How Does Jayant Bhandari Maximize Returns And Minimize Risk?

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Sometimes a market in turmoil offers opportunity. Independent investment adviser Jayant Bhandari regularly sifts through bourses to find opportunities that maximize his reward for the least amount of risk. Bhandari currently sees two paths to value: companies that were either oversold in heavy tax-loss selling late in 2015 or in the "free upside" offered in arbitrage situations. In this interview with The Gold Report, Bhandari explains why much of the world's populace is already chasing gold and why a smattering of junior gold equity names offer more than what a market in turmoil might suggest.

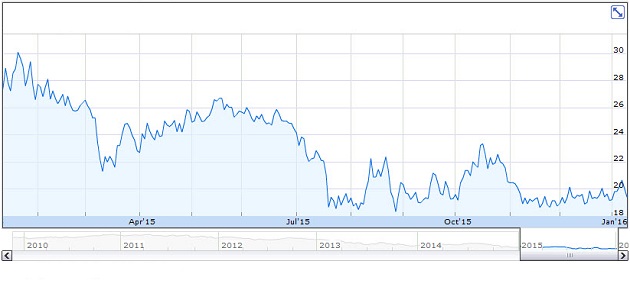

Market Vectors Junior Gold Miners ETF 1-Year Chart

The Gold Report: So far in 2016, Saudi Arabia has severed diplomatic ties with Iran over a religious dispute, and several Saudi allies have followed suit. Meanwhile, China's major stock exchanges started the year with a selloff, prompting the Chinese government to inject $20 billion into the system to help stabilize it. Which situation is likely to have a greater impact on the gold price?

Jayant Bhandari: It's not only a problem in the Middle East. The problem is in Africa. The problem is in South America. The problem is in Central and Southeast Asia. There is a huge amount of political turmoil in these areas. The reality is that most of the countries outside the West, with the exception of China and some smaller city-states, look very unstable. This will contribute to gold chasing by the populations in these countries because the economies are stagnant in all these countries except China and some city-states.

TGR: If there is global instability, don't rough waters threaten to sink all boats, even gold?

JB: These are not sinking ships, these are ships that are stagnating. The economies in these countries are stagnating, and some of the countries are politically unstable. In all these cases, people buy gold. Historically, most of the gold purchasing has happened in the Middle East and the Indian subcontinent. These countries have negative-yielding economies, which means that investing in manufacturing or investing in infrastructure does not provide investors with a profit in these countries. Contrary to popular myth perpetuated by the World Bank and the International Monetary Fund, it is not the lack of capital that keeps poor countries poor, but their utter failure to productively deploy the capital.

For the last 30 years, imported technology from the West allowed these economies to grow very quickly. But the people in these countries haven't changed their cultures, which continues to be tribal and irrational. I am from India and the country completely refuses to change its ways of thinking. It benefitted from the low-hanging fruit that came with technology from the West, but the low-hanging fruit is gone.

TGR: What role do you expect India's stagnating economy to play in terms of gold demand in 2016 and beyond?

JB: Indians are already buying increased amounts of gold. The reason is that the Indian stock market is going nowhere. When you adjust for inflation, which is typically 8–10% every year, investments do not provide you with any return, often negative returns. That's when investors start buying gold and property. The West continues to believe India will be the next China. I guarantee you that India is not the next China. Worse, I'm increasingly scared about India, as it has taken the path of fanaticism, in religion and in nationalistic feelings, both based on arrogance and dogma rather than on principles.

TGR: In different blog posts you've written that China's economic growth will continue for the foreseeable future. What are you seeing that most economists are not seeing when it comes to China?

JB: The Chinese economy is still growing at between 6 and 7%. Economists like to say that China is slowing. That's erroneous. China is not slowing; Chinese growth is slowing. These things are different. Chinese growth is falling, which has to happen for a country that has grown at such an enormous pace for 20–30 years. I see nothing wrong with that. At 6–7%, China's economy is growing faster than most economies.

TGR: What do you make of China's recent stock market weakness?

JB: It's difficult to understand what is happening with the day-to-day stock trading in any country, but the reality is that China continues to grow. I am very optimistic about China. The Chinese have among the highest IQs in the world and have consistently proven it. I don't waver with the day-to-day changes in the stock market. It's an emerging economy. China has had similar kinds of crashes in the past, and it has re-emerged from those crashes. It pays to remember that the stock market does not necessarily tell you about the underlying economy—the U.S. stock market has done extremely well since the beginning of 2009, but its economy hasn't.

TGR: Are there other geopolitical events gold investors should be tracking?

JB: The biggest thing that gold investors should pay attention to is not inflation or deflation—it's negative-yielding economies. This is the reason why people in the Indian subcontinent and Middle East have bought gold in the past. Most economies in countries outside the West are starting to stagnate. Interestingly, the same is increasingly visible in the West.

