Google Tumbles Despite Beating As Spending Skyrockets

With FANG stocks soaring all day without a specific catalyst, many investors were hoping that today's panic bid in growth stocks was to front run Alphabet's after-hours results, which many expected would be another beat, sending the stock higher.

And to those who expected a beat, they were right, because moments ago Google Alphabet reported Q4 EPS of $12.77, beating exp. of $10.82 soundly (thanks to an 11% effective tax rate, down from 138% a year ago), with revenue ex-TAC of $31.84BN also not only above the consensus forecast of $31.33BN, but also above the highest Wall Street forecast of $31.81BN.

The other Q4 core earnings highlights were all solid as well:

- paid clicks on Google properties +66%

- cost-per-click on Google properties -29%

- operating margin +21%

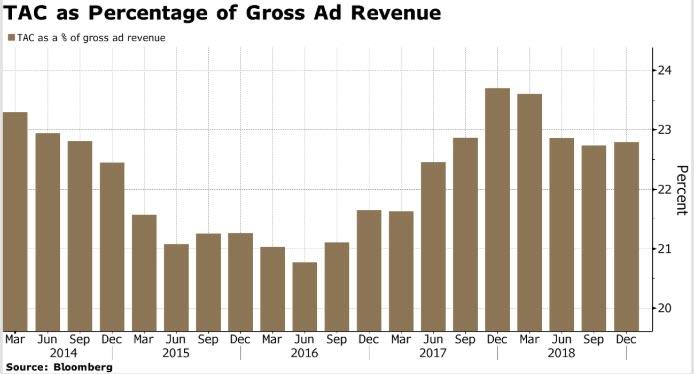

More good news: ads on Google properties were up 21% while TAC as a share of ad sales was down from last year.

(Click on image to enlarge)

So far so good, and if this was it, the shares would have maintained their kneejerk spike higher and continued today's levitation.

However, as in the case of Amazon, it was not meant to be, because after scanning the company's top and bottom-line beats, traders shifted their attention to how much money Alphabet was spending to maintain its top line growth and margins, and it was here that a problem emerged, as Google's Operating Income of $8.2BN miss expectations as costs and expenses rose faster than expected. One source of spending during the quarter was Google's hiring spree, as the company added nearly 20,000 employees over the year.

Furthermore, as Bloomberg notes, with its various new businesses including selling devices and cloud-computing, Google has become a much bigger marketer itself than prior years, as a result, sales and marketing costs went up 18% percent from last year.

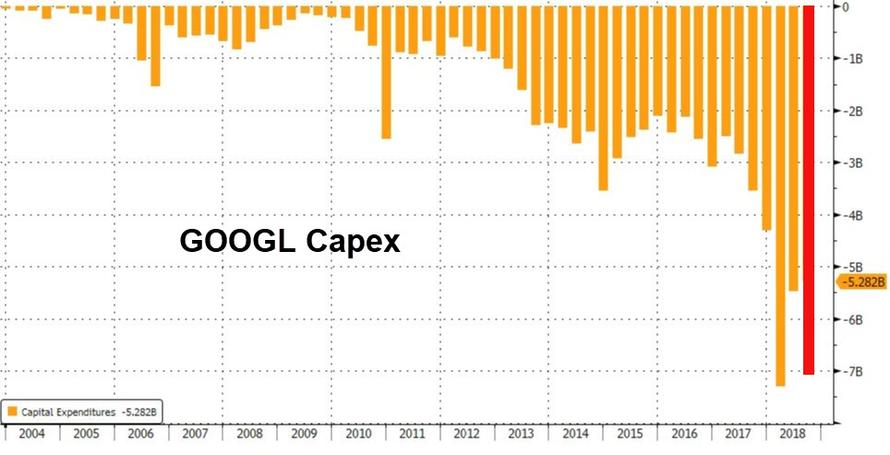

In addition to operating costs, Google's capitalized expenses also spiked as CapEx exploded 80% higher from the $3.8BN a year ago to a whopping $6.85BN, while total CapEx surged to $7.1BN, far above the $5.66BN estimate, amid a surge in spending on cloud and hardware business, and - as in the case of Amazon - concerns emerged that Alphabet will have to spend far more to maintain its profit and cash flow.

(Click on image to enlarge)

As a result of the surge in CapEx, shares tumbled as much as 3.8% in extended trading, which as Bloomberg notes, if repeated in the cash market tomorrow, it would be the biggest drop since Dec. 4.

(Click on image to enlarge)

Needless to say, the Nasdaq is not happy, with the last minute spike now fully wiped out...

(Click on image to enlarge)

... and absent some very optimistic disclosures during the earnings call, expect today's sharp Nasdaq levitation to be unwound overnight and during tomorrow's cash session.