Government Shutdown: Melt-Up Or Sucker’s Rally?

“Start every day off with a smile and get it over with.” – W. C. Fields

It’s good to know markets can actually move in more than one direction, isn’t it?

Last year, for lack of a better way of saying it, simply sucked. The three major declines of February, October, and December were incredibly compacted, with crash-like velocity occurring over just a few days that ultimately defined the year. Global equities largely gave up their gains from 2017, and you would have been extraordinarily lucky to have ended the year positive in your portfolio given the path of market behavior.

The government shutdown, while painful for many, hasn’t been bad at all for asset holders. As a matter of fact, since the government shutdown began, the S&P 500 has surged with its best shutdown performance ever (as of writing). Don’t equate correlation with causation, however – much of the move that happened post-Christmas was simply because stocks exited last year at some of their most oversold levels in history.

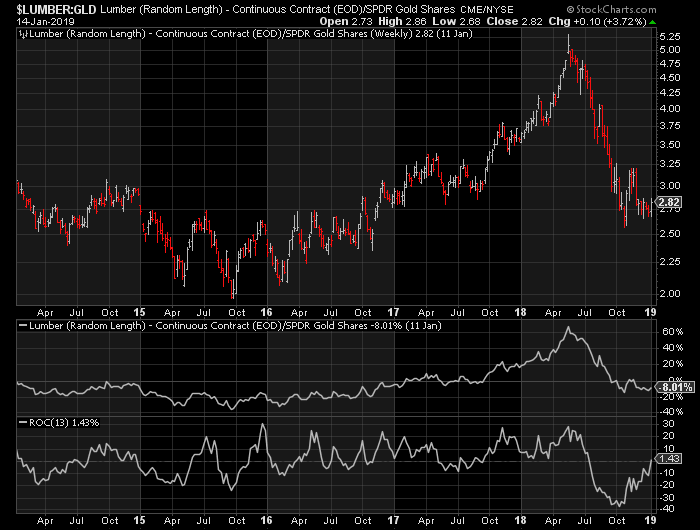

So here we are, resolving oversold and quickly becoming overbought, and the big question is whether or not this is the start of a new uptrend/melt-up or a sucker’s rally before testing/breaking new lows. I’m more of the opinion it’s the former from objectively looking at leading indicators of risk sentiment like lumber relative to gold (GLD). If you haven’t taken a look at the 2015 award-winning paper, “Lumber: Worth Its Weight in Gold”, I co-authored, I encourage you to take a look at some of the conclusions.

The synopsis of the findings? When lumber (cyclical due to housing) outperforms gold (non-cyclical) over a rolling 13-week period, generally going forward stocks have lower volatility than otherwise, and lower volatility tends to coincide with melt-up environments. Looking at recent behavior, one can see Lumber has stabilized, the 13-week rate of change has just turned positive.

(Click on image to enlarge)

The other encouraging sign here? Utilities (XLU) which have gotten smoked since the December low. Utilities, when they outperform over a short time period to the S&P 500 (SPY), tend to warn of increased volatility and correction risk. The spike in outperformance was arguably so extreme that it could end up being a blow-off with hindsight, and has many weeks more to fall, also suggesting a better environment for equities is ahead in the near-to-intermediate term.

(Click on image to enlarge)

Note that all this is happening during the shutdown. Stocks, from an intermarket standpoint, are actually preparing themselves more for upside rather than downside. Now, of course, these intermarket trends can be wrong, but historically they have tended to be more indicative of what’s to come than not. From a macro perspective, the rally may not be over. Odds favor increased risk appetite in the weeks and month ahead (for now).

Disclosure:This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to ...

more