Good Places

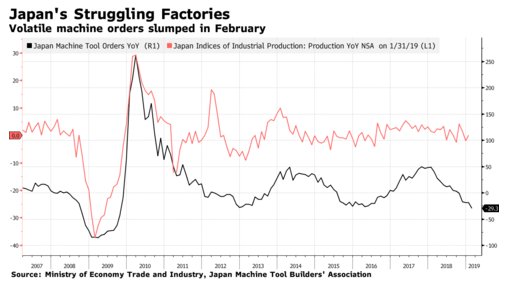

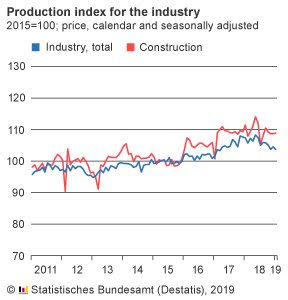

Welcome to Monday and the ides of March. Markets are in a good place – or good enough to rebound as the FOMC continues to push its wait-and-see policy. US/China talks are in a good place according to the rumor mills from Beijing/Washington even as the weekend showed less CNY loans and lower PPI/CPI. The UK appears to be in a less good place as the PM May has “run out of road,” and considers offering up her resignation in exchange for a Brexit deal with her Tory party. The tragedy of Ethiopia Air crash Sunday also leaves Boeing in a less good place with China and others grounding their 737 Max 8 plane. North Korea and the US are also in a less good place as satellite images suggest further missile test preparation and a UN security council report admits holes in the sanctions regime. The clearly not good place is Venezuela as it suffers the 4th day of blackouts with no cell phones, the government urging stay in place and food rotting in stores. Throw in the weakness in the economic data today from Japan machine tool orders – there is a growing debate about recession risks now there - and German industrial production weakness continuing and you get the picture of a world in a less good place than the US. Markets are struggling to be bearish, however, as risk aversion last week left many value opportunities and the passive money flows continue.

- FOMC Chair Powell: Outlook is good, economy doesn’t need higher or lower rates. The just right policy mix sent shares higher in Europe – even as he sees China and European slowdown risks. “Our interest-rate policy is in a very good place,” he said during a rare television interview broadcast on CBS 60 Minutes Sunday. “What’s happened in the last 90 or so days is that we’ve seen increasing evidence of the global economy slowing down. We’re going to wait and see how those conditions evolve before we make any changes to our interest-rate policy,” Powell noted.

- UK May might need to resign to get Brexit deal passed. Several cabinet members suggest she should offer this up ahead of the late Tuesday vote. “It is all quite tense. It looks like it will go right down to the wire,” said one aide to the prime minister. “It has been quite a tough week.” Another said that one “shouldn’t assume” that Mrs. May would travel to Brussels.“I don’t believe there is a single one of us who thinks it’s a good idea for her to stay beyond June,” one cabinet minister told the Sunday Times. Another said: “She’s run out of road.”

- DJIA suffers with China/Boeing issue. China orders all its airlines to ground the Boeing 737 Max 8 aircraft after Sunday’s Ethiopia Air jet crashed killing all 157 on board. This is a similar enough crash to Indonesian Lion Air jet crash in October. It is highly unusual for regulators to take such a step before a similar move by regulators in the country that certified the aircraft type. However, the Chinese move is being followed by Indonesia, Ethiopia and Cayman Airways.

- North Korea eludes UN sanctions according to security council report. North Korea has accelerated its import of oil products through ship-to-ship transfers, increased its coal exports, and sold weapons to Iran-supported Houthi rebels in Yemen, Libya, and Sudan. “These violations render the latest United Nations sanctions ineffective,” notes the report,referring to the North’s success in importing petroleum products and selling coal “Global banks and insurance companies continue to unwittingly facilitate payments and provide coverage for vessels involved in ever-larger, multi-million-dollar, illegal ship-to-ship transfers of petroleum products, as well as an increasing number of ship-to-ship coal transfers and attempted transshipments,” it adds. As sanctions enforcement has lagged, the report notes, North Korea’s nuclear and ballistic missile programs “remain intact.”

For a risk on and off perspective, today is about GBP as it continues to play on the UK Brexit stories evolving. This matters for the USD and the EUR and more importantly to the growth outlooks for the months ahead. The break back below 1.30 today opens the 1.2780 target and 1.25 fear trade next with 1.33 the key resistance.

