How Good Are Managed-Risk ETFs?

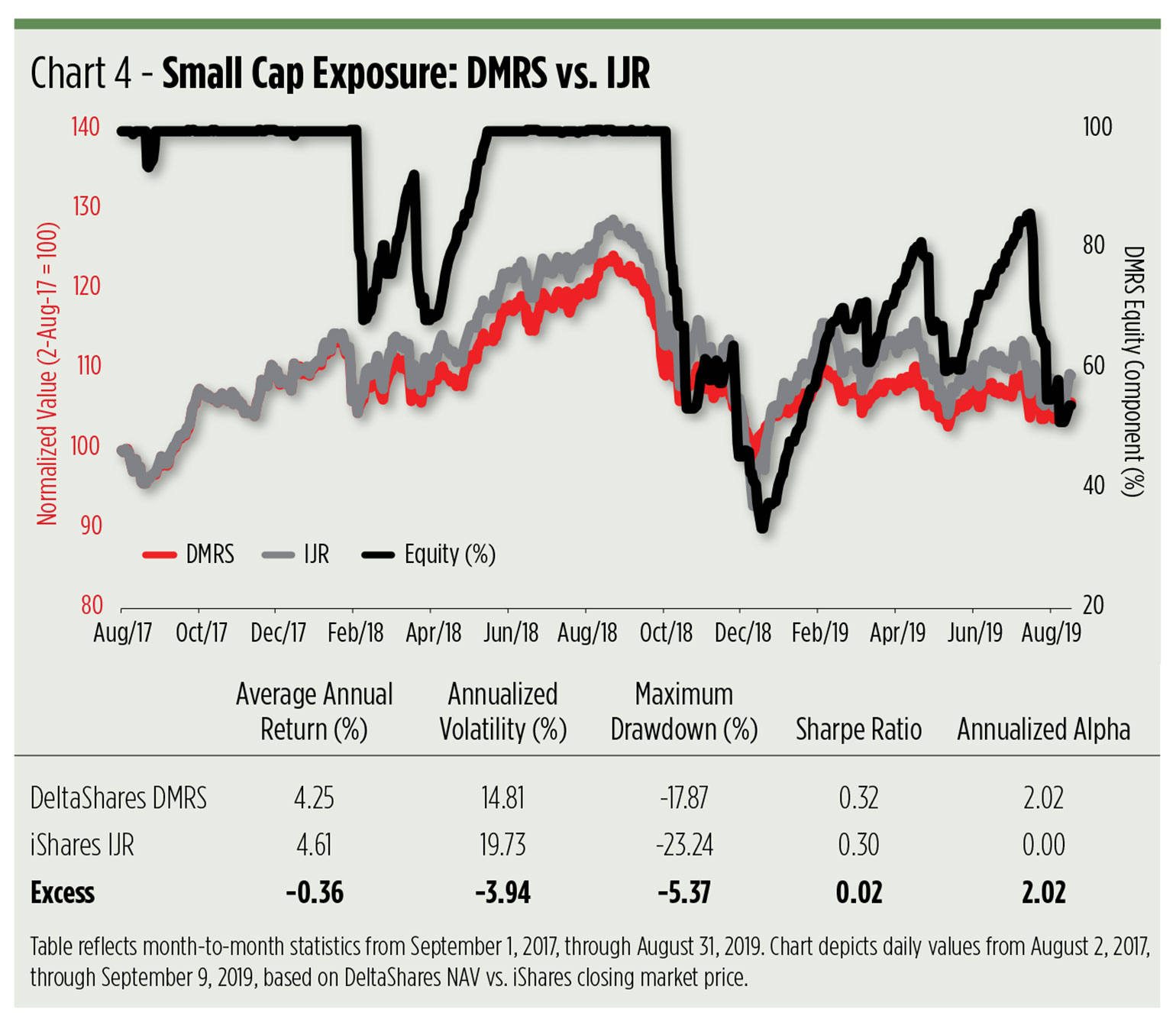

The value proposition for the DeltaShares strategy is strongest for the small-cap segment.

