Global Stocks Slide Ahead Of Crazy Week; Iron Ore Soars

It's a sea of red in global equity markets as Friday's euphoria fizzled after President Donald Trump made clear he won’t take no for an answer in his effort to construct a border wall while investors are hunkering down ahead of an action-packed week which includes the UK Parliament's Brexit "Plan B" vote, a Fed meeting, a new round of US-China trade talks, the deadline for the Huawei CFO extradition notice, a potential Venezuela showdown, January US payrolls report and the busiest week of earnings season.

While stocks jumped on Friday after Trump "caved" and agreed to reopen the government, the party moody was dented after Trump tweeted "Does anybody really think I won’t build the WALL?” late on Sunday as the committee of lawmakers crafting a plan for the southern U.S. border is expected to start meeting this week. On Sunday, Trump told the WSJ he'll get the funding even if he has to use emergency powers while Trump's acting chief of staff said he's prepared to shutter the government again or declare an emergency if needed to get the wall money.

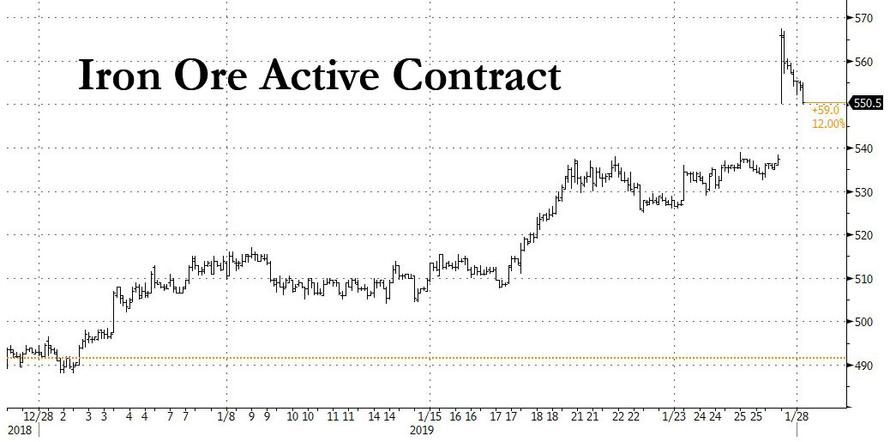

The dollar was flat as were 10Y TSY yields, while iron ore prices soared following a deadly dam collapse at a mine in Brazil which killed at least 58 people in a huge blow to Brazil mining giant Vale, the world’s biggest producer iron ore, which announced overnight it would suspend its dividend as it shores up liquidity ahead of what could be a crushing legal penalty.

Asian markets started off the week mixed, as bourses in Shanghai, Hong Kong, Tokyo and Seoul all losing ground: Japanese shares retreated along Chinese peers due to trade tensions, while stocks in Hong Kong pared gains to close little changed. The yuan appreciated to its strongest against the dollar since July, the CNH rising some 400 pips tracking the weaker dollar, before Vice Premier Liu He’s trip to Washington for trade talks, and as the People’s Bank of China freed up a potential $37 billion for bank lending and a new chief was named to lead the country’s main securities regulator.

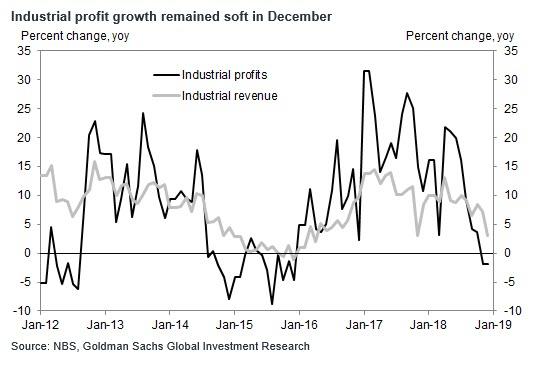

Overnight concerns about China's slowing economy re-emerged after earnings at China’s industrial firms shrank for the second straight month, suggesting trouble ahead for manufacturers struggling with falling orders, job layoffs and factory closures amid a protracted trade war with the United States.

Investors are now waiting for Chinese Vice Premier Liu He’s visit to the United States on Jan. 30-31, for the next round of trade negotiations with Washington. But with the sides still far from resolving trade issues, the dollar stood firm as traders sought a safe haven as they await news from U.S.-China talks on Tuesday and Wednesday.

