"Good News Will Soon Be Bad News": Why BofA Is Turning Bearish In Q3

It just won't end: nearly four months after the Christmas Eve massacre which saw the S&P briefly dip into a bear market, and resulted in Mnuchin's famous call to the Plunge Protection Team and Fed Chair Powell putting the Fed's rate hikes on hold, sending stocks soaring back to all time high, professional investors just refuse to buy it... literally.

While so many analysts - including Marko Kolanovic and Charlie McElligott - have bet that it is only a matter of time before institutional and retail investors capitulate and allocate cash to the stock market, this has yet to occur, and according to EPFR the latest week saw another $1.1 billion in stock outflows ($7.9bn ETF inflows, $9.0bn mutual fund outflows), coupled with $8 billion in bond inflows.

Indeed, the three core trends that we have discussed since the start of the year remains largely intact, and include:

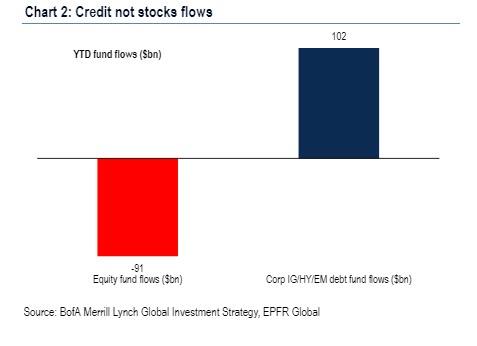

Trend 1.... credit not stocks:

Sixth consecutive week of broad inflows to IG, HY & EM debt funds; $102bn credit inflows YTD, a stark contrast with $91bn redemptions from stocks.

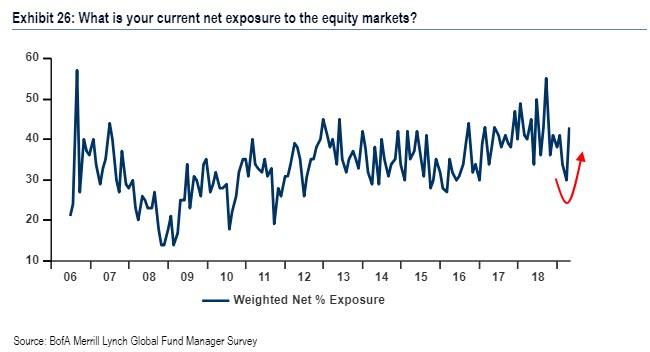

Meanwhile, with Q1 earnings season about to peak in the coming weak, hedge funds simply have no confidence in continued market upside as one can see by their net beta exposure, which as the DB chart below shows is "near YTD lows with the market near record highs" even as Gross Leverage is near 12M highs.

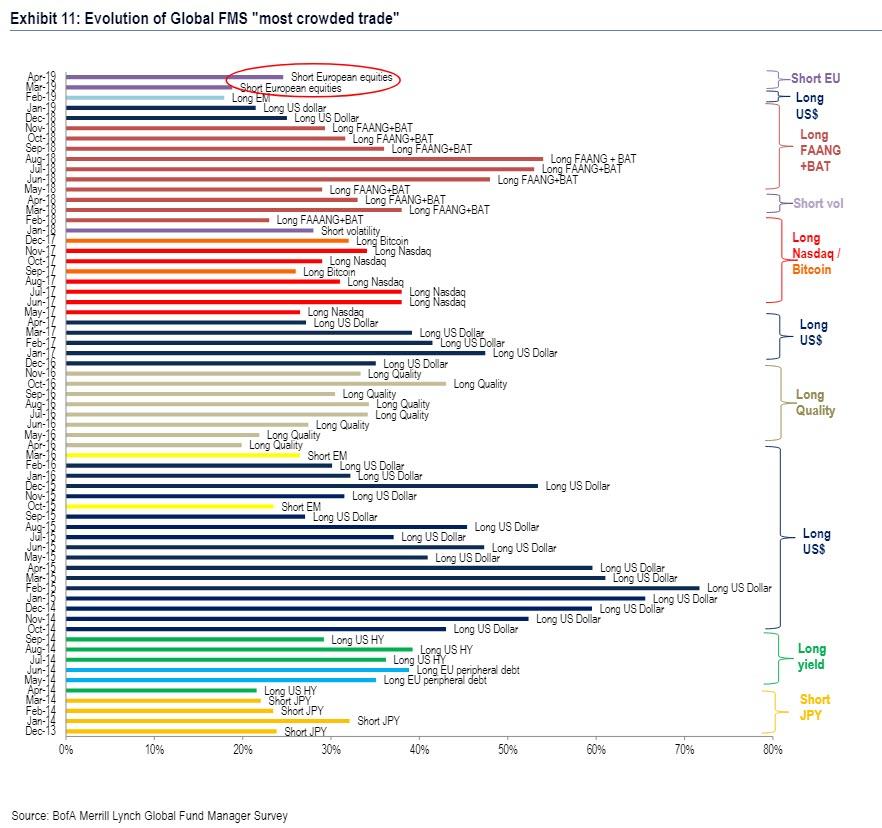

Trend 2…no thank EU

While the US saw modest inflows of $1.9BN in the last week, the outflows from European equities continue and after another $2.5 billion this week, we have seen a total of $138BN redemptions from EU (a whopping 10% of AUM) since March 18; In fact, as we noted last week, for the second month in a row, the BofA fund manager survey showed "short Eurozone stocks" as most crowded trade.

