How Efficient Is The S&P/KRX Carbon Efficient Capped Index?

Following the South Korean government’s announcement of the Green New Deal in the summer of 2020, S&P Dow Jones Indices and the Korea Exchange (KRX) partnered to launch the S&P/KRX Carbon Efficient Capped Index on Nov. 16, 2020. The S&P/KRX Carbon Efficient Capped Index seeks to provide exposure to the Korean equities market, while also minimizing exposure to high-carbon-emitting companies and most importantly, promoting change from corporates in the market.

Image Source: Pixabay

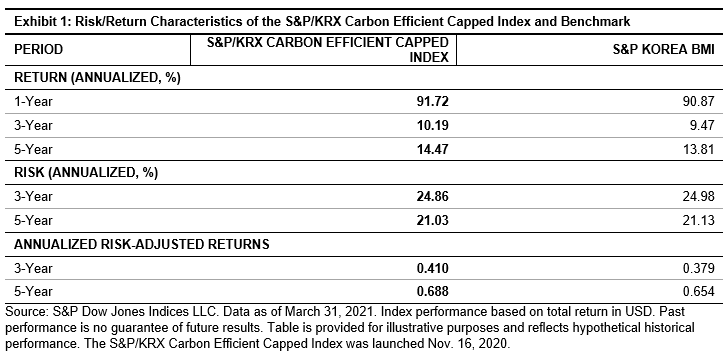

With the industry group’s weights kept neutral, the index is designed to have similar performance characteristics to the benchmark, as shown in Exhibit 1. However, that being said, it is promising to see that the carbon-efficient strategy slightly outperformed over the past several years, perhaps reflecting the positive effect on returns for carbon-efficient companies. In the next section, we take a deeper look at how companies are reweighted within the S&P/KRX Carbon Efficient Capped Index to achieve the 36.35% reduction in carbon intensity.

S&P Carbon Global Standard

The S&P Carbon Global Standard was launched in 2018 to compare any company within a given industry group to a global standard. For each GICS® industry group, decile thresholds are determined that would categorize companies from 1 to 10, from the least carbon intensive to the most. In addition, the S&P Carbon Global Standard also reviews the industry groups and classifies each as either “High,” “Mid,” or “Low” impact. Both of these identifiers are utilized by the S&P Global Carbon Efficient Index Series Methodology. The S&P Carbon Global Standard is revised on an annual basis to ensure that it is up to date with the status of emissions by companies around the world. Results are posted to the S&P Dow Jones Indices website, and can be found here.

Decile Classifications

Based on company carbon intensity data as provided by S&P Global Trucost, each company in the S&P/KRX Carbon Efficient Capped Index is assigned a decile rank according to the S&P Carbon Global Standard.

In comparison to their average weight in the underlying index, companies in the top three deciles saw weight increases ranging from 49.49% to 108.75%. On the contrary, companies in the bottom decile had an average weight decrease of -35.24%.

It is in constituent companies’ best interest to keep an eye on their emissions levels relative to their industry peers, as the S&P Carbon Global Standard changes on an annual basis. As companies around the world are changing their business practices to decrease their carbon intensity, complacency with the current status quo may leave a company behind.

Conclusion

Achieving decreased carbon intensity can be done in several ways. For example, simply excluding companies from high-carbon sectors such as Energy and Utilities has the potential to significantly decrease the footprint of a strategy. However, a simple exclusion of these sectors would not actually advance innovation and transformation, as these companies would be excluded solely for their classification within a sector, rather than their relative footprint in comparison to their industry group peers. As a result, the highest-emitting sectors would not have the same incentive to change their business practices as their peers.

As we have begun to see the impact of investments in carbon-efficient methodologies across other regions, such as Japan with the S&P/JPX Carbon Efficient Index, where carbon disclosure increased by more than 30% over the past three years, we are excited that the S&P/KRX Carbon Efficient Capped Index gives Korean companies and investors the opportunity to drive change.

Disclaimer: Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. Please ...

more