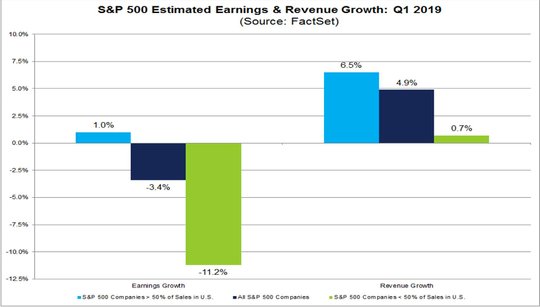

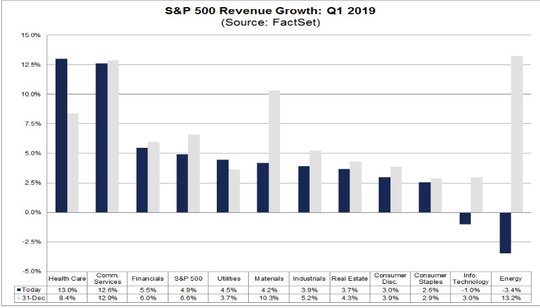

Question for the Day: Does USD strength matter to the S&P 500? Here is the list of factors detracting from the present USD bid: the USD repatriation push from tax reform is over now, the FOMC is on a wait-and-see mode, the growth outperformance of the US against the rest of the world is less certain, and US political pressures are rising against Trump. For the USD the list is shorter: with US/China trade deals seen as supportive (shrinking the US trade deficit), with US energy independence supporting and adding to the trade improvement, with US rate spreads still supportive and with US confidence holding.

The role of the USD in the S&P500 price starts with the dependence of many sectors upon foreign revenues for their earnings. The FactSet charts from their Friday report are worth noting and pondering as markets open the week with risk-on moods despite a raft of rather anti-global headlines from China, North Korea, and the UK.

What Happened?

- Japan February machine tool orders -29.3% after -18.8% - worst since 2009. This was the fifth month of weakness according to the Japan Machine Tool Builders Association. The weakness was blamed on China growth slowdown, the US trade war and EU uncertainty.

- German January trade surplus E18.5bn after E19.9bn - less than E21bn expected. The exports were 0% m/m to E108.9bn after +1.5% m/m better than the -0.5% m/m drop expected, while imports rose 1.5% m/m to E94.4bn after 0.7% m/m – more than the 0.2% m/m expected. Exports to the EU were up 0.6% y/y to E65.3bn and imports up 3.7% to E51.7bn. Outside EU trade showed exports up 3.3% to E43.5bn and imports up 6.5% to E42.7bn. The January C/A narrows to E18.3bn after E23.1bn - better than the E16.8bn expected.

- German January industrial production drops -0.8% m/m after +0.8% m/m (revised from -0.4% m/m) – still weaker than +0.5% expected. The ex-energy and construction output -1.2% m/m, with categories mixed – capital goods -2.5% m/m, intermediate -0.7% m/m while consumer goods up 1.5%, construction -0.2% and energy up 3.6% m/m.

- Spain January retail sales up 0.3% m/m, 0.8% y/y after revised -0.5% m/m, 0.6% y/y – (prel -0.6% m/m, 0.8% y/y ) – weaker than +0.4% m/m, 0.9% y/y expected. By product, ex fuel station sales were up 0.5% while fuel was -0.1%, food up 0.1%, household equipment up 1.1% m/m.

Market Recap:

Equities: The S&P 500 futures are up 0.1% after losing 0.21% Friday. Focus is on DJIA weakness due to Boeing. The Stoxx Europe 600 is up 0.3% while the MSCI Asia is up 0.5% with China leading on trade deal hopes.

- Japan Nikkei up 0.47% to 21,125.09

- Korea Kospi up 0.03% to 2,138.10

- Hong Kong Hang Seng up 0.97% to 28,503.30

- China Shanghai Composite up 1.92% to 3,026.99

- Australia ASX off 0.38% to 6,263.30

- India NSE50 up 1.20% to 11,168.05

- UK FTSE so far up 0.75% to 7,158

- German DAX so far up 0.25% to 11,487

- French CAC40 so far up 0.2% to 5,242

- Italian FTSE so far up 0.2% to 20,528

Fixed Income: Another day with weaker data, but bid stocks temper any rally – German 10Y Bund yields off 1bps to 0.07%, France up 2bps to 0.47%, UK Gilts off 2bps to 1.17% while periphery mixed Italy up 5bps to 2.56%, Spain up 1bps to 1.19%, Portugal flat at 1.36% and Greece off 1bps at 3.77%.

- US Bonds are lower with curve steeper post-Powell with eye on supply– 2Y up 2bps to 2.48%, 5Y up 2bps to 2.44%, 10Y up 3bps to 2.65%, 30Y up 3bps to 3.04%

- Japan JGBs stuck watching BOJ, equities, US/China– 2Y flat at -0.14%, 5Y flat at -0.15%, 10Y flat at -0.03%, 30Y flat at 0.59%.