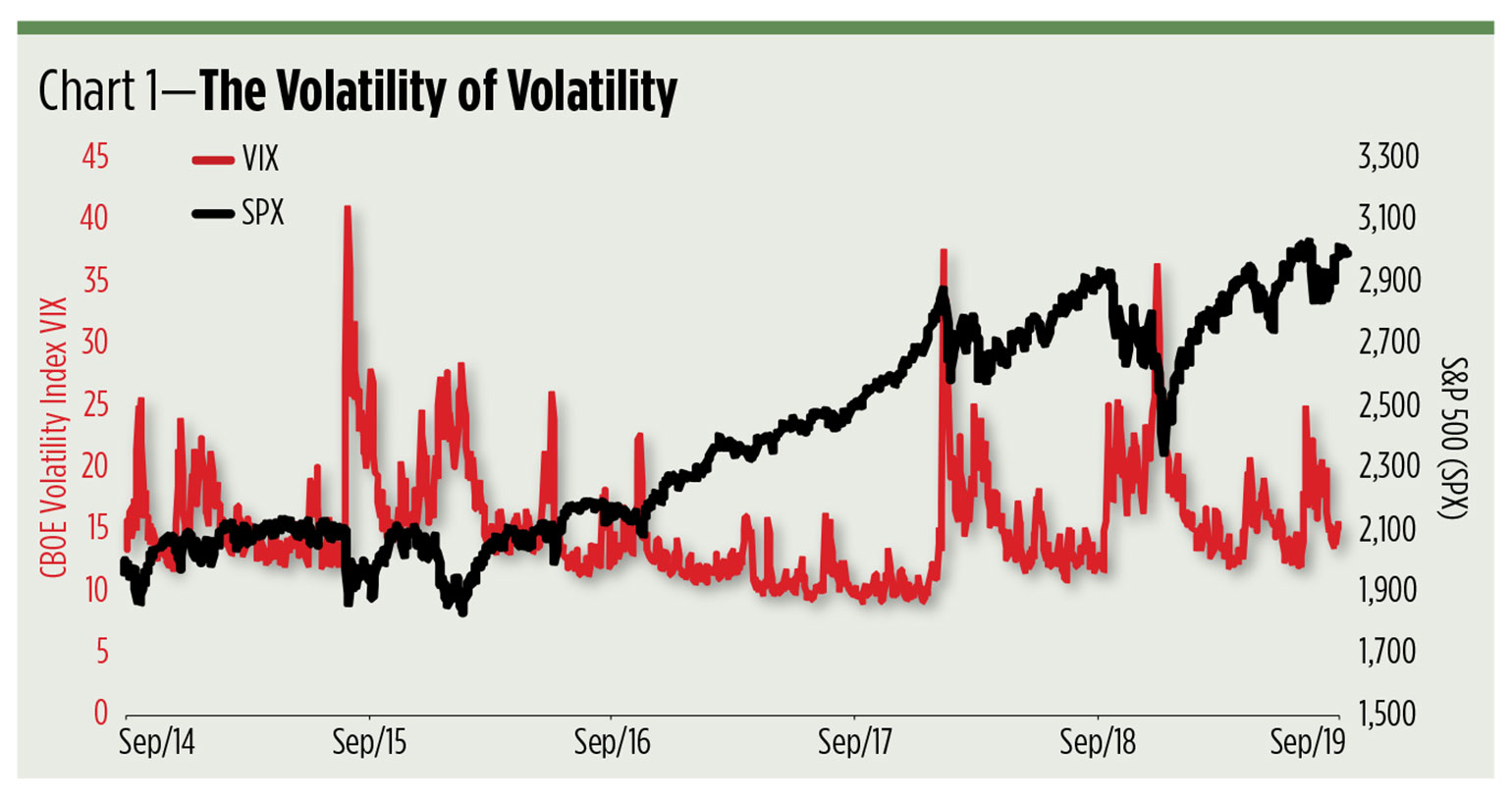

Option market makers love volatility. Retirement-minded investors and their advisors? Not so much. Volatility’s a bugaboo mostly because of its association with market downdrafts. Historically, the correlation between the S&P 500 Index and the CBOE Volatility Index—also known as the “Fear Index”—has been strongly negative, meaning that when folks say the market is getting more “volatile,” it tends to mean it’s going down.

Volatility’s effect is corrosive. As most investors and advisors know from experience, falling off a market cliff is easier than regaining the lost ground. If, for example, the market is drawn down 10%, it takes a subsequent 11% gain just to get back to breakeven. The now-smaller asset base needs a bigger boost to restore itself to its former value. Lose 25% and the market must climb 33% to claw its way out of the hole.

In an effort to combat these depredations, a number of low-volatility portfolios have been floated in the exchange traded fund space. Some of these products have become wildly popular as market choppiness—a more benign word for fear—has increased.

