Gold Has More Extreme Return Outcomes Than Equity

We look at rolling 5-year periods starting each month since December 1991 for four asset classes, namely, equity, bonds, commodities, and gold. From this, we can get an idea about the probability of, for example, losing money or earning double-digit returns in each of the four asset classes.

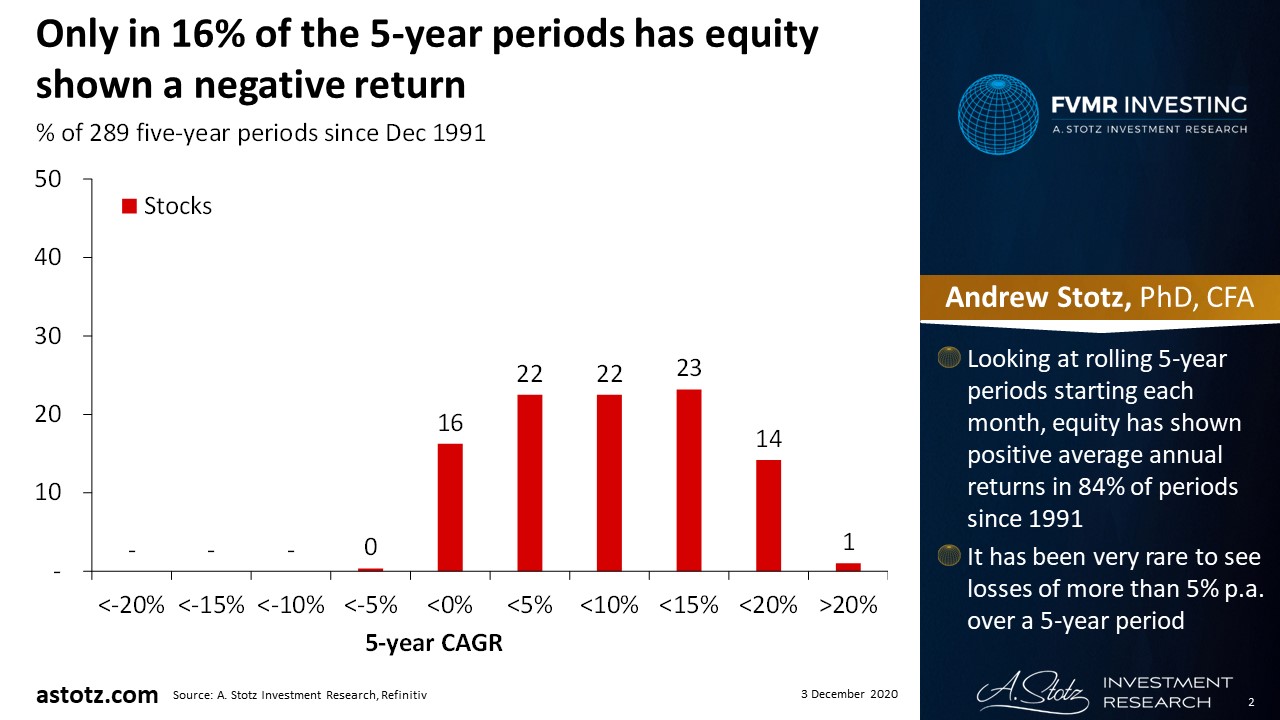

Only in 16% of the 5-year periods has equity shown a negative return

(Click on image to enlarge)

- Looking at rolling 5-year periods starting each month, equity has shown positive average annual returns in 84% of periods since 1991

