Healthy Food Won’t Make Snyder’s-Lance A Healthy Business

A company with a large and varied product offering needs to stay focused on efficiency to ensure profits do not suffer. As we have detailed in many Danger Zone reports, companies often use hollow acquisition-driven growth to mask deterioration in the underlying business, i.e. efficiency. This week’s Danger Zone stock fits this description to a tee. Add in extremely high profit growth expectations and it’s easy to see why Snyder’s-Lance (LNCE: $35/share) is in the Danger Zone.

Lance’s Business Is Declining Despite EPS Growth

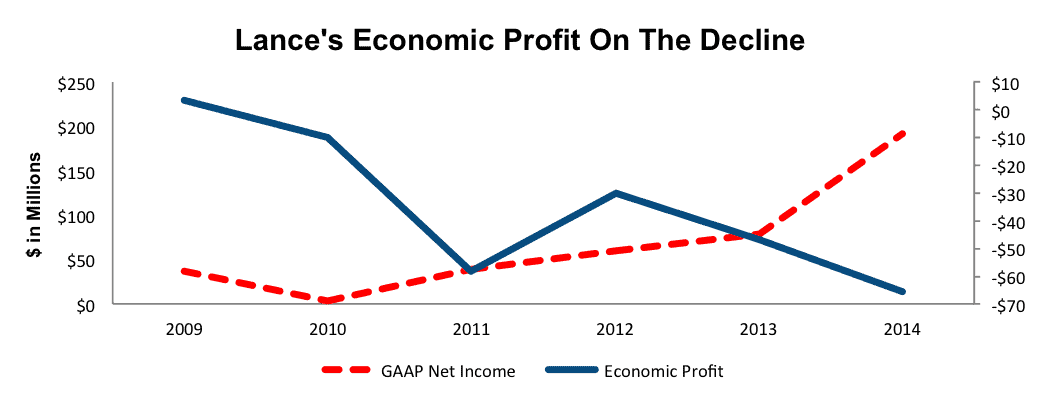

Since 2009, Lance’s business has been headed in the wrong direction despite what EPS may show. Over this time, GAAP net income has grown 40% compounded annually while economic earningshave declined to -$66 million, from $3 million. Figure 1 shows how GAAP net income has created a false picture of Lance’s profits.

Figure 1: Snyder’s-Lance GAAP Net Income Is Misleading

Sources: New Constructs, LLC and company filings

In 2010, Lance merged with Snyder’s of Hanover in an equal stock deal. This new company, which claimed numerous synergies due to their similar operations was supposed to be much more efficient due to increased distribution networks. However, the combined company failed to generate any efficiencies as Lance’s return on invested capital (ROIC) has fallen to a bottom quintile 4%, down from 10% the year before the merger.

The decline in ROIC can be attributed to the expansion of Lance’s balance sheet. Invested capital has grown at 32% compounded annually since the Snyder’s merger and subsequent acquisitions of Baptista’s Bakery, Snack Factory, and distributor Stateline Service Corp. In Snyder’s-Lance, we see a clear case of acquisition’s helping to fuel EPS growth, while destroying the underlying shareholder value.

To quantify this value destruction, the cost of off-balance sheet liabilities and equity capital, costs overlooked in GAAP analysis, was $1.90/share in 2014. After removing this charge we find that economic EPS is -$0.94 vs. GAAP EPS of $2.72 in 2014.

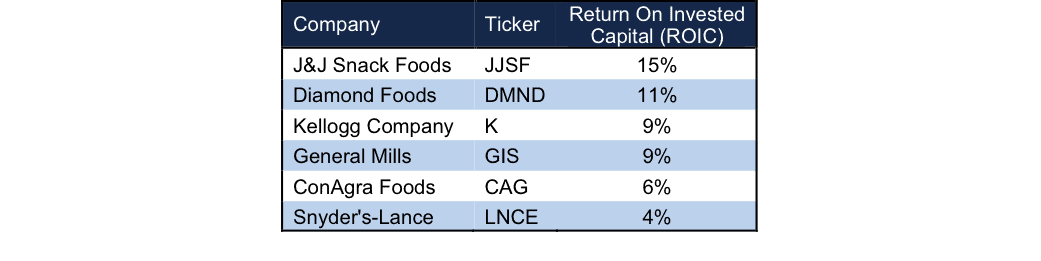

Competitors Are Everywhere and More Profitable

Operating in the snack food market opens Lance up to considerable competition. Many of the competitors, large and small can be seen in Figure 2. Additionally, Lance faces threats from private companies Frito-Lay, Mars, Nestle USA, and others. In the niche snack food market, pricing is paramount to success and as can be seen in Figure 2, Lance operates with very little pricing power, as its profitability is much lower than that of competition.

