How To Read Tea Leaves - The FOMC And Policy Communication

Global Macro Quagmire or Cosmic Soup?

The global macroeconomic picture has undoubtedly been mired with a great deal of confusion as markets quickly react to critical negotiations underway in Greece, at ASEAN over Chinese currency policy and whether Crude has bottomed out around a price level that can be maintained for the foreseeable future as OPEC tries to squeeze alternative sources, mainly the massive Fracking in the US which puts the country on a trajectory to become self-sufficient regarding domestic petroleum consumption, as well as becoming the largest Crude exporter in the world in the next five to seven years. As Jim Rogers, the former partner of George Soros and author of "Adventure Capitalist", "Street Smarts", "Hot Commodities" and "A Bull in China" has repeatedly stated in his books: "If you want to understand the true condition of any emerging market economy, check the exchange rates offered in the black market compared with official nationally published exchange rates"

Currency traders will price exchange rates to reflect reality, whereas the State will price exchange rates to reflect their desire of what reality should be. At present, the Chinese Yuan has declined significantly over the past year, dropping over 8% with talks of widening the allowable trading band to let the Yuan trade lower. The currency is constantly trading at the edge of or just below the lower band of the envelope already. The one-way bet on the Yuan continually rising is over and traders know it, which is why major hedge funds have been using offshore Yuan to short the Chinese currency aggressively. China has wisely used only a small fraction of their massive forex reserves to support the Yuan. A weaker currency is precisely what their fledgling manufacturing sector needs at the moment. This little tidbit might seem shocking to some of you, since China has always been portrayed as the evil trading partner of the US, amassing a mountain of US Dollar reserves due to a trade imbalance between the US and China blamed on an artificially weak currency and even allegations of currency manipulation. What most investors never hear is the fact that China is now running a national debt of $5.2 Trillion USD or the equivalent of 32 Trillion Yuan. This amounts to $3,830 per citizen in a country with the largest population of any country on earth. Every second, the interest China owes on that debt is $5,539 and growing.

(Source: NationalDebtClocks.org and WSJ Feb. 19th).

While there are some important distinctions to be made here relative to economies of western nations whose national debt's run close to 100% of GDP, Chinese debt relative to GDP is approaching 60%. Moreover, the national debt figure includes total local-level debts because in China, the government is ultimately responsible for local debt. As such, all local debt is added to total national debt.

What Makes China Different?

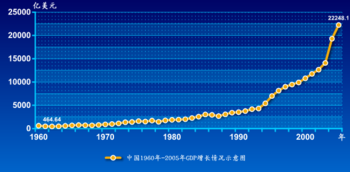

While one can look at the difference and say this debt level is manageable relative to first world economies, the underlying truth is based on continuing GDP growth in excess of 9%.

Chinese GDP (Source: Wikipedia Photos)

Should GDP in China drop below 8%, there would be significant concern not only within China but across the globe. If GDP were to drop to a much lower level, like 6%, China would face the equivalent of a major economic recession in scope and scale similar to America's worst fears during the Great Credit Crisis of 2006-2009. Recent drops in commodity prices and dry bulk shipping rates attest to the sharp drop in demand for raw materials from China, combined with overall global weakness in Europe and economic sanctions against Russia. Although lower commodity prices, especially crude, could be long-term net positives for the US, especially with a stronger dollar giving American's greater buying power and more discretionary income as they spend less money on gasoline, thus giving a major boost to both the automotive and airline sectors. On the other hand, if China enters a significant recession and continues to see major capital flight, the Central Government may be forced to abandon their fixed exchange rate policy and join the international race to devalue currencies.

For years, the US has been fighting China to allow their currency to float freely, but China has resisted, instead opting for a controlled and gradual rise in the Yuan from over 9 to the Dollar to 6.35 to the Dollar today, albeit quite reluctantly. A stronger Yuan is stifling Chinese exporters precisely when they need a major boost from a weaker currency. Every other advanced economy and even developing and emerging economies have engaged in a race to devalue faster than their trading partners, so why should China fight this trend? It would be understandable if Chinese GDP were double digits and a stronger currency could therefore keep a lid on inflation, but with Chinese GDP looking shaky at best and possibly reported inaccurately at worst, a weaker Yuan would mean China has entered the global race to weaken national currency exchange rates with the US Dollar with the hope being that history repeats itself and demand from US consumption picks up the slack to help boost the global economy back on stable footing.

The Federal Reserve: Dogs of War or Comfortably Numb?

