Gold: Short Squeeze?

Fundamentals

Today we have a couple of economic indicators that came out. We appear to be looking at an inflation rate that is a little higher than expected. Investing.com reported that retail sales fell in May, while producer prices rose.

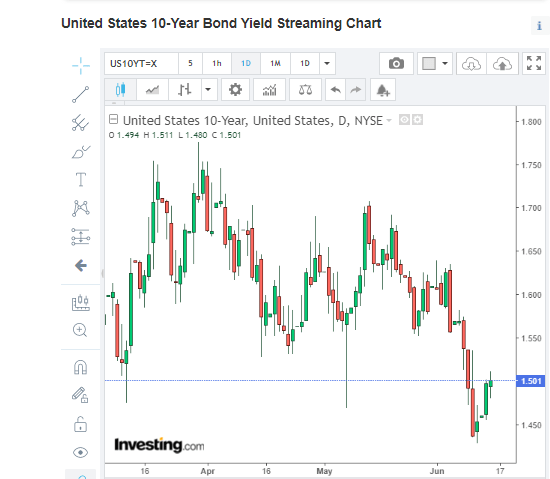

Image Source: Pixabay

The CPI came in at 6.6% which was higher than expected. The 10-Year Note is not reacting at all. It is still at 1.501. We have come up slightly from the 1.43 low a few days ago, but no dramatic change in interest rates. The price of copper just fell off the table. It is down to 4.3520 in a major, major sell-off today. This does not appear to be related to any news of inflation running wild. Even the equity markets today are fairly quiet.

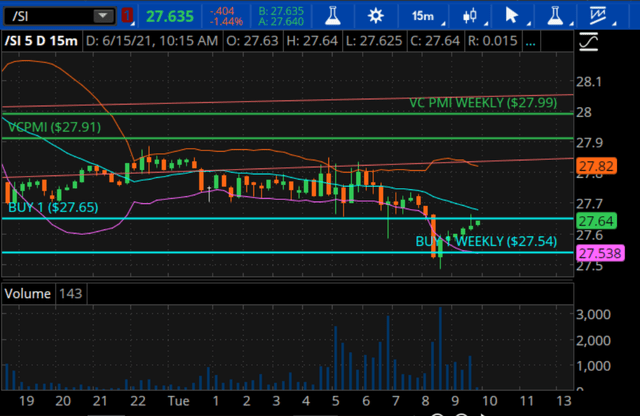

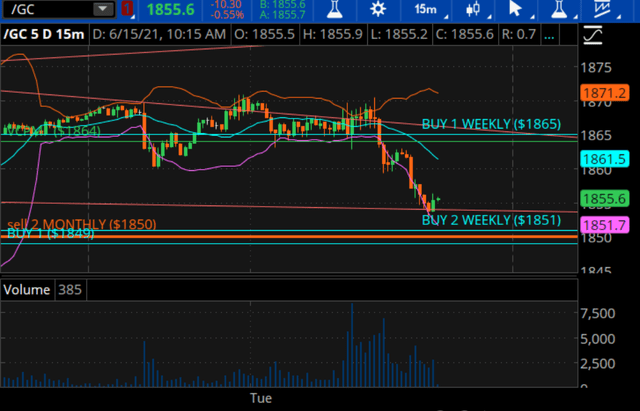

Courtesy: TDAmeritrade

Silver and gold have been all over the place this morning. Silver activated a Buy trigger from the Buy 1 level at $27.65 early this morning. It is in a buy mode. Gold is trading around the average of $1864. The Sell 1 level is $1883 and the Sell 2 level is $1898. The Buy 1 level is $1849 and the Buy 2 level is $1830. The market trading above the average price of $1864 means that it is in bullish price momentum, indicating the VC PMI target of $1883.

