Has The Global Market Recovery Run Out Of Steam?

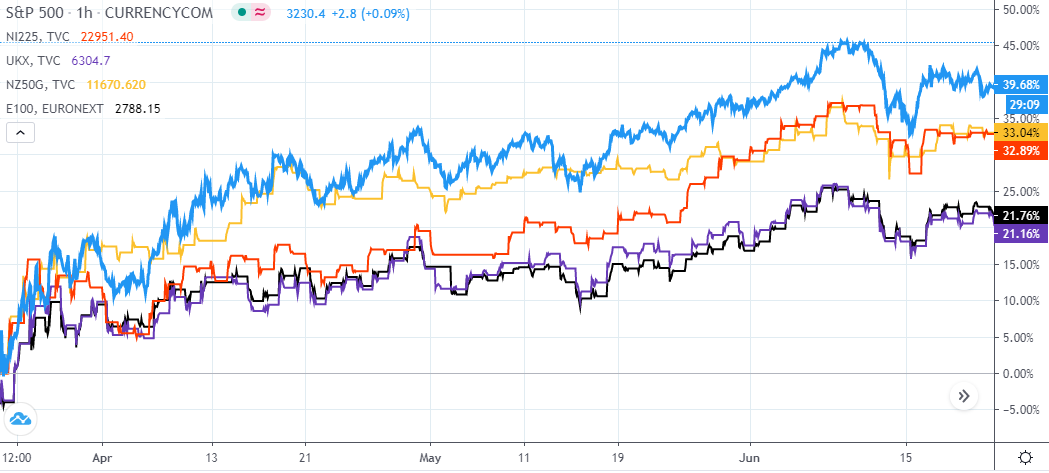

The coronavirus pandemic has ravaged the global financial markets after triggering a flash crash in March. Since then, the world’s leading stock indices have recovered significantly with the S&P 500 Index gaining nearly 40%. Japan’s Nikkei 225 index has also made a significant recovery rallying more than 33% while the UK and EU-based stocks are up about 21% as per the FTSE 100 index and the EURONEXT 100.

Looking at the chart below, it is clear that that recovery may have run out of steam. This happened in early June amid fears of a second wave of the coronavirus pandemic flaring up. This was shortly followed by another pullback. However, unlike the previous collapse which saw markets sink into a recession, the current pullback appears to be only a blip for now. In fact, there have been some decent rebounds since mid-June. Whether this rebound results in a major run is another question.

The current trend in the global market makes it challenging to identify stocks to invest in especially given that reports still point towards a continued slowdown this year and the next. But that does not mean that investors cannot profit from the market.

Pouncing on short-term opportunities

With the expected volatility in global stocks, opportunities to short the market or pounce on short-term rebounds will be multiple. And the best thing is that with advanced technologies, traders can now pounce on all these opportunities via a single platform. Stock trading via CFDs is now becoming more popular across the globe as online share brokers continue to add blue-chip stocks in their asset portfolio.

US stocks are currently reporting earnings for Q2. This week, it has been mostly the financial and industrial sector reporting but in the coming weeks, the likes of Facebook Inc. (FB) on July 29, Apple Inc. (AAPL) and Alphabet Inc. (GOOG) both July 30, among other technology giants will announce their results.

This sets the market up for some exciting times in the near future. With the anticipated earnings results, the stock prices of these companies could become a little volatile. This creates more opportunities for traders to capitalize on the pre-earnings period.

How soon could we begin to talk about a post-COVID-19 rally?

While traders will be looking to profit from the volatility of the stock market in the short-term. Value investors will be looking to pounce on bargain stocks that could do extremely well after COVID-19. There are positive developments around finding a vaccine for COVID-19. If this comes to fruition within the next 12 months as highly anticipated, then we could witness a major bull-run thereafter.

In the US, the November presidential elections could curtail the prospected rebound momentarily, but given the measures the government has taken to stimulate the economy, the long-term future looks bright. Therefore, it is conceivable to say that within the next 12-18 months, investors could be looking back and celebrating their decisions to pick some bargain stocks at the height of the coronavirus pandemic.

It is also clear that the US, about 40% up, stays ahead of the rest of the world in terms of recovery as demonstrated in the market indices comparative chart at the beginning of this article. Europe and the UK, about 21%, appear to be trailing by a big percentage while Asia and Oceania about 33%, are hovering at the mid-point level.

Conclusion

In summary, the global markets appeared to be on the road to recovery following the COVID-19 driven plunge back in March. That now appears to have slowed after a major pullback earlier last month. This does not mean that there are no opportunities for traders to capitalize on.

Traders can trade volatility created by the market uncertainty via stock CFDs offered by brokers across the globe. Value investors can also identify potential bargain stocks that are only suffering from market risk. They could turn out to be multi-baggers after COVID-19.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more