Gold Uptrend Offers Similar Wave-4 Pullbacks On Two Time-Frames

Gold (XAU/USD) made a strong bullish bounce at the 38.2% Fibonacci retracement level. This is probably a wave 4 pullback, which means that more uptrend is still expected.

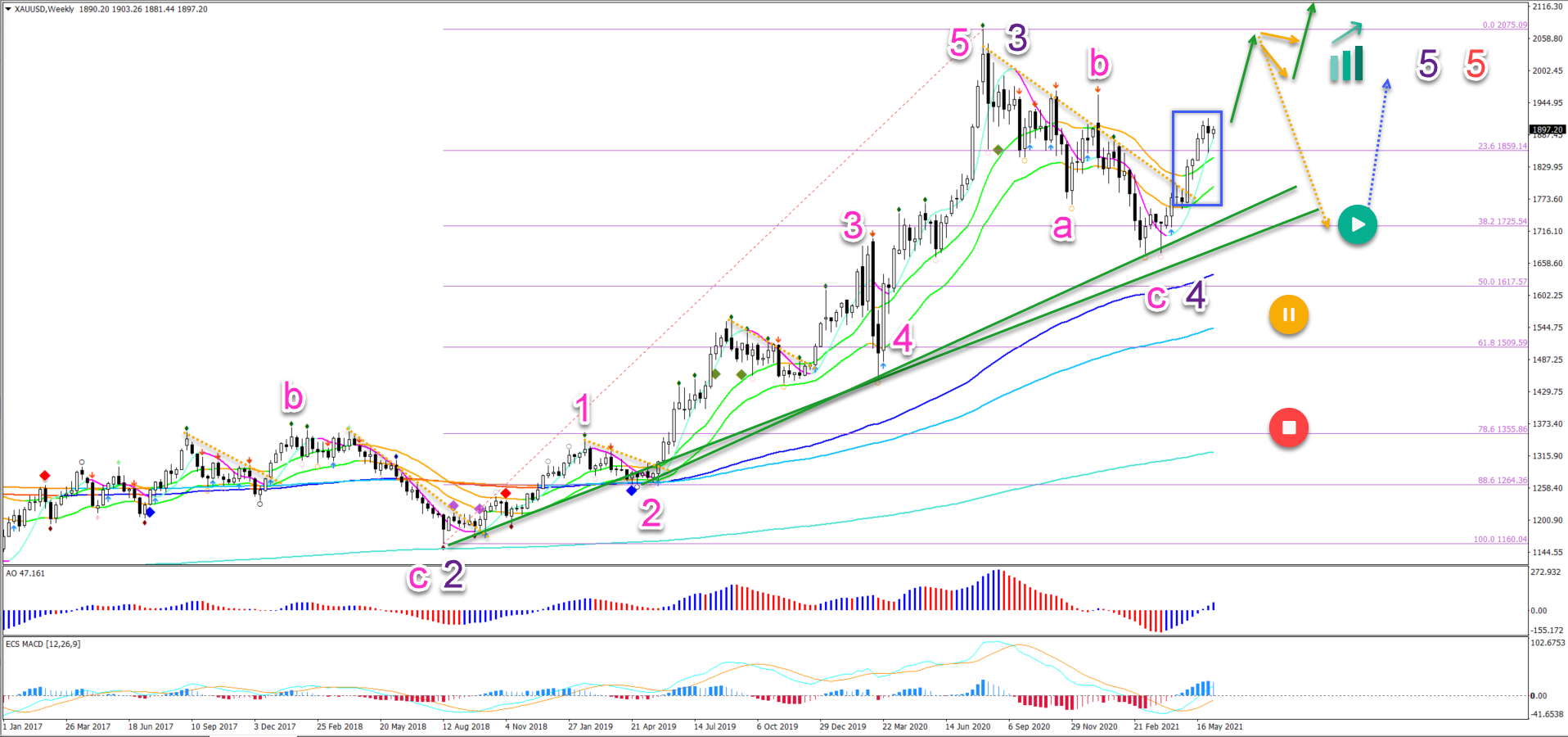

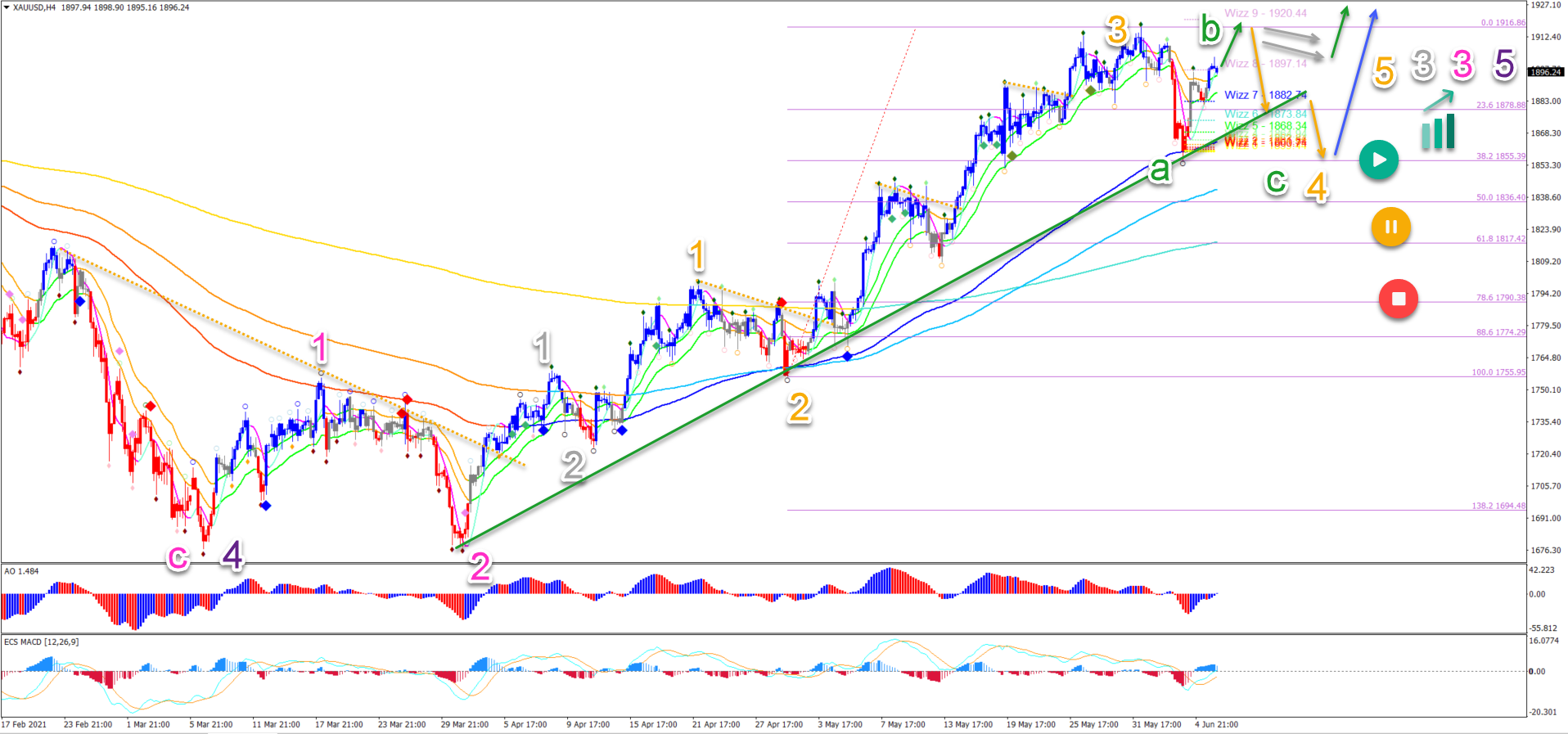

This article reviews the Elliott Wave patterns and Fibonacci levels on the XAU/USD weekly and 4 hour charts.

Price Charts and Technical Analysis

(Click on image to enlarge)

The XAU/USD seems to have completed a strong bullish impulse, which has been labelled a wave 3 (purple). An ABC pattern (pink) took price back to the 38.2% Fibonacci level, which acted as a support zone. Price action broke above the 21 ema zone and resistance trend line (dotted orange) as well. Let’s analyse what to expect next:

- The bullish impulse and breakout (blue box) above the 21 ema zone is strong. A retest of the previous top is likely (first green arrow).

- A sideways bull flag pattern (orange arrows) could indicate that the uptrend is dominant (second green arrow).

- A strong bearish bounce (dotted orange arrow) indicates that the wave 4 (purple) pullback will expand into a larger and more complex ABC pattern.

- The previous bottom should still act as support (dotted blue arrow).

- The main targets are the -27.2% and -61.8% Fibonacci levels at $2319 and 2634. Round levels like $2250 and $ 2500 are also targets.

- A break below the 50% Fib places this Elliott Wave outlook on hold (orange circle) and a deep retracement invalidates it (red circle).

On the 4 hour chart, price action seems to be developing a strong bullish impulse. This is probably a wave 3 (grey) of a wave 3 (pink):

- The pullback respected the 38.2% Fibonacci as well, which is probably a wave 4 (orange).

- A bearish ABC (green) pattern is expected to develop within wave 4 (orange).

- A bullish bounce is expected at support (blue arrows).

- A bull flag pattern (grey arrows) could indicate an immediate uptrend (green arrow).

- A break below the 50% Fib places this Elliott Wave outlook on hold (orange circle) and a deep retracement invalidates it (red circle).

- The main targets are the Fibonacci targets at $1960, $2016, $2078, $ 2179, and $2234 for the wave 3 (grey).

(Click on image to enlarge)

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more