Gold: Will Stimulus Reach 10% Of GDP Under Biden?

Fundamentals

We believe that gold is going to go much higher. It should adjust to the relative volatility of Bitcoin, stocks and crude oil. The commodity markets are starting to explode. We have yet to see how fast commodity prices are going to affect the mainstream economy. Soybeans are trading at around $14 from a low of $8 a bushel just a few months ago. Those prices are yet to be reflected in retail prices. Government statistics do not include energy and food, which are considered short-term anomalies. However, these prices are not short-term anomalies. They are intermediate- to longer-term problems. The lockdown globally and locally has destroyed the supply chain. We are using current inventory and, when those supplies are used up, then prices will rise rapidly. Real estate, which uses lumber and various metals and basic commodities, has seen an explosion in prices. Inventory is very low. So there's an anomaly between where prices are and the rising cost of the inputs. The US dollar continues to lose value as more stimulus is added to the economy, which leads to inflation. In the supermarket, products are being sold in smaller amounts for the same price, which is helping to hide inflation.

Image Source: Pixabay

We could be reaching 10 percent of GDP just on stimulus, which is $23 trillion or more. These are staggering numbers. We have to support main street and get the economy going, but that stimulus will lead to inflation. Now we have vaccine issues in terms of who gets it, distribution and availability. Politically, we appear to be moving into extremes to the right and left as the economic system collapses - although the new President Biden may achieve some stability and unity.

The key positive factor for the US is that the dollar is the world's reserve currency, so we can print as much currency as we want. Others cannot do that. The percentage of reserves held in the US dollar has been in decline for decades, but it's still the world's major reserve currency. This system has benefited a handful of billionaires, but has hurt Main Street, the middle class and the poor. We have the largest wealth disparities in US history, and based on history, it cannot last. Change is coming. The pandemic took the veil off what was already a failed or weak system that was full of debt. Central bankers today do not have any room to manipulate interest rates anymore. With global record debt, they cannot raise interest rates. With a global lockdown, which has closed almost every sector of the economy, they cannot raise rates. Now trillions of dollars in spending is talked as if it is almost nothing. The key is to look for ways to protect yourself. Gold and precious metals can be critical to retaining your lifestyle and supporting your family. Gold and precious metals have been valued for centuries.

Fundamentally, gold and silver appear to be poised for a major move up as a risk and safe-haven asset. Technically, both also appear ready for major moves up. All major surprises are going to be on the long side.

In March 2020, when gold collapsed to $1451, gold became a currency and the US dollar became a commodity. After making the high of $2089 in gold, it then fell down to $1767 and we are now at the beginning of what appears to be the second leg. As we move into the end of the month, if this price holds, it may be the seasonal low. We are looking from this low to a rally to at least $2000.

Gold

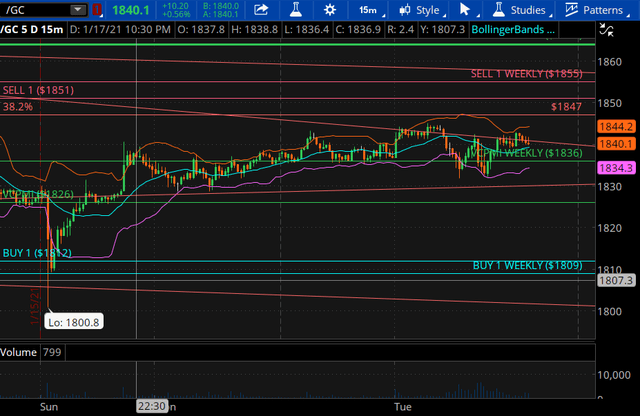

It's becoming clear that around $1800 is the bottom of the gold market and is highly likely to revert back up. We are using this correction to add to our long positions. The gold market is trading last at $1834.30, up about $4.30. We made a low of $1800 last night. We use the Variable Changing Price Momentum Indicator (VC PMI) to analyze the market.

The VC PMI daily numbers show that $1812 was the Buy 1 level and Buy 2 was $1786 as of Friday. The market on Sunday night came down to $1800, and it came right into this area of support of supply. It then reverted quickly and closed above the weekly Buy 1 of $1809 and the daily Buy 1 level of $1812. It activated a strong signal with the targets of the daily and weekly averages of $1826 and $1836. The market then met those targets. The VC PMI then went neutral at $1836.

The market is reverting from what appears to be an area of demand. Gold is trading above the daily and weekly averages. The pattern is unfolding from a bearish to neutral to bullish pattern. Trading above the daily average of $1826 puts the target of $1851 into play for the day, unless it closes below $1826. If you want to go long, these levels are excellent areas to enter the market from. You want to wait for the market to come down below the mean to buy or well above the mean to sell. The weekly with a target of $1855 is also coming into play. The daily and weekly signals have now been activated.

Silver

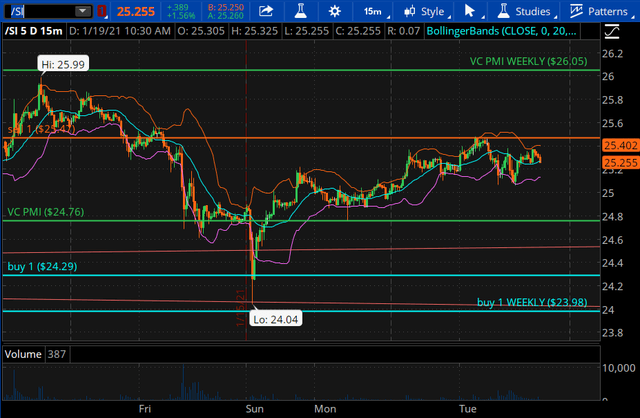

Silver has also completed a pattern of the daily Sell 1 target from the extreme below the mean of the Buy 1 level of $24.29 to $25.47. That was a nice trading range on the GLOBEX. Now we are at the upper end of the range. Supply is starting to come in. Silver has gained about 35 cents. It is lagging the gold. We expect silver to have incredible volatility compared to gold.

Gold and silver, given their incredible volatility, offer tremendous opportunity for traders. If you can tolerate and manage the risk, such as by using the VC PMI, you can trade these markets with great effect.

Disclosure: I am/we are long GDX.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on more