In Europe many sovereign bonds trade at negative yields, which means that there is an increased acceptance in Western countries toward becoming negative-yielding economies. Similarly, U.S. publicly listed companies are sitting on trillions of dollars of cash, earning negative real interest. That pretty much means that all economies are becoming stagnant. One of the biggest reasons is that democracies have placed people who don't understand economics in charge of economies. That is exactly when people buy a lot of gold and property because they have no better places to keep their money. Both land and gold offer you zero yields, and hence better than negative yields. This means that the stars are aligned for gold to go up. But what has to happen does not necessarily happen right away.

TGR: Do you think the U.S. Federal Reserve made the right move when it made the 25-basis point interest rate increase in December 2015 and set guidance at 1.6% rates by the end of 2016?

JB: The Fed did not increase interest rates enough. Savers get penalized when they get a 0% interest rate. This is morally discouraging for a society. Low interest rates create a boom-and-bust scenario, which means that a lot of malinvestments are taking place. But that does not mean that the Fed will further increase interest rates. I think the Fed will reduce interest rates again, for it is mostly run by people who have no real-life experience and hence they lack an understanding of complexity and unpredictability of life. They are mostly driven by political expediency.

TGR: Can the U.S. inflate its way out of this?

JB: There is not a chance. America has become a welfare state, which requires it to continue to print money. It might take a step back once in a while, but the movement eventually will be in the direction of increased money printing, increased inflation, increased regulation and increased oppression of entrepreneurs. The way our rulers think, they will do exactly more of what created the original problem. The average voter will go along, for he only worries about the seen, not the unseen, long-term consequences.

TGR: Historically, January tends to be a strong market for junior gold equities. In March 2015, the Market Vectors Junior Gold Miners ETF (GDXJ:NYSE.Arca) was at 30 but finished the year below 20. Obviously, there was massive tax-loss selling late last year. How did tax-loss selling position the sector for what's happening now? Are we going to see a rebound or more of the same?

JB: You will see an elastic rebound. Two companies in particular - IMPACT Silver Corp. (ISVLF) (IPT:TSX.V) and Energold Drilling Corp. (EGD:TSX.V) (EGDFF) - fell hugely from tax-loss selling last month. Some of these companies will see a rebound as the inertia of tax-loss selling goes away.

This year should be a very good year for the good companies in the junior mining sector after we saw a bifurcation occur in 2015. Some 70 to 80% of companies that have no value have continued to fall and will continue to fall, but the good companies have found a foothold and have made gains over the last year. Those companies will continue to increase in value as they raise money and move in the right direction. So I'm very optimistic about selective companies within the junior mining sector.

TGR: Is there a deal going on between Energold and IMPACT Silver?

JB: They are both companies run by the same management in the same office. Energold is Impact's biggest shareholder. So they should be merged entities but they are two separate entities.

TGR: What are the key elements of a good junior mining company?

JB: The biggest thing is the management. The quality of management is always key because if the management is not good, that will destroy value. It's hard to believe, but a lot of junior mining CEOs are financially illiterate. A lot of them live a lifestyle using the company's treasury.

TGR: What are some post tax-loss selling value plays?

JB: Have a look at Oban Mining Corp. (OBM:TSX) (OBNNF). The company is backed by the Osisko Gold Royalties Ltd. (OR:TSX) (OKSKF) group and it is trading for pretty much its cash value.

TGR: Oban has some heavy hitters on the board with Sean Roosen and Ned Goodman. What's the next step for Oban?

JB: It has been releasing news continuously for several months. The market just doesn't pay much attention because there's not much liquidity in Oban's shares. One of the biggest shareholders has been selling consistently over the last couple of months. You can see that in its insider filings. Once that selling pressure is gone, I see management continuing to create value. I know COO and Director Jose Vizquerra-Benavides very well. I think he will do very well with the company.

TGR: Any others?

JB: Helio Resource Corp. (HRC:TSX.V) (HELOF) owns the SMP gold project in Tanzania, which has been forgotten by the market. Of course, it has suffered from tax-loss selling. SMP is very close to a producing mine owned by AIM-listed Shanta Gold Ltd. (SHG:AIM). Shanta can truck ore from SMP, making it a natural acquirer of Helio.

Another interesting opportunity is Starcore International Mines Ltd. (SAM:TSX) (SHVLF), which had a very decent last quarter last year. It is also going to process concentrate from smaller miners in Mexico. That processing plant apparently is ready to go and the company is trading at $0.265/share. Big players can't play in these companies because they lack liquidity but this is where, fortunately, medium-sized investors and retail investors can take advantage of opportunities.

There is another company called Coro Mining Corp. (COP:TSX) (CROJF), which has the Berta copper project in Chile. The company's shareholder structure is crazy and its balance sheet is difficult to understand, which is dragging down its share price. I wouldn't recommend investing too much in this, but it certainly looks like a good opportunity.

IMPACT Silver, Energold, Helio and Starcore are certainly suffering from tax-loss selling. They offer good entry points in the market.