The MSCI world equity index, which tracks shares in 47 countries, fell 0.1 percent, while MSCI’s main European Index dropped 0.5 percent. The broader Euro STOXX 600 index also fell 0.5%, failing to rebound from a slide at the open after two days of gains, with most sectors falling except miners which followed the rising price of iron ore. West Texas oil fell below $53 a barrel after America’s rig count rose for the first time this year.

In addition to Trump's border wall crusade, traders will focus on negotiations between the US and China which are set to resume in a very busy week which also include: Fed chair Jerome Powell will host a press briefing after the U.S. central bank’s policy decision, some of the biggest technology companies including Apple, Microsoft, Facebook are reporting Q4 results, and there will be another series of potentially key votes in the U.K. Parliament about Brexit. To cap it all, a flurry of American economic figures including GDP and jobs data are also set for release.

Elsewhere, Bitcoin fell again, putting the biggest cryptocurrency on track for its lowest close since December. Emerging-market stocks edged lower while their currencies climbed. Gold retreated. Russia’s MOEX stock index touched an intraday record high after sanctions were lifted on Rusal, before reversing gains to trade lower as oil prices slumped.

The dollar index, a gauge of its value versus six major peers, was flat at 95.801 as the dollar recovered following the Tokyo fix and Treasuries gained as global stocks started the week on a defensive note. "In this environment the dollar was holding up well,” said Thu Lan Nguyen, a forex strategist at Commerzbank. “I assume that this will continue to be the case, even as the conflict intensifies at the end of the week."

The dollar will also get a strong steer from this week’s Fed meeting, where the central bank is expected to signal a pause in its tightening cycle and to acknowledge growing risks to the world’s biggest economy. Though the Fed has forecast two more interest rate hikes for 2019, a darkening global economic outlook and highly volatile stock markets have clouded the policy picture.

Elsewhere in currencies, sterling drifted lower as investors consolidated positions ahead of crucial votes in the British parliament designed aim to break the Brexit deadlock. The British currency edged down a quarter of a percent lower to $1.3164. Lawmakers earlier this month rejected Prime Minister Theresa May’s EU withdrawal agreement, which included a nearly two-year transition period to help minimize economic disruption. That defeat set up a series of votes on Tuesday through which lawmakers and the government will try to find a way forward.

Emerging-market currencies rose to the strongest level since June before the rally lost steam, while oil prices consolidated.

In commodities, Brent crude futures were down 1.8 percent, at $61.01 a barrel. Oil prices fell amid signals that crude output may rise further, and worries grew over the signs of economic slowdown in China, the world’s second-largest oil user. Gold was slightly down. Spot gold was down 0.2 percent at $1,300.56 per ounce, hovering just below a more than 7-month high of $1,304.40 reached earlier in the session.

Market Snapshot

- S&P 500 futures down 0.4% to 2,652.00

- STOXX Europe 600 down 0.3% to 356.69

- MXAP down 0.1% to 154.68

- MXAPJ up 0.01% to 504.86

- Nikkei down 0.6% to 20,649.00

- Topix down 0.7% to 1,555.51

- Hang Seng Index up 0.03% to 27,576.96

- Shanghai Composite down 0.2% to 2,596.98

- Sensex down 1% to 35,665.99

- Australia S&P/ASX 200 up 0.7% to 5,905.61

- Kospi down 0.02% to 2,177.30

- German 10Y yield rose 0.4 bps to 0.197%

- Euro unchanged at $1.1406

- Brent Futures down 1.8% to $60.51/bbl

- Italian 10Y yield fell 1.0 bps to 2.293%

- Spanish 10Y yield rose 0.4 bps to 1.235%

- Brent Futures down 1.8% to $60.51/bbl

- Gold spot down 0.3% to $1,301.52

- U.S. Dollar Index up 0.04% to 95.83

Top Overnight News

- Trump said in an interview Sunday with the Wall Street Journal that he doubted whether a group of 17 lawmakers could strike a deal before the next lapse in government funding in less than three weeks and vowed to build a wall anyway, even if he has to use emergency powers

- Prime Minister Theresa May risks losing control of Brexit in a series of votes in Parliament this week that could see her forced to suspend the entire divorce or sent back to Brussels to negotiate the impossible.

- According to weekend news reports, European Commission President Jean-Claude Juncker told Theresa May in a private phone call that the price for the EU revising the Irish backstop would be a permanent customs union for the U.K.

