Goldman’s Hedge Fund VIP List And More: 50 Stocks That Matter Most

Goldman Sachs publishes a quarterly report based on 13F filings. This is a comprehensive report that takes time to prepare. The data team at Insider Monkey finished processing 13F filings and we had some time on our hands. So, we decided not to wait for Goldman Sachs to publish its report. After all, its methodology is pretty straightforward. Goldman’s hedge fund VIP List “contains the 50 stocks that appear most frequently among the top 10 holdings of fundamentally-driven hedge fund portfolios.” Insider Monkey is probably more selective in its hedge fund list but it is very likely that at least 90% of the hedge funds are in the same list. Identifying the top 10 holdings of a hedge fund is a no-brainer. We considered only top 10 stock holdings of each hedge fund and excluded options or convertible notes positions.

We also noticed that focusing on the top 10 positions of a hedge fund is quite arbitrary. Does a hedge fund really have 10 great ideas every quarter? Our experience shows that a good hedge fund can come up with 2-3 good ideas every year. So, we decided to compile other VIP Stock Lists that are based on each hedge fund’s top 5, top 3, top 2, and top holdings. If the same names consistently come up in our list, then we can eliminate the arbitrariness of the “top 10″ positions.

We didn’t have time to conduct back tests on these VIP Lists. Goldman claims that its VIP list managed to outperform the market by about 3 percentage points per year between 2001 and 2010. We think this number could be improved by restricting the list to the top 2-3 positions of hedge funds.

