German GDP Forecast: Is It Really So Bad? Low Expectations Open The Door To EUR/USD Gains

The winter wave of coronavirus has been a bitter disappointment for Germany’s health systems – but was it so bad for the economy? Europe’s “locomotive is releasing Gross Domestic Product figures for the first quarter of the year, and economists expect a squeeze of 1.5%. That data is set to rock the euro and overshadow eurozone GDP data released later on Friday.

Image Source: Pixabay

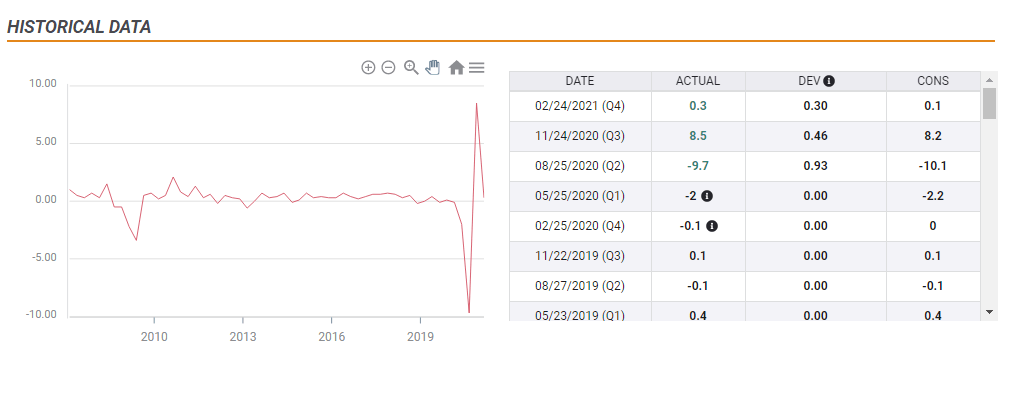

One reason to expect a better outcome comes from previous expectations – they were too low in the past four quarters:

(Click on image to enlarge)

Source: FXStreet

Will Europe’s largest economy beat the doomsters once again? Another positive factor is that economies in developed countries have learned to cope with lockdowns. After the paralysis in the spring of 2020, consumers have gotten used to working from home and buying online.

Output data for January and February from the UK – which underwent an even stricter shuttering than Germany’s – showed the resilience of the economy. That could be seen elsewhere.

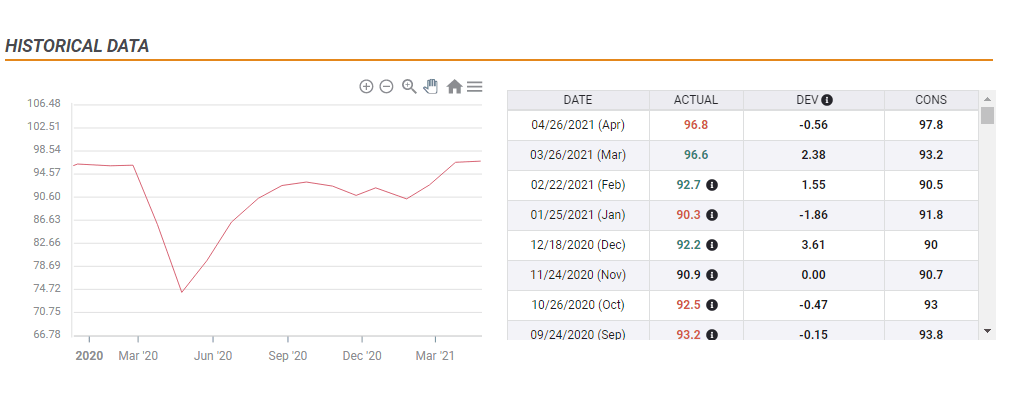

Soft data from recent months, such as the highly regarded IFO Business Climate survey, have been showing optimism on the recovery even during the darkest winter months. Optimism about a vaccine-led recovery was strong despite the sluggish pace of inoculations.

(Click on image to enlarge)

Source: FXStreet

Another factor playing in favor of Germany – more than other eurozone countries – is demand for its exports. The Chinese economy continued growing at a satisfactory pace and the US also rebounded from the covid crisis. Rising demand should also prevent a substantial downfall.

All in all, there are reasons to expect Berlin will report better than expected figures.

EUR/USD reaction

The euro is the currency market’s “comeback kid” – brushing off concerns about a slow immunization effort. Moreover, with the US Federal Reserve extending its bond-buying scheme for longer, the euro benefits from dollar weakness and from the broad risk-on sentiment.

Therefore, it would only take a minor beat of expectations to jolt EUR/USD higher.

In case this analysis is wrong and German GDP disappoints with -1.5% or even -2%, there is also a good chance that investors would shrug it off. The figures are for the quarter that ended in March and both vaccination and economic activity have substantially picked up in April. Markets tend to look forward – especially when the bias is in favor of further gains.

Conclusion

The publication of German GDP looks like a “win-win” situation for EUR/USD bulls as expectations may be too low and amid the currency pair’s upside momentum.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more