If there’s any trouble with these ETFs, it’s that the low-vol switch is forever in the “on” position. Volatility, though, ebbs and flows, as you can see in the trajectory of the CBOE Volatility Index depicted in Chart 1.

Research has long established the existence of a low-volatility anomaly contravening the direct relationship between risk and reward postulated by the Capital Asset Pricing Model. By keeping drawdowns in check, low-vol portfolios can and do outperform conventional index products. In the end, that is. At times, a low-vol tactic can actually act as a drag on performance during an investor’s holding period. The standard deviation of a low-vol ETF can be paradoxically higher than that of its conventional analog. That could produce disastrous results for investors who don’t time their investments well.

The good folks at Transamerica Asset Management think they’ve got the answer to this problem. Transamerica partnered with Milliman Financial Risk Management to subadvise the DeltaShares line of ETFs, a flotilla of portfolios that toggles equity exposure on the basis of realized market volatility. Among the five DeltaShares products are three keyed to well-known domestic capitalization–tier indices: the S&P 500, the S&P MidCap 400 and the S&P SmallCap 600.

Milliman’s rules-based index methodology throttles down each fund’s exposure to the relevant S&P index portfolio whenever annualized volatility spikes above 22%. These excursions trigger reallocations away from stocks and into reserve assets, including five-year U.S. Treasury notes and short-term Treasury bills. (The note/bill mix is determined by the yield premium and volatility of the S&P 5-Year U.S. Treasury Index; in extremis, it’s possible for a DeltaShares portfolio to be solely invested in Treasury bills.)

If equity volatility subsequently declines, the algorithm calls for paring down the reserve asset allocation and stepping up equity exposure again. In sum, the DeltaShares model is designed to simulate the dynamic allocations made in a volatility-managed portfolio.

DeltaShares Performance

The DeltaShares line was launched in mid-2017, just in time to get its feet wet before being tested by 2018’s volatility spikes. So, how did these ETFs perform? Well, each of the domestic portfolios reduced drawdown risk, but none actually outdid the market’s return.