- U.K. Prime Minister Theresa May has told cabinet ministers she won’t take the country out of the EU without a deal, the Sun reported, citing people familiar with meetings between May and her ministers over the past week

- Trump is prepared to close the federal government again if he and congressional leaders are unable to strike a budget deal that includes funding for a U.S.-Mexico border wall, acting White House Chief of Staff Mick Mulvaney said

- One Bank of Japan board member said it would be very difficult to make out the underlying price trend in the year starting in April because of a sales tax hike, softening oil prices and a reduction in cell- phone related fees, Dec. minutes show

- Europe’s retail crisis deepened as companies in the U.K. and Germany are set to cut thousands of jobs as online shopping accelerates the erosion of sales from traditional stores

- U.S. and China will hold a pivotal round of talks this week in an attempt to end their trade war. Interpreting if they’d made real progress toward a truce won’t be an easy matter

Asian equity markets initially began the week mostly higher as the region resumed the positive momentum seen on Friday in the US, where all majors gained and President Trump agreed with lawmakers to end the record-long government shutdown. This lifted sentiment across the Asia-Pac bourses in early trade with ASX 200 and Nikkei 225 (-0.7%) the exceptions as Australia remained closed for holiday and Japanese stocks were hampered by recent currency flows, with Japan Display among the worst hit after it flagged a severe situation regarding its FY net. Elsewhere, Hang Seng (U/C) and Shanghai Comp. (-0.2%) positive for most the session as corporate updates also provided a catalyst in which Sinopec were underpinned by an increase in preliminary FY net and revenue. However, the region later failed to hold on to early gains amid several factors including PBoC liquidity inaction, a consecutive monthly decline in Chinese Industrial Profits and looming risk events including US-China trade discussions. Finally, 10yr JGBs were relatively uneventful with only brief support despite the underperformance of Tokyo stocks and BoJ presence in the market for JPY 1tln of JGBs, while the BoJ minutes from the December meeting also failed to garner a reaction as it provided no surprises and considering there was also a more recent meeting held last week.

Top Asian News

- Here Are Three Scenarios for U.S.-China Trade Talks This Week

- India Stocks Extend Drop as Company Share Pledges Sour Sentiment

- How Low Can China Bond Yield Go? 10-Year Rate Flirts With 3%

- Morgan Stanley’s Quant Signals Say to Stay Long Emerging Markets

Major European equities are in the red [Euro Stoxx 50 -0.5%] following on from a negative end to Asia ahead of key risk events US-China talks and the Brexit ‘Plan B’ vote. Sectors are similarly in the red, energy names are underperforming (amid the price action in the complex) with some outperformance seen in telecom names; with the likes of Dixons Carphone (+3.1%) in the green after being upgraded at Morgan Stanley. Other notable movers include, Telecom Italia (+1.4%) who were initially at bottom of the Stoxx 600, though the company pared losses amid reports suggesting that Enel’s (-0.3%) open fibre unit are said to be seeking a pact with the Co. Elsewhere, London-listed Ocado (+2.7%) are towards the top of the Stoxx 600 following reports that the Co. have held talks with Marks and Spencer (+0.4%) concerning the launch of a food delivery service. Finally, miners are initially outperformed (Rio Tinto +1.6%) amid hopes of rising iron ore prices following the dam collapse at the Vale mine in Brazil.

Top European News

- U.K. PM Told Cabinet Ministers She Will Rule Out ‘No Deal’: Sun

- Poland Vows to Stop ‘Speculators’ as Soros Bids for Radio Zet

- Scottish Investors See CPI-Linked Gilts as ‘Unrealistic’: DMO

- Kering Drops on $1.6 Billion Tax Fine From Italy Over Gucci

In FX, GBP - The main G10 underperformer ahead of Tuesday’s Brexit vote, as Cable recoils from 1.3200+ overnight peaks and Eur/Gbp bounces off circa 0.8637 lows to trade around 1.3150 and 0.8670 respectively. Consolidation, profit-taking and/or position paring has stemmed the latest advance in Sterling, along with a broader stabilisation in the Dollar and relative resilience in the single currency (holding above 1.1400 vs the Usd) following firmer than forecast Eurozone M3 data. Note, decent Eur/Usd option expiry interest between 1.1400-15 as 1.4 bn rolls off at the NY cut. Back to the Pound, some chance of additional impetus via BoE members today including Governor Carney, Broadbent and Ramsden, but in truth tomorrow’s Plan B Parliament judgement will likely be the next major driver.