As if Chinese imports are not already cheap due to a much less expensive labor force, continued strength in the US Dollar as Quantitative Easing has all but ceased while the Fed continues to run the printing presses at capacity is a signal from markets to expect a series of rate hikes on the horizon. How early depends on the next series of CPI numbers. It is our opinion that as long as the Fed has the tailwind of lower oil prices behind it, pumping out more dollars without fearing imminent inflationary threats is the current unspoken policy of the FOMC. So rather than come out fighting with aggressive language, the Fed is maintaining the status quo by allowing the market to continue dictating near-term policy during this sensitive period surrounding a Presidential election cycle, a period when the Fed has traditionally remained on the sidelines, even if it means dealing with a larger problem when the next administration takes power.

Recently released minutes of the last FOMC meeting clearly suggest a move towards a hawkish stance, but with enough disclaimers for the Fed to backtrack if necessary. By hinting that tightening is inevitable, the statement deferred to future economic developments for final policy decisions. The wording in the minutes appears to suggest the Fed is trying to exert policy influence through rhetoric rather than action. After the minutes, yields on 10yr Treasuries spiked significantly but have since settled back down a bit. The minutes obviously spooked bond holders but the mass short-term exodus seemed like a sudden fire-sale for large institutional bond investors who jumped in to take advantage of the sudden pop in yields.

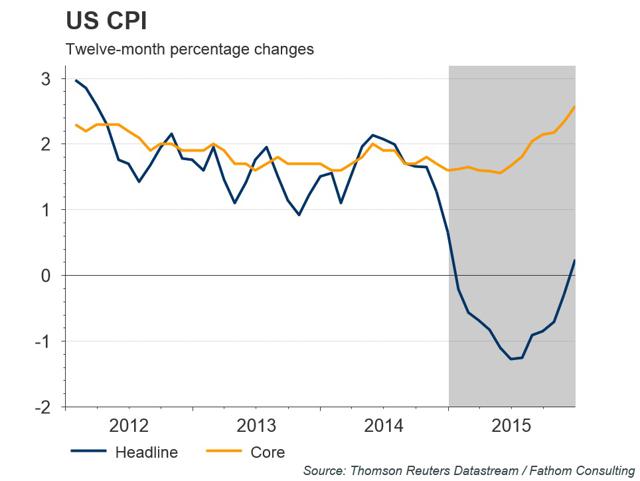

As the diagrams below indicate, the 12 month trend for core inflation is definitely down, although there was a much needed reprieve from 2010 to 2012 as rates spiked from almost 0.5% to 2.4% and have since gradually dropped, caught in the long-term downward trend fueled by lower crude prices and strength in the US dollar.

Federal Reserve Policies

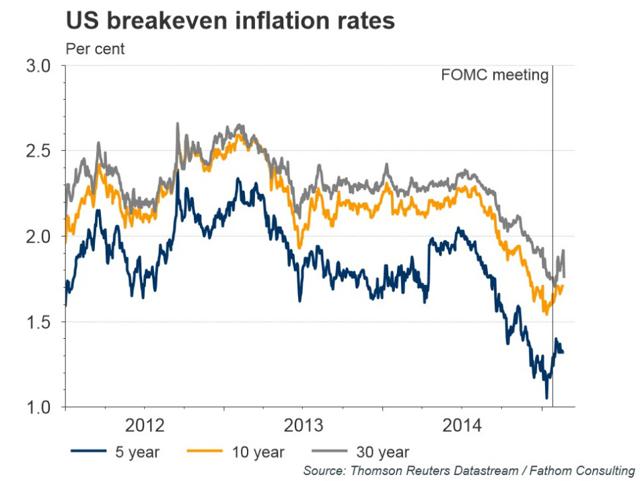

The recently released FOMC minutes revealed that the Committee had become more cautious about tightening policy between the December 16-17 meeting and the following January 27-28 meeting. Although the minutes suggested a more relaxed consensus regarding falling energy prices and their longer-term transitory implications on headline inflation, there was obvious concern around the current level of core inflation taken in conjunction with declining inflation expectations by the market. The ensuing diagrams show US Core Inflation, US Breakeven Inflation, and US CPI. Although the economy showed a much needed surge between 2010 and 2012 as Core Inflation approached 0.5%, the drop back to 1.5% and heading lower is again of concern as deflation is every much as bad for the economy as inflation, if not worse.

As defined by Inflation-Linked.com, "Breakeven Inflation" is

Before drawing any firm conclusions from the latest set of minutes, it is worth noting that the January meeting took place before strong payroll data was released in early February. The February numbers showed payrolls had risen by a better-than-expected 267k in January. More importantly, there was an upward revisions of 147k to the cumulative gain in payrolls over the preceding two months.

It is almost inevitable that the US will experience a period of significant, outright deflation on the headline measure. The more substantive point in our view is that core inflation will likely rise steadily from current levels, reflecting strength in domestic demand and higher wages as a result of the tightening labor market. This will give the Fed confidence to begin the process of policy normalization.