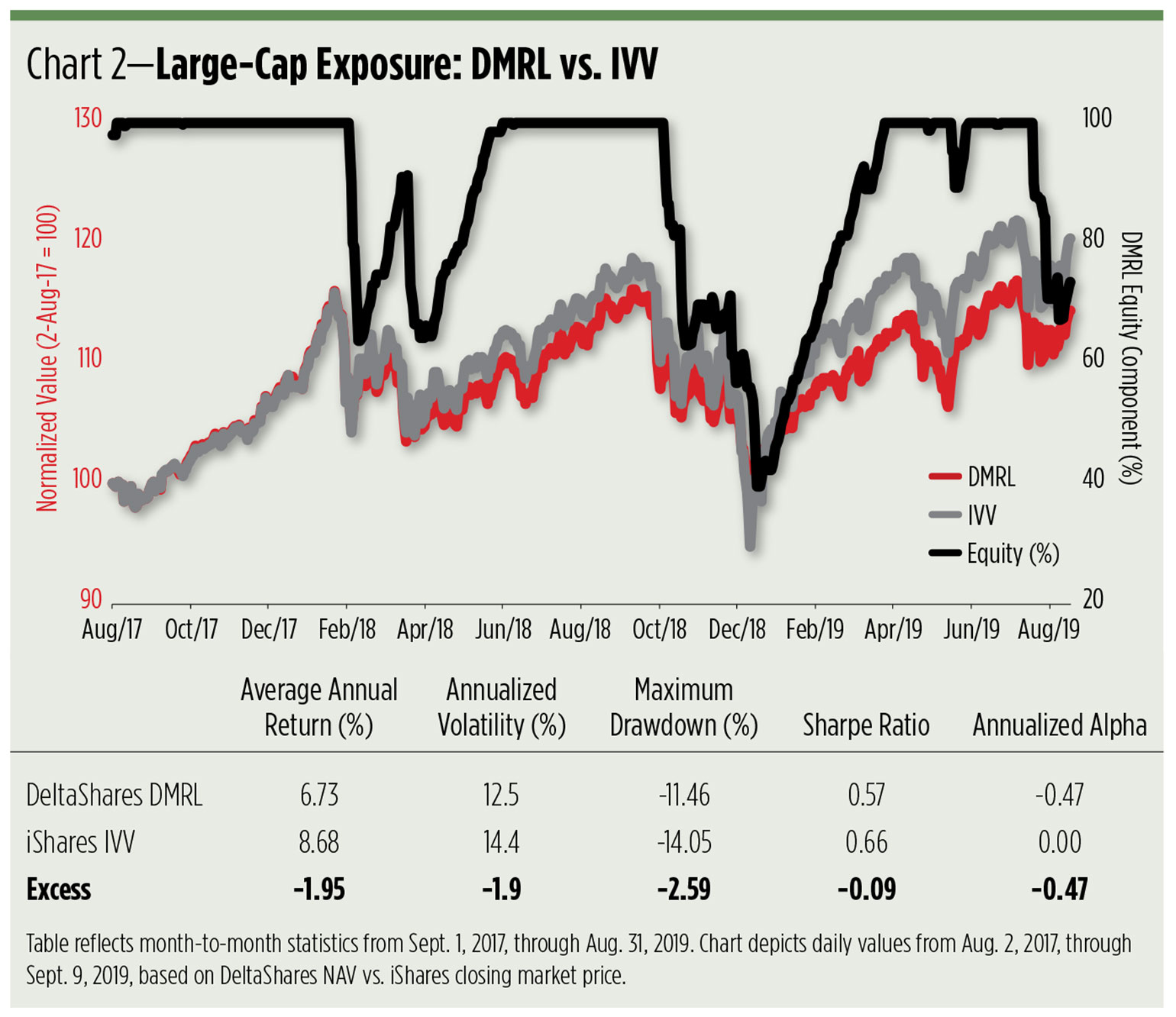

The DeltaShares S&P 500 Managed Risk ETF (DMRL) started life with 100% exposure to equities, just like the iShares Core S&P 500 ETF (IVV). When the S&P 500 headed south in early 2018, though, DMRL’s allocation to the S&P index portfolio was ultimately slashed by 36%. Equity exposure then bounced between 100% and 40% before ending up at 73% in September 2019. The result of all this toggling is portrayed in Chart 2.

As you can see, DMRL’s average return ended up lagging IVV’s by almost 2 percentage points per year. That DMRL’s annualized volatility was nearly 2 percentage points lower than IVV’s is both good and bad. True, the initial drawdown in DMRL’s value was appreciably less than that suffered by IVV, but the DeltaShares reserve asset allocation acted as a drag when stocks later rebounded.

You could look at DMRL’s return from a different perspective, though. From inception through early September 2019, the DMRL portfolio has been fully exposed to the S&P 500 portfolio only 55% of the time. In that time, the DeltaShares fund racked up a cumulative 14% gain compared with a contemporaneous 20% run-up in the IVV fund. Despite the disparate results, one could argue that DMRL is actually a more efficient portfolio. If IVV had been fully exposed to the S&P 500 only 55% of the time, its gain might have been just 11% (55% x 20%), fully 3 percentage points less than the appreciation realized by DMRL. This assumes a binary operation in IVV: either 100% exposed, or not exposed at all. That’s a purely hypothetical case and definitely not tax-efficient.

