Greenspan’s Massacre Masterpiece

What most Economists “learned” from the Great Inflation was how important psychological factors had become. You would think that such a huge monetary disconnect would teach especially monetary officials the importance of monetary competence. However, as Upton Sinclair once wrote, paraphrasing, it’s difficult to get a central banker to understand money when his paycheck can be saved by blaming you (inflation expectations) for his mistakes.

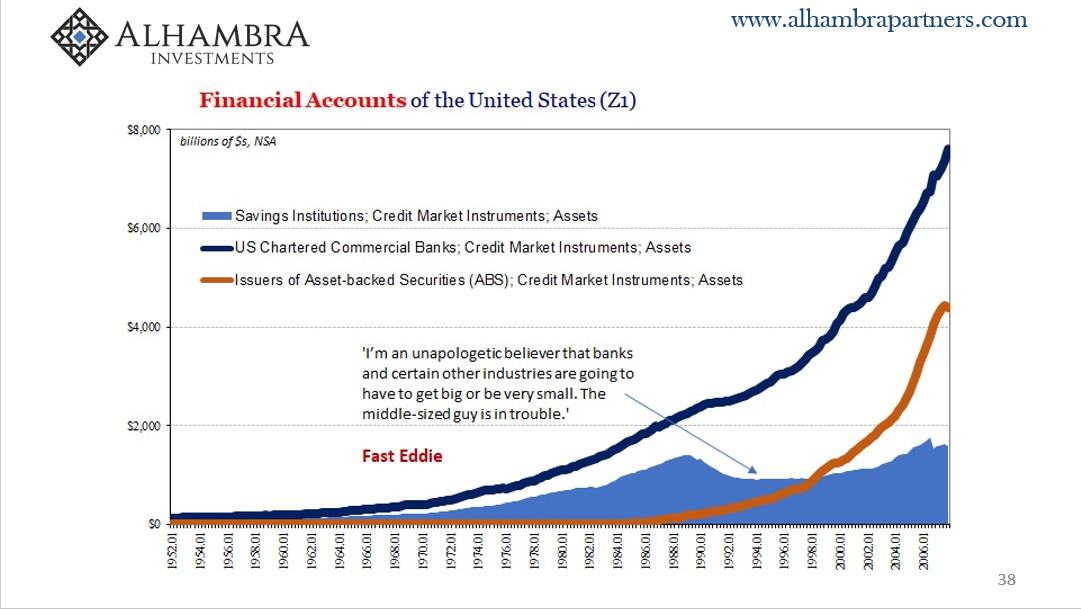

The economic boom of the eighties, alighted by further and even more massive monetary evolution, offered Economists the chance to re-align monetary policy with their new approach. They couldn’t any longer define money so monetary policy as it stood was useless (targeting bank reserves or a broad money supply definition, those that had already been rendered obsolete two decades before).

J. Alfred Broaddus Jr. was President of the Richmond branch of the Federal Reserve and therefore rotated to become a voting member of the FOMC for the first time in the crucial year of 1994. The US economy had fallen into recession in 1990-91, and then somewhat sluggish recovery following from it (a pattern that has grown worse). President Bush (41) was defeated by “it’s the economy, stupid” even though the prior contraction had ended, technically, in March 1991 – nineteen months before the election held in November of 1992.

Stubborn economic weakness had meant the FOMC kept pushing the federal funds target, their relatively new policy approach, lower and lower. More than a year after the recession finished, FFT would finally come to rest at a low of 3% just months before the Presidential vote.

Then, everything changed in 1993; recovery ignited as if from out of the blue. Greenspan, of course, took it a sign of his and the new policy approach’s proficiency. But that left these same people to wonder and worry about thereafter. Problematic inflation was still fresh in their memories. Even in the late eighties, the CPI had become uncomfortably high again – it would peak at greater than 6% in 1990 during the contraction.

If monetary expectations policy was as powerful as authorities began to believe, then they had to act quickly. After all, a 3% federal funds rate was the lowest in decades. The dangers of an inflationary breakout dominated conventional thinking as 1994 approached and the economy kept improving.

It sounds very strange to us in 2019. Policy hawks in this day and age are central bankers who maybe, sort of act every once and a while. A quarter-century ago, Greenspan went full throttle on the hikes.

They began in February 1994, the usual +25 bps; followed in March and April with the same, +25 each. Then +50 in May, a pause, +50 in August, another pause before +75 in November 1994. The policy cycle would end in January 1995 with a last +50 bps. Seven moves, less than a year, federal funds +300 bps in total.

Alfred Broaddus would later recall:

This understanding grew out of the mistakes of the 1970s. Back then, inflation psychology was so embedded, the only thing that would break inflation was a hit to the economy. By taking a pre-emptive approach, we learned, you can minimize the fallout from tightening.