- NZD - The Kiwi tops the major league, albeit helped by external factors, like a firmer Yuan and Aud cross flows, as Australia’s national day celebrations spilled over to Monday. Nzd/Usd is pivoting 0.6850 and Aud/Nzd has dipped below 1.0500, while Aud/Usd hovers just under 0.7200. Back to the Kiwi, NZ trade data looms and could be key.

- DXY - As noted, the Buck appears to have gleaned some traction in the run up to the FOMC, US-China trade talks and NFP, with perhaps a degree of support coming via the deal to re-open Government. However, the index still looks vulnerable sub-96.00 within a 95.920-671 range, and as the Greenback remains softer vs the Jpy and Chf circa 109.50 and 0.9915.

In commodities, Brent (-1.6%) and WTI (-1.7%) are both firmly in the red, weighed on by risk sentiment, ahead of this week’s key events including US-China trade talks in Washington. Furthermore, Friday’s Baker Hughes rig count showed the number of active oil rigs increased by 10 (first increase this year); adding additional downward pressure to the complex.

Gold (-0.2%) is marginally in negative territory, weighed on by dollar strength despite of the negative risk sentiment, as the yellow metal detaches itself from its safe-haven status (again). Elsewhere, the US has removed sanctions on Rusal and two other firms connected with Russian billionaire Deripaska; with the move returning some certainty to the aluminium markets supply. Separately, iron ore prices have moved higher as markets react to news of a dam collapse at the Corrego do Feijao iron ore mine in Brazil; for reference the mine has an approximate capacity of 7.8mln tonnes.

The focus today will be central banks, with the ECB’s Draghi speaking at a European parliament hearing in Brussels, while the BoE’s Carney, Broadbent, Ramsden, Place and Woods will also be speaking. In terms of data, there is the Chicago Fed National Activity Index for December and the Dallas Fed Manufacturing activity for January. We also have earnings from Caterpillar and the US Congressional Budget Office will be releasing its Budget and Economic outlook.

US event calendar and backlogged econ data:

- Jan. 28-Feb. 4: Advance Goods Trade Balance, est. $76.1b deficit, prior $77.2b deficit, revised $77.0b deficit

- Jan. 28- Feb. 4: Retail Inventories MoM, prior 0.9%, revised 0.8%

- Jan. 28- Feb. 4: Wholesale Inventories MoM, est. 0.45%, prior 0.8%

- Jan. 28-Feb. 4: New Home Sales, est. 567,000, prior 544,000

- Jan. 28- Feb. 4: New Home Sales MoM, est. 4.22%, prior -8.9%

- Jan. 28-Feb. 4: Construction Spending MoM, est. 0.2%, prior -0.1%

- Jan. 28-Feb. 4: Factory Orders, est. 0.3%, prior -2.1%

- Jan. 28-Feb. 4: Factory Orders Ex Trans, prior 0.3%

- Jan. 28-Feb. 4: Durable Goods Orders, est. 0.8%, prior 0.8%

- Jan. 28-Feb. 4: Durables Ex Transportation, prior -0.3%

- Jan. 28-Feb. 4: Cap Goods Orders Nondef Ex Air, prior -0.6%

- Jan. 28-Feb. 4: Cap Goods Ship Nondef Ex Air, prior -0.1%

- Jan. 28-Feb. 4: Trade Balance, est. $54.0b deficit, prior $55.5b deficit

- Jan. 28-Feb. 4: Monthly Budget Statement, est. $10.0b deficit, prior $204.9b deficit

