How To Build An ETF Rotation Strategy With More Than 50% Annualized Returns

In this paper I want to explain the readers how the Maximum Yield Rotation Strategy of Logical Invest is built. This Strategy achieves very high returns investing in inverse volatility. From 2011 to today the annual performance was more than 50% per year. The Sharpe Ratio (Return/Risk) of 2.04 is a "DREAM VALUE" and I doubt that someone can show me a strategy with a higher ratio.

The strategy invests in 4 different ETFs:

- US Market (MDY S&P MidCap 400 SPDRs)

- U.S. Treasury Bonds - (EDV Vanguard Extended Duration Treasury 25+yr)

- Volatility - (ZIV VelocityShares Inverse VIX Medium-Term)

- cash - (SHY Barclays Low Duration Treasury) only if Treasury correlation to SPY > -0.25

The Maximum Yield Strategy switches semi-monthly between these 4 ETFs. For the switching I use a ranking system like the one I explained in my Global Market Rotation Strategy article in 2013. The ranking system is also using 3-month historical performance and 20 day volatility. Using volatility is quite important, because it reduces the ranking of high volatile ETFs like ZIV.

However, if you want to play such a rotation strategy by yourself, then you can also just look at the 3-month historical performance.

In this strategy the ZIV ETF is the most important performance driver. ZIV can only be backtested since 2011, so that I cannot present a longer backtest for the whole strategy, but the way the strategy is built, you can backtest parts of it for more than 10 years.

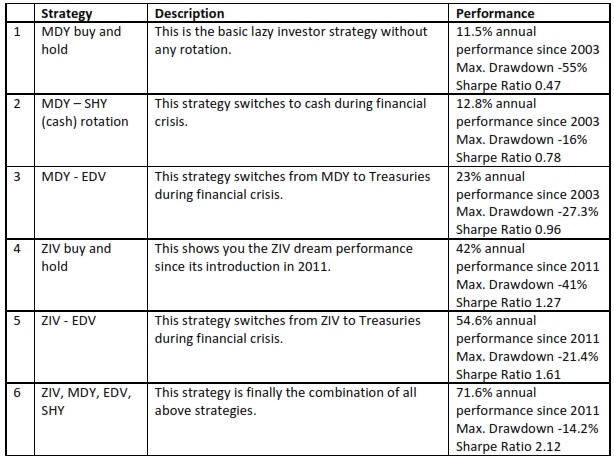

The Maximum Yield Rotation Strategy is composed of several smaller sub-rotation strategies. Here is an overview of these different strategies:

Here are some comments to the above strategies:

- I decided to use MDY (S&P400) instead of SPY (S&P500) because MDY performed better in the backtests. SPY only performed 8.4% annually compared to 11.5% for MDY during the last 10 years. I normally prefer to buy the S&P400 COMEX futures instead of the MDY ETF, but MDY can also be easily replaced by other similar ETFs like RWK, the return weighted midcap ETF, which even performed a little bit better than MDY.

- Switching to cash during financial downturns does not increase the annual performance a lot, but it reduced the maximum drawdown of your investment during the 2008 Subprime Crisis from -55% to -16%. I think this reason alone should be enough to decide that from today you do not invest anymore without a clear exit strategy. Normally we enable cash switching only in our rotation strategies if Treasuries have a higher than -0.25 correlation to SPY. This is the case just now, but normally Treasuries have -0.5 to -0.75 negative correlation to SPY.

- Much better than a simple cash exit strategy is to switch to a negative correlated asset during financial downturns. During the last 10 years the best was to switch to Treasuries. In my strategy we switch to EDV during financial downturns. During the last 10 years we made nearly the same performance during down periods of the market as we made during up periods of the market. A MDY - EDV rotation strategy even had the best annual returns in the years 2008 and 2011 with the biggest market corrections in our 10 year period.

Instead of EDV we normally invest in Comex Ultra T-Bonds futures, but we buy about 1.5x the normal investment volume, because EDV behaves like a 1.5x leveraged Ultra T-Bond or TLT ETF. - The 54.6% annual performance of the ZIV buy and hold strategy shows you the return potential which is in such an inverse volatility ETF. The ZIV ETF itself is shorting midterm VIX futures. These futures are in a strong contango of about 3% per month since 2011. Because ZIV is shorting these futures, you profit directly from this contango.

- There is also the XIV ETF which is shorting front month VIX futures. XIV profits from about 10% VIX contango at this time, but the XIV future is very volatile which results in a much too high time decay. The Sharpe ratio (Return/Risk) of ZIV is 1.17 compared to 0.79 for XIV, so I prefer to invest in inverse midterm volatility (ZIV).

Investing in VIX volatility is not so simple. You need to have a good exit strategy in place, because in case of a bigger market correction ZIV (and even more XIV) can lose most of its value in short time. There are several parameters I control nearly on a daily basis. The most important is the VIX future contango. Normally in case of a market correction the front month futures can temporarily go into backwardation and later also midterm futures go into backwardation. This should be the latest moment to exit your inverse volatility investment. Because volatility can change quite quickly, the Maximum Yield Strategy is updated every two weeks. The EDV and SHY exits work very efficiently together with the ZIF ETF and so the risk of losses is very much reduced. - In our rotation strategy the EDV Treasury ETF makes sure that we exit our ZIV investment early enough in case of a market correction. During these corrections EDV can generate quite good returns. By switching ZIV - EDV you could achieve 54.6% annual performance. This even includes the recent strong Treasury correction because of rising yields. In our final 4 ETF strategy rising yields are not a big problem anymore, because we still have cash (SHY) as an exit for the case that treasuries do not have the normally negative correlation anymore.

Conclusion:

It is my absolute conviction that it is much better to have a small portfolio with only a few ETFs than to buy a lot of different shares. If you have only a few ETFs in your portfolio, then you can react very quickly and with low costs to any market changes. However for this, it is very important to have a mandatory strategy with strict exit rules.

It needs quite some discipline to sell an ETF and buy another during a market correction. Most people would prefer to sit it out and wait for it to recover. However in this strategy it is really important to check your investment at these semi-monthly terms. If you do this, then this strategy is very safe. You can check the full list of semi-monthly returns of the Maximum Yield Rotation Strategy since 2003 on our logical-invest.com website and you will see, that due to the very efficient EDV/SHY crash brake mechanism, the maximum drawdowns have been much smaller than using a classical buy and hold investment style.

If you think you have the discipline to check your investment regularly, then you can play this strategy yourself.