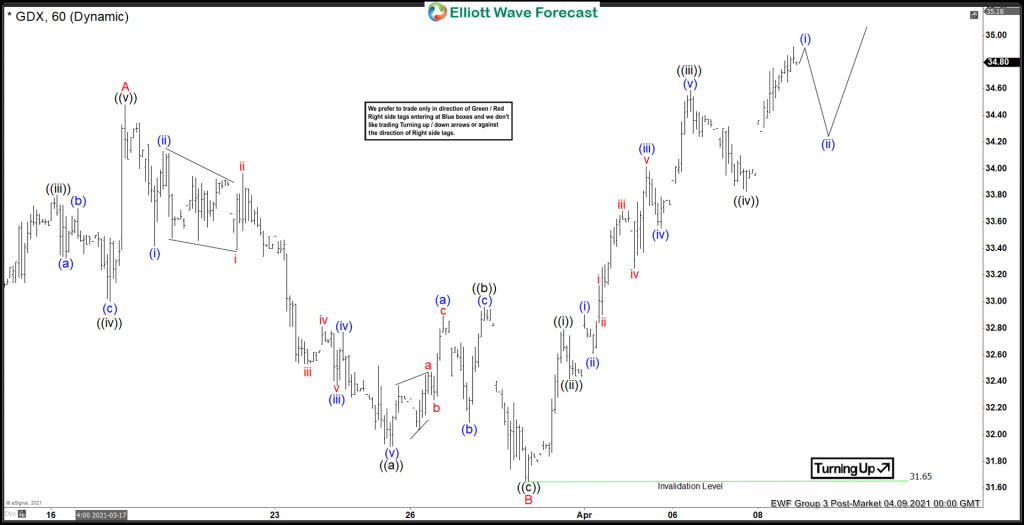

GDX Elliott Wave View: Showing Corrective Bounce

Video Length: 00:05;2

Short term Elliott wave view in GDX suggests that it is doing a recovery from March 03, 2021 low in a corrective structure. The internals of that bounce is unfolding as Elliott wave zigzag structure where the first leg of the bounce ended in wave A at $34.48 high. Down from there, the GDX made a 3 wave pullback in wave B with another lesser degree zigzag structure. While the lesser degree wave ((a)) ended in 5 waves at $31.91 low. Wave ((b)) bounce ended in 3 swings at $32.96 high and wave ((c)) ended at $31.65 low thus completed wave B pullback.

Afterward, the ETF is trading higher in the next leg higher within wave C. The internals of the current bounce is unfolding as an impulse sequence where wave ((i)) ended at $32.79 high. Wave ((ii)) ended at $32.42 low, wave ((iii)) ended at $34.59 high and wave ((iv)) ended at $33.83 low. Near-term, as far as the pivot from $31.65 low stays intact then GDX is expected to take the extension higher in wave ((v)) towards $35.47- $37.83 area higher. Before it ends the cycle from 03, 2021 low in a zigzag structure & consequently the correction against the cycle from January 05, 2021 peak.

GDX 1 Hour Elliott Wave Chart

(Click on image to enlarge)

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more