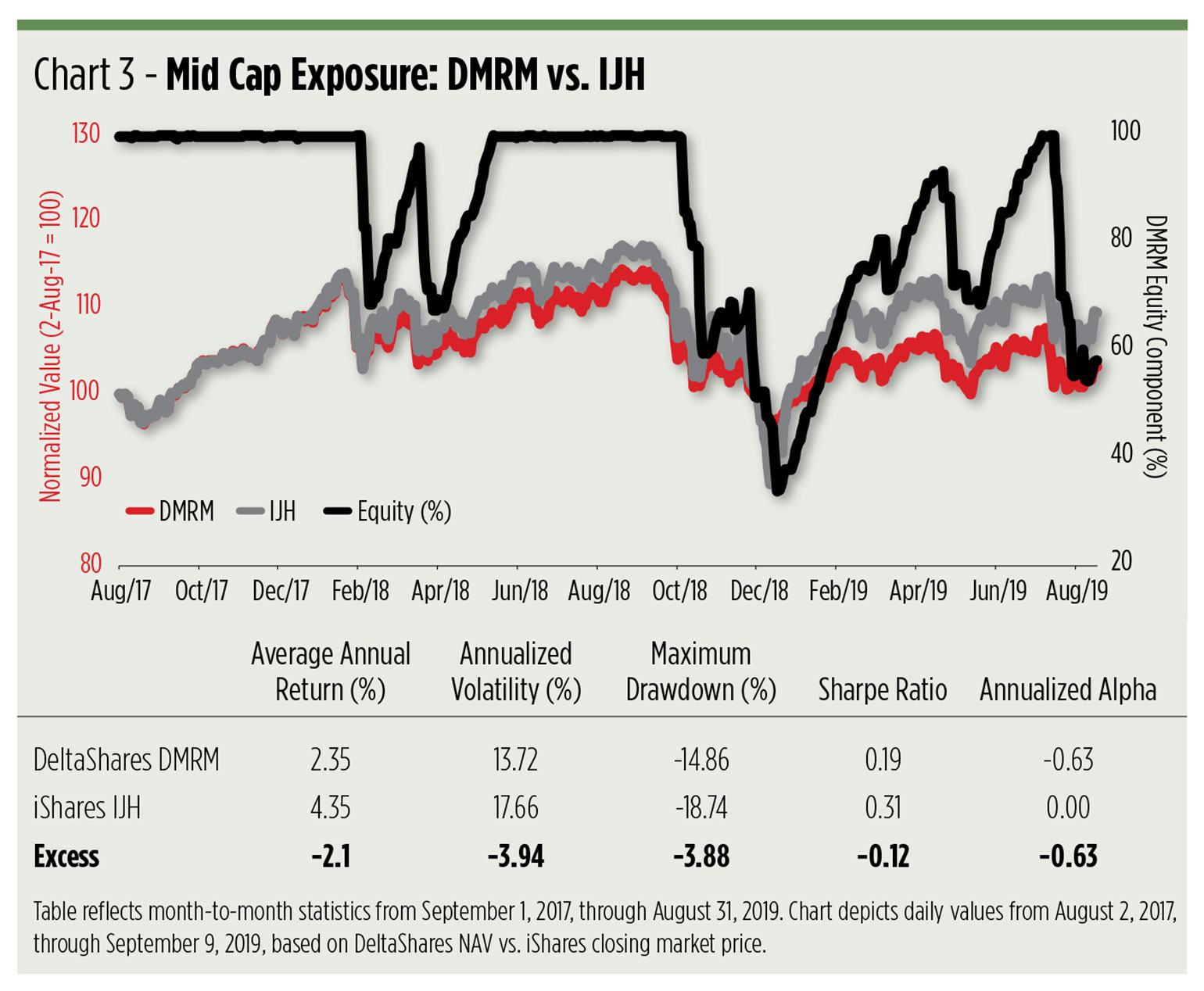

Investors in the mid-cap DeltaShares S&P 400 Managed Risk ETF (NYSE Arca: DMRM) find themselves facing the same kind of headwind as DMRL shareholders. Compared with the iShares Core S&P Mid-Cap ETF (NYSE Arca: IJH), DMRM trimmed drawdown risk at the cost of upside returns over the past two years. Fully exposed to the S&P MidCap 400 only 46% of the time, DMRM’s cumulative return trails IJH by 8 percentage points now.

Investors in the small-cap space could take cheer with the performance of the DeltaShares S&P 600 Managed Risk ETF (NYSE Arca: DMRS). DMRS is the only domestic DeltaShares portfolio generating a positive Sharpe ratio and a positive alpha coefficient. Still, it came into September with a cumulative return 6 percentage points behind the iShares Core S&P 600 ETF (NYSE Arca: IJR). The DeltaShares fund has spent just 43% of its life fully exposed to the S&P SmallCap 600.

So What?

It’s still early days for DeltaShares. They won’t be considered seasoned for another year. An argument can be made that the Milliman strategies haven’t really been tested in a protracted downturn. Indeed, the funds’ worst drawdowns to date have spanned just three or four months.

Some inkling of the funds’ potential, however, may be obtained by comparing their post-drawdown performances. Most readily apparent is the difference in the market trends across the capitalization tiers. After the late-2018 sell-off, the large-cap segment went on to recover its lost ground and then some. The current trajectory of big stocks appears attenuated but still bullish. Not so for mid-caps or small caps. These two segments haven’t fully recovered. Small caps seem to be in the worst shape, signaled by a string of lower highs. But here, the value proposition for the DeltaShares strategy is strongest as evidenced by DMRS’s Sharpe and alpha readings.

Is this risk-adjusted outperformance in the small-cap space sustainable? Will the DeltaShares portfolio’s cumulative return eventually pull ahead of its conventional analog? The coming year may provide the opportunity for these funds to shine.

Disclosure: None.