- Australian bonds lower with focus on US/China– 3Y up 2bps to 1.61%, 10Y up 1bps to 2.04%.

- China stuck waiting for more data/PBOC/trade talks – PPI/CPI/M2 all point to more easing– 2Y off 2bps to 2.77%, 5Y flat at 3.02%, 10Y up 1pbs to 3.17%.

Foreign Exchange: The US dollar index 97.34 flat. In emerging markets, the USD is mostly lower – ASIA: INR up 0.15% to 69.887, KRW off 0.2% to 1135; EMEA: ZAR up 0.3% to 14.38, RUB up 0.3% to 66.07, TRY off 0.2% to 5.437.

- EUR: 1.1250 flat. Range 1.1223-1.1258 with focus on 1.1180 and 1.13 as key levels watching US data/equity flows.

- JPY: 111.20 up 0.1%.Range 110.88-111.31 with EUR/JPY 125.05 up 0.15%. BOJ this week and 110-112 intact all about risk mood.

- GBP: 1.3000 off 0.1%.Range 1.2960-1.3018 with EUR/GBP .8650 up 0.2% - still all about Brexit with 1.2950-1.3150 on the tight for focus.

- AUD: .7045 flat. Range .7027-.7052 with NZD .6805 flat. Focus is on commodities – copper down, politics, US/China with .6880-.7120 keys.

- CAD: 1.3420 flat. Range 1.3406-1.3435 with focus on economy, politics, and oil – watching 1.3380 for 1.35 again.

- CHF: 1.0090 up 0.15%.Range 1.0070-1.0093 with EUR/CHF 1.1345 up 0.15%. All about equities and risk-on mood with 1.0080 pivot for 1.00 or 1.02.

- CNY: 6.7230 flat. Range 6.7170-6.7260. Focus is on US/China trade deal still with 6.70-6.77 key. PBOC fixed 6.7202 from 6.7235.

Commodities: Oil up, Gold off, Copper off 2.1% to $2.9070.

- Oil: $56.48 up 0.7%.Range $55.96-$56.79. Focus is on equity bid, Venezuela, OPEC with $55.50-$57.00 WTI on the tight. Brent up 0.7% to $66.22.

- Gold: $1296.10 off 0.25%.Range $1295-$1299.20 with focus on USD, risk-mood in equities and $1282 base. Silver off 0.1% to $15.33, Platinum off 0.3% to $815.20 and Palladium up 1.1% to $1475.

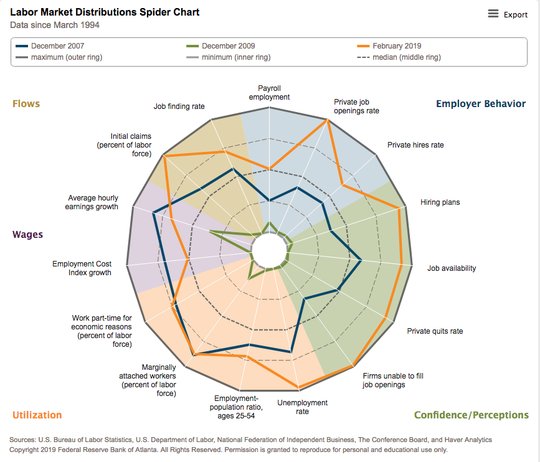

Conclusions: Did the US jobs report matter to markets? There was a lot of confusion about the US non-farm payrolls missing, the average hourly wages beating and the participation rate rising. The net analysis of the US jobs report was more hawkish than dovish for the Fed. Some of this worry reversed with FOMC Powell comments on CBS Sunday but the full thrust of future policy revolves around how the US economy handles the rest of the world’s troubles. The US labor market appears to be strong enough to counterbalance China and European economic woes. Whether this matters going forward rests on the data – with weekly claims likely a key focus going forward. The best analysis of where the US jobs market is now and where to watch the multiple components is from the Atlanta Fed. See their chart below.

Economic Calendar:

- 0830 am US Jan retail sales (m/m) -1.2%p 0%e (y/y) 2.3%p 1.9%e / ex autos -1.89%p 0.3%e

- 0900 am BOE Haskel speech

- 1100 am US Feb consumer inflation expectations (NYFed) 2.97%p 3%e

- 1130 am US Treasury sells 3M and 6M bills

- 0100 pm US Treasury sells 3Y notes

- 0700 pm FOMC Chair Powell speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.