Here Are The Three Companies Apple May Buy Next, According To JPM

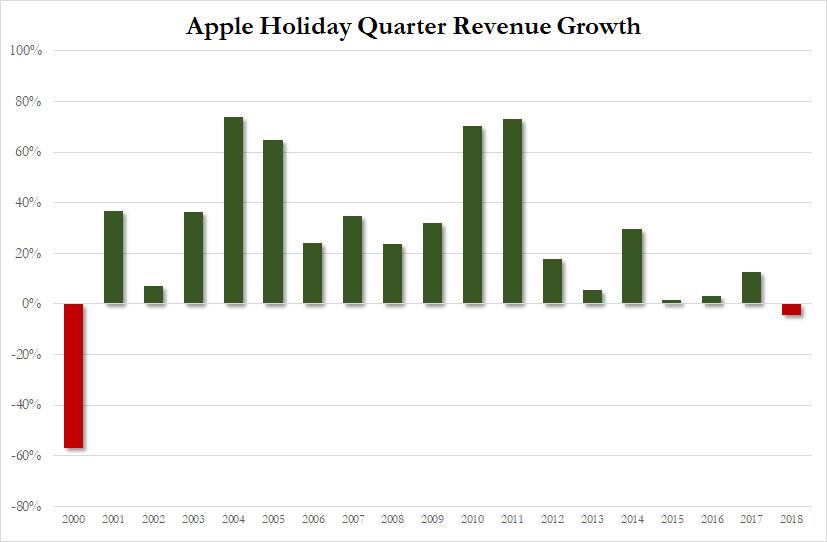

With Apple's growth rate appearing to have plateaued now that the iPhone market appears to be saturated and the company reporting its first holiday quarter iPhone revenue decline since 2000...

(Click on image to enlarge)

... questions are starting to swirl if and how Apple will use its record $130 billion in net cash, along with some $45 billion in cash flow generated every year after dividends, to acquire some additional and much-needed growth for the company that until recently had the world's biggest market cap.

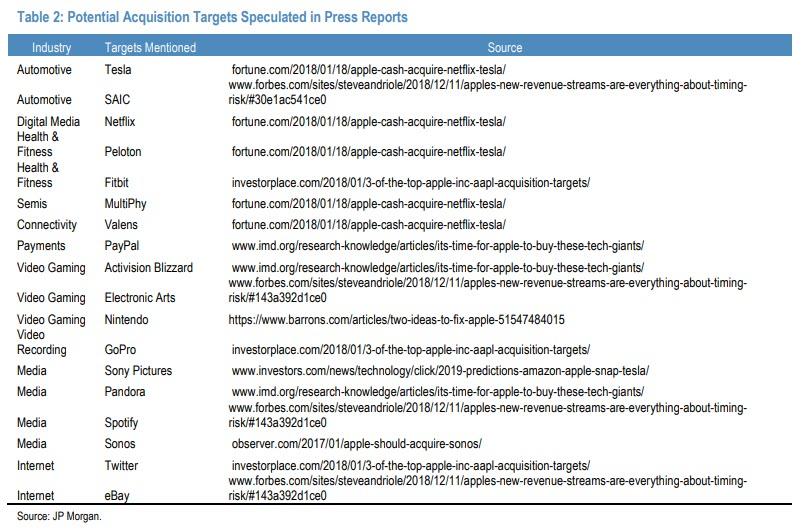

To be sure, acquisition targets for Apple have been widely discussed in press reports on a regular basis, despite the company itself offering no comments on the subject or giving any indication to investors of its intentions about future products/services. According to a JPM sample survey of these press reports shows that speculation has included a wide range of industries, from automobile manufacturers, like Tesla, to information platforms, like Twitter.

(Click on image to enlarge)

Yet while investors are hardly complaining about the massive buyback pace, including a record $73 billion just last year, JPMorgan according to analyst Samik Chatterjee, investors are increasingly hopeful that Tim Cook & Co "uses its balance sheet strength to insulate the business against often-seen disruptions in the technology landscape, some of which Apple itself has

driven in the past" even though as the JPM analyst concedes, although "Apple does not have a history of large acquisitions", although clearly $175BN in gross cash can buy a lot of growth:

