How Many REITs Should I Own?

In a few days I'll be providing a list of my Top 10 REITs to own in 2016.

I own more than 10 REITs now and part of my job as a REIT analyst is to filter out the best companies to own with a goal of providing durable income and reliable share price appreciation.

I often get asked, "How many REITs should I own?"

My typical reply is, "More than one and not more than twenty-five."

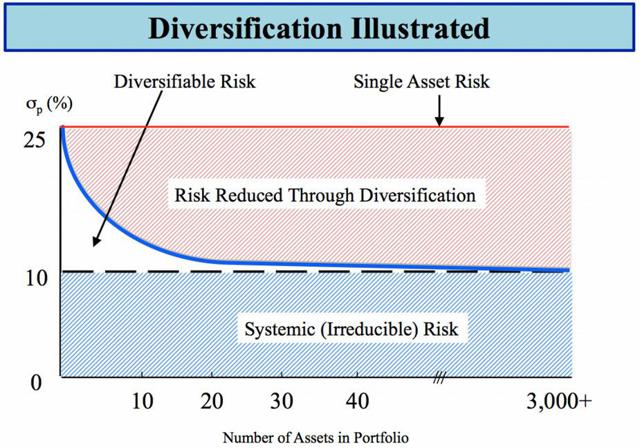

I then explain that real estate is an uncorrelated, inflation-linked asset class that complements a multi-structured portfolio offering diversification, potential risk reduction and return enhancement.

(click to enlarge)

By utilizing REITs - superior vehicles for investing - these favored dividend stocks provide for differentiation due to their liquidity, transparency, and total return characteristics. Additionally, public REITs enhance overall portfolio diversification by geography, sector, strategy, property, and tenant.

Looking back over the last eleven months, I can cite quite a few examples where diversification has been a life saver. Just a few days ago, CorEnergy(NYSE:CORR) dropped hard from around $25.00 per share to $16.64, and because I own a limited number of shares, I was able to mitigate the volatility by staying within my small-cap rule (no more than 2% of any small-cap REIT in my REIT portfolio).

(click to enlarge)

Part of my investing strategy is to own an over-weight percentage of blue chip REITs; that's the reason you see Ventas, Inc. (NYSE:VTR), Realty Income(NYSE:O), Tanger Factory Outlets (NYSE:SKT), and Welltower(NYSE:HCN) listed in my disclosure tab. While the smaller, lesser-proven REITs offer enhanced share price appreciation, they can be equally unstable because of their thinly-traded attributes.

Continue reading here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more