Global Recession - 92.11% Chance We’re In One

Global Recession - Stocks Fall Slightly

The stock market fell slightly on Monday as the S&P 500 fell 0.34%, the Nasdaq fell 0.94%, and the Russell 2000 fell 1.01%. I consider this a healthy decline because it’s much softer than the violent action in December.

The market was overbought heading into this 2 day decline. Finally, instead of reacting to one extreme move, with the opposite extreme move, the market has settled down. The VIX rose 4.84% which helped push the CNN fear and greed index down from 30 to 28.

Compared to where the market was 4 weeks ago, this is tepid action.

Global Recession - Citigroup Rallies On Earnings Beat

The most important news this week isn’t the government shutdown; it’s the banks’ earnings reports.

Citigroup started the week off on a positive note as its earnings beat led to a 4.06% rally in the stock. As you can see from the slide below, the major financial stocks are relatively cheap.

This means expectations are low. This increases the odds they will rally after earnings. My top long trade of the year, which is to buy the regional bank index, has done well.

The KBW index is up 5.57% year to date which beats the S&P 500’s performance of 3.02%.

Specifically, Citigroup earned $1.61 excluding one time events which beat estimates for $1.55. The firm had 14% earnings growth because of lower expenses, lower corporate taxes, and lower credit costs.

Operating expenses were down 4% to $9.89 billion because of lower compensation costs. On the negative side, revenues missed estimates as they came in at $17.1 billion instead of $17.6 billion. This miss was caused by a 21% decline in fixed income trading revenues as they fell to $1.94 billion.

Global Recession - Even as investors worry about a recession, Citi doesn’t see one...

Its allowance for loan losses fell from 1.86% last year to 1.81%, and company-wide loans were up 3% to $684 billion. We have less economic data because of the government shutdown, so this information is more important than ever.

CFO John Gerspach stated, while the “real economy” of consumers and corporations spending and taking out loans “continued to be robust,” there are concerns that the impact of both the U.S.-China trade dispute and moves by central banks to reverse quantitative easing will impact the economy in 2019. I think the important point here is that people are still doing business.

His opinion on the Fed’s quantitative tightening is simply regurgitating what the media reports. I don’t think the unwinding of the Fed’s balance sheet matters much. The trade war is important, but I think it will be resolved in the next couple of months.

Global Recession - Will This Be A Volatile Earnings Season?

This has been a terrible earnings season, but it’s very early which makes it tough to fully define. Based on my memory, when earnings season starts off a certain way, it usually continues in that direction.

However, I will wait until the end of next week to decide how it was. This week 36 firms are reporting earnings. As of last week, 20 firms had reported, and 75% had their estimates cut by 6.63%.

As you can see from the chart below, the average implied movement after earnings is 7.4% for individual stocks.

That’s the highest implied movement since Q2 2009. The good news is that in Q2 2009, realized movement was only 6%. The options market is acting like we are in a recession as it expects major moves. If the earnings cuts keep coming because of weak guidance, we might see high realized movements.

This certainly isn’t going to be as good of an earnings period as Q4 last year. It’s interesting that even though those earnings were great, stocks still crashed in the winter of last year because of the sentiment reversal.

Now there is much more negativity. More importantly, the fundamentals are weaker.

Global Recession - Goldman’s Latest Forecasts

Headlines claim Goldman expects 3% earnings growth, but that’s the bear case.

The base case is for 6% earnings growth which would be good enough for stocks to rally. I’m not saying stocks will have an amazing year, but they can increase 0% to 5% based on this.

Since many investors are expecting a bear market and a recession, that doesn’t sound bad. The concept of a bull case, base case, and bear case doesn’t help many investors because all it says is that stocks can go anywhere.

However, Goldman’s projections tell us what the market expects, so they are valuable.

Goldman projects U.S. GDP growth could be 2.4% and global GDP growth could be 3.5% in 2019. Because China still drives so much of global growth, its weakness is a huge headwind to global growth this year.

Even if America slows, it should do great in rate of change terms compared to the rest of the world. If America would stop shooting itself in the foot through the government shutdown and trade war, it would be the obvious best place to invest this year.

The good news is the Fed has likely ended its hawkishness, so one policy mistake was avoided. I think the Fed will be even more dovish in its next meeting on January 30th. Currently, there is a 18.5% chance of any hikes this year.

Global Recession is Here

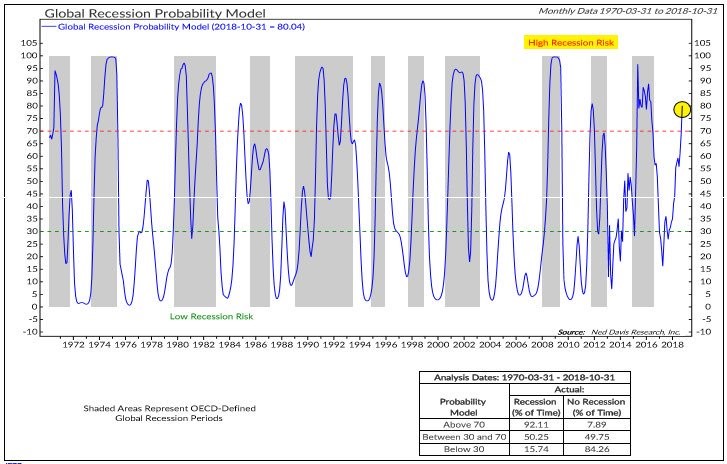

Getting back to thesis of slowing global growth, Ned Davis’ global recession model, seen in the chart below, has a reading of 80.04.

Analysis shows there is a global recession 92.11% of the time when the reading is above 70.

America is in great shape relatively speaking as its Q4 GDP growth should be above 2%. Q1 2019 GDP growth would be above 2% if it wasn’t for the shutdown which has now shaved off at least 0.4% off growth.

Global Recession - Conclusion

Earnings guidance has been terrible. At least Citigroup reported great results which tells us the economy isn’t in a recession.

This could be a volatile earnings season. I think the global economy is already in a recession. America will be in great shape relatively speaking if it re-opens the government and makes a trade deal with China.