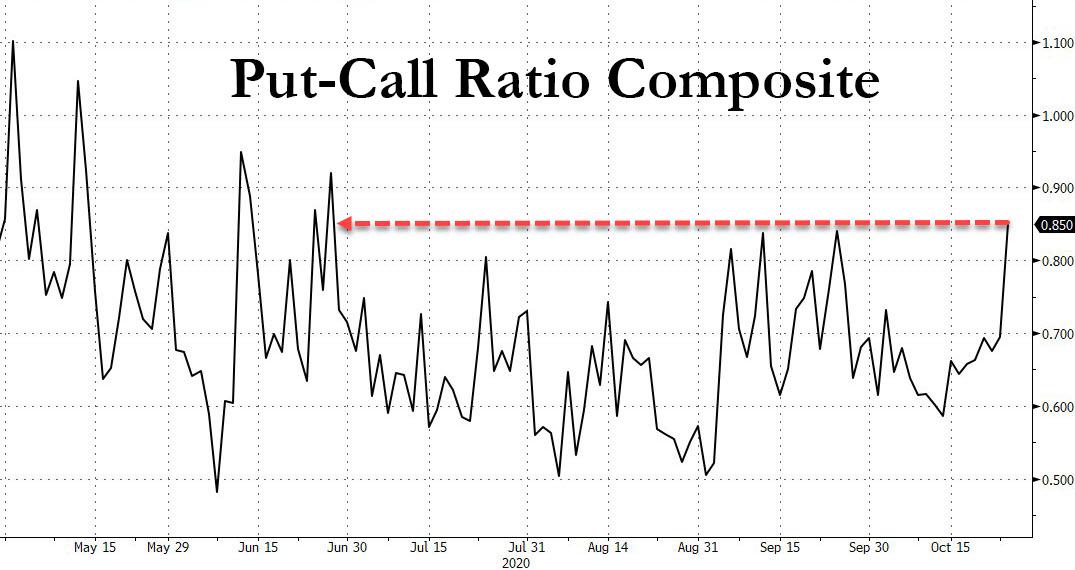

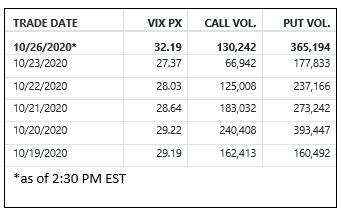

And while at 2:30pm EST the SPX options volumes were fairly heavy at 1 million contracts, the 1.2 Put:Call ratio "doesn’t reflect much panic" (although at a level last seen in June, there certainly was outsized activity).

This was also reflected in VIX options volumes: the table below shows EOD call & put volumes for VIX vs today's volume.

As SpotGamma concludes, one can see today as of 2:30 PM "we are trading very heavy put volumes, possibly indicating traders are using this spike as an opportunity to short more vol."

In other words, with stocks sliding the "Powell put" is back in play as traders use today's surge in the VIX to do the only thing they know how to do: sell vol, and hope that if things get ugly, the Fed will quickly bail them out again.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more