TGR: As a long-time investor in the junior gold equity space, how are you approaching the market given the current economic backdrop?

JB: I'm very optimistic about gold as a commodity. There are many companies that offer good value. I want to make money with the least amount of risk. Some people say that with risks come rewards. I don't think that is necessarily true. I'm looking to maximize my rewards for the least amount of risk. Today, the way the market is, I seek opportunities with arbitrage upside because that's free upside. Arbitrage opportunities offer you one of the safest and high reward opportunities in this market.

TGR: What are some current arbitrage opportunities?

JB: There's a company called Sunridge Gold Corp. (SGC:TSX.V; SGCNF:OTCQX), which has a project in Eritrea that is getting sold to a Chinese entity. On a per share basis, based on my calculation, a shareholder will get about $0.35/share in cash or more. It was trading at about $0.26 in early January, and that offers about 35% upside. Sunridge also has warrants trading in the stock market. Sunridge has released a news release saying that it would offer $0.02 per warrant to the owner of these warrants. The warrants trade at between $0.01 and $0.015, offering you anything between 30–100% upside by investing in a Sunridge warrant.

Another company called Kobex Capital Corp. (KXM:TSX.V) (KBXMF) is trading at about $0.56/share but has about $0.70 in cash. In a news release the company said it would either return cash to shareholders or make a strategic transaction by March 31, 2016, which means that my $0.56 share has the opportunity to become $0.70 in cash if the company decides to return its cash.

TGR: How do you find these opportunities?

JB: I constantly travel the world to meet the people managing these companies. I go to conferences all over the world and engage with private equity people. So I constantly hear what is happening with these companies.

TGR: Are there other companies that offer exceptional value in this market?

JB: There is another company called Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX), a Canada-listed company with the small, but very high-margin, Pilbara gold project in Australia. Hopefully, it will reach commercial production later this year. That's another very good company.

TGR: Novo is run by Dr. Quinton Hennigh and you once worked together.

JB: I worked with him as an independent director on the board of Gold Canyon Resources Inc. Since we talked in August, Gold Canyon merged with First Mining Finance Corp. (FF:TSX.V), which was a good deal for shareholders of both companies. That's how value should be created for shareholders in the junior market.

TGR: Can you give us updates on other companies that we discussed in August?

JB: There is Callinex Mines Inc. (CNX:TSX.V; CLLXF:OTCQX), which is run by exceptional people. The company is cash rich and is among the few companies in the Flin Flon mining camp actually investing money in the ground. The company has been drilling during the last year and it just received a permit for more drilling. It will soon launch a 7,000–8,000 meter winter drill program.

TGR: What's the goal of the drill program?

JB: Its projects are within trucking distance to HudBay Minerals Inc.'s (HBM:TSX; HBM:NYSE) 777 processing plant. So if Callinex can outline even a small resource, it could be mined and sent to HudBay's nearby processing plant, which is actually quite hungry for ore. HudBay suffers from a lack of resources, so if Callinex can drill off a deposit that can be mined economically, it could quickly realize value.

TGR: Can Callinex make money shipping ore to a smelter or is a takeover by HudBay or another company the best path to shareholder gains?

JB: HudBay might take over the Flin Flon project or it might joint venture the project with Callinex but that's likely the limit of HudBay's interest. But first Callinex has to find something of value to HudBay.

TGR: What is the one message you want to convey to investors at this moment in history?

JB: The world has become quite unstable and governments have too much control over our savings and net worth. They already take away about half of what we produce, in a plethora of taxes. Despite this they are forever in deficits. It is important for investors to internationalize their wealth. It is important for them to take a part of their wealth outside the formal system to protect it from what might happen in the future. One way to do that is to invest in physical gold. What happened in Cyprus will happen in other countries. It's only a matter of time. Your accounts will get frozen. Your money will be expropriated by your government. It pays to prepare yourself for this eventuality.

TGR: Thank you for your insights, Jayant.

Jayant Bhandari has been an Asia-based institutional investor adviser for the last three years. Prior to that he worked for six years with U.S. Global Investors in the United States, a boutique natural resource investment firm, and for one year with Casey Research. Prior to his involvement in the investment industry he established and managed Indian subsidiary operations of two European companies. He received his Master of Business Administration from Manchester Business School (UK) and holds a Bachelor of Engineering from SGSITS (India). He frequently writes on cultural, political and social issues for several publications.

Jayant Bhandari has been an Asia-based institutional investor adviser for the last three years. Prior to that he worked for six years with U.S. Global Investors in the United States, a boutique natural resource investment firm, and for one year with Casey Research. Prior to his involvement in the investment industry he established and managed Indian subsidiary operations of two European companies. He received his Master of Business Administration from Manchester Business School (UK) and holds a Bachelor of Engineering from SGSITS (India). He frequently writes on cultural, political and social issues for several publications.

Disclosure:

more