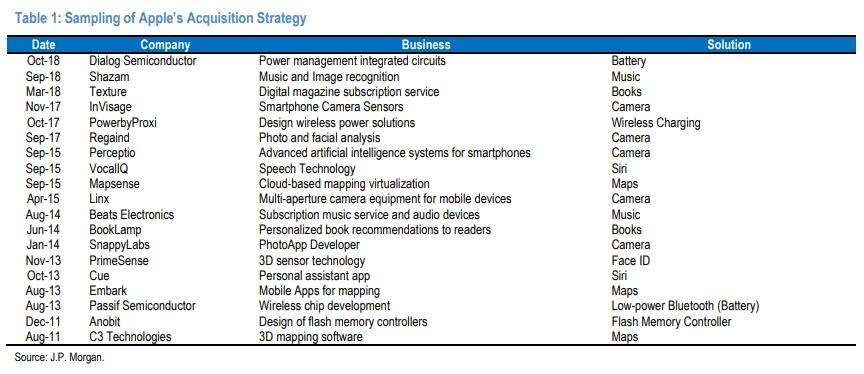

As shown in Table 1, Apple has a history of making multiple “bolt-on” acquisitions every year, which have largely been focused on bringing hardware technology that the company expects to be crucial to competitive differentiation in-house and better manage its development toward commercialization. In fact, Apple has been very successful with the strategy to-date as many of the applications in use on iPhones today can be associated with bolt-on technology acquisitions of the past (e.g., 3D sensing facial recognition, Siri speech recognition). Despite a track record of multiple acquisitions, the largest acquisition to date for Apple remains Beats Electronics, which was acquired for proceeds of $3 bn, while typical acquisition sizes are in the hundreds of millions. Apple's track record on acquisitions has made a lot of investors question the willingness of the current management team toexplore large acquisitions.

(Click on image to enlarge)

And so, of the potential acquisition targets that have been widely speculated, JPMorgan found "three industries to be of the most strategic value, providing potential growth opportunities to leverage services over a wider installed base" namely video gaming, smart home speakers and video content. So drilling down, here are the companies in each vertical which JPM believes Apple will be most drawn to in the coming months:

- Video gaming stands out to us as a potential sector target given the combination of 1) leverage to an industry rapidly transitioning to mobile; 2) hardware capabilities for high-end gaming potentially supporting a replacement cycle; 3) synergies in gaming services with iPhone’s hardware leadership, including in AR/VR; and 4) access to installed gaming hardware of hundreds of millions of units, including both mobile and consoles.

Among targets mentioned in press reports, JPM finds Activision Blizzard to be the best strategic fit. Activision shares rose 1.4$ percent, with a market cap of just under $36 billion. Given that JPM is highlighting Activision as a gaming platform that is attractive to investors, the bank expects an obvious question to be as to why "we don't think Apple should acquire Nintendo, as recently speculated in a Barrons article" to which the bank responds that "while we will not rule anything out, our preference for Activision as a strategic fit over Nintendo relates to the opportunity for Apple to acquire a services platform with access to a wide installed base of devices, instead of a services platform that has access to only Nintendo's installed-base of hardware. With recent moves from Apple to allow Apple Music to leverage Amazon Alexa’s installed base and Apple TV to leverage Samsung’s, LG’s and Vizio’s installed base of TVs, with stand-alone software offerings, we believe Apple is more focused on leveraging a wider installed base to drive services growth."

- Smart home speaker also stands out given the combination of 1) focus on high engagement with customers; 2) synergies in driving Apple Music services; 3) currently lagging competitors in the smart home category.

Among targets mentioned in press reports, JPM finds Sonos to be the best strategic fit "due to its differentiated position as a premium home speaker system relative to Amazon Alexa and Google Home, strong loyalty among current consumers, and robust international presence." JPM also notes that Sonos would give Apple access to high income households to play catch up with Amazon and Google in the home, and additionally, it estimates "that households with premium purchases, such as a Sonos speaker system, are typically high-income households that can afford multiple media content subscriptions, allowing Apple Music to play catch up relative to leading platforms like Spotify." Sonos, which had a market cap of $1.2 billion, as of Friday’s close, rose 6% on Monday, its seventh straight daily gain, and the longest such streak in its history, following the JPM report.

- Video content is another possibility given the combination of: 1) leverage to rapid growth in content consumption on mobile; 2) an established platform to accelerate Apple’s nascent investments in original content; and 3) opportunities for advertising revenues in the future, enhancing Apple's position as an aggregator of content.

Here, JPM finds Netflix as the best strategic fit, although it notes that a combination is less likely as Netflix is "unlikely to be a seller for a modest premium" and would have a "transformational impact on Apple's balance sheet."

if we assume Apple were to purchase Netflix for a 20% premium (Netflix is unlikely to be a seller, in our view, and might command a much higher premium), it would imply an enterprise value of $189 bn (Netflix has a net debt position of ~$7 bn), implying that Apple would likely end the year with a neutral cash position, which is a long-term target for the company (assuming the termination of share repurchases in the year of the acquisition).

Still, a combination with Netflix would accelerate Apple’s original content plan "which will allow it to differentiate itself relative to other streaming services", additionally Apple could enhance its position as an aggregator of content in addition to offering original content and last but not least, "Netflix could be a conduit for Apple to access more than 139 mn on-demand content consumers globally."

Finally, JPM notes that while press reports have discussed a wide range of traditional media companies, including Sony Pictures, as potential targets, the bank believes "Netflix is a better strategic fit relative to other speculated targets because 1) Netflix would further support Apple's intent to act as an aggregator of content relative to traditional media companies; 2) Netflix's subscription revenue model is a better fit for Apple's strategic direction with services revenues, and it is challenging to transition the revenue models of the traditional media companies to subscription-based models; and 3) While Netflix is a less likely seller, there are even greater barriers to acquiring its direct competitors, including Hulu and Amazon Prime."