Going Out Like A Lion

Does anyone remember if Punxsutawney Phil, aka “the groundhog,” saw his shadow this year? Well, let’s just say the “Economic Groundhog” did see its shadow, and we’re seeing the U.S. data for March being robust—i.e., Q1 is “going out like a lion.”

Let’s look at the laundry list of examples investors have seen thus far in the first half of April:

- Total nonfarm payrolls rose by +916,000 in March, well above consensus forecasts, and the breadth of the job gains was also robust, as goods-producing, services, and government all posted strong showings.

- In a recurring theme, it appears that the lifting of pandemic-related restrictions played a visible role as “leisure & hospitality” employment surged.

- ISM Manufacturing rose to its highest level since 1983.

- ISM Services rose to its highest level EVER!

- This is an important development because the service sector was hit disproportionately hard from the pandemic lockdowns

- Consumer confidence surged to its best showing since last March.

- Although this data was for the week of April 10, the stubbornly high jobless claims figure dropped to its lowest reading since the pandemic-related spike in March of last year.

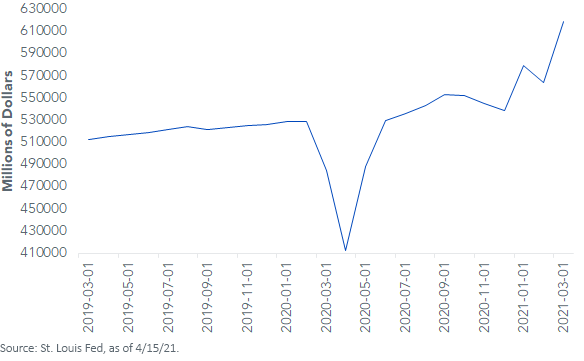

- Finally, Retail Sales surged 9.8% and is now well above its pre-pandemic levels (see below)

- Once again, “re-openings” and the $1,400 stimulus checks were key supporting factors.

Advanced Retails Sales

What does it all mean, you might ask? Well, instead of the expected “soft patch” for the U.S. economy in Q1 that was being projected just a couple of months ago, real GDP estimates for the opening three months of the year are now being revised upward to potentially reveal explosive growth. Indeed, some estimates are now moving toward the +10% threshold!

Interestingly, there could be some discussion regarding growth being “pulled forward” at the expense of the second half of this year. In my opinion, while there could be some of this effect at work, the momentum appears to be in place to keep the robust recovery moving ahead for the remainder of 2021 as well. Admittedly, any news on the pandemic-related front needs to be monitored closely, and unfortunately, it could alter our base case recovery outlook in the case of any potential negative developments. However, if the vaccine rollout process and “re-openings” continue, combined with unprecedented fiscal and monetary policy stimulus, the foundation for “above pre-pandemic trend” growth appears to be in place.

Conclusion

The other piece of this puzzle is inflation. This topic is already being debated, and I’ll weigh in on it in an upcoming blog post in the not-too-distant future. Here’s a little taste:

- Year-over-year March Producer Price Index (PPI) increased 4.2%, its highest reading since 2011

- The March Consumer Price Index (CPI) report, +2.6% year-over-year and up nearly a full percentage point from February, looks to be the beginning of a run of higher inflation readings in the months ahead

Unless otherwise stated, all data sourced is Bureau of Labor Statistics, Census Bureau, as of 4/16/21.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more