Germany Slowing Further; S&P 500 Monthly Trend Line Hit And Reversal

When you have negative divergences on an index chart or any chart for that matter, you're waiting for a gap down to occur in order to get that negative divergence to kick in and create real downside action. The gap down we saw today was quite powerful, but what was even more impressive was the gap and run lower. Many times we get a gap down, but most of the damage is done in the first few minutes. After that, the market starts to recover and all is forgiven. This gap down didn't have those characteristics. Quite the opposite. It gapped down quite nicely and kept running lower. A sign of real selling from the big boys and girls who rule price. A negative divergence can be in place for weeks or months before the right candlestick hits and carries it appreciably lower.

The gap down is always the best news for the bears when this situation exists. Today's action with the gap and run is truly important because it's a change of character. It's essential to focus in and recognize a change in market character as it can tell us what to expect for the short-term at the very least. A gap and run with force hasn't taken place in a very long time, and since it came from near an all-time high, you have to take notice. It's telling us that the negative's out there are for real and that the market is respecting them. For a long time, the market hasn't respected the real world, but the culmination of bad news recently on the economies globally are starting to take hold. The red flag is up with today's technical action. We're still above 2134, but we're now nowhere near 2194. Oh so close, but no cigar.

Germany had a report last night that said their imports and exports were going in the wrong direction. Increases of 0.8 and 0.3 respectively were met with readings of MINUS -0.7 and -2.6 respectively. Huge misses, and yet another sign of how bad things are not just here at home, but all over the world, especially in key hot spots of supposed growth. Areas of the world that contribute mightily to the well-being of the global economies. The Eurozone, especially Germany, are looked upon to help carry the burden of growth, but the numbers that are coming in are painting a very different picture.

We have had huge problems here at home just recently with our ISM Manufacturing Report and services numbers. Jobs also pulled back. The real problems were those two ISM readings. Services, which are now nearly 80% of our economy fell from near 58% to just above 51%. A gigantic fall. There doesn't seem to be any areas of growth. In fact, Japan announced just two days ago that they are seriously considering lowering already negative rates. Are you kidding? The reality of where the global economy is heading is not a pretty picture. The trend is south and doing so quite rapidly. Something that needs to reverse soon or a recession isn't too far behind.

The most interesting thing out there is how many fed Governors are coming out and saying it's time for a rate hike. You have fed Governor's coming out it seems almost every day trying to prepare the markets for a rate hike even though the economic reports aren't any good. I think they're starting to understand the bubble they've created. I think they understand that the nonsense has to stop somewhere and maybe, just maybe, that time is finally upon us as housing prices soar for no good reason while the economy is weakening.

The bubble created is an all-timer as earnings are on a massive decline while P/E's are soaring. The disconnect just about as bad as I've ever seen it. The madness has to stop somewhere but knowing the fed it may not have stopped. Who knows what else they'll do. That said, Ms. Yellen does seem to be thinking harder about actually raising rates. The market will now focus endlessly on September 21 when she announces whether she's raising or not. The way she's sending out so many of her crew to talk up rate hikes, she may actually just do it. Interesting times as maybe we're about to finally see rate hikes in our future. The real world needs it. The bubble will burst someday.

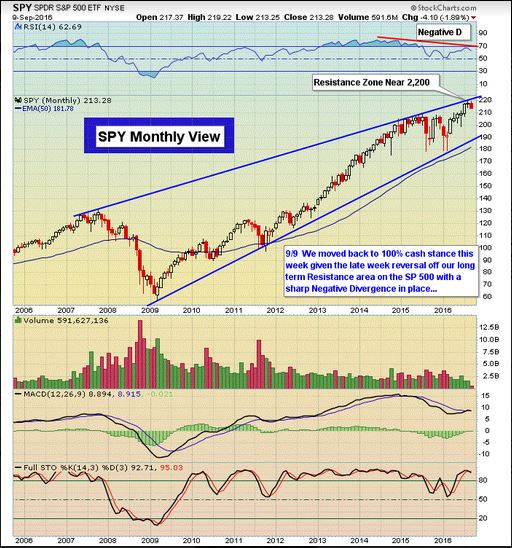

Finally, let's focus on the monthly S&P 500 chart, which recently hit its trend line top. The question was whether it would breakout above the trend line or reverse lower. With oscillators at very high levels, and with negative divergences in place, it seemed most logical for failure to ensure. The market has ignored all negatives, so there was no guarantee, but it seems as if the reversal has taken place and now we have plenty of room to fall if the market wants to do it. Of course, we'll see if 2134 holds or not and over time whether 2100 holds, but, for now, all we know is that the trend line top has caused the reversal. The catalyst being the rate hike talks. It takes only one piece of news to reverse things when you're in a bubble.

We watch and learn over the days and weeks to come.

Disclosure: None.

Please join us for a free 3 week trial at www.TheInformedTrader.com