Gold: Bears Caught In A Trap

Fundamentals

We are in a historic political, economic and social moment. There's a great deal of noise affecting traders. The key is to block out the noise and focus on what the market is telling you. If you pay attention to the media, by the time you hear it in the media a few times, that news already is factored into the market. We have three black swans right now: the pandemic, social-political tensions, and an economic crisis. Europe is close to imposing another lockdown. Last time, the lockdown shut down supply chains, which could happen again. A second lockdown could be more devastating than the first, with longer-term implications. Such implications would, in all likelihood, cause gold and silver to rise in price.

After almost a year of this pandemic, it's becoming clear that we are not going to return to any normal state as we knew it. Early in the crisis, the Fed announced that they would provide unlimited stimulus, which caused equities and gold to rally - n gold’s case about $600. Gold did then come down again based on the fact that we went from $1458 to $2089. The market then paused to see what the real damage to the economy would be, which caused gold to come back down somewhat. The Fed has spent trillions of dollars in stimulus, which means that inflation is likely to occur, if not hyperinflation, which would cause gold to rise in value.

Precious Metals

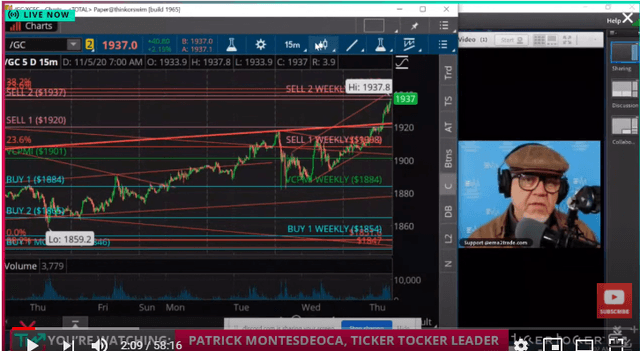

Gold is trading last at $1937.20. It's up in a fast market. NUGT is up 8.62. JNUG also is substantially higher. The gold market is breaking out to the upside. The Variable Changing Price Momentum Indicator (VC PMI) tells us gold met the daily Sell 2 level target. We are taking some profits. If you are net long, the targets are being completed at $1937 right into the weekly target of $1938.

Courtesy: TickerTocker

Fundamentally the market is supported by all the political uncertainty in the United States as the election outcome is still uncertain. The market also is expecting a larger amount of stimulus. The key questions are when and how much it will be.

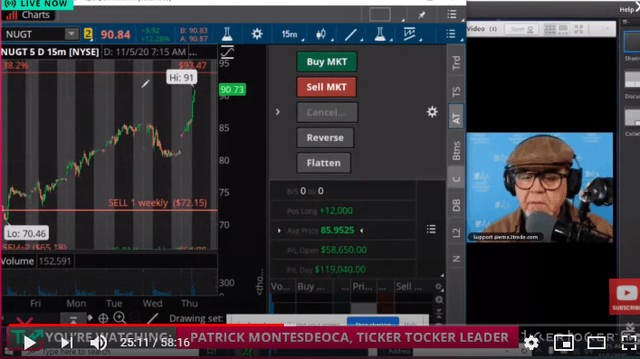

We use aggressive derivatives, such as JNUG and NUGT, to trade the market. NUGT is up 11 percent. Gold is up 2.5 percent. We are using these instruments to manage the risk, by avoiding the risk of a margin call. We use the futures contract to scalp the market. We build speculative wealth in the gold mining shares, which have produced significant profits. Now that gold is taking off, you will begin to see all of these gold mining shares take off. They are undervalued and oversold tremendously in relation to other classes of assets. Silver is a particularly high-risk sector. It has a great deal of volatility, but great upside potential.

Gold is taking out all of the supply that is being offered, so it's continuing to go up in price. As it broke through about $1920, it indicated that the demand in the market was far greater than the supply that's being offered. The VC PMI identifies for you the extreme levels above and below the mean price. It provides a structure for you to trade.

With the market at $1944, levels such as $1937, which is the Sell 2 daily, and the weekly at $1939 have been taken out and have become support. The market is now retracing the correction that we saw from the high at $2089. The price traded into the blue zone on our VC PMI charts, which told us that it becomes a high probability area where buyers will come into the market. Gold is building a beautiful base and we did find buyers. Around $1859 are the lows that you want to use to measure the extensions to the upside. Using the Fibonacci extensions, we are looking at a retracement of $2260 approximately.

Yesterday, we recommended covering any short positions and to get on the long side of the market. Now gold is challenging the $2000 area. We have broken out of the VC PMI monthly resistance levels, the weekly levels, and the daily levels. Gold is breaking out of the resistance level around $1928, so we are now targeting the $2000 level, which could happen really fast. By coming down to the monthly average yesterday of $1884, regardless of the fundamental reason, it verified that it was a turning point and an excellent time to get in on the long side. On the VC PMI monthly, we have completed the first target at $1937. Now $1973 is the next target that has been activated.

NUGT is at 90.95. If you are long, lock in some profits now. If you don’t lock in profits, then the market will take it back. The hardest thing about trading is to know when to get out, when to take profits.

SILJ is a silver ETF. This also is a time to lock in profits in SILJ, if you have been long since the VC PMI told you to buy SILJ.

We use the gold market to day trade, but also to build speculative wealth for the long term.

Now that we have accomplished all the daily and weekly Sell 1 and 2 targets, as well as the monthly Sell 2 target, it's time to narrow your exposure. If you bought at $1884, take profits and reduce your risk. You don’t need to liquidate everything, but limit your exposure.

Disclosure: I am/we are long NUGT.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on more