- Jan. 28-Feb. 4: Retail Sales Advance MoM, est. 0.1%, prior 0.2%

- Jan. 28-Feb. 4: Retail Sales Ex Auto MoM, est. 0.0%, prior 0.2%

- Jan. 28-Feb. 4: Retail Sales Ex Auto and Gas, est. 0.4%, prior 0.5%

- Jan. 28-Feb. 4: Retail Sales Control Group, est. 0.4%, prior 0.9%

- Jan. 28-Feb. 4: Business Inventories, est. 0.3%, prior 0.6%

- Jan. 28-Feb. 4: Net Long-term TIC Flows, prior $31.3b

- Jan. 28-Feb. 4: Total Net TIC Flows, prior $42.0b

- Jan. 28-Feb. 4: Housing Starts, est. 1.25m, prior 1.26m

- Jan. 28-Feb. 4: Building Permits MoM, est. -2.93%, prior 5.0%

- Jan. 28-Feb. 4: Housing Starts MoM, est. -0.48%, prior 3.2%

- Jan. 28-Feb. 4: Building Permits, est. 1.29m, prior 1.33m

- 8:30am: Chicago Fed Nat Activity Index, prior 0.2

- 10:30am: Dallas Fed Manf. Activity, est. -2.7, prior -5.1

DB's Jim Reid concludes the overnight wrap

Here we go again. It’s January, yesterday was bitterly cold with wind and hail in equal measure, I played a miserable round of golf not helped by being battered by the elements and what happens when I get home? Yes a bout of golf club foliage related hay fever kicked in. I spent much of the evening sneezing and rubbing my itchy eyes. Good job my new house (when it’s ready in April) isn’t opposite the entrance to the golf club!! Oh wait it is. Time for my annual ingesting of daily anti-histamines, nasal sprays, local honey and eye drops.

This always happens to me at the golf club from January onwards and how time has flied since last year’s bout. In markets, with only 4 days of January left we are fast coming up to the first anniversary of the vol shock we had after a surprisingly high average hourly earnings print in the January 2018 US payroll report. As you’ll remember the VIX traded over 50 at the intra-day peak in the first week of February as ETF vol products saw a massive unwind. One year on, this Friday will see the latest payroll report with very few people worried about inflation. That surprise print a year ago was +2.8% YoY. Last month we again surprised on the upside at +3.2%. So US inflation has still been building up over the last 12 months, and if you want a curveball for 2019 it’s that inflation continues to edge up and the Fed has to choose between controlling it on one hand and appeasing financial markets on the other, with the latter making it quite clear that it doesn’t want tighter policy. Indeed hopes of the Fed ending its balance sheet wind down early and positive thoughts about China’s latest stimulus (see Zhiwei Zheng’s note on how this moves them closer to QE here ) helped markets end last week on a high.

Updating our screens this morning, Asia has opened the week on a mixed note following Friday’s rally. Although the Hang Seng (+0.42%), the Shanghai Composite (+0.32%) and the KOSPI (+0.44%) have opened higher, the Nikkei (-0.38%) and other Japanese markets are trading lower as investors await the outcome of US-China trade talks and the latest batch of earnings reports. Ahead of those trade talks, the Chinese yuan appreciated to its highest level against the dollar in six months, while in commodity markets WTI oil is trading lower (-0.63%) as investors assess the implications of the current political turmoil in Venezuela.

Back to the week ahead now. Outside of payroll Friday the highlights are the FOMC on Wednesday, fresh Brexit votes from Tuesday, Chinese Vice Premier Liu He arriving in Washington for 2-days of trade talks on Wednesday, the very important global manufacturing PMIs on Friday and 123 S&P 500 companies reporting with Europe’s earnings season also kicking into gear.

Going through these in a little more detail, Wednesday's Federal Reserve meeting is the first to be followed by a press conference as they all now will. No change is expected to interest rates, but investors will be closely watching Powell’s comments as they aim to discern the future path of monetary policy this year. With no change expected the focus might be on questions on an early end to balance sheet reduction. For a full discussion of DB’s expectations see "January FOMC preview: See you in June" (link here ).

On an approximate basis as I’ve lost count, Brexit reaches pivotal week number 25 with the other 24 or so not in the end proving that pivotal. The UK parliament votes on the possible next steps on Tuesday. MPs will be further debating the government’s Brexit plan, and have the opportunity to vote on a variety of different amendments, which have been proposed by MPs from across the political spectrum. These could include one that says parliament should be able to hold indicative votes on different Brexit outcomes, one that requires the Prime Minister to extend Article 50 if the House of Commons has not approved a Brexit deal by February 26, another simply that the UK should not leave without a deal, and another calls for an expiry date on the backstop. The Speaker of the House of Commons will decide which are to be debated by MPs. The one regarding having an expiry date on the Irish backstop seems to be one both the PM and Tory party Brexiters are gravitating towards at the moment so it will be interesting to watch the support for this. However the Irish and the EU have both suggested there is no wiggle room on renegotiating the backstop. So we will see!!