Reversal of Roles - Big Bank vs Little Bank

FOMC minutes do nothing to change the fact that the Fed will have to tighten before the end of this year, with September being their last possible window before the election cycle kicks off. However, the outlook for UK monetary policy is quite different. With the economy continuing to slow, it is very difficult to envisage a shift in policy towards tightening until late 2016 or early 2017.

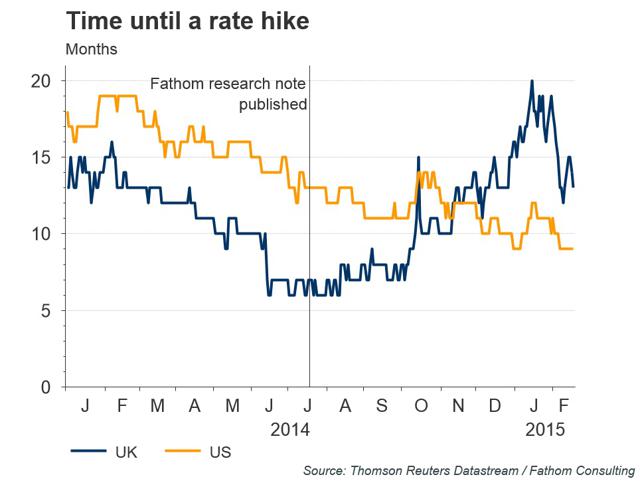

Starting from the beginning of last year, our next chart shows the period, measured in months, until a 25 basis point hike has been fully priced in by the Fed Funds futures market in the US, and by the OIS market in the UK. In July of 2014, underlying fundamentals of the US and UK economies suggested the Fed would likely raise rates before the Bank of England. At the time, markets were expecting the MPC to raise rates half a year earlier than the Fed. It now seems to be the other-way around.

Dare We Predict the Timing of any Rate Hikes?

Sentiment began to change drastically in the second half of 2014 and by January of 2015, predictions had been adjusted to suggest the Fed would make a move approximately 3 quarters before the Bank of England would move. Reflecting the strengthening US Dollar and the hard impact it is having on US exporters, the gap has now been reduced to a more realistic four months. In the days leading up to publication of the February Inflation Report, there was an unexplainable leftward shift in the short-end of the UK forward curve.

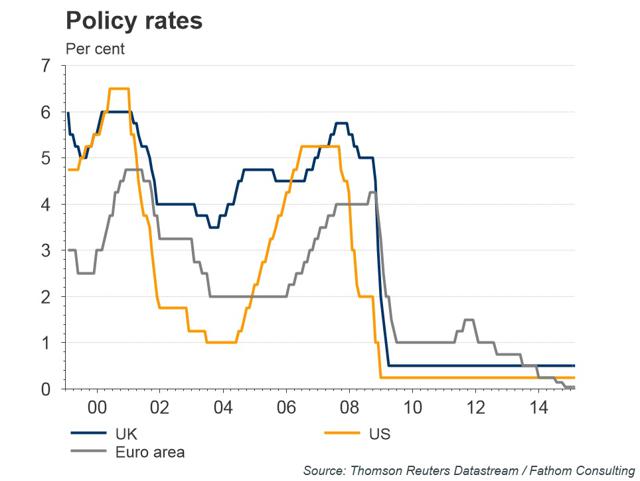

It is often suggested that the US and UK coordinate interest rate policy and therefore tend to move together. Although there is some precedent to that effect, the last chart displays a correlation which appears underwhelming to say the least. Which leads us to this final conclusion. Since the inception of the Euro in January 1999, policy rate set by the Bank of England more closely correlates with policy rate set by the ECB and not the Fed, although the difference is marginal but obvious.

The Bottom Line

Historical comparisons are no different than looking in the rear view mirror after a bad stock trade, especially in the present climate with uncertainty in Greece, a fledgling Eurozone and the 800lb Gorilla: A slowing Chinese economy with policy response allowing the Yuan to devalue. With US and UK economic conditions on quite different paths as the UK is overburdened with excess debt and weakening supply; US growth is projected to pick up to 4.1% this year before an expected drop to 3.0% in 2016. Granted predicting GDP that far out requires a huge grain of salt thrown, sticking with the spirit of taking a salt bath, based on our data analysis, we predict UK growth will slow to between 2.1% and 2.4% this year before dropping as low as 1.3% and possibly below 1% next year. With UK inflation remaining significantly below target, it's unlikely the BoE will tighten irrespective of any action taken by the FOMC or even the ECB.

Disclaimer: This article is for informational use only. It is not intended as a recommendation or inducement to purchase or sell any financial instrument. All data presented is deduced from ...

more