It was the first time the central bank had done anything like this; to act so severely before there were any real signs of inflation. To try and use inflation expectations as a predictable policy input. But what if the pre-emptive approach was too much pre-; an economy thought to be on the verge of an inflationary breakout, but not really anywhere close?

This wouldn’t have to be considered in 1994. The reaction in financial markets was severe, an outcome policymakers were to some extent counting on. With short rates being aggressively challenged by a rampaging Alan Greenspan, interest rates moved sharply upward. It was remembered, simply, as the massacre.

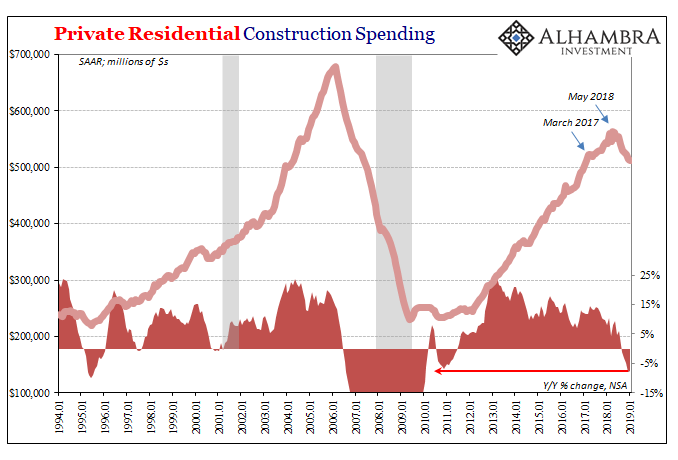

What came next, however, it was what made him the “maestro” in the public’s imagination. Having provoked a response from markets and then the economy, in rate-sensitive sectors like housing, the FOMC would balance them out with three “soothing” rate cuts the first delivered in July 1995 less than a year and a half since hikes began.

As ’95 turned to ’96, everyone believed he had done it. The Fed’s new approach had worked as Alfred Broaddus had suggested. They had steered the economy into its mythical “soft landing.” To this day, myths about central banks and monetary policy crucially depend upon this one episode.

Is this really what happened?

In one sense, you can see the US economy partly responding. The housing sector clearly did, but to mortgage rates which were set by UST’s – not directly the Fed’s “rate hikes.” If the bond market sees the same scenario as whatever Fed Chairman, then monetary policy, bonds, and rate-sensitive economic sectors are in harmony. A massacre can be a good thing.

As we see from just the other side of construction spending, the economy overall was healthy behind all this. For whatever reasons, in 1993 things started to go right. You can attribute this to fed funds 3% if you like, or maybe the negative effects of the S&L crisis fading into modern eurodollar (commercial banking) reality.

Non-residential construction, for example, capex, turned higher and never looked back. It didn’t pause for the massacre or anything else. In fact, despite +300 bps “tightening” on fed funds, capex spending would accelerate even more in 1995 while housing slumped.

Was the economy booming because of Greenspan, or had Greenspan unwittingly taken advantage of a booming economy to establish his policy’s “credibility?”

Economists will claim that was the whole point – to take a little steam out of the boom by directly affecting the parts of it most susceptible to these kinds of policy changes. But you can make that claim only because there was a boom in the first place (R*, as they like to use now, wasn’t zero-ish). Federal funds around 6% truly didn’t bother anyone; even the housing slump didn’t last long.

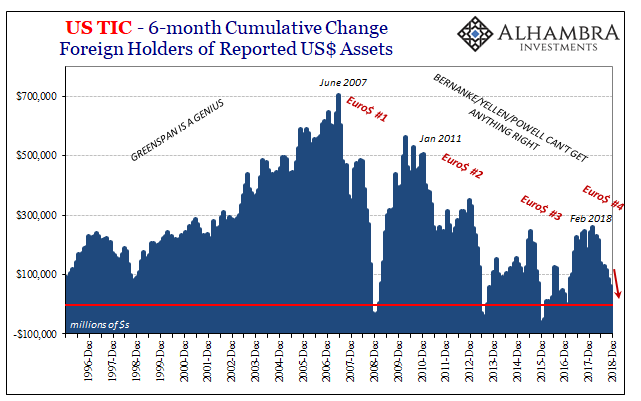

In the middle 2000’s, of course, Greenspan would do it again; or try to recreate his maestro magic. The federal funds rate was pushed from a new low of 1%, following the dot-com recession of 2001, to as much as 5.25%. No bond massacre this time, the housing bubble reaching new heights of mania and insanity anyway. It was as if the FOMC didn’t matter.

Perhaps bond investors, meaning banks, had learned a thing or two about what was really going on over the prior decade.

