How About Midpoint Decoupling?

With some PMI’s in the US on somewhat of an upswing, it already raises the issue of a midpoint in their trend. Given how the US data is pretty isolated in that way, could there also be midpoint decoupling? That’s what we would have to believe if the “bottom is in” folks have it right, those like Jay Powell who are arguing the worst is behind us (even if risks remain).

Remember that the idea of decoupling has already once been dashed during this eurodollar cycle. In 2018, while renewed (and “unexpected”) overseas turmoil erupted, for a brief time during especially the latter half of last year there was some talk of the US economy decoupling then. It didn’t happen, of course, which is how we got where we are today (rate cuts, not rate hikes).

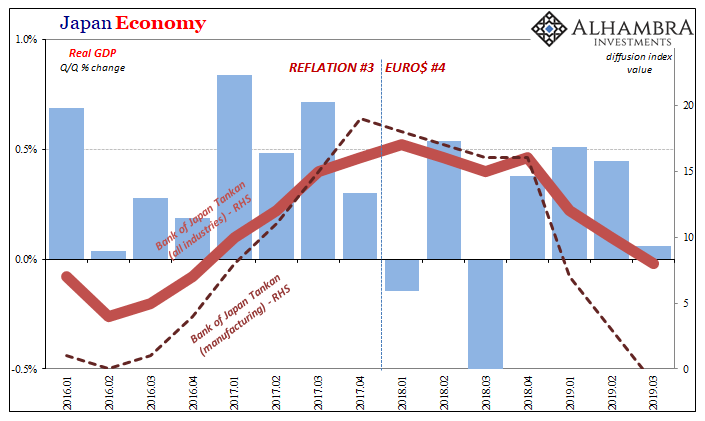

In terms of IHS Markit’s PMI’s, then, the US is heading in the good direction while others, such as Japan, continue their way downward. Jibun Bank’s flash composite PMI for Japan, in conjunction with Markit, was 49.9 in November 2019. While that is up from 49.1 in October, Markit’s chief Economist warns that Q4 GDP is on track to be the first (annual) negative since Euro$ #3. And this follows near-zero growth in Q3, and therefore the precipice of technical recession already.

The economic weakness in November once again stemmed from a further deterioration of manufacturing operating conditions, where production volumes fell for an eleventh straight month. This marked the longest period of factory downturn since the depths of the global financial crisis in 2008-09.

Is Japan’s weakness really different from the cross-currents Jay Powell believes are in the US economy’s rearview mirror?

No. That’s why there’s never decoupling. Not last year, the time before (2015) nor the first time the idea was raised all the way back in early 2008 (Euro$ #1; only then it was hoped the rest of the world would decouple from the growing American and European disaster; it didn’t). Globally synchronized remains globally synchronized all the way through, start to finish.

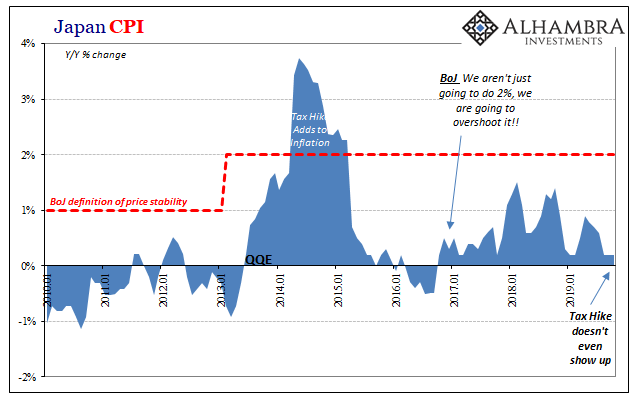

In Japan, it is actually quite easy to see the externality. Start with inflation and how the Japanese CPI has evolved over the past few years. It was on the rise in later 2017 and early 2018, causing central bankers like Haruhiko Kuroda to prematurely celebrate his own success; by April 2018 talking about ending QQE entirely and even, gasp, raising rates.

Over the last year and a half, however, inflation has begun to decelerate and is once more flirting with outright deflation. And in the case of October 2019’s estimate, the latest reading released yesterday, not even that month’s tax hike made much difference (though, also ominously, it sure did for Japanese households).

In 2014 when the VAT tax was previously raised, it caused an enormous (and unsustainable) spike in the CPI as prices all across Japan were raised when it was passed along to consumers. While the October 2019 increase this time exempted food, even still there was nothing in the CPI. Zilch. The index was up 0.2% year-over-year for the third consecutive month.

