GE: Don't Lose Sight Of What The SIFI De-Designation Really Means

- GE is now not designated as a SIFI, but the most important takeaway is the reason why the SIFI designation was rescinded.

- The company has reported impressive operating results over the last year, and this trend should continue through 2018.

- GE is a long-term buy at the $30/share.

General Electric (NYSE:GE) has been in the news a lot over the last few weeks, and the latest news that hit the wire was that the company received approval from the Financial Stability Oversight Council, or FSOC, to remove the systemically important financial institution, or SIFI, designation. Even some influential politicians have already chimed in on the GE ruling, as Senator Sherrod Brown released a statement praising the council's final ruling, "The council's action shows that 'systemically important' firms have a clear choice between stricter oversight or reducing their threat to taxpayers and financial stability".

(Source)

There are pundits on both sides of the aisle as some are saying that this ruling creates a buying opportunity while others are saying that now may be the best time to sell GE shares (i.e. buy the rumor, sell the news). The main focus of almost every article that I have read on the SIFI de-designation has been on the topic that GE is now able to return as much capital as it wants but I believe that investors should take a step back and really consider the true impact of this ruling. It is important not to lose sight of the real reason behind this ruling, which is the fact that the company has sold a majority of GE Capital and therefore is less prone to the risks associated with the financing business. This factor alone warrants excitement for GE's future business prospects.

As I described in this article, GE is a buy around the $30/share range and this ruling actually makes me want to add to my already overweight position. Let me explain why.

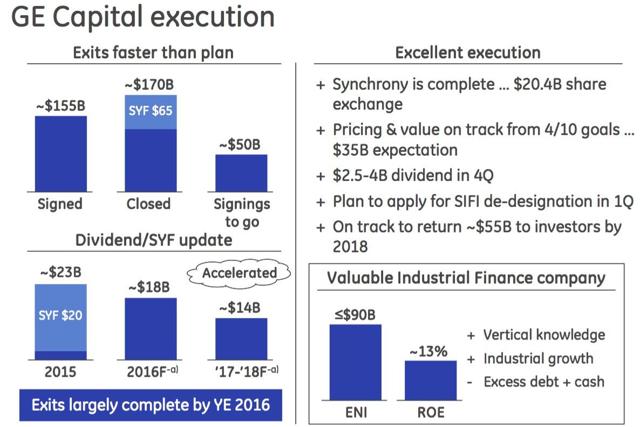

GE Capital, How Did We Get Here?

In early 2015, GE announced plans to create a "simpler, more valuable industrial company" by selling a majority of the GE Capital assets over a number of years. Today, the company has made significant progress in a short period of time as just last week management announced that the company is already within ~10% of reaching its goal of selling $200b of financial assets. The sale of GE Capital's U.S. restaurant finance assets to three financial institutions brought the total agreements to $180b, and this is well ahead of the previously disclosed target.

(Source: Annual Outlook Investor Meeting)

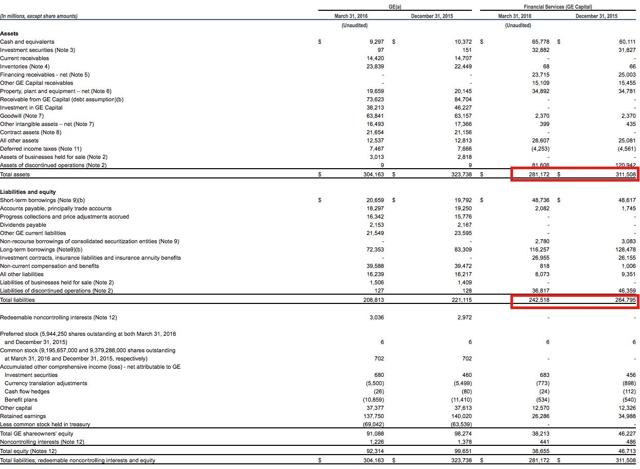

Evaluating the company's current state based on the previously disclosed financial target is great, but reviewing GE's most recent balance sheet shows a clearer picture of the true progress that has been made in short order.

(Source: 1q2016 10-Q, edited by author)

At 1q2016, GE Capital's total assets were down by ~$30b, or 10%, and total liabilities were down by ~$22b, or 8%, when compared to the last quarter of 2015. The picture looks even brighter when taking a step back, as GE Capital's 1q2016 total assets and total liabilities were down ~$195b and ~160b, respectively, when compared to the 1q2015 numbers.

These results are encouraging and major work has indeed been done since the 90% plan was first announced in April 2015, but GE still has some work to do to satisfy the investment community. Remember, GE Capital consistently accounted for a large portion of the company's total revenue and profit over the last five years.

| $ - in billions | 2015 | 2014 | 2013 | 2012 | 2011 | |

| GE Capital revenue | $10.8 | $11.3 | $11.3 | $11.3 | $11.8 | |

| Consolidated revenues | $117.3 | $117.1 | $113.2 | $112.6 | $110.1 | |

| Avg | ||||||

| % of consolidated revenue | 9% | 10% | 10% | 10% | 11% | 10% |

| GE Capital profit | $(7.9) | $1.2 | $0.4 | $1.2 | $1.5 | |

| Total segment profit | $10.0 | $19.0 | $16.6 | $16.7 | $15.5 | |

| Avg | ||||||

| GE Cap % of total segment profit | n/a* | 6% | 2% | 7% | 10% | 6% |

(Source: 2015 10-k)

*The large loss was a result of the announced restructuring of GE Capital

On average, GE Capital's revenue and profit accounted for ~10% and 6% of the consolidated figures from 2011 to 2015. Therefore, management will need to prove that GE is more than just a company that is selling off assets and depending solely on buybacks to meet the earnings estimates over the next few years. So far, so good.