Last night the Sun reported that Prime Minister May has privately told cabinet ministers that she wouldn’t leave the EU without a deal, with reports suggesting it is being kept on the table as a negotiating tactic. Sterling rallied on the news, trading above $1.3200 for the first time since October as investors priced in the decreasing likelihood of a no-deal outcome. This continues a trend (the pound has gained against the dollar for the last six consecutive weeks) of sterling gains, and comes after a majority in the House of Commons, including a number of Conservative ministers and backbenchers, have made clear their opposition to a no-deal outcome.

The other major political event for markets this week comes as Chinese Vice Premier Liu He visits Washington for trade talks on Wednesday, meeting with Treasury Secretary Mnuchin and US Trade Representative Lighthizer. Last week saw a host conflicting headlines on how much progress has been made so expect more of the same.

Earnings season continues, with 123 companies in the S&P 500 reporting this week and the European season building. Those reporting globally include Caterpillar today (always lots of snippets on how they see global activity), Apple, Pfizer and SAP on Tuesday, Microsoft, Facebook, Boeing and Alibaba on Wednesday, Amazon and Samsung on Thursday, and on Friday, we have Exxon Mobil, Chevron, Merck and Sony. With 109 companies in the S&P 500 having reported, 75% have beaten earnings expectations and 59% have beaten sales expectations.

For payrolls DB is forecasting a gain of 165k jobs which is around the same as consensus. The aforementioned average hourly earnings is expected to remain at 3.2%, the joint highest since the GFC. Other releases of note will be the Q4 GDP data on Wednesday and the Core PCE Price Index on Thursday. With the shutdown now over - for at least the next three weeks - also expect to see the backlog of data slowly come out. Finally, keep an eye out today for the US Congressional Budget Office who will be releasing its Budget and Economic Outlook, including ten-year economic budget projections. These were quite shocking this time last year in terms of the debt and deficit projections. On a rounded up basis the US wasn’t expected to see a deficit below 5% of GDP over the next decade and indeed out to the end of their forecasting period 30 years ahead. Pretty stunning stuff.

Turning to Europe, there are number of data highlights. On Thursday, we have the first release of Q4 GDP for the Euro Area, which will give an indication of whether the slowdown of the European economy continued through the end of the year. Markets are expecting quarter on quarter growth of 0.2%, as in Q3. Elsewhere, Wednesday will see the European Commission release its consumer confidence indicator for January, while Friday will see the release of manufacturing PMIs for January as well as the flash estimate of January’s CPI for the Euro Area. The full week ahead is at the end.

Turning to a recap of last week now where we saw the S&P 500 dip slightly for its first weekly decline of the year, dropping -0.22% (but +0.85% on Friday). The DOW and NASDAQ were close to flat, up +0.12% and +0.04%, respectively (+0.75% and +1.27% Friday). Semiconductor stocks outperformed, with the Philadelphia semiconductor index gaining +4.30% after strong earnings reports (+2.17% Friday). In Europe, the STOXX 600 advanced +0.22% (+0.61% Friday), with equities across the continent gaining. The exception was the UK, where the FTSE 100 fell -2.28% (-0.14% Friday) as the pound rallied +2.52% versus the dollar (+0.99% Friday). As mentioned, the pound’s outperformance was due to the perception that the worst case risk for Brexit is diminishing though the dollar retreated more broadly, with the DXY index down -0.56% (-0.84% Friday) and EM currencies up +0.46% (+0.22% Friday).

Sovereign bonds rallied on the week, with yields on Bunds and Treasuries down -6.9bps and -2.6bps, respectively (+4.3bps and +1.3bps Friday). Flash European PMIs came in soft and the ECB shifted its balance of risks to the downside, boosting safe havens. Peripheral yields rallied as well, with BTPs -8.1bps on the week (-1.0bps Friday) partly as markets started to price in a likelihood of fresh TLTROs even if Draghi gave no additional hints at Thursday’s ECB meeting. Despite a rally on Friday, HY credit ended the week +6bps and +2bps wider in the US and Europe respectively (-10bps and -4bps Friday respectively). WTI oil retraced a drop of as much as -3.73% early in the week to close the week down only -0.20% (+0.90% Friday).

The focus today will be central banks, with the ECB’s Draghi speaking at a European parliament hearing in Brussels, while the BoE’s Carney, Broadbent, Ramsden, Place and Woods will also be speaking. In terms of data, there is the Chicago Fed National Activity Index for December and the Dallas Fed Manufacturing activity for January. We also have earnings from Caterpillar and the US Congressional Budget Office will be releasing its Budget and Economic outlook.