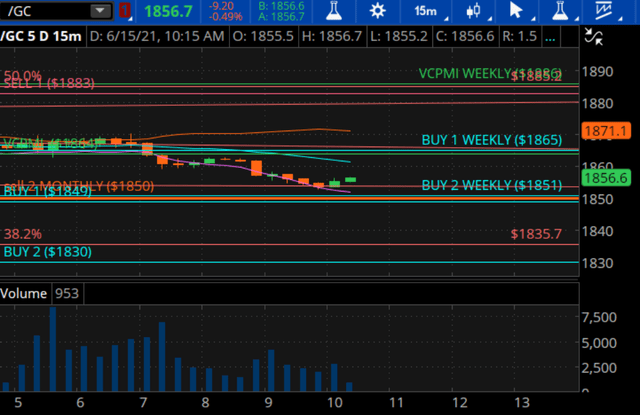

Courtesy: TDAmeritrade

The economic news did not seem to cause much of a reaction in the markets. So far, we have a pretty stable market. We appear to be looking at a buy the rumor, sell the fact. We have been expecting a surge in inflation, due to supply change issues and labor shortages, so the news today didn’t surprise anyone. It is still unclear what the Fed will do about interest rates. The sentiment appears to be that the Fed will raise interest rates. However, it seems that the Fed cannot allow interest rates to rise or get out of hand. The debt to GDP ratio is around 300%, so any increase in interest rates is going to be devastating. Globally, debt levels are no better than for the US, so we are facing a staggering amount of debt. The Fed must keep interest rates low. The Fed is supplying dollars in massive amounts to avoid a credit squeeze as happened in 2008. The amount of repos per month is around $120 billion, so we are looking at a pretty bleak picture for the US dollar.

Gold and silver are still down, however. It is a perfect example of buy the rumor, sell the fact. The bus in the gold market is overcrowded. Every article on the Internet is about this short squeeze mentality and that the US dollar is weakening and doomed. They all scream that gold and silver will rocket up. Even so, gold and silver are down. The market is telling us that the recent rally was in anticipation of all of this inflation news. Now the markets are taking a breather since the news is now out.

The Fed is going to comment on interest rates tomorrow. We believe that they are not going to do anything. They said they are going to allow inflation to run its course. They do not believe that this inflation is long-term. The 10-year note appears to be confirming that. Lumber prices and copper are collapsing, which seems to show more of a deflationary reaction to the current environment, rather than inflation. We would not be surprised to see a deflationary correction, just as we saw in March - probably not as deep - before another run up in prices.

Gold and silver are in short supply. To get it, you have to pay a hefty premium. The paper market is still open, but seems to be the opposite of what the cash market is saying. Mints are beginning to report that they are running out of silver and gold. It is like they are crying wolf because the market now doesn’t appear to react to such reports anymore. We have been in a bearish pattern since August 6, 2020, and the high than in gold. We have been in a long-term correction ever since. Yet when you look at the price of commodities, they are at record levels. Soybeans are up to 16.67 a bushel. Corn is up to 7.35 a short time ago on May 7. Wheat reached 773. We have seen a little bit of a correction in grains, taking a little off the inflationary sentiment, but the media are still focusing on rising prices. Overall, prices are rising. The key is whether it will be short or long term?

Courtesy: TDAmeritrade

Gold has come down below the VC PMI daily average price and has activated a bearish price momentum with a target of $1849. The uptrend failed. Most conservative traders avoid trading around the average price. Wait for the market to reach an extreme above or below the market to trade, when the probabilities are far higher then the trade will revert back to the mean. It is not 100%, but the odds greatly favor such reversions to the mean. We still recommend staying long with your core positions. These short-term gyrations do not affect our long-term fundamental picture that the economic and monetary policy, the debt, interest rates, shortages, and other factors all favor gold and silver increasing in price. It appears that inflationary fears are overblown, so gold is still testing the $1860-$1865 area. The market appears to have already factored in the risk for inflation for now.

Gold has come down into what is an oversold condition daily and weekly according to the VC PMI. We have a mixed signal between the daily and weekly until the market gets above $1865 when it will indicate a daily bullish price momentum with a target of $1883. The weekly Buy 1 trigger will also be activated with a target of $1886.

Courtesy: TDAmeritrade

For silver, we are almost down to the Buy 1 weekly level of 27.54. We are nearing the area where it is the highest probability to go long.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and ...

more