Got Bond Concerns?

The market largely continued last week’s mixed moves, with the S&P and Nasdaq mildly retreating from record highs and the Dow eking out another record close.

The sentiment remains mostly rosy thanks to earnings that continue to impress, plummeting virus numbers worldwide, indicators that the economic recovery is gaining steam, and imminent stimulus.

But we’re not out of the woods yet, and I still worry about complacency and valuations.

But now, you can add one more concern to the list- rising bond yields.

On Tuesday (Feb. 16), the 10-year Treasury yield jumped 9 basis points to top 1.30% for the first time since February 2020. The 30-year rate also hit its highest level in a year.

Why is this concerning?

Rising interest rates=less attractive stocks.

Sure, the banks benefit. But what do you think this means for growth sectors such as tech that have benefited from low-rates?

You couple that with the fact that according to the Buffet Indicator (Total US stock market valuation/GDP), the market could be 228% overvalued, and tech stocks may be at valuations not seen since the dotcom bubble? Genuine concerns.

A rebound in rates could also put a dent in the economic recovery if both companies and consumers find it increasingly expensive to borrow.

While I don’t foresee a crash like we saw last March and feel that the wheels are in motion for a healthy 2021, I still maintain that some correction before the end of Q1 could happen.

Bank of America also echoed this statement and said last week that “We expect a buyable 5-10% Q1 correction as the big ‘unknowns’ coincide with exuberant positioning, record equity supply, and as good as it gets’ earnings revisions.”

Corrections are healthy and normal market behavior, and we are long overdue for one. They are also way more common than most realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

A correction could also be an excellent buying opportunity for what could be a great second half of the year.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and the end of Q1 2021 is possible. I don’t think that a decline above ~20%, leading to a bear market, will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

The Streaky S&P Is Back at a Record

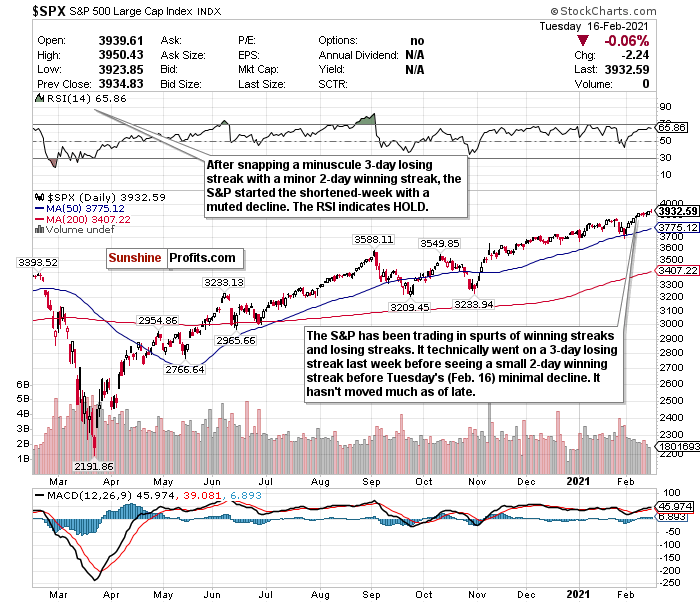

Figure 1- S&P 500 Large Cap Index $SPX

The S&P continues to trade as a streaky index. It seemingly rips off multiple-day winning streaks or losing streaks weekly.

Before Tuesday’s (Feb. 16) “decline” (if you can call it that), here’s how the S&P has traded in February. It kicked off the month by ripping off a streak of gains in 6 of 7 days. It then promptly went on a 3-day losing streak, followed by a two-day winning streak and more record closes.

Then it declined a 0.06% to kick off the President’s Day shortened trading week.

More than 80% of S&P stocks that have reported earnings have beaten estimates, which is quite impressive. Yes, the forward P/E ratio is historically high. However, this P/E ratio has coincided with growing earnings.

With the index also up 5.9% month-to-date and a healthy outlook for the second half of the year, we could have some more room to run.

While the S&P’s RSI is still hovering around overbought levels, it’s remained stable at a HOLD level, mainly reflecting its muted moves over the last week and change.

A short-term correction could inevitably occur by the end of Q1 2021, but for now, I am sticking with the S&P as a HOLD.

For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

Disclaimer: All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be ...

more