Goldman Slashes 2021, 2022 GDP Forecasts Again, Blames Fiscal Drag, Slowing Consumer Spending

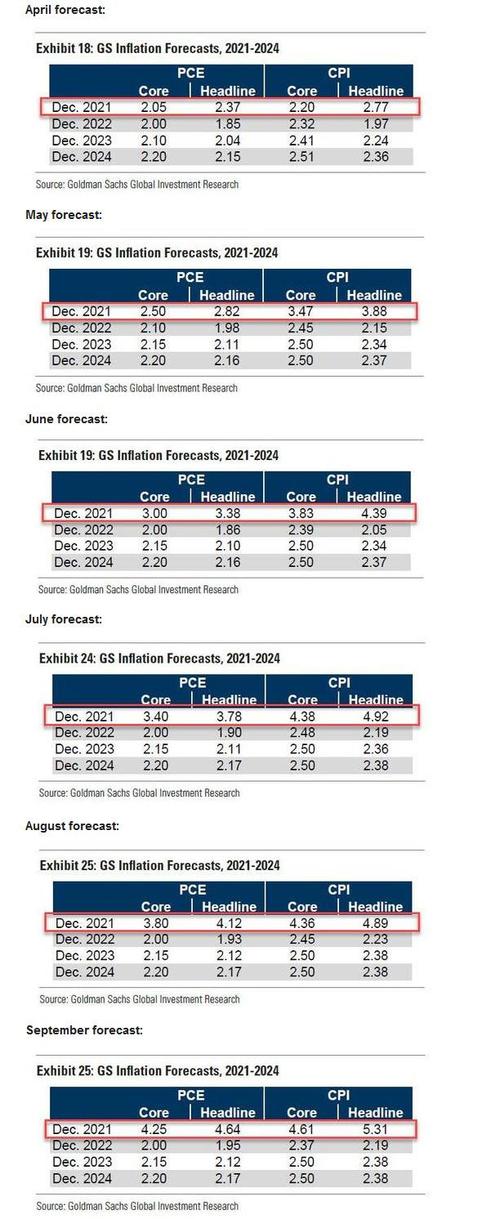

Last week, we showed that in its latest Monthly Inflation Monitor, Goldman Sachs had once again hiked its 2021 year-end inflation forecast. The bank is now expecting core PCE of 4.25%, up from 3.80% the previous month, and a headline print of 4.64% (up from 4.12%).

This is a result of what Goldman called "temporary" shortages, snarled supply chains, surging energy prices, and a relentless demand for goods over services. One may expect another hike at the start of October, which will likely push Goldman's headline PCE above 5.0%

To be sure, this wasn't the first time Goldman had aggressively hiked its inflation outlook: as we also showed, the bank had consistently underestimated the persistent impact of non-transitory inflation every month since April, when it launched a monthly increase of its inflation forecast to the tune of about 0.40% per month.

(Click on image to enlarge)

While this would be normal if overall economic growth was also rising, just the opposite is happening. A little over a month ago, Goldman surprised Wall Street when it slashed its Q3 GDP forecast to just 5.5% from 8.5%, and from 9.5% just days before that, a move the bank's chief economist Jan Hatzius said reflected "hits to both consumer spending and production."

Then last weekend, confirming the stagflationary direction of the US economy, Goldman once again cut its Q3 and Q4 GDP forecasts again, from 5.5% to 4.5% and from 6.5% to 5.0%, respectively. Incidentally, the latest Atlanta Fed GDPNow tracker for Q3 GDP has US growth collapsing to just 1.3%, not just far below the consensus Wall Street GDP estimate of 5%, but below the lowest economist forecast of just below 3.0%

Incidentally, last weekend we also predicted that as Goldman keeps hiking its inflation targets, it will similarly keep slashing its GDP forecast, and we were proven right when Goldman economist Joseph Briggs once again cut the bank's GDP forecast. Only this time it was not just for the current quarter, which as of the time of writing is just 3.25% from last week's 4.0%, but for future quarters. It appears as:

-

Q4 2021 to 4.5% vs. 5.0% previously.

The bank also cut its GDP forecast for the first three quarters of 2022, as the "temporary" hit to growth appears to be far more persistent without an offsetting boost to GDP:

- Q1 2022 to 4.5 vs 5.0% previously.

- Q2 2022 to 4% vs 4.5% previously.

- Q3 2022 to 3% vs 3.5% previously.

- Q4 2022 to 1.75% vs. 1.5% previously (the only forecast that was hiked).

Goldman calculates that changes imply a downgrade to 2021 GDP growth to 5.6% on an annual basis, and a downgrade in 2022 growth to 4.0% on an annual basis. Since Goldman is believing some boost of growth will emerge eventually, Briggs notes that "these changes are mostly offset by upgrades to our growth forecast in 2023 and 2024, however."