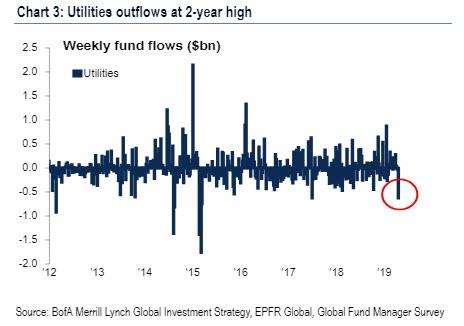

Trend 3…interest rate expectations have troughed

At least according to rate-sensitive equities, as we just witnessed the biggest inflows to financial sector funds in 8-months ($0.9bn) in contrast with biggest outflows from utilities in 2-years ($0.6bn).

Yet while there is no clear "panic" scramble by either institutional or retail investors into stocks to validate what Larry Fink last week said would confirm the blow-off top moment in the market, similar to what took place in January 2018, BofA has spotted five "greed shoots", which suggest trends that signal "unambiguous bullish positioning."

Greedy $102bn inflows to credit YTD

…a "floor" in spreads & volatility will be 1st sign financial conditions have stopped easing.

Greedy hedge fund leverage

BofAML April FMS showed biggest jump in net equity exposure since Jun'18.

Greedy technicals

BofAML Global Breadth Rule now at 14-month high of 64% (i.e. 64% of MSCI country equity indices are above 50 & 200dma)…tactical sell signaled when rule hits 88% (as stated last week LQD >$122, SOX >1650 would signal most overbought conditions in credit & tech since 2010).

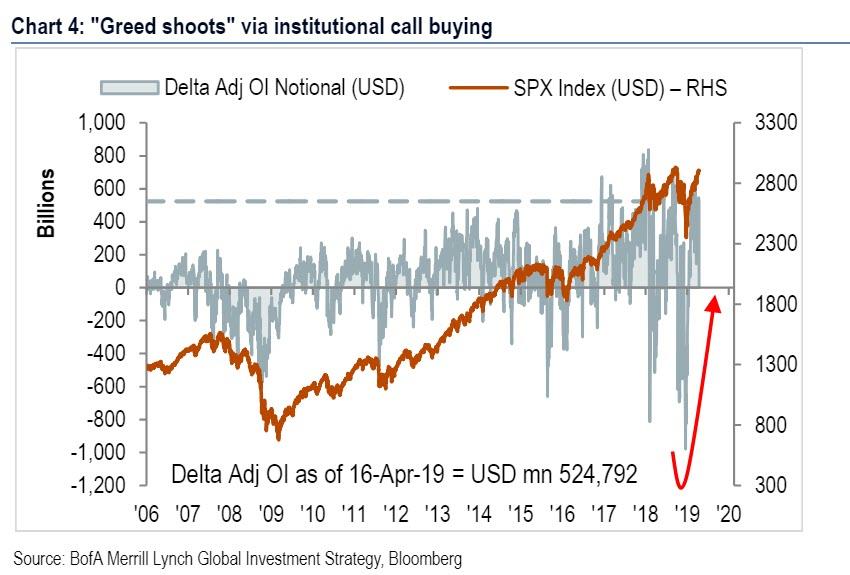

Greedy institutional call buying…US equity index delta adjusted open interest now $524 billion

My comparison was $837 billion at January 18 highs and was a negative $980 billion at December 18 lows.

Greedy rotation

A furious US healthcare sell-off also reflects inflow-starved institutions funding rotation to cyclicals via selling of defensives. A sell-off in US REITs & staples and European utilities & staples would signal a bullish rotation is complete (as would jump in bond yields, e.g. Aussie 10-year >2%, German 30-year >1%).

So with all the indicators that another blow off top may be forming, just as Larry Fink predicted last week, what does that mean for tactical exposure? To BofA, the message is simple: the bank remains bullish (for now), with its favorite Q2 longs are commodity currencies & bank stocks, as the bank now expects continued rotation from credit to equity and commodities prior to formation of a big summer top in risk assets, when it will await greedy Positioning, end of Policy stimulus, and higher Profit expectations before turning bearish in Q3.

Or, as BofA's Chief Equity Strategist Michael Hartnett puts it, "in Q1 "bad news was good news", in Q2 "good news is good news", in Q3 "good news will be bad news"."