- It has been very rare to see losses of more than 5% p.a. over a 5-year period

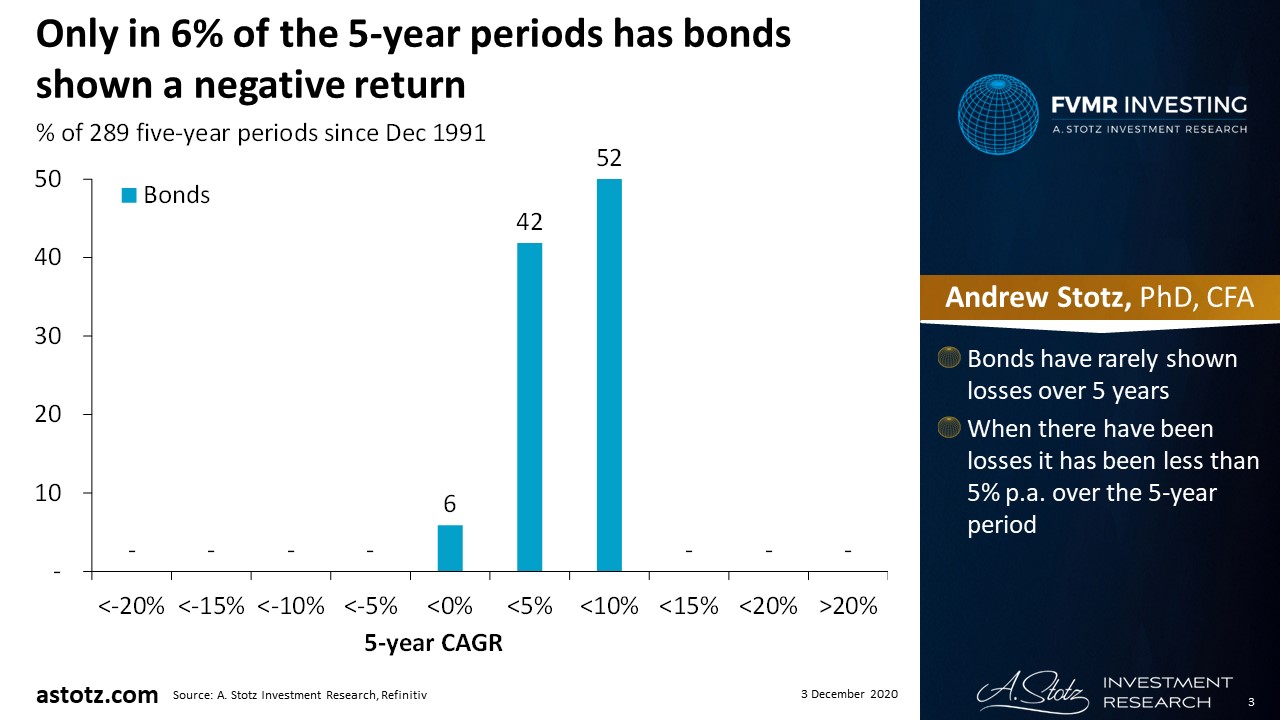

Only in 6% of the 5-year periods has bonds shown a negative return

(Click on image to enlarge)

- Bonds have rarely shown losses over 5 years

- When there have been losses it has been less than 5% p.a. over the 5-year period