Figure 2: Competition Is More Profitable Than Lance

Sources: New Constructs, LLC and company filings

Healthy Eating Trend Doesn’t Make A Business Healthy

With the recent acquisitions and new product releases planned for 2015, it’s clear that Lance is focusing on a healthier/organic product base of snack foods, which correlates with their new “better for you” slogan. This initiative would appear to be a smart business move as, according to Lance’s investor presentation, industry-wide organic retail food sales increased to $60 billion in 2014, triple the sales from 2010. However, Lance makes it quite difficult to measure the profitability or effectiveness of its venture into healthy/organic foods because it does not break out its individual product sales. Additionally, one must wonder if Snyder’s-Lance is too late to the party. The rise of organic foods has been ongoing for a few years, and we believe it may have reached a peak already.

Using history as a guide, Lance’s management has not given us much confidence in its ability to create shareholder value while increasing or acquiring new products. Not only will these products be costly, as shown by the 9% compounded annual increase in cost of sales and SG&A since 2012, but they will cater to a narrower customer base. Worse yet, without an even more costly and risky brand makeover, it is hard to see how a traditionally convenience-store and Wal-Mart-based product line will get much traction with organic-oriented customers. Despite these headwinds, the stock price implies the company will execute on these opportunities to perfection.

A Buyout Could Take Place, But Would Be Unwise

The snack food industry is no stranger to consolidation, especially after the mega deal between Heinz and Kraft Foods earlier this year. Additionally, Lance has shown that it is willing to acquire growth in what it believes are key markets. As some larger competitors look to the future, they may see Lance as a viable option, but we believe any acquirer should think twice. Lance’s debt, including off balance sheet operating leases sits at $507 million, or 21% of market cap. With such a large debt load and significantly overvalued shares (as we’ll show below) any acquisition at current prices would heavily overpay for a company not creating value.

Impact of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to Lance’s 2014 10-K. The adjustments are:

Income Statement: we made $194 million of adjustments with a net effect of removing $124 million of non-operating income (8% of revenue). We removed $35 million related to non-operating expenses and $159 million in non-operating income.

Balance Sheet: we made $371 million of balance sheet adjustments to calculated invested capital with a net increase of $5 million. The largest adjustment was the removal of $237 million due midyear acquisitions. This adjustment represented 14% of reported net assets.

Valuation: we made $712 million of adjustments with a net effect of decreasing shareholder value by $697 million. The largest adjustment to shareholder value was the removal of $157 million in deferred tax liabilities. This liability represents 6%% of Lance’s market cap.

Valuation Implies Perfect Execution

At current prices, Snyder’s-Lance is priced for significant profit growth. LNCE is up 26% over the past year and shares have reached levels simply unjustified by the operations of the business. To justify its current price of $35/share, Lance must grow after-tax profit (NOPAT) by 15% compounded annually for the next 18 years. Keep in mind that Lance has only grown NOPAT by 2% compounded annually since 2012.

Even if bulls are right, and Lance is able to achieve increased revenue growth and margins through healthier food products the stock still has huge downside. If Lance can increase NOPAT margin to 6% (4% in 2014) and grow NOPAT by 10% compounded annually for the next decade, the stock is only worth $14/share today – a 60% downside.

Catalyst: Earnings Miss Will Sink Shares

Within the next year, we believe Snyder’s-Lance will miss earnings estimates as its new products fail to generate the profits investors expect. We believe that the rush to go organic (across the market, not just at Lance) may have been a fad that has peaked and may actually be fading. Many stocks, most notably Whole Foods (WFM), rode that wave to new heights only to fall 40% over the past six months. We warned investors of issues with Whole Foods’ business model in 2010 because we thought the stock was writing checks the business cash flows could not cash. Our thesis came true only after the organic trend dissipated and the underlying profit challenges within Whole Foods finally came to light. If Whole Foods can’t capitalize on the organic market it seems unlikely that Snyder’s-Lance could do much better.

Executive Compensation Could Be More Shareholder Friendly

Apart from base salaries, executives receive annual cash bonuses and long-term equity awards. Annual cash bonuses are determined based on the achievement of target revenues and EPS, which we know to be an inaccurate measure of profitability. Long-term equity awards are based upon relative shareholder return and ROIC as calculated by Snyder’s-Lance. While it is a positive to see Snyder’s-Lance focusing on ROIC, their cash bonus program could be improved to focus on more shareholder friendly metrics, such as economic earnings and not EPS.

Dangerous Funds That Hold LNCE

The following funds receive our Dangerous-or-worse rating and allocate significantly to Snyder’s-Lance.

Disclosure: New Constructs staff receive no compensation to write about any specific stock, sector, or theme.