Some more details:

"We are currently tracking 2021 Q3 GDP growth at 3.25%, although inventories and foreign trade remain important sources of uncertainty... we have cut our growth forecast for 2021 Q4 to 4.5% (vs. 5.0% previously) and revised our growth forecast for 2022 Q1-Q4 to 4.5%/4%/3%/1.75% (vs. 5.0%/4.5%/3.5%/1.5%).

"These changes imply a downgrade in 2021 GDP growth to 5.6% on an annual basis (vs. 5.7%) and 5.2% on a Q4/Q4 basis (vs. 5.3%) and a downgrade in 2022 growth to 4.0% on an annual basis (vs. 4.4%) and 3.3% on a Q4/Q4 basis (vs. 3.6%).

"These changes are mostly offset by upgrades to our growth forecast in 2023 and 2024, however."

What's behind the latest downgrade? Well, in addition to the continued lack of consumers' service spending, Goldman is now pointing to the sharp drop in fiscal support as the tailwind from COVID-19 stimulus ends. As Briggs explains, he sees two main challenges to medium-term growth.

"First, fiscal support is set to step down significantly through the end of the year. Although we maintain a positive outlook for household income because a recovering labor market and firm wage growth—particularly among low-wage workers—should keep income above its pre-pandemic trend through end-2022, the decline in transfer income will likely cause a pullback in spending for some households.

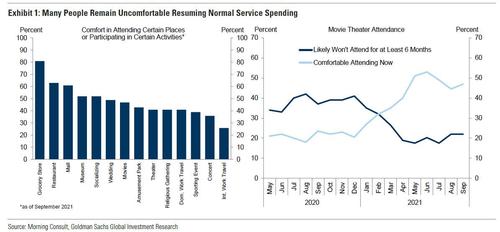

"Second, consumers’ service spending will need to recover quickly to offset a decline in goods spending as the latter normalizes from its current elevated level. This will likely prove challenging while COVID-19 cases remain elevated, since many people still feel at least somewhat uncomfortable engaging in many activities that were routine prior to the pandemic (left chart, Exhibit 1). Furthermore, for activities like going to a movie theater, many individuals don’t anticipate resuming normal spending patterns for at least another 6 months, suggesting a full normalization in economic activity may take some time (right chart, Exhibit 1)."

Echoing its previous concerns about the lack of consumer spending on service, Goldman notes that "in addition to the near-term virus drag, we also expect that spending on some services and non-durables will remain persistently below its pre-pandemic trend, particularly if a shift to remote work results in some workers spending less overall."

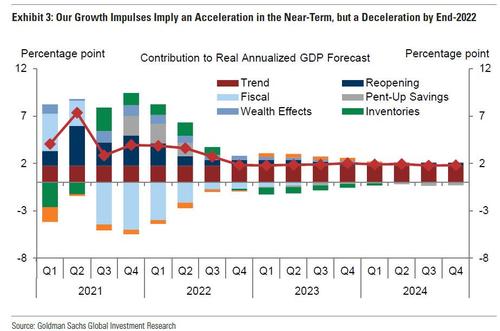

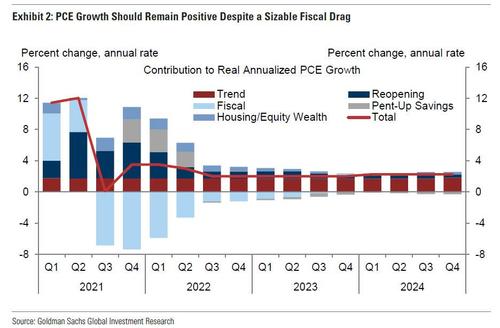

Next, the bank decomposes its consumption forecast across the various growth impulses— reopening, fiscal stimulus, pent-up savings, and wealth effects—that drive its outlook and trend growth. The bank continues to expect that the fiscal impulse will remain very negative for the next several quarters as the spending contribution from pandemic-related fiscal transfer fades, but that other impulses will more than offset this drag.

A novel twist is also Goldman's admission that inventory restocking will not come as it had previously expected, and the bank's model now assumes that semiconductor supply will not improve until 2022 H1 "and inventory restocking will therefore be delayed. These estimates imply a moderate acceleration in growth in the near-term, but a deceleration back to near trend by end-2022."

And while it remains to be seen just how positive the impact from re-openings will be, one area where we disagree with Goldman is the bank's generous modeling of an upside boost to growth from "pent-up savings," which the bank expects to offset a substantial portion of the fiscal hit. As we will show in a future post, the excess savings - in as much as they still exist - mostly benefit the top 1%, with the bulk of the population benefiting from only 30% of the total accumulated amount.

As such, the contribution to consumption from excess savings will end up being far smaller than most Wall Street strategists predict (since the propensity of the top 1% to spend their savings is far less than the broader population).

The result: expect even more aggressive cuts to GDP growth in coming quarters - from both Goldman and its peers - even as inflation continues to rise, cementing a painful period of non-transitory stagflation for the US.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more