Has Stock Bias Adversely Affected Your ETF Asset Allocation?

Bonds must be unbelievably dull. When the Dow broke 17,000 and when the S&P came withing a stone’s throw of 2,000 – media messengers enthusiastically reported the peachy particulars. In contrast, 10-year German bund yields are currently logging record lows and the vast majority of fixed income ETFs are registering 52-week highs, yet CNBC’s focus remains on the geopolitical impact of Ukraine tensions on stocks.

Might anyone other than a bond fund manager discuss the potential value of bond assets in a portfolio? And why is it that when stocks are rocking, fewer folks question the possibility of additional gains, but when bonds are proving their mettle, everyone raises the threat of rising interest rates

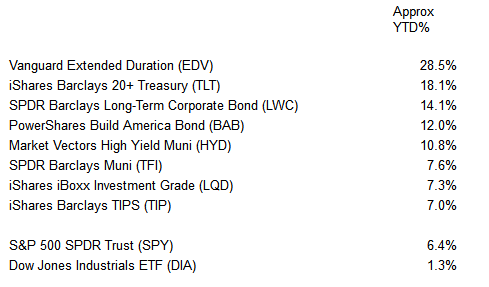

New 52-Week Highs: Did You Give These Fixed Income ETFs A Fair Shake?

As the president of a Registered Investment Adviser with the SEC, I may not have time to read many of the comments on every article that I write. Yet one comment recently surprised me. In essence, the author explained that “there is no reason why our interest rates have to rise just because someone looks at a chart and sees that they’ve been falling for 32 years. They can fall for 35 and STAY there for another 25.” I agree with that assessment, not so much because of a fundamental or technical evaluation, but because there are no geometric givens in the investing universe.

In October of 2002, at the start of the 10/2002-10/2007 bull market for stocks, scores of high-profile professionals had been asked about the one thing that they felt most confident about. The answer, not surprisingly, was the notion that interest rates would rise. It seemed obvious enough. The Federal Reserve had been suppressing the overnight lending rate. The economy had been coming out of recession. Why shouldn’t rates rise?

The problem with the simplistic commentary was the reality that short-term rates could rise on Federal Reserve tightening and, simultaneously, longer-term rates could stay in the same place or even fall. In other words, the yield curve can widen, stay the same or flatten. And during 10/2002-10/2007, the overall flattening of the yield curve corresponded to exceptionally poor performance for rising rate mutual funds like ProFunds Rising Rates Opportunity (RRPIX). Judging by what happened in the previous stock bull market, as well as what is happening in the current five-and-a-half year run, might the writer of the comment above have a valid point?

Perhaps speakers should cease describing stocks as being the only game in town. As feeble as the income portion of the total return may be, bonds still provide safer haven qualities. Geopolitical fighting, stock price overvaluation, limited supply of government debt due to quantitative easing, ongoing deflation shocks in Europe – one can most certainly make the case that bonds will remain the big winner in 2014. Then again, with fixed income being so darn dry, will anyone other than Gundlach and Gross (and yes, Gordon too) even talk about it?

One final observation regarding the stock market’s penchant for rallying on bad economic news. Granted, the U.S. Federal Reserve succeeded in bolstering confidence in equities through its ultra-loose monetary policies. On the other hand, the notion that the Fed will forever ride to the rescue is hardly preordained. If the consumer looks weak in real estate-related data or retail data – if employment information disappoints and/or GDP is unimpressive and/or wage growth wanes – investors seem convinced that the Fed will maintain its zero percent target well into the latter half of 2015. On the flip side, how high can stocks really climb if that same data stifle corporate revenue and profits?

One of the more telling indications that U.S. stocks may have trouble making significant headway involves Wal-Mart’s anguish. Some might even choose to dub it the, “Wal-Mart Indicator.” Same store sales at the consumer staples giant have declined for five consecutive quarters. Meanwhile the corporation’s shares figure prominently in SPDR Select Consumer Staples (XLP) as well as Market Vectors Retail (RTH). In fact, the price of RTH has yet to reclaim its November 2013 highs.

Will stock asset demand overcome both Wall Street’s “Wall of Worry” as well as Wal-Mart’s “Wall of Woe?” Even if it does, might you be able to get over a stock bias to allow for a little bit of bond asset love?

ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser ...

more