Gold & Silver Review/Preview: Recent Performance, Fundamental Drivers, Lessons, & Playing US Jobs Reports

A guide for short term gold and silver traders, ideas on trading Friday’s key events, particularly the US non-farms payrolls, unemployment rate, and average hourly earnings.

Summary

-Gold and silver have been predictably tracking the USD over the past 24 hours.

-There are 2 big likely sources of volatility today, only one is likely to impact gold and silver, via its influence on the USD.

-Ideas on short term trading for gold and silver Friday.

In yesterday’s post we correctly predicted:

Gold’s outlook neutral to negative in the next 24-48 hours, with no significant news before Friday’s monthly US jobs reports.

GOLD 4 HOUR CHART FOR MAY 7TH AND START OF MAY 8TH

KEY:10 PERIOD CANDLE EMA DARK BLUE, 20 PERIOD CANDLE EMA YELLOW, 50 PERIOD CANDLE EMA RED, 100 PERIOD CANDLE EMA LIGHT BLUE, 200 PERIOD CANDLE EMA VIOLET,DOUBLE BOLLINGER BANDS NORMAL 2 STANDARD DEVIATIONS GREEN, 1 STANDARD DEVIATION ORANGE.

Source: MetaQuotes Software Corp, www.FXGlobe.com

02 May. 08 07.18.jpg

Note the very tight trading range, ~1180 – 1188, and overall drift lower over the course of Thursday, with the range tightening even more as the day wore on. We had precisely the same price action for silver.

SILVER 4 HOUR CHART FOR MAY 7TH AND START OF MAY 8TH

KEY:10 PERIOD CANDLE EMA DARK BLUE, 20 PERIOD CANDLE EMA YELLOW, 50 PERIOD CANDLE EMA RED, 100 PERIOD CANDLE EMA LIGHT BLUE, 200 PERIOD CANDLE EMA VIOLET,DOUBLE BOLLINGER BANDS NORMAL 2 STANDARD DEVIATIONS GREEN, 1 STANDARD DEVIATION ORANGE.

Source: MetaQuotes Software Corp, www.FXGlobe.com

03 May. 08 07.30.jpg

The reason for the narrow trading ranges, again as predicted, was that the relatively weak set of scheduled events was unlikely to move precious metals. Given that gold and silver are moving in the opposite direction of USD rate speculation (rising rate hike expectations, rising USD, falling gold and silver, andvice versa) than anything else this week, caution ahead of today’s monthly US jobs reports was also a restraining factor.

Potential Sources of Volatility Friday

There are 2 big events Friday.

One is the UK election results, which were forecasted to be inconclusive but as of Friday morning exit polls are showing a clear conservative victory. That’s bullish for the GBP, and by extension slightly bearish for the USD, (GBPUSD trades comprise ~ 10% of USD trades) and thus not relevant for gold and silver.

The other event is of course the monthly US jobs reports, which could definitely move the gold and silver because they’re priced in US dollars and thus tend to move in the opposite direction of the USD, falling on dollar strength and rising on US weakness.

Indeed that negative correlation has been working well over the past 24 hours. Note how the USD index has behaved in the opposite fashion, a tight range but with a bias to the upside.

USD INDEX 4 HOUR CHART FOR MAY 7TH AND START OF MAY 8TH

KEY:10 PERIOD CANDLE EMA DARK BLUE, 20 PERIOD CANDLE EMA YELLOW, 50 PERIOD CANDLE EMA RED, 100 PERIOD CANDLE EMA LIGHT BLUE, 200 PERIOD CANDLE EMA VIOLET,DOUBLE BOLLINGER BANDS NORMAL 2 STANDARD DEVIATIONS GREEN, 1 STANDARD DEVIATION ORANGE.

Source: MetaQuotes Software Corp, www.FXGlobe.com

04 May. 08 07.41.jpg

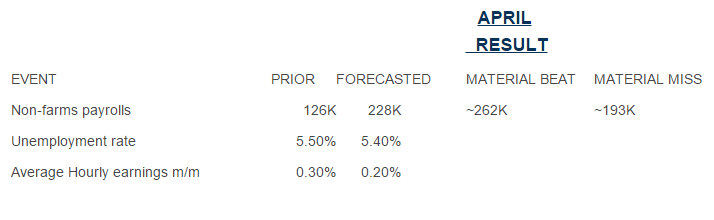

Thus the only possible market moving event today for gold and silver would be a jobs report that markets see as materially exceeding or disappointing expectations.

Gold & Silver Short Term US Jobs Reports Trade Strategy: Play The Recent Trading Ranges

A material beating of the consensus forecast would boost rate hike expectations, and thus the USD, and thus pressure gold and silver downward towards the lower end of their recent trading ranges:

· Gold: Likely headed down to test support around 1181, after which 1177 would be the next major support level.

· Silver: Likely headed down to test support around 16.23, after which 16.19 would be the next major support level.

A miss would produce the opposite result:

· Gold heads up to test near term resistance around 1185.5, then 1187, then 1190.

· Silver heads up to test near term resistance around 16.35, then 16.44, then 16.60

Watch Out For Prior Month Revisions

Remember that revisions to the prior month’s results (these happen all the time as data often comes in late) can also affect market response as much as the latest data.

Note that a roughly 15% revision to the prior month’s result up or down (assuming no material beat or miss of forecasts) could have roughly the result as noted above, obviously depending on how big the revision, up or down.

An upward revision with a forecast beat would be extra bullish for the USD and bearish for the precious metals, possibly pushing them down to the above mentioned deeper level of support.

A downward revision with a miss would be doubly bad for the USD and boost the PMs to the aforementioned higher level of resistance.

Beware: Initial Moves Can Be Misleading

Those trading on very short term charts should note that market moves in the first few hours after the news can reverse. Stick to your range-trading plan, have your entries and exits entered in advance, along with stop losses, to keep emotions out of your trading decisions.

Disclosure: The above represents the personal opinion of our Chief Analyst, and is not represented as any guarantee of what will happen by him or ...

more