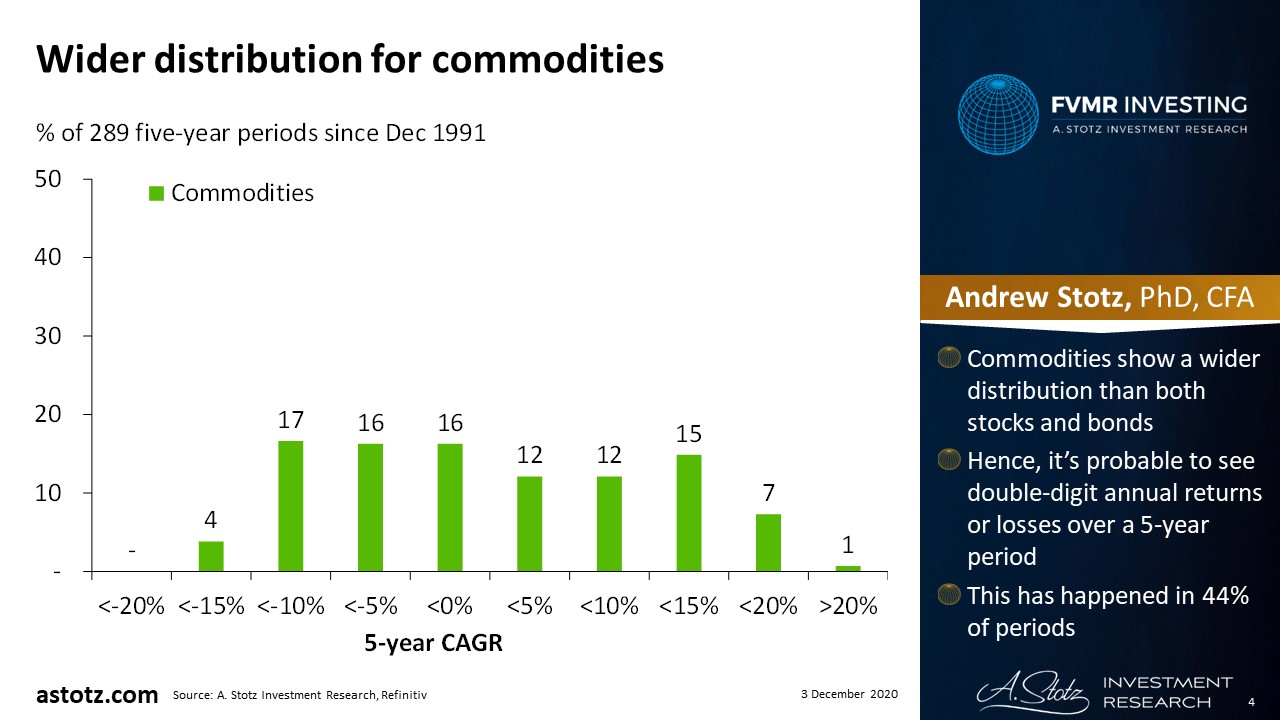

Wider distribution for commodities

(Click on image to enlarge)

- Commodities show a wider distribution than both stocks and bonds

- Hence, it’s probable to see double-digit annual returns or losses over a 5-year period

- This has happened in 44% of periods

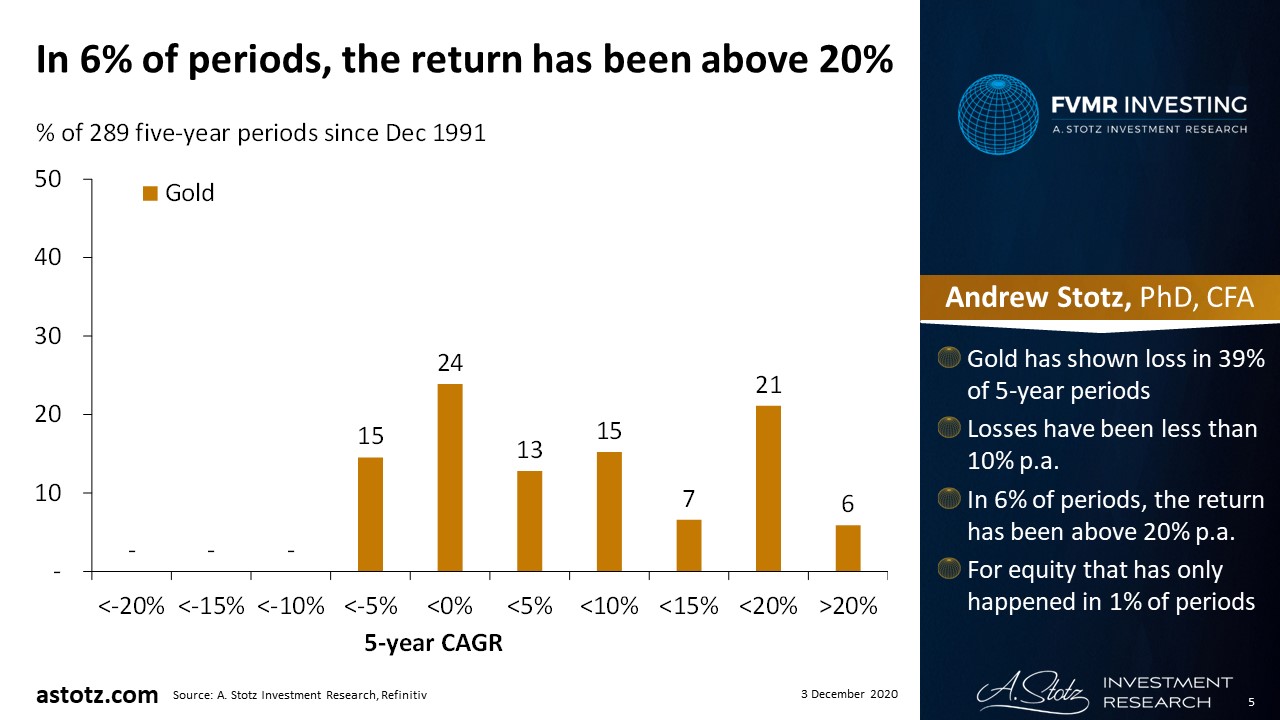

In 6% of periods, the return has been above 20% p.a.

(Click on image to enlarge)

- Gold has shown a loss in 39% of 5-year periods

- Losses have been less than 10% p.a.

- In 6% of periods, the return has been above 20% p.a.

- For equity that has only happened in 1% of periods

Disclaimer: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and ...

moreComments

Please wait...

Comment posted successfully.

No Thumbs up yet!