Growing Expectations Of Two Rate Cuts In 2020 Focus S&P 500 Investors On 2020-Q4

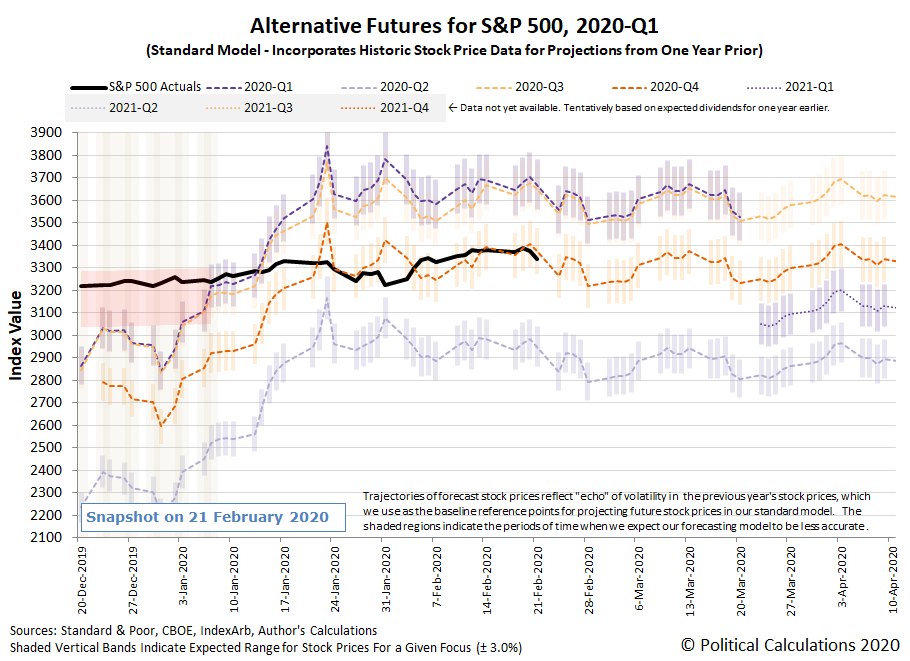

Coronavirus epidemic-related news continued to dominate the headlines most relevant for S&P 500 (Index: SPX) in the third week of February 2020, sending the index up to a new record high of 3,386.15 on Wednesday on expectations of a much bigger economic stimulus out of China, before also sending stock prices downward to close the week 1.4% lower as the virus' impact to global supply chains started to draw attention.

And yet, the S&P 500 continued to behave predictably, with its trajectory following the path defined by a dividend futures-based model assuming investors are focusing on 2020-Q4 in setting current day stock prices.

(Click on image to enlarge)

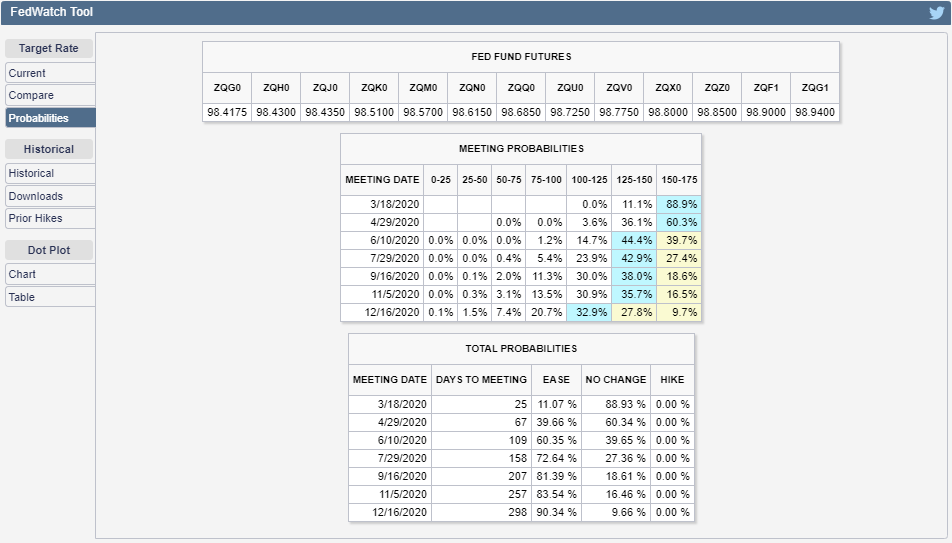

The reason we believe investors are focusing on the distant future quarter of 2020-Q4 is because that's when investors are increasingly betting the U.S. Federal Reserve will be compelled to cut interest rates by a quarter point for a second time in 2020 to stimulate economic growth, following an already expected quarter point rate cut in 2020-Q3. The latest rate change probabilities indicated by the CME Group's FedWatch tool confirm that growing expectation:

(Click on image to enlarge)

That doesn't mean that Fed officials are happy about that situation, where many are clinging to the hope they can avoid additional rate cuts. And as you'll see among the market-moving headlines of the past week below, at least one Fed official is counting on China's coronavirus epidemic dissipating to justify avoiding additional rate cuts.

Tuesday, 18 February 2020

- Fed minions happy to hold interest rates steady:

- Flight to safety: Foreign inflows into U.S. Treasuries in 2019 hit largest in 7 years: data

- Bigger stimulus developing in the Eurozone, China:

- Dow, S&P 500 decline after Apple's sales warning

Wednesday, 19 February 2020

- Oil up more than 2% on slowing coronavirus cases, U.S. move on Venezuela

- Putting on a brave face: China central bank sees limited impact to economy from coronavirus

- But only saving face. Even bigger stimulus developing in China:

- Fed minutes show Fed minions looking to hold rates steady, want to end emergency liquidity injections:

- S&P 500, Nasdaq hit record closing highs, lifted by China stimulus hopes

- Not just U.S. stocks: European shares hit record high on drop in new virus cases, hopes of China stimulus

Thursday, 20 February 2020

- Oil prices rise as U.S. crude stocks build less than expected

- Coronavirus icing on cake of global recession?

- Shipping lines, ports count cost as coronavirus hits supply chains

- U.S. manufacturers scramble for costly alternatives as coronavirus cuts Chinese supplies

- Too early for accurate figures on coronavirus impact on global growth: IMF

- EU's Gentiloni says expected rebound in Italy, France, Germany now uncertain

- Fed's Clarida says U.S. economy is strong, still too soon to judge virus risk

- Even bigger stimulus developing in China:

- Indexes fall, led by tech decline on mounting fears coronavirus could spread

Friday, 21 February 2020

- Oil falls over 2% on concerns over economic toll from virus

- U.S. services, manufacturing sectors hit wall in February: Markit

- Fed minions say they'll take strong action in downturn, but think they won't have to:

- Wall Street slides as gloomy data adds to coronavirus fears

Meanwhile, if you're looking for more context for what else was going on in the Presidents Day holiday-shortened week, Barry Ritholtz lists the positives and negatives he found in the past week's economics and market-related news - we like how he framed the week's Number 1 negative!

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more