GE Is More Than Just A "Shrinking Story"

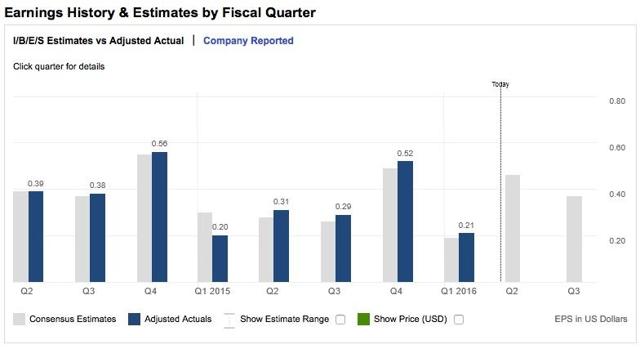

GE's earnings base has obviously been shrinking as a result of the company selling the financing business, but, in my opinion, this is a necessary evil. Moreover, the earnings results have actually been pretty impressive over the last year but the assets sales have taken the center stage. For example, the company has been able to meet or beat the consensus earnings estimates in seven of the last eight quarters.

(Source: Fidelity.com)

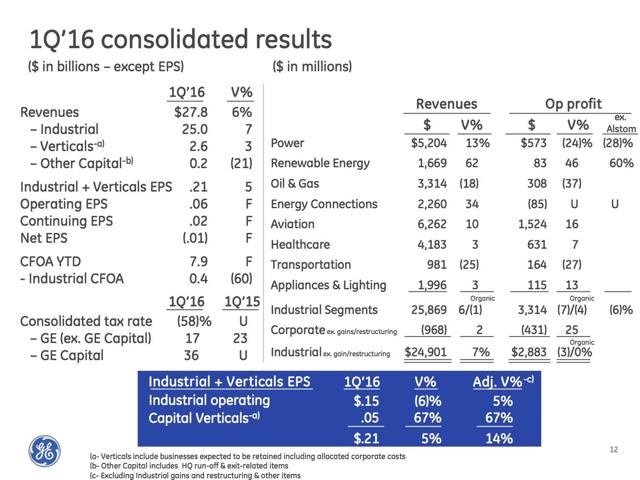

More importantly, the company has reported improving industrial operating results over the last few quarters with the most recent example being the first quarter of 2016.

(Source: 1q2016 Earnings Presentation)

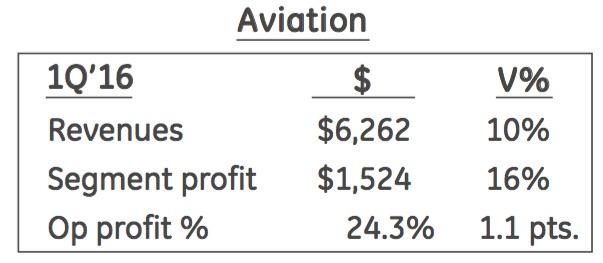

At 1q2016, the industrial revenue was up 6% and the industrial + verticals EPS was up 5%. In addition, GE reported 1q2016 EPS of $0.21, which beat the consensus estimate of $0.19 by 10%. There were several industrial segments that had impressive operating results for the quarter with the Aviation segment being a good example. The Aviation segment reported double digit YoY increases in both revenue (10%) and profit (16%).

(Source: 1q2016 Earnings Presentation)

These results are encouraging, especially when considering that the industrial businesses are now becoming more important than ever with the shrinking GE Capital assets. So far management has shown that the company is able to grow earnings even in this challenging operating environment, and I expect this to continue for the remainder of the current year.

Risks

Another important factor to consider is Moody's recent statementthat the SIFI ruling may negatively impact GE's credit profile. This has the potential to result in downward pressure for the stock price and is definitely a risk, and is something that should be monitored by investors going forward, but it is not a risk that causes me to be overly concerned about GE's long-term business prospects.

Bottom Line

The rescinded SIFI designation is a net positive for GE, as strict regulations and oversight always comes at a cost. Yes, the lack of oversight may cause some investors to be concerned about management again putting the company in a position to fail (i.e. similar to the Financial Crisis) but, at the end of the day, the rewards far outweigh the risks. The costs of being a SIFI are significant and difficult to quantify but think about what has to take place when a company is under this type of oversight: senior management has to dedicate valuable time to staying on top of the regulations and filings (i.e. less time to focus on the industrial businesses), the add to staff costs are tremendous, the company needs to get annual capital return plans approved by regulators, and the list goes on. Therefore, this ruling was a benefit to both the company and its shareholders.

The analysts that are calling for investors to sell their GE shares just because of the recent run-up in the stock price (see here for my thoughts on GE's current valuation), are, in my opinion, losing sight of the real impact of a SIFI-less company. The real impact is the potential for GE to become a purer play industrial that warrants a higher valuation and a company that is lower on the risk spectrum (i.e. less reliant on financing assets). Furthermore, management will now be able to direct their full attention towards to the company's long-term strategy of growing the industrial businesses.

GE reports 2q2016 results on July 22, 2016, so investors should pay close attention to what type of impact, if any, the recent ruling has on management's expectations for the remainder of the year. Management previously provided EPS guidance in the range of $1.45-$1.55 and announced 2016 capital return plans to be in the range of $26b ($8b in dividends and $18b in buybacks), but the SIFI ruling creates an opportunity for these figures to be revised. Personally, I do not see management increasing the dividend or buybacks in the near-term but it could happen. However, GE should be considered a long-term buy at $30/share with or without any revisions to the 2016 estimates.

Disclosure: I am/we are long GE.

Disclaimer: This article is not a recommendation to buy or sell any stock mentioned. These are only my personal opinions. Every investor must do his/her ...

more