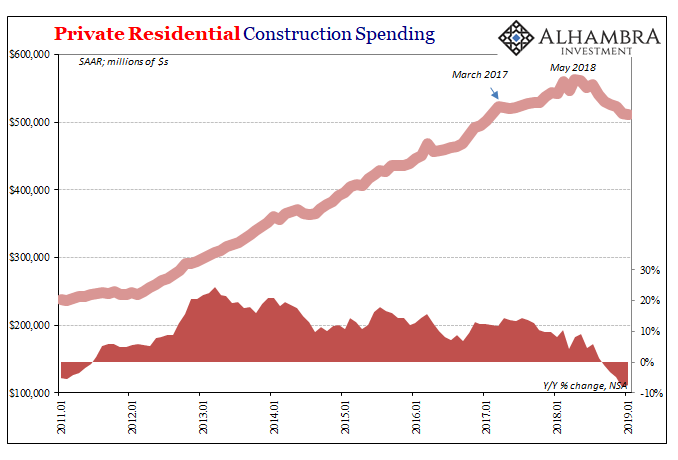

The housing market enters 2019 once more in a slump, the most serious since the last housing bubble burst. Construction figures, as other data on real estate and building, show unequivocally there is something wrong here.

Residential construction spending was down 7.6% year-over-year (unadjusted) in January 2019 according to new estimates provided by the Census Bureau (starting to catch up from the government shutdown). Spending for November and December was revised substantially downward, with construction in December 2018 now believed to have been 8.1% lower compared with December 2017.

That’s just rate hikes, they say. Mortgage rates are up from the lows, sure, but they remain still very low. The net change low to high across several years, again, dictated by the UST market, is less than half of the change during 1994’s massacre. The slump in residential construction is already greater this time compared to that one.

The issue instead may be that unlike 1994 (or 1995 and beyond), there is no booming economy. The Fed’s models projected one especially in 2017 just like they did in 1993 (and for the same reasons, this monetary policy “stimulus” via expectations). Only this time Jay Powell won’t be the maestro to take credit for favorable economic trends because there aren’t any.

The economy of the nineties wasn’t really impeded much by fed funds going from 3% to 6%, but the economy of the 2010s becomes dreadful because EFF gets to 2.4%? Clearly, something besides economic growth is missing from the story. What is it that explains all the facts, in all time periods.

This is the nut of R*. All it means is that Economists agree there is something wrong putting it into terms they understand, this interest rate stuff revolving around an academic framework of people’s expectations. The problem is, in this view, you and me and everyone else around the world. It is their get-out-of-jail-free card. If Alan Greenspan once felt the need to back off at 6% but now Jay Powell gets the same feeling not halfway there, R* says “not my fault!”

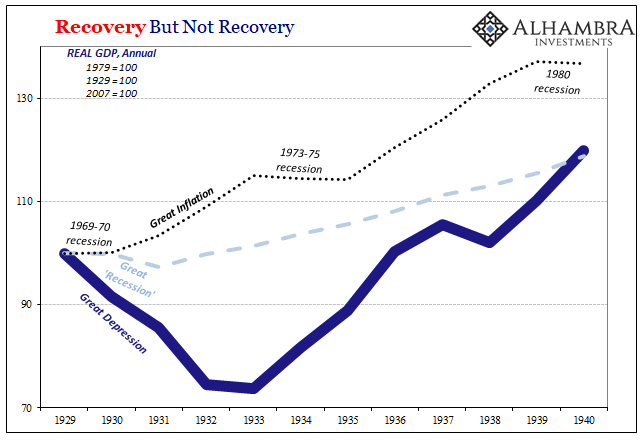

R* is how Economists justified categorizing what was honestly weak economic growth as a booming boom; the new 21st-century definition no longer means sustained robust growth, it today means the best that we think anyone can do even if it isn’t very good at all. Be thankful it’s not worse, you ingrate! This is why there are celebrations for an occasional quarter of 4% GDP expansion. To sell you on good enough, a pretty good come-back from the low point as FDR once said under much too similar circumstances.

The bond market, however, no longer buys the “maestro” BS. No massacre this time, either, the theatrical run of Greenspan’s show once fresh and inspiring now sadly tired and boring. The housing slump, the low and now inverted curves, the lack of any capex consistent with a boom, it all adds up to the same thing. There is a boom out there, but it is impossible to reach until there are significant, deep, meaningful changes to the monetary system. It would really help if there was some money in it.

To use Mr. Broaddus one last time, by taking the pre-emptive approach the Fed again shows us its hand. It is and has always been, bluffing.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more

There is money, but it is not where it should be, and a little more would help the overall economy. But asset inflation while wages hardly grow is simply not cutting it. But the Fed likes it this way.