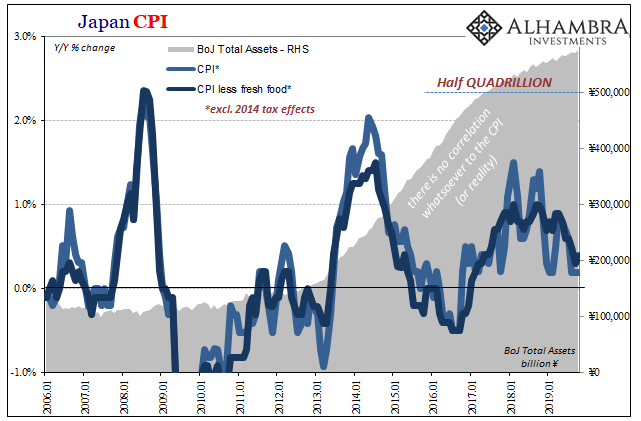

If taxes aren’t contributing to the most recent inflation estimates, then that’s just consistent with how the Bank of Japan isn’t adding anything, either. Total assets now in Mr. Kuroda’s hands moved above the ¥575 trillion level in October, and still, inflation decelerates across all the CPI accounts; core and not.

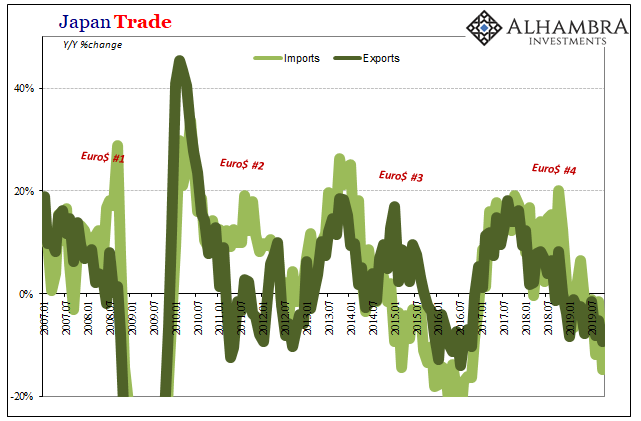

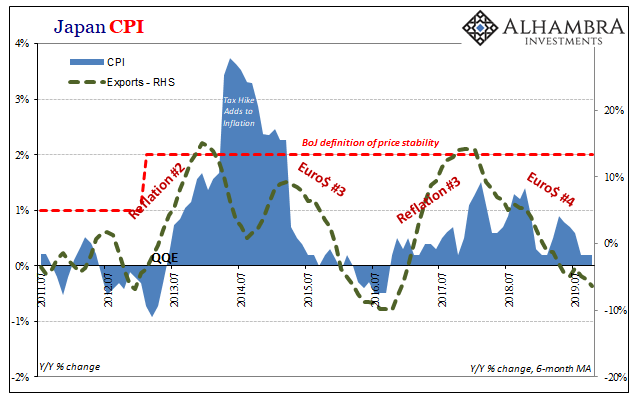

In fact, what’s clearly visible instead in the CPI figures is an all-too-familiar pattern, particular the last eight years since the 2011 slowdown (Euro$ #2). If the Japanese government isn’t moving inflation, therefore economy, and the Japanese central bank isn’t, either, then the source of these swings up and down must be:

The chart above pretty clearly demonstrates the motivating factors in both accounts, inflation, and trade. This isn’t to say that exports are in the driver’s seat for consumer prices, though there are likely some indirect effects, rather it merely shows the general correlation in that the same overall tendencies appear across both as the same trends at the same times. They display the common factor for the marginal direction of Japan’s entire economy.

Not fiscal nor monetary policies. Only “dollars”.

What that means for the US is pretty simple; if the eurodollar squeeze is responsible for continuing weakness in Japan (as Europe, China, and pretty much everywhere else), why would the American economy become exempt from further downside? It has already been impacted to a substantial degree, with a serious slowdown developing as pictured in GDP already (Q4 estimates aren’t good), so if Euro$ #4 is continuing to negatively impact everyone else why not the US, too?

It’s a question that Jay Powell certainly doesn’t have an answer for. He continues to suggest the reason could be the strong labor market reasserting itself later on this year and early next, but the last FOMC meeting minutes poured a ton of cold water on what sometimes looks like such confidence. Not just in terms of what policymakers recognize as pretty sketchy labor data of late, but also what it is they see as the driving force behind serious remaining downside risks:

However, other downside risks had not diminished. In particular, some further signs of a global slowdown in economic growth emerged; weakening in the global economy could further restrain the domestic economy…

Thus, Japan’s example. Euro$ #4 continues to be the main force pushing the Japanese economy off course as seen throughout its economic data. If that’s true, even the FOMC realizes what it is likely to mean for the US. And it’s not decoupling, midpoint or otherwise.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more