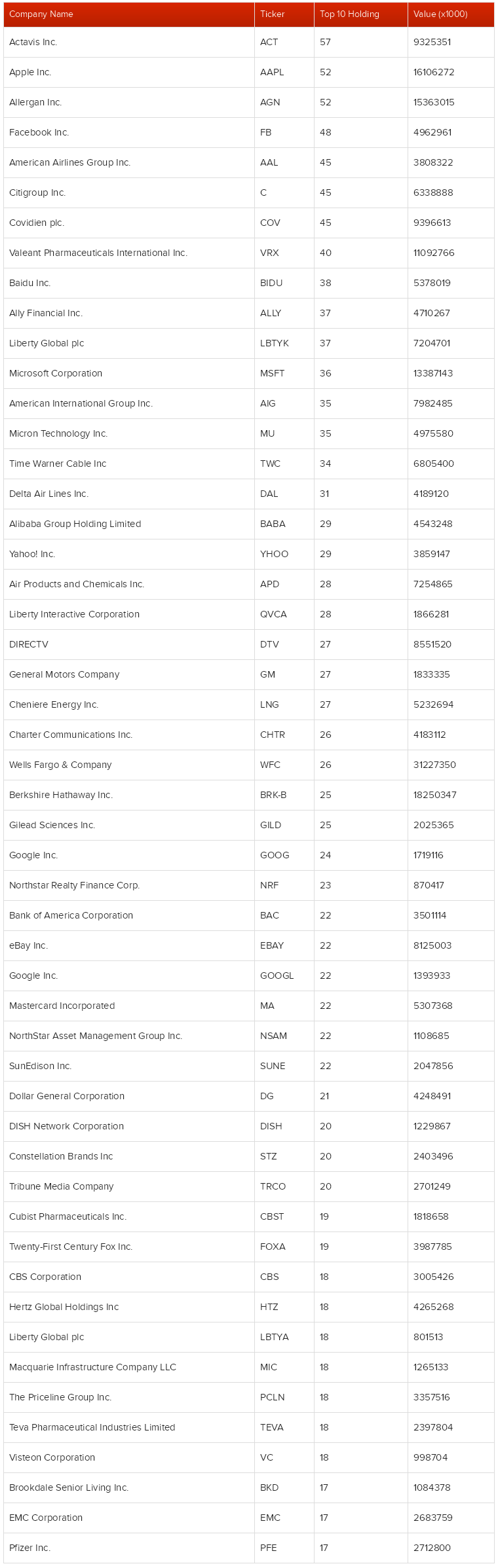

This article has 5 tables. The first table is an approximation for Goldman’s VIP List. Actavis plc (NYSE:ACT), Apple Inc. (NASDAQ:AAPL), and Allergan, Inc. (NYSE:AGN) are the top three stocks. We also compiled the list of 10 most popular stocks among hedge funds, but Allergan wasn’t in the top 3 in that list. Goldman’s VIP List is more similar to our billionaires’ top stocks list. Facebook ranks number 4 in Goldman’s list whereas it wasn’t among the top 10 in the billionaires’ list. This indicates that we get a slightly different list every time we use a slightly different criteria. One interesting stock that showed up in Goldman’s list is Covidien plc (NYSE:COV). It isn’t one of the top 30 stocks among all hedge funds (no restrictions), yet it shows up in this list. This means hedge funds are more likely to place a large bet on Covidien than a small one.

The list doesn’t change much when we restrict our list to only the top 5 stock positions in each hedge fund’s 13F portfolio. Here is the list:

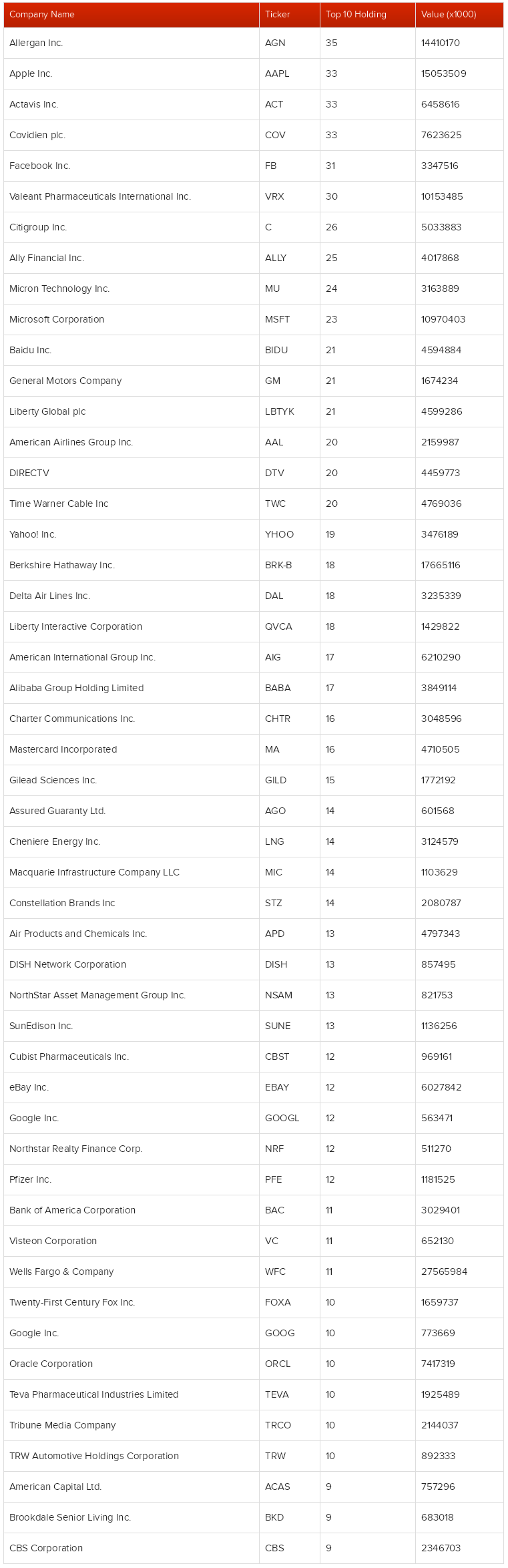

When we get more restrictive, things got a little bit more interesting. Covidien climbed to the fourth spot and Alibaba Group Holding Ltd (NYSE:BABA) also got more popular. Interestingly, both Allergan and Apple are still number 1 and number 2. Here is the top 50 stocks that are among the top 3 stock positions in hedge funds’ portfolio:

In the following table we restricted our list to the top 2 stock ideas of hedge funds. We think this list makes more sense because these stocks are more likely to be the best ideas of hedge funds. Other than the obvious merger arbitrage related plays, three stocks attracted our attention in this list. First, Apple is the most popular stock. Twenty-two hedge funds have Apple as their #1 or #2 position. That’s a huge vote of confidence. The other stock is Yahoo! Inc. (NASDAQ:YHOO), which is now one of the top 10 stocks. Yahoo also ranks higher than Alibaba. We don’t have any positions in either stock but we believe buying Yahoo is better than investing directly in BABA. Here is the list:

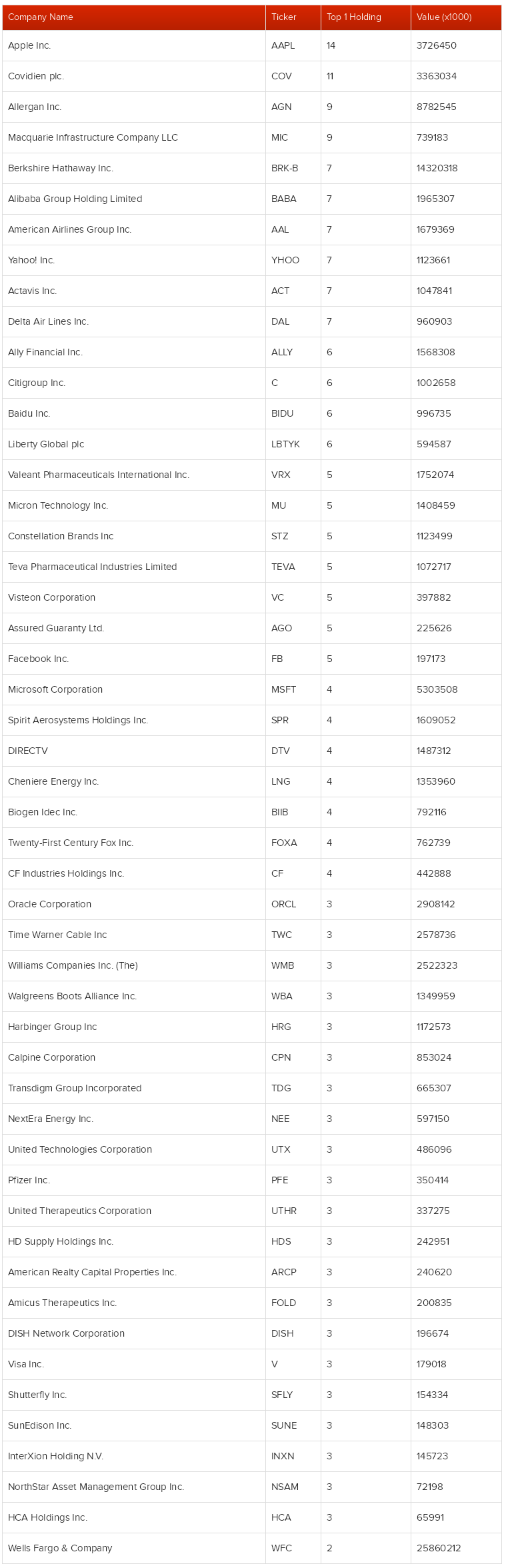

Here is the final table. These are the most popular #1 stock picks of nearly 750 equity hedge funds. You probably guessed it right, Apple is the most popular #1 stock pick among hedge funds. Another interesting stock among the top 5 is Warren Buffett’s Berkshire Hathaway Inc. (NYSE:BRK-B). Let’s take this opportunity and tell you why it isn’t a great idea to buy BRK-B if your goal is to tap into Buffett’s investing wisdom. We usually don’t recommend investing in hedge funds because of their high fees. Our research has shown that investors were able to beat the market by an average of 18 percentage points per year by investing in their top 15 small-cap ideas (read the details).

Warren Buffett doesn’t charge his investors huge fees. His salary is actually microscopic in comparison to what he has done for his investors. The problem with investing in Berkshire is that it hoards a ton of cash and this affects its returns. Last year, the New York Times ran an article bashing Buffett. We explain in this article why the New York Times was wrong about Buffett. In a nutshell, Buffett’s top stock picks actually perform much better than index funds even when you buy them two weeks after the 13F filings. By buying Buffett’s entire 13F portfolio investors could have outperformed the market by 6 percentage points per year between 1999 and 2009.

We haven’t done any back tests based on the following list. Theoretically it should yield much better returns than Goldman’s original 50 VIP Stocks list. For the time being you can use it as a source of ideas for